Powerful algorithms have become table stakes and no longer create competitive advantage, as they once did. Today what matters is having the best data for those analytics engines to crunch. Yet many companies still haven’t identified the data that gives them a sustained competitive advantage, and their lack of data maturity hinders their data strategies and business outcomes.

Whether a company is looking to make better use of existing data to achieve specific business outcomes, or wants to gather new data to create an additional line of business, it needs to understand and address various barriers to data maturity. Then it needs to identify its advantaged data and formulate a data strategy to open new sources of competitive advantage—tasks that entail answering several key questions about advantaged data, data collection strategy, data monetization strategy, and operating model.

The Barriers to Data Maturity

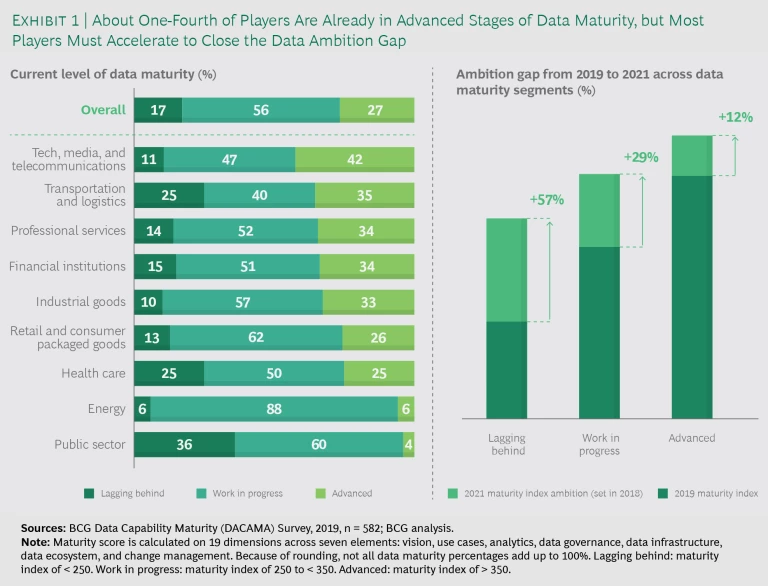

We have documented companies’ struggles with data maturity across industries and geographies. Since 2016, BCG has conducted digital transformation surveys of companies to assess their ability to leverage data. In 2019, we found that only 27% of companies had reached the advanced stage of data maturity, which we calculate based on seven elements: vision, use cases, analytics, data governance, data infrastructure, data ecosystem, and change management. (See Exhibit 1.)

We also found that while many companies have high data ambitions, few achieve those ambitions. In 2019, only about 10% of companies reported that they had met the data targets they had set in 2016. Moreover, most were far from achieving their 2021 ambitions, which they set in 2018.

Companies need to accelerate their progress toward data maturity in order to achieve their data ambitions. But it’s not easy. Our interviews with leading companies identified five major pitfalls that companies encounter when trying to reach data maturity:

- They lack a compelling vision or value proposition for the data, or their thinking about data usage is too incremental.

- They are insufficiently creative about new business models and partnerships, and are unable to identify and monetize advantaged data sets.

- Data is stranded in organizational silos because the company lacks a modular, interoperable architecture.

- Their ability to activate and scale data use cases is inadequate.

- They have not shifted their corporate culture toward data-driven decision making.

Meanwhile, however, some companies are avoiding these pitfalls and have successfully improved their data maturity by identifying their advantaged data sets. John Deere put sensors on its large installed base of agricultural equipment and began acquiring data to improve machine performance and provide advanced decision support for farmers.

A leading oil company partnered with BCG to collect data on drilling operations, equipment, and geological characteristics. It used this data to train machine learning algorithms and develop tools to give workers end-to-end visibility into whatever process they are running. This enables them to make quick decisions at the rig so that, for example, they can better manage the circulation and pressure of the fluid used in fracturing the rock, and maintain fast enough drill-bit rotation to prevent the machinery from getting stuck.

Putting a Data Strategy in Motion

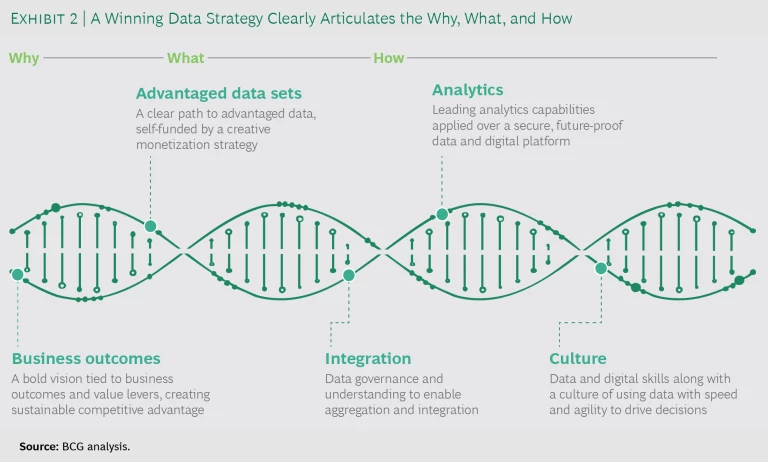

Once a company has identified its advantaged data sets—which link closely with the business outcomes it plans to achieve—it will have a much easier time managing the other parts of the data strategy: defining business outcomes, identifying needed analytics, integrating the data, establishing appropriate infrastructure to retrieve the data, and adapting the corporate culture to use the data optimally. (See Exhibit 2.)

Identifying advantaged data sets does not always entail making exceptional efforts to gather new data or create a new line of business. In some instances, the strategy defines the data requirements; in others, the data defines the strategy. But leaders should always think through the two in tandem. By reframing the business outcomes, they can turn existing data into advantaged data sets.

In order to define and leverage advantaged data, company executives need to ask four key questions.

What is my advantaged data? Given a clearly articulated vision for the business, what data sets can bring that vision to life and create a unique competitive edge? (See the sidebar.) For example, does the company want to differentiate itself from its peers by delivering a great customer experience or by maximizing its operational efficiency or by innovating rapidly? Once all stakeholders are aligned on the vision, leaders can work backward to identify the data needed to achieve the targeted business outcomes.

Advantaged Data Redefines Competitive Advantage

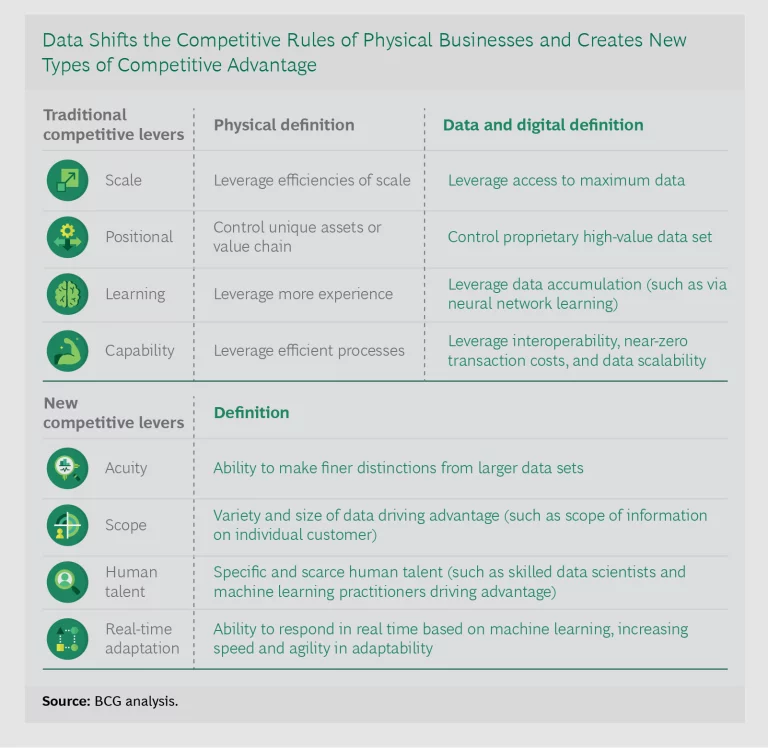

Thanks to IoT and cloud technologies, data sets today can be orders of magnitude larger and more comprehensive than their counterparts a decade ago; and thanks to new analytics, especially AI, they can be analyzed continuously and in real time. The competitor with superior data can segment, customize, detect anomalies, see trends, and innovate faster than its competitors. Over time, those advantages build on themselves. This mechanism is so powerful that data—like geography, manufacturing capacity, and brand in previous eras—may become the asset that defines the boundaries of businesses and even entire industries.

In John Deere’s case, the overall strategy is to extend a traditional manufacturing business into the lucrative realm of agricultural services. Consequently, the advantaged data related to how customers use its equipment, and how that equipment performs under different circumstances.

For the oil company, the advantaged data sets involved a database of old, unused wells (consisting of operations data mudlogs, details about geological characteristics, and the like) along with information that advanced sensors were capturing from live wells (such as operational parameters, drilling parameters several kilometers down the well, and stratigraphic features). This data helped the company optimize its operations.

What is my data collection strategy? After identifying the necessary data, a company can use several methods to collect or acquire the data. This may involve leveraging internal data, or it may involve acquiring external data in various ways:

- Collect data from existing customers. By collecting such data, a company can make data-driven decisions related to marketing, inventory, store location, and the like, thereby creating a hyperpersonalized customer experience.

- Partner/purchase data. If the data a company needs to fulfill its vision and create a competitive advantage does not exist within the organization, the company may need to participate in a data ecosystem that will enable it to buy the data or create a partnership to access the data. For example, Uber’s real-time algorithms that match riders with drivers rely on Google Maps for data on traffic and road conditions. In the case that involve personally identifiable information, however, companies must do their utmost to respect consumers’ expectations about how the company uses their information, especially outside the context where it originated.

- Acquire a company. A company that can’t purchase the data it needs through a data ecosystem—or establish a partnership to access the data—may need to buy another company that has such data. This reality has driven many acquisitions in recent years. For example, in order to develop data-driven personalized health care related to cancer, Roche acquired Flatiron Health for its proprietary data set. In another case, the London Stock Exchange acquired the financial data and analytics company Refinitiv.

- Orchestrate an ecosystem. A company that possesses a significant amount of proprietary data and can buy or partner for additional data may be able to orchestrate an ecosystem that other companies participate in. For example, John Deere has used its data strategy to transform itself from an agricultural equipment manufacturer into a data-driven technology company. It has positioned itself at the center of the precision agriculture ecosystem.

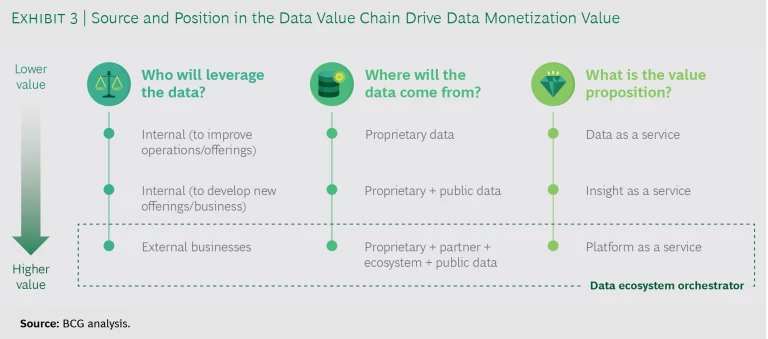

What is my data monetization strategy? How will the company create new revenue streams with the data? An internal monetization strategy involves using data that the company already captures in new ways (possibly in combination with public data), and then leveraging that data across business units to improve current offerings or develop new ones. An external monetization strategy involves relying on propriety and public data, as well as on data from partnerships and ecosystems, to create a data platform as a service.

Ideally, an organization will sequence its monetization strategy so that it can use an early mix of quick revenue wins to fund bold transformational moves that take longer to generate returns. But even if a well-conceived data strategy requires sustained investment, its transformative, strategic benefits will massively outweigh the interim cash drain. In any event, whether the monetization strategy is internal or external, the organization needs to understand who will leverage the data, where the data will come from, and what the value proposition is. (See Exhibit 3.)

John Deere monetized its investment by creating an open platform that combines proprietary data with data collected from machines, farmers, and external partners. Farmers can use software tools on this platform to manage their fleets, save fuel costs, and decrease equipment downtime.

For its part, the oil company has monetized the data behind its new drilling technology by cutting nonproduction time by 4%, drilling faster (decreasing drilling time by 6%), and doing so more safely.

What operating model do I need? Effective use of advantage data will not materialize unless the company and its culture become data centric . To prepare its organization for this fundamental shift, the company needs to move forward on five fronts:

- Define new roles and governance rules. The company needs to make clear who is responsible for building and running new models and systems and maintaining specific types of data—and how to manage those people. Change must begin at the top: senior leaders should adopt data-driven objectives, clearly prioritize and appropriately fund them, and cascade those goals throughout the organization. Top management may want to establish data councils to extend the work to all sectors of the organization and to carry it out more effectively. The company should promote data awareness by having data champions disseminate data-driven practices.

- Build a data-first culture. To move quickly and to continually find new ways to apply data, companies should behave a bit like software development operations, embracing a test-and-learn culture that encourages experimentation, accepts—even celebrates—failure, and is always learning. Companies can encourage desired cultural change through organizational moves such as creating internal startup units where employees can focus on experimentation or co-locating data labs within operating units. Another way to promote the new culture is by creating cross-functional teams that share data across silos, thereby encouraging openness and collaboration throughout the organization.

- Adopt a new approach toward technology. Leaders should consider decoupling digital business transformation from core IT transformation. We refer to this approach as data and digital platforms (DDP) . DDP creates a data layer to liberate data from core systems that are scattered across the enterprise. With a DDP approach, technology stacks have simple interfaces, data moves faster and becomes a new source of competitive advantage, and agile teams can work in new and more collaborative ways.

- Embrace agile ways of working. The entire organization does not have to become expert in agile methodology, but the company can adopt many agile tactics and use them in everyday operations to increase the organization’s responsiveness and adaptability. It can establish scrum teams with squads and tribes to tackle specific problems—and it can accelerate the pace of work with weekly sprints, rather than months-long efforts. Teams and groups can implement morning standups and weekly demos (reviews) as a regular part of part of governance. Overall, the new ways of working should emphasize autonomy and reduce hierarchy.

- Cultivate the necessary talent and skills. If data-based transformation is to work, the company must have talent with the right skills to execute data-driven strategies and manage data-based operations. The company should create an inventory of the talents and skills that its employees will need, and it should identify gaps in its current workforce. Companies will have to retrain current employees, hire new talent, or use a partnership to get the right capabilities. To recruit people with digital skills, the company may need to rethink the value proposition it offers—work, opportunity, rewards, career path, and so on—in relation to what tech companies offer.

As capabilities around algorithms and analytics quickly become table stakes, companies must look to advantaged data sets for a sustainable competitive edge. John Deere realized that complacency about its leading market position would give smaller, nimbler players an opening to disrupt the market. So instead it proactively began to define its advantaged data sets and devise a new data strategy. The oil company’s advantaged data sets and new data strategy took shape when its leadership embraced a vision of becoming one of the most innovative, efficient, and safe oil drillers.

The good news is that in many cases such data already resides within the company’s walls and is there for the taking—as long as the organization puts a sound data strategy in place to collect, analyze, integrate, and use the data in daily business decisions. Even if the company must buy or partner to access the right data, its ability to pair that external information with internal proprietary data can be a powerful source of competitive advantage over the long term.