Passenger rail has the potential for unprecedented growth because it provides one of the best opportunities to address continuously worsening traffic in major urban centers and to fight the congestion and pollution that contribute to climate change. Yet the industry faces significant limitations—all linked to maintenance—that include capacity constraints, reliability issues, and cost inefficiencies. However, the widespread application of digital technologies in rail maintenance offers a strategy to overcome these growth hurdles.

For now, another factor limiting rail traffic is the COVID-19 pandemic and fear of transmission. But traffic is expected to return to normal, and with it will come all the punctuality and capacity problems that have hampered the industry. That’s why rail operators need to begin the shift to digital maintenance practices now.

Aerospace has pioneered the use of digital technology to improve maintenance services, and other industries, such as shipping and mining, are quickly following suit. In the rail sector, several OEMs and software companies are pushing digital solutions into the maintenance market that can serve as a launch point. We believe it is essential that rail operators decide what digital maintenance means for them, examine how it creates the most value, and create a strategy to unlock that value.

Releasing the Brakes

The three biggest factors limiting growth in passenger rail are:

- Constrained Capacity. It’s not easy to grow a locomotive or railcar fleet. To acquire more rolling stock, most rail companies must go through time-consuming tender and order processes. There is no inventory sitting in manufacturers’ yards, and that contributes to long delivery times. Maintenance issues exacerbate a train car shortfall. About 20% of a typical rail fleet is undergoing maintenance at any given time.

- Insufficient Reliability. Many travelers avoid rail out of frustration with unreliable train services. Trains are often late or canceled. From 10% to 25% of European passenger rail trains suffer delays, depending on the operator. About a third of those delays are caused by poorly maintained trains.

- High Cost. Costs for rail travel in many countries are significantly higher than those for alternative travel modes such as cars, airplanes, and long-distance buses. Maintenance is a significant cost driver, accounting for about 40% of the total life cycle cost of rolling stock and thus contributing to expensive fares.

Digital maintenance can address these limitations. Robotics, for example, will allow for faster maintenance execution, which will improve capacity by increasing the amount of time that rolling stock can be in operation. Advanced analytics and artificial intelligence could also improve capacity by looking at planned train schedules and ensuring that the assignment of rolling stock and crews is synced with maintenance cycles. That reduces inefficiencies such as maintenance delays or unused maintenance slots.

Predictive maintenance via sensors and algorithms can minimize the types of unexpected failures that often cause delays and cancellations. That would increase customer satisfaction significantly. It would also save money by reducing the number of tickets that operators must refund as a result of service outages.

Rail companies can also use technologies like process automation and optimized stock keeping to reduce maintenance expenses and improve efficiency. Spare parts, for example, can be ordered automatically and delivered to the right track just in time. No longer will a worker have to order parts days in advance only to learn that one component won’t be available for two weeks. Everything can be staged in advance of the train rolling into the maintenance depot. Such improvements, combined with cost savings from faster repairs and predictive maintenance, would allow operators to offer prices that better compete with other forms of transportation.

The Building Blocks of Digital Rolling Stock Maintenance

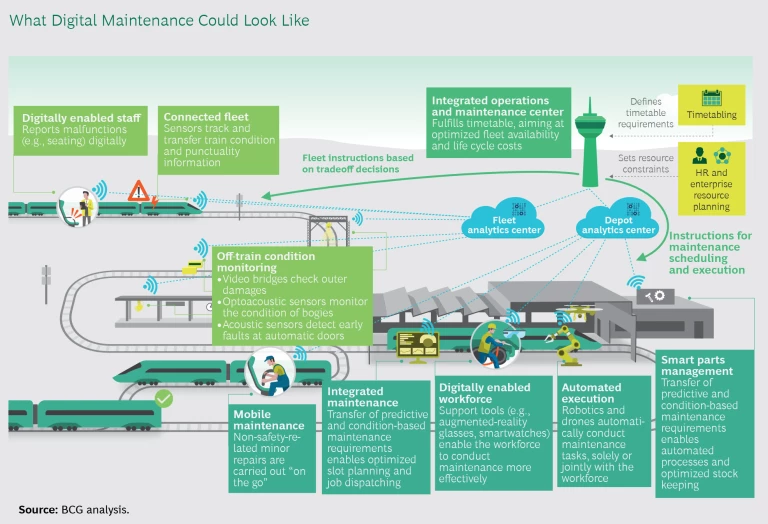

Three components will form the core of the maintenance system of the future and support a digitally enabled workforce that can conduct maintenances much faster than is possible today. (See the exhibit.)

Advanced Maintenance Execution. In the future, rail operators will rely on a host of technologies. Augmented-reality glasses will provide instructions on infrequent maintenance tasks, allowing for more versatile deployment of staff. Smartwatches will enable simple digital documentation of work and further increase productivity. Robots and drones will execute some tasks autonomously and support humans in others. Some servicing and repair could be performed via a mobile maintenance workforce, reducing the required physical depot space. The seamless transfer of condition-based and predictive maintenance requirements will provide the rail operator with a smart parts management capacity. Automated processes and optimized stock keeping will provide a more efficient and reliable ordering and inventory system for spare parts. And an analytics center at the depot will manage maintenance execution by collecting and melding information on maintenance capacities such as maintenance slots and workforce availability.

Fully Connected Fleet and Trackside Diagnostics. On the trains, a digitally enabled staff will report malfunctions, such as seat problems, directly via a digital board book, preventing communication gaps between fleet management and the depot. The connected fleet will be equipped with various sensors that collect data on acoustic, visual, and thermal conditions and transfer the information to the maintenance center. Trackside diagnostic systems will offer an additional method for monitoring specific components from locations along the rail line. Video taken from bridges will check for damage to the outside of train cars. Elsewhere, optoacoustic sensors will monitor the condition of bogies, or wheelsets on the rolling stock. Acoustic sensors at train stations will detect early faults at automatic doors. All of the data will be transferred in real time to a fleet analytics center, which will collate information on fleet condition, maintenance needs, and punctuality to create a 360-degree view of operations.

Connecting the Dots. An integrated operations and maintenance center (IOMC) will be the centerpiece of digital maintenance. It matches the available maintenance supply—workers, slots, and space—with the demand. The goal is to comprehensively fulfill the predetermined timetable by coordinating both operations and maintenance while optimizing fleet availability and reducing the life cycle cost of rolling stock.

The IOMC will need to measure tradeoff decisions, such as weighing the extra expense for unplanned maintenance against the costs of service outage, and provide instructions for the fleet and the depot. To make sound decisions, the IOMC must have a comprehensive overview of the fleet’s current and future maintenance requirements, the operator’s maintenance capacity, and ongoing maintenance activities. The analytics centers will provide all the required information.

Predictive modeling will be crucial to the IOMC. It enables, for instance, a comprehensive and reliable maintenance forecast and automatic computation of material needs.

Unlocking the Digital Maintenance Potential

As rail companies consider incorporating digital maintenance into their operations, they should follow these four guiding principles.

Focus on more than the service depot. It’s common to focus on the maintenance operations at a central depot offering adequate space and equipment. Certainly, there are depot-centric gains to leverage through the use of automation and new material management technologies such as 3D printing. However, digital maintenance’s full potential can be harnessed only via an integrated view of the maintenance and operations cycle. Maintenance can be married to operations through the real-time allocation of trains to maintenance slots depending on actual, rather than scheduled, train arrivals. That creates agility: slots can be swapped or adjusted based on what is actually happening on the tracks, increasing utilization.

Synchronize the maintenance value chain. Every aspect of the maintenance operation must work together seamlessly. Even the most efficient maintenance execution would be upended if poor planning meant that spare parts were not available when needed. Rail companies need to employ multiple levers along the entire maintenance value chain. They can improve planning through a predictive demand forecast for spare parts. They need digital tools that allow operators to execute a more advanced disposition of resources through the real-time allocation of technicians and other workforce segments to tasks, freeing them from having to conform to a fixed schedule. Process automation, such as using robots to deliver and stage spare parts and specialize tools, can improve maintenance execution and efficiency.

Adjust for rail’s unique requirements. Some of the unique characteristics of running a 24/7/365 rail system limit the adoption of digital tools from other industries. In contrast to fixed assets such as a factory, rolling stock is always on the go and unforeseeable circumstances frequently cause delays in a train’s arrival at the depot. Idle hours for maintenance are limited because rolling stock needs to run daily. At many operators’ depots, there’s minimal physical space available for maintenance and service functions. To account for these restrictions, mobile maintenance of minor malfunctions might be one option.

Sync the system. Rail operators must consider their system architectural requirements. Differing information technology and operational technology from various OEMs must be integrated into a singular maintenance system. Typically, operators have rolling stock from multiple manufacturers. Each could have a different operating system and communication standard. Moreover, interfaces to adjacent IT systems—such as timetabling, personal planning, and other enterprise resource planning systems—should be automated to ensure the seamless integration of maintenance into the broader operations.

Creating a Strategic Vision

As they embark on the digital maintenance journey, rail operators must consider multiple questions that will govern their vision for the system. That starts with making strategic decisions about how operators will position themselves in the maintenance market:

- Insourcing Versus Outsourcing. Not all operators will be able to build the capabilities and invest the required funds to digitize their maintenance, even when there is a strong business case. That’s where outsourcing maintenance activities or even fleet ownership as a whole might make sense. It would allow the rail company to profit from efficiency gains and improved fleet uptime with a smaller investment. But operators need to ask how much they want OEMs and other players to be involved in their maintenance activities. Operators need to consider their data strategies, such as whether they will continue to own their fleet and maintenance data. Effective usage of owned data has significant economic potential, such as reliable prediction of maintenance needs.

- Changes to the Internal Governance Model. The holistic approach of digital maintenance will alter the current relationship between fleet management, operations, and maintenance departments. As a result, the governance between these functions may have to be realigned to achieve a cross-functional optimization of train availability.

- New Capabilities. From a people and organizational perspective, digital maintenance requires completely new capabilities in some areas. Data must be processed and analyzed. Robots and drones must be programmed and maintained. Even comparably minor changes—like adopting digital dispatching tools such as smartwatches—require a certain degree of workforce training.

Rail operators have a unique chance for growth. Digital maintenance is one of the key enablers of this growth opportunity; it promises to slash expenses, improve reliability, and increase the utilization of capital-extensive rolling stock. Moreover, virtually all of these tools can be applied to freight, which typically faces fewer regulatory and maintenance issues than passenger rail. In the face of rising digital competition, rail operators need to elaborate on their digital maintenance strategy now to define the future of rail maintenance.