Be prepared for a major transition in banking during the early 2020s: it’s time to adopt cryptocurrencies. Retail-banking clients and institutional investors are expressing increased interest in this financial vehicle and in the distributed-ledger technology (DLT) that underlies it: particularly innovations such as blockchain . Indeed, some investors, fintechs, and venture capital funds are beginning to make a sustained commitment to cryptocurrency, regarding it as the future of money . Banks can no longer afford to ignore this opportunity.

Of course, they have reason to be cautious. Some financial services leaders remain skeptical of the value that cryptocurrency has as an asset class, and individual cryptocurrencies have lost market capitalization at times (including this year). During the COVID-19 crisis, cryptocurrencies have experienced volatility, and their reputation has been tarnished by the association of Bitcoin, the most prominent cryptocurrency, with criminal acts such as the Twitter hack of July 2020.

Nonetheless, cryptocurrencies are a vehicle with great prospects. They have the potential to outperform conventional banking products while offering greater efficiency, less bureaucracy, and more transparency.

Cryptocurrencies are a vehicle with great prospects.

Many industry observers have been aware of the opportunities for some time. As far back as 2012, for example, American Banker writer Jeremy Quittner proposed that banks launch a variety of cryptocurrency offerings: processing payments, providing escrow services, facilitating international cash transactions, helping customers exchange their money for bitcoins, and even making loans in the currency.

Nonetheless, only recently have some banks and financial services institutions begun to build and launch their own entries in the ever-maturing blockchain ecosystem. In 2019, for example, JPMorgan Chase introduced JPM Coin, its own cryptocurrency, which it uses primarily for funds transfers and faster transaction settlements among clients. Morgan Stanley has offered blockchain-based investment products since 2018. Goldman Sachs introduced a new leader for oversight of digital assets in recent months, an indication that it expects activity to increase. More than 100 banks have tested instant payments with the use of the cryptocurrency Ripple. The European Central Bank has set up a task force to explore offering a digital euro, “not because we want to keep up with fashionable trends,” says ECB executive board member Yves Mersch, “but because we have to be ready.” Central banks in China, Sweden, and the UK have indicated interest in cryptocurrencies as well.

Technology companies are also seeking to use cryptocurrencies and similar instruments to gain advantage in the financial services marketplace. One prominent example is the Libra Association’s Libra system: a global payment settlement mechanism that promises to reduce volatility and transaction costs to nearly zero. This effort has been scaled back and delayed, but plans to launch the system remain intact.

Despite all this activity, many banking leaders are still uncertain about how best to use these currencies, how to avoid the challenges associated with them, how to manage transactions into and out of fiat (government-issued) currency, and what safeguards and guidelines to follow. Fortunately, the path forward is becoming increasingly clear as the industry learns from its practices and as regulators and banking leaders adjust to the new realities. And banks still have time to differentiate themselves in this domain and act as first movers in their regions. Financial institutions that educate themselves now, and introduce well-designed experiments and offerings, will be in a good position to lead the industry in their regions or even worldwide.

Crypto’s Continuing Momentum

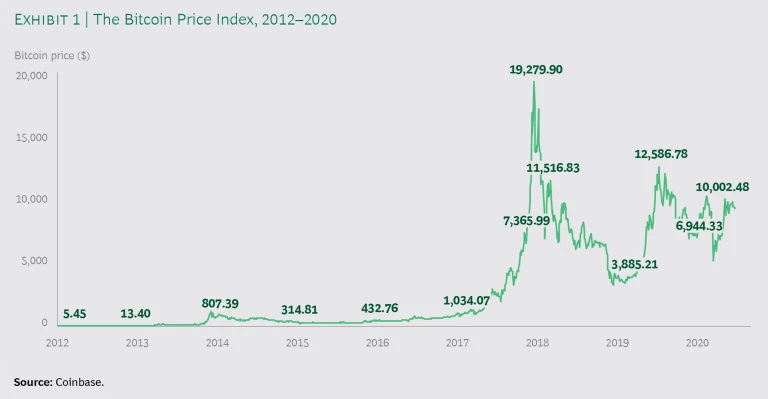

Because press reports and commentaries about cryptocurrency vary from wildly enthusiastic to highly pessimistic, it is important for bankers to take stock of the actual trends in the field. The most prominent cryptocurrency, Bitcoin, is a highly speculative investment. It fell by more than 75% from its peak in December 2017 but has since regained a third of those losses. (See Exhibit 1.)

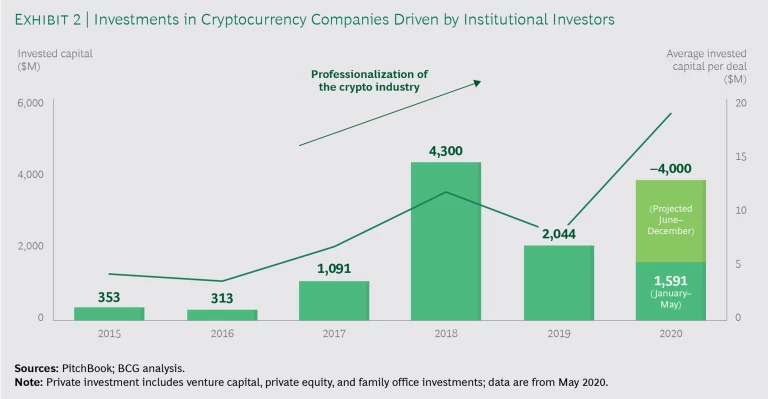

The continuing momentum in cryptocurrency is clear from the pace of investments by institutional investors, venture capital firms, and private equity funds. Invested capital per deal has risen from about $5 million in 2015 to almost $20 million during the first two quarters of 2020, much greater than investments per deal in the first half of the previous year. This year’s total invested capital looks like it will be close to that of 2018, which was a peak year. (See Exhibit 2.)

Several factors explain the growth. First, investors are responding to the general professionalization of the cryptocurrency industry. The growth in average capital invested per deal is an indicator of this.

Second, new investment vehicles are available. These include recently introduced startup currencies, such as the initial coin offerings (ICOs) that are sometimes used to launch new ventures and the treatment of which varies considerably from jurisdiction to jurisdiction. They also include illiquid funds with venture capital features, highly liquid hedge funds, and market-based investment opportunities. Because regulators and large retail banks have gotten involved, these options are seen as safer than they were a few years ago.

A third factor is increased familiarity with other blockchain applications like smart contracting, settlement processes, and some investment vehicles for capital markets. This bolsters investors’ confidence in crypto offerings, for themselves and their clients.

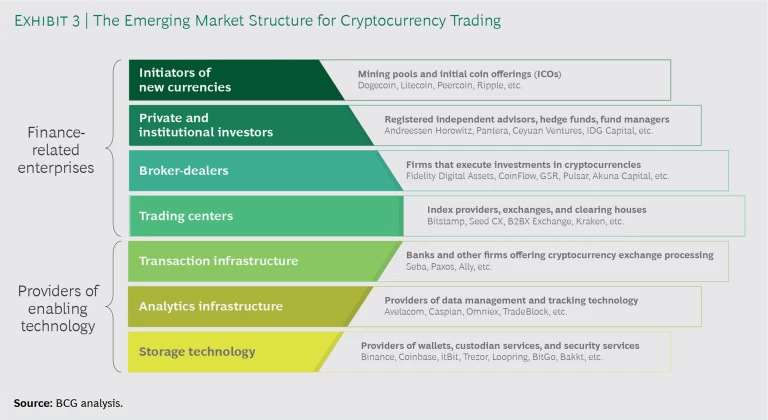

Finally, because the gains and losses in this asset class do not always correlate with the stock market, crypto investment is sometimes seen as a diversification play. A more established market structure for institutional trading in cryptocurrency is thus beginning to take shape. (See Exhibit 3.) Other than some investors, most of the companies involved in cryptocurrency tend to be young: less than two or three years old. But many will participate in the digital ecosystems, just emerging now, that will most likely facilitate cryptocurrency-related activity in the future.

The Right Mix of Crypto Offerings

Time may be running out for banks to avoid being disrupted by cryptocurrency-oriented competitors. Challengers from the technology industry are moving in rapidly. As Bank of England deputy governor Sir Jon Cunliffe warned in a speech on February 28, 2020, these new offerings could draw away so much capital from current accounts that banks could have difficulty lending. “It could become mainstream,” he said, “for people to move from holding all or much of the money now in ‘current accounts’ at banks to holding it in ‘stablecoin’ in virtual ‘wallets’ provided by non-banks.”

Nonetheless, both large and regional banks still have a chance to enter this field, gain a first-mover advantage, and win the expansive margins that come with any differentiated and profitable offering. Because of their track records in protecting their customers’ assets, these banks are often well trusted. Cryptocurrencies can help them boost their competitiveness in today’s increasingly digital business environment. The first step is to raise their own awareness: to explore how cryptocurrencies can help them attract new clients and prevent their existing clients from migrating away. (For an overview of this new asset class and related technologies, see “A Quick Introduction to Cryptocurrencies.”)

A Quick Introduction to Cryptocurrencies

Bitcoin, the first cryptocurrency, has the largest market capitalization, at $249 billion in early 2020; it was released in 2008 by a still-anonymous technologist who uses the pseudonym Satoshi Nakamoto.

The second-largest cryptocurrency is Ethereum, which went live in 2015 on an open-source platform. It was initially funded through a crowdsourcing initiative and distinguished by its innovations in distributed computing, native tokens, smart contracts, and other decentralized applications.

The underlying technical structure of a cryptocurrency is a system for recording transactions automatically in a distributed digital ledger, called distributed-ledger technology (DLT), the token associated therewith. This makes it a tamperproof, continually growing database that does not need oversight by a bank, regulatory agency, or other central authority. The more owners there are, the more nodes hold parts of the database—and thus the safer and more stable the system is.

These nodes, often called wallets, use public and private keys that are linked mathematically. The public key acts as an anonymous but unique ID, similar to a bank account number. The private key is typically kept secret, like a bank account PIN. The database tracks each exchange of bitcoins among wallets, using private-key validation to ensure their integrity. Every transaction includes a “checksum,” a mathematically calculated tag that incorporates a time stamp and proof of value, along with data from previous transactions.

As demand for a currency increases, computers in its network create new blocks through calculation processes called mining. These tend to require intensive computer power, a limitation on mining that allows the cryptocurrency to grow while sustaining its value. The system is trusted because counterfeiting or tampering would require creating new blocks at a higher rate than the entire mining network could manage.

Most cryptocurrencies are dedicated to specialized financial applications, such as clearing and settlement, securities issuances, payment, trade finance, and digital identity. Noncommercial use cases include creating financial avenues for the world’s most impoverished people and preventing voter fraud. Cryptocurrencies can also be differentiated by the way they deploy the underlying blockchain technology. For example, rather than employing a proof-of-work model that relies on solving mathematical problems, some cryptocurrencies grow through a consensus model, adding blocks when participants agree it is time. These features and prospects led a rising number of banks and financial institutions to adopt use cases for cryptocurrency; every banker needs to be aware of the opportunities associated with them.

Banks have many possibilities and business use cases to choose from as they enter this market, involving the currencies themselves, the underlying distributed-ledger technologies (DLTs), or both. In the currency domain, they can help startup ventures bypass the ordinary capital markets through ICOs, where the coin offering becomes the primary vehicle for funding the new enterprise. Banks and investment firms can help customers invest directly in cryptocurrencies, steering them toward the relatively few offerings that are likely to succeed (by attracting enough customers to become hubs of activity). For sophisticated customers, one option is tokenization investments, which are a cryptocurrency-based analog to securitization, bringing a variety of investments together in tranches.

Banks can also provide currency-trading services (for example, in bitcoins or digital euros if they are offered) and crypto-enabled digital payments and transactions. These coin swaps can be offered through three types of exchanges: central-bank digital currencies (CBDCs) issued from national financial authorities, private blockchain-based currencies from a bank or company, and network-issued currencies, such as Bitcoin or Litecoin, with a public blockchain.

As for deploying DLTs, banks can do this for either front- or back-office operations. They can offer real estate investments in which the blockchain technology makes the transactions more trustworthy. Crypto or blockchain technologies can be used to set up smart-contract offerings, with automated time stamps, updates, and verification of milestones.

To some extent, bankers should take a cue from their clients and customers, who are moving rapidly to advance in the most relevant directions and may request crypto-oriented services from their banks. Large investors may be interested in crypto-based growth assets or in having their banks offer transaction-monitoring services based on DLTs. Venture capital funds tend to favor designated crypto funds and other vehicles for raising capital for startup investments, while retail clients may be looking for rapid-growth investments to diversify their portfolios.

One promising approach is to integrate cryptocurrency with established payment platforms or other existing offerings. The UK-based fintech startup Revolut does this with its money transfer options. When people post a money transfer transaction, they are asked if they want it sent in pounds, dollars, euros, or one of five cryptocurrencies, which are stored in a pooled wallet. Those who choose cryptocurrencies may want to add to this part of their portfolio or may be preparing for other crypto transactions coming up in the near future. Customer fees take the value of this convenience into account. Other retail banks could take the same approach to integrating cryptocurrency into their existing products and services.

Mitigating Risk

When offering products in this fast-developing sector, banks need to protect themselves and their customers against the risks that such new technology can bring.

In March 2019, the Basel Committee on Banking Supervision stated that crypto-related assets “do not reliably provide the standard functions of money and are unsafe to rely on as a medium of exchange or store of value.” It suggested that four practices are essential with any offering: due diligence on each cryptocurrency offered to customers, an internal governance and risk management framework, disclosure of all related activities in financial statements, and an appropriate dialogue with regulatory supervisors.

All these practices are significant, and due diligence is particularly important. Some cryptocurrency offerings have been associated in the past with “dark money” transactions: illicit trade and criminal activities, including ransom and extortion payments. In a few publicly identified cases, terrorist groups financed themselves with cryptocurrency. Tax evasion also remains a concern, and classification is difficult in some jurisdictions where regulators have not determined consistently whether to treat cryptocurrencies as assets, currencies, securities, or commodities.

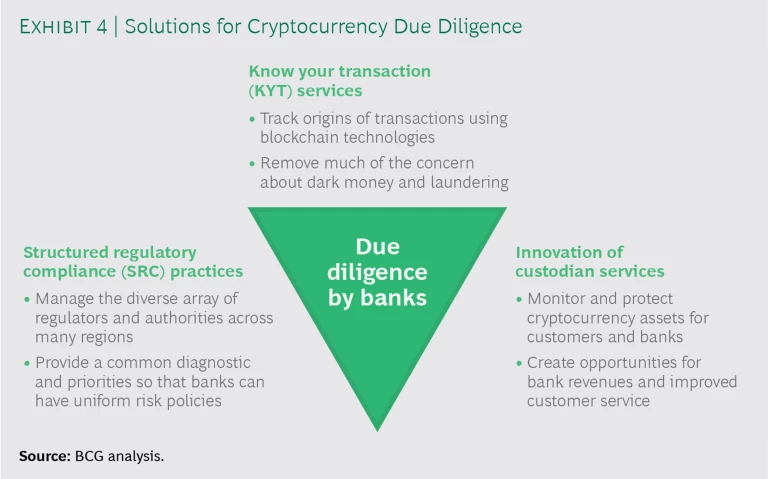

In practicing due diligence of this sort, banks can rely on three types of solutions: know your transaction (KYT), structured regulatory compliance (SRC), and custodian services. (See Exhibit 4.) These can be outsourced, but banks may benefit from bringing them in-house and making them substantial parts of the institution’s own crypto service chain. Together, these three solutions can build trust and address most concerns. They do not always need to be handled separately by each bank. Ultimately, the financial services industry will probably establish practices and platforms that embed these safeguards into every credible cryptocurrency offering.

KYT: Beyond Customer Verification

Verification has long been an issue for cryptocurrencies because of the standard way that banks establish trustworthiness. When they bring a new client onboard, they rely on know your customer (KYC) verification, which regulators have required for many larger exchanges for at least a year. This might involve government identification, proof of employment, reliable collateral, and credit references. But KYC is a check only on the customer and not on the transaction, so it may not detect all cases of counterfeiting and money laundering. Some smaller exchanges do not use KYC, and it generally applies just to retail customers. The task of tracing any transaction back to the original source is often too onerous and costly for banks, especially at scale. As a result, counterfeiting and money laundering frequently go undetected.

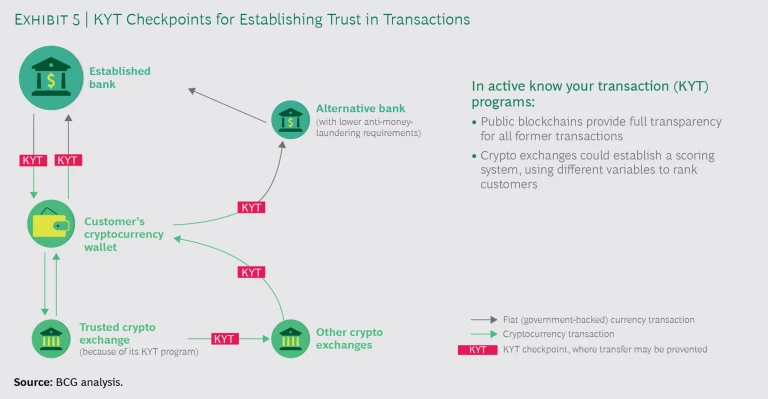

But the blockchain technology enables KYT, which can be used to easily track almost all transactions back to their sources. (See Exhibit 5.) The digital ledger automatically stores the complete history of currency exchanges and payments, in a distributed record that cannot be faked or tampered with in any way. Moreover, the KYT process can include analytics that recognize patterns of behavior associated in the past with criminal activity and set off alarm bells when those patterns occur.

To be sure, the technology will not solve all verification problems or address the risks associated with cryptocurrencies, but as Bank for International Settlements (BIS) economist Raphael Auer notes, “It might open up new ways of supervising these risks.” In a 2019 BIS working paper, Auer proposed a concept called “em-bedded supervision,” in which digital ledgers are continually monitored for transgressions. In other words, rather than fitting new crypto offerings into estab-lished regulatory-compliance practices, technologies are put in place to track and reveal problems as they occur.

KYT does not replace KYC; they complement one another. Exchanges and banks can use them together in order to establish a scoring system, ranking potential customers according to (for example) the reputation of transaction partners or the timing as well as the geographic location of particular transactions. In this way, KYT could enable banks to meet their anti-money-laundering and financial-crime compliance obligations while increasing customer trust. Strong KYT programs might also make banks more willing to process transactions that would otherwise be prohibited by their internal policies. That would encourage customers to keep their business with the bank, rather than taking it to competitors.

In addition, banks often need to conduct further rigorous analysis of the sources of transaction records, a process called know your data (KYD).

Together, KYT, KYC, and KYD can be used in several ways:

- To verify transactions on exchanges or broker platforms, which do not write every transaction directly to the blockchain network

- To trace transactions from services with non-blockchain-based origins (for example, with fiat currencies)

- To track transactions where part of the sale occurs offline, as in a face-to-face handoff

- To validate data from experimental cryptocurrencies where, by design, some transactions are not automatically traced

For the KYT approach to work, banks need to raise their internal capabilities. On the purely technological side, the required functions include connectivity and analytics; it is essential to gather and analyze a vast amount of transaction data on an ongoing basis. Then, in real time, several managerial skills are needed. These include the ability to identify illicit transactions, recognize and counter attempts to disguise transaction origins, link accounts to their sectors and countries, manage and update lists of questionable actors, build and maintain relationships with regulators in this new context, and fit the technology into an established compliance system without compromising it. As is often the case with new technologies, the greatest challenges are less a matter of digital implementation than of embedding the right attitudes and habitual behaviors throughout the bank’s workforce and in its organizational culture.

Structured Regulatory Compliance

Cryptocurrencies and related blockchain technologies are regulated by a wide variety of government organizations around the world, each of which has introduced its own laws and guidelines. Countries hold a broad spectrum of views. Some are highly restrictive, banning or severely regulating both cryptocurrency exchanges and ICOs. Others are mostly hands-off. Still other regulators have yet to indicate that they will take any action at all.

The most prominent cryptocurrency regulators in Europe and the US have taken opposite positions on rules and standards.

Currently, the most prominent cryptocurrency regulators in Europe and the US have taken opposite positions on rules and standards. In Europe, where oversight falls to individual nations, the German Federal Financial Supervisory Authority argues that cryptocurrencies need to comply with existing rules and standards. In the US, interagency regulators are committed to evaluating digital currencies further while regulations continue to evolve. (For reference, we provide an overview of US legal, tax, and regulatory considerations in Appendix A .) Since neither Europe nor the US has a comprehensive regulatory regime, other sovereign regulators will tend to follow the guidelines set by one of these two influential boards—which means that the approaches will likely be different on each side of the Atlantic.

New policy frameworks continue to emerge. The European Commission has proposed, for instance, a draft legal framework that would regulate crypto assets and their market infrastructure, although it is unclear if and when such a framework would be enacted. Separately, Liechtenstein’s recently established approach is considered to be a comprehensive, robust model.

Other countries also have digital currency policies under review. In the US, for example, the Federal Reserve Bank of Boston announced that it—together with MIT’s Digital Currency Initiative—is evaluating more than 30 different blockchain networks in experiments to determine if they would support a digital dollar. China has announced plans to launch a digital yuan, with the aim of becoming the first country in the world to offer a digital sovereign currency. BIS has published findings that central banks representing one-fifth of the world’s population say they are likely to issue their first central-bank digital currencies during the next three years.

This regulatory inconsistency is one of the greatest impediments to the growth of cryptocurrencies. Business leaders are keenly aware that their investments could fall in value if regulations change. One particularly important unresolved question concerns the legal definition of these offerings. Will they be treated as assets or as vehicles of monetary exchange? As securities or commodities? As a single category of financial instruments or as two or more categories, each with different rules? These decisions will have a major impact on how businesses and investors approach crypto asset investments in the future.

Subscribe to our Financial Institutions E-Alert.

Because no clear universal regulatory structure exists, banks must develop their own consistent guidelines. First, they should create a regulation heat map and conduct a gap analysis. This combined exercise should cover the most relevant regulations, anticipate future changes, and outline regulatory gaps (in other words, the difference between existing requirements and potential changes) in each region.

Second, banks should develop a risk management diagnostic for their own activity. In this exercise, they should identify and prioritize cryptocurrency initiatives. Then they should inventory the key sources of expertise and technology needed for these priorities. An implementation plan needs to be created, laying out the required steps to comply with current and anticipated regulations. Another rigorous program should be designed to archive key milestones so that the work can be retrieved.

Finally, banks should consider developing a risk management software solution for their own transactions—and to sell to other parties, such as exchanges, in order to help finance the banks’ costs. All these steps can help institutions prepare for their cryptocurrency endeavors while managing the most material risks and taking current and future regulations into account.

Innovation of Custodian Services

Cryptocurrencies are often targets of fraud or cyber intrusion. Banks thus have an increasing need for custodian services: the storage, maintenance, and protection of cryptocurrency assets. Entering the crypto custody market can be a lucrative business for suppliers that offer value-added services. Banks are ideally placed to provide this solution: a digital equivalent to the old-fashioned safe-deposit box, taking advantage of the high levels of cyber protection that are already used to safeguard financial holdings and records. In July 2020, the US Treasury’s Office of the Comptroller of the Currency published an interpretive letter clarifying that national banks and federal savings associations have the authority to start offering these services—as a modern version of traditional banking activities.

Entering the crypto custody market can be a lucrative business for suppliers that offer value-added services.

There are still debates over what type of technology to use. The most secure option is cold storage (keeping cryptocurrency data in devices not connected to the internet), but that means physically hooking up the device for each new transaction. Hot storage (always connected to the internet) is more accessible though also vulnerable to attack.

Some fintech companies are beginning to offer custodian services. As Mike Belshe, CEO of the cybercurrency security services provider BitGo, pointed out in a recent report, fintechs are seeking to fill the gap and thus attract institutional investors. For example, the US fintech Gemini provides custodian services, such as insurance against fraud and thievery, to customers. But most institutional investors do not accept fintech-based wallet services at this point because of the relatively high risk and regulatory compliance issues.

A few traditional finance players, like Bank of America and Nomura, have announced plans to enter this space, but no bank has yet established a dominant presence. Banks that offer cryptocurrency services can develop a profitable business model around this type of service. For example, no other enterprise in this field can match banks’ reputations, existing track records, and regulation-oriented skills and relationships. Some estimates suggest these attributes are worth as much as 1% per annum of the value of the assets they store.

More regulatory consensus is needed here to make custodian services viable. US Securities and Exchange Commission (SEC) rules require institutional investors to maintain their assets with a “qualified custodian,” while the European Securities and Markets Authority has not defined safekeeping yet, even though it has stated that custody is a major risk for crypto assets.

The next few years will more than likely bring cryptocurrencies and DLTs into the mainstream. Innovation in financial services is just beginning. The result will be new ways of handling payments, investments, and savings. And for risks, the three solutions of KYT, SRC, and custodian services are adequate for the foreseeable future, unless circumstances change.

The real uncertainty is not about risk but about missing opportunities.

The real uncertainty is not about risk but about missing opportunities. Will banks be able to offer the innovations in investment vehicles and transaction services that their customers expect? Will they be able to integrate these new technologies into their existing operations? There is no universal playbook for this, but the financial enterprises that are first to design and implement a viable approach will lead the industry.