On January 10, 2020, China published the complete genome of the coronavirus responsible for COVID-19 from specimens collected in Wuhan. Less than a month later, on February 7, the biotech company Moderna completed the first clinical batch of a candidate vaccine in Cambridge, Massachusetts. On March 16, the US National Institutes of Health announced that the first participant in its Phase I study had been dosed—marking a total of 63 days from virus sequence selection to initial human dosing. A month after that, on April 16, a Boston-based synthetic biology company, Ginkgo Bioworks, announced that it will support Moderna with process optimization for the raw materials needed in manufacturing mRNA vaccines (Moderna’s underlying technology), using its high-throughput automated tools for biological engineering.

We do not know whether the candidate vaccine will prove successful, and researchers have a long road to travel before we find out. But a few facts are already notable. First, Moderna developed its candidate vaccine with unprecedented speed, and it is now in Phase II trials. The company is hardly a biopharma powerhouse, although it does have 21 drugs in development, including 13 in clinical trials. It was founded by Harvard and MIT professors in 2010 with venture capital backing from another Boston-based firm, Flagship Pioneering. It went public in 2018 and has raised $3.2 billion, making it a so-called technology “unicorn.” Since its inception, it has partnered with multiple other biopharma companies (including AstraZeneca, Merck, and Vertex), government agencies (BARDA and DARPA), and universities, as well as the Bill and Melinda Gates Foundation.

Ginkgo Bioworks has a similarly impressive history. Founded in 2009 as an MIT spinoff, it uses a combination of hardware and software to deliver rapid prototyping and high-throughput screening for new biotechnologies. Funded during its early years by government grants and awards, Ginkgo Bioworks started raising external capital in 2014. It achieved a valuation of more than $4 billion in its latest funding round in 2019—making it another unicorn. It also started partnering from an early date with established corporations such as Cargill, ADM, and Bayer, as well as with other startups.

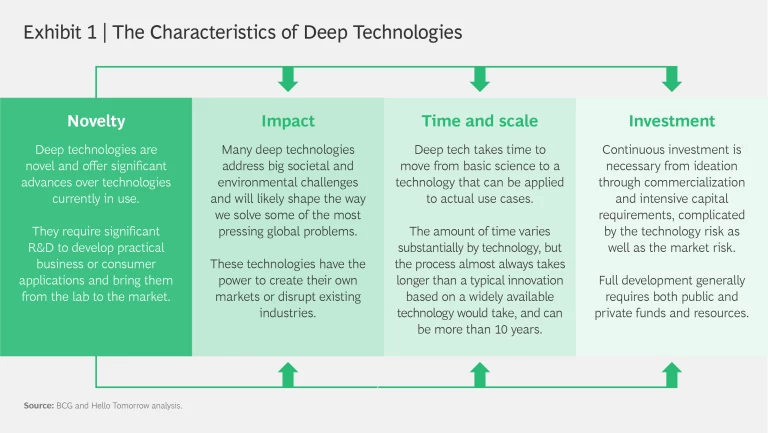

Moderna, Ginkgo Bioworks, and the technologies behind them are high-profile examples of the deep-tech ecosystem at work and of the role that deep technologies and the companies that develop them can play in the future of society and business—a role that the current coronavirus crisis could accelerate for everyone’s benefit. (See Exhibit 1.)

The Dawn of Deep Tech

Typically developed by startups (often university spinoffs), deep technologies are notable for their novelty and potential impact, for the time and scale needed to develop them, and for the level of financing required to move from laboratory science to viable commercial product. In those respects, Moderna’s mRNA technology and Ginkgo’s biology engineering approach fit the bill perfectly, but in some important ways these companies are more exception than rule.

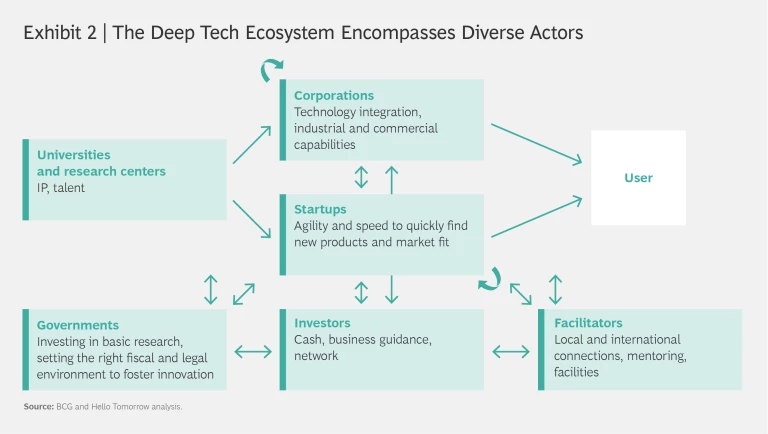

Deep-tech companies rely on an ecosystem composed of other startups, universities, government agencies, venture capital investors, foundations, and established corporations to survive and thrive—which is what happened with Moderna and Ginkgo. (See Exhibit 2.) But this is far from a standard pattern. In the first place, these are two highly successful unicorn companies, and unicorns are not representative of startups in any industry. Moreover, the life sciences and biotech ecosystem is by far the most advanced of any surrounding a deep technology. It has a clear path to commercialization, well-defined growth trajectories and milestones, significantly more capital than most, and better-established pathways to liquidity (via IPOs or M&A). In fact, 71% of deal value among deep-tech companies in the US in 2018 was concentrated in life sciences.

Most other deep-tech ecosystems are still in their infancy. Nevertheless, their potential is enormous in both the near and long term. For example, one estimate projects the market for synthetic biology—defined as the intersection between biology and engineering—to grow from about $6 billion in 2018 to almost $20 billion in 2022, an annual rate of 34%. BCG has estimated the value for end users of quantum computing, still a nascent technology, in coming decades at more than $450 billion. Estimates of the value of other deep technologies—including advanced materials, robotics and drones, artificial intelligence, and photonics—vary, but the numbers climb quickly. For now, however, startups in these fields require collective effort from all participants in the ecosystem, as well further evolution, to bring their potential to fruition.

COVID-19 and the New Reality

Moderna and Ginkgo Bioworks aside, the global response to the coronavirus crisis is highlighting the potential of deep technologies and the power of an ecosystem approach. Hello Tomorrow, a Paris-based deep-tech ecosystem facilitator that has collaborated with BCG on deep-tech ecosystem research, has published a list of some 50 startups that are engaged in fighting various aspects of the virus, from detection to drug discovery to mitigation of side effects. In April, the New York Times reported at length on the heightened collaboration between scientists and industry worldwide. Innovative partnerships such as the one between German engineering and technology giant Bosch and UK in vitro diagnostics manufacturer Randox Laboratories are pushing research into new solutions. Companies have embraced the ecosystem approach, recognizing that, especially in times of crisis, delivering a bigger pie through collaboration, rather than competing for the biggest slice of the pie, leads to better and faster results.

Crises of the magnitude of COVID-19 bring competitive and societal discontinuity. Although the current crisis is forcing companies to focus on surviving a brutal next year or two, it is also accelerating existing trends that will shape the medium and long terms . In the new post-COVID-19 reality, the push for collaboration, typical of deep tech, reflects not only the urgency of “flattening the curve” but also a consistent focus on the relevance to companies of nonmarket aspects such as creating advantage through resilience and collaborating in the common interest.

As management teams reimagine their business for the post-COVID-19 era, shifting their focus from near-term profitability and efficiency to resilience and the advancement of the common interest on issues such as climate change, three big changes stand out: the new logic of competition, the increase in innovation and resilience through diversity, and optimization for social and business value. Because deep tech is uniquely positioned to create competitive advantage in each of these areas, it should play a key role in defining and shaping the new reality for the better. Companies’ reactions to downturns have often been defensive, delayed, and insufficient. But downturns also present opportunities—and to realize them, companies must do more than assume a defensive stance.

As others have pointed out, the last crisis that produced discontinuity of a similar magnitude was World War II, which fostered numerous major social and technological innovations. The list includes radar, the jet engine, penicillin, synthetic rubber and oil, nuclear power, radio navigation and landing, the pressurized cabin, and the first electronic programmable digital computer (using vacuum tubes).

The Story of Hyaline

The present moment offers plenty of similar opportunities. Consider the development of Hyaline, a revolutionary film for electronics applications and the brainchild of Zymergen, a synthetic biology unicorn that leverages multiple deep technologies in its R&D—including robotic automation, machine learning, and genomics—to tap into nature to design and manufacture novel materials. Hyaline is actually a biological invention that is sustainably manufactured using the process of fermentation, but its applications are in such areas of electronics as flexible circuits, display touch sensors, and printable electronics. It combines the benefits of advanced biofabrication with traditionally manufactured materials to outperform competing products—computer chips that use silicon- and petroleum-based products. Zymergen’s partner in developing Hyaline is Sumitomo Chemical, Japan's second-largest chemical company and a leading supplier to many electronics companies.

Hyaline demonstrates the power of deep tech and the impact it will have on business in the post-COVID-19 future. It is the result of a company that competes on imagination . It was conceived and designed out of a reimagination process, and it will trigger multiple new possibilities down the supply chain for companies to rethink their product or create new ones. As Zymergen’s CEO told Forbes in April 2020, “We identified a market gap for moderately priced, high-performance films and set out to design and deliver a product that would outperform incumbent materials using biology. Hyaline demonstrates differentiated and sustainable performance optical and mechanical properties that were previously unavailable. It will enable a revolution for existing products and spark the imagination of designers creating next-generation products.”

Zymergen is also a company that Building a Resilient Business Inspired by Biology while mobilizing purpose for the common interest. In a world in which supply chains must be rethought to increase resilience, deep technologies will permit such rethinking on a fundamental level—for instance, by leveraging biomanufacturing, which significantly improves the sustainability of production processes in comparison with technologies that depend on inputs such as petroleum.

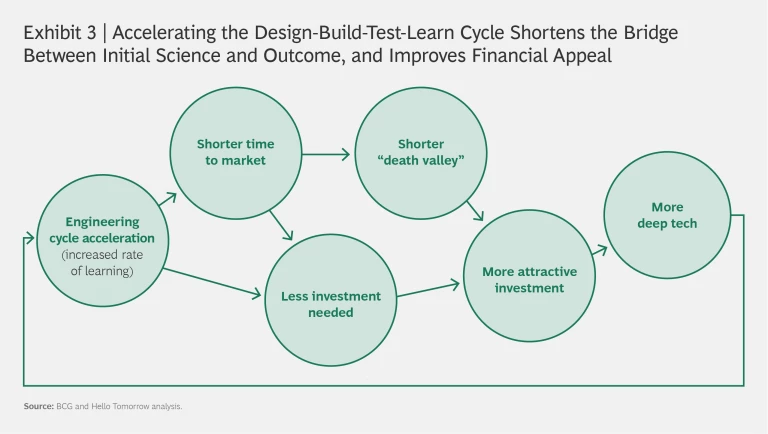

In addition, companies such as Zymergen Competing on the Rate of Learning . One key element of the redefinition of the logic of competition is the capability to derive competitive advantage from an exponentially expanding amount of available data. Both Zymergen and Ginkgo Bioworks have pushed advances in synthetic biology with the help of process automation and machine learning, which permit parallel testing of thousands of experimental conditions and automated analysis of the results. By leveraging high-throughput (and now ultrahigh-throughput) analysis, these companies have increased the amount of data flowing in the engineering design-build-test-learn cycle by at least three orders of magnitude. They then apply machine learning to generate better solutions in very fast cycles, making the rate of learning one of their core competitive assets.

Hyaline is a great example of the promise of synthetic biology, but it is hardly unique. The “clean tech” bubble—when venture capital firms rushed to invest $25 billion between 2006 and 2011 only to lose over half of it—remains a cautionary tale, but the many real use cases and companies behind synthetic biology are cause for optimism. Examples (in addition to those described above) include Ginkgo and its many partnerships, TWIST in DNA storage, AMSilk with its biosteel fiber for multiple textile and technical applications, Impossible Food with the Impossible Burger, Ecovative Design with its compostable molded mycelium for packaging, and Modern Meadows with its biofabricated leather.

Other deep technologies, such as quantum computing are likely to have similar levels of impact in other areas. A mass virtual drug-screening campaign is already using quantum-inspired algorithms against COVID-19. Quantum computers are likely to play a role in combating climate change , too—for example, by helping devise a replacement for the Haber-Bosch fertilizer production process (which consumes 3% to 5% of all natural gas globally), accelerating the development of new catalysts that split water molecules more efficiently and thereby lower the cost of binding carbon.

Advancing the Deep-Tech Ecosystem

Synthetic biology and quantum computing are only two of many promising deep technologies. It’s hard to anticipate what potential will be unlocked as these technologies develop and converge, new possibilities open up, and previously insurmountable constraints fall away. But none of this can occur by itself. For deep tech to realize its potential and shape the new reality, three things must happen.

The core engine of deep tech must be fine-tuned. One way to think about deep tech is as the place where new science meets engineering. For deep tech to come of age, we need to establish bridges between the scientific method and the commercial outcomes that permit faster iterations and better results. Imagination and an improved rate of learning through engineering are the supports on which these bridges will be built. Imagination enables deep-tech startups to identify novel use cases and ways to remove constraints. Engineering know-how shortens and accelerates the design-build-test-learn cycle, possibly also leveraging other deep technologies in the process, as has occurred with cloud computing and is occurring in synthetic biology. The continuing development of platform technologies such as machine learning and quantum computing has the potential to accelerate this trend and hugely hasten the development of deep tech. (See Exhibit 3.)

The ecosystem needs to be nurtured. All participants in the ecosystem have to be clear about what they bring to the ecosystem, what they want from it, and—most importantly—how they interact with others to achieve their goals. Investors and corporate partners are critical to this process. Even before the current crisis (and despite some notable exceptions at both the company level and the technology level), the deep-tech ecosystem was struggling with underinvestment, a limited amount of available capital, and a shortage of the types of resources and market knowledge that established companies can bring to the table. Learning from life sciences, we can create a much better and clearer investment pattern for deep tech, including facilitating exit options. In this context, accelerating the engineering design-build-test-learn cycle plays a key role, as it reduces both the amount of capital needed and the time horizon for investors. Securing the attention of impact investors —asset managers and others that factor sustainability and societal impact into their investment decisions—can also help, especially since many deep-tech startups actively seek to advance the UN’s sustainable development goals.

Large companies should embrace deep tech. New technologies are important tools for corporations that are trying to reimagine themselves and leverage the current competitive discontinuity to create sustainable competitive advantage and drive sustainable business model innovation . Companies can participate in the ecosystem in multiple ways: through partnerships and joint ventures, collaborations, corporate venture capital, incubators, accelerators, and even M&A. In contrast to digital disrupters, deep-tech startups are potential allies, with strengths that complement those of established companies. They also need the capabilities that large companies can offer, such as market knowledge and customer contacts. It is important, though, that startups and large companies build on each other's strengths and avoid the misunderstanding and frictions that have undercut a number of deep-tech/corporate ventures in the past.

World War II was followed by the Wirtschaftswunder—an economic boom, unprecedented growth, and decades of prosperity. We don’t know yet what the new reality following the current crisis will look like or when it will take shape. But as difficult as it may seem at this moment, companies need to take a long-term view. Together with pursuing impact investing and innovating a sustainable business model, embracing deep tech can create a trifecta of capabilities that will shape the new reality for the better, making the world a richer, healthier, and stronger place, and making its companies more profitable and sustainable.