Among the business sectors that quantum computing has the potential to transform, financial services stands out, for several reasons. First, the size of the prize is enormous—up to almost $70 billion in additional operating income for banks and other financial-services companies as the technology matures over the next several decades. Second, financial institutions continue to be among the most aggressive companies to embrace advanced technologies and develop practical applications. As an industry, financial services ranks at the top of BCG’s Digital Acceleration Index , which assesses digital capability and compares companies’ digital performance with peers. And third, a growing number of financial institutions are beginning to position themselves for a quantum future through recruiting, investments, and partnerships with technology companies.

Quantum computing is still in its infancy, but as it matures into adolescence, a rapid rise in practical financial-services applications is well within reason. From a strategic standpoint, every financial institution of any size should recognize that this complex emerging technology could be both a game-changing opportunity and an existential threat.

Here’s a look at where quantum computing stands today in financial services, what leading players are doing, where the technology is likely to evolve in the near and longer terms, and how financial-services companies can play.

Quantum Benefits

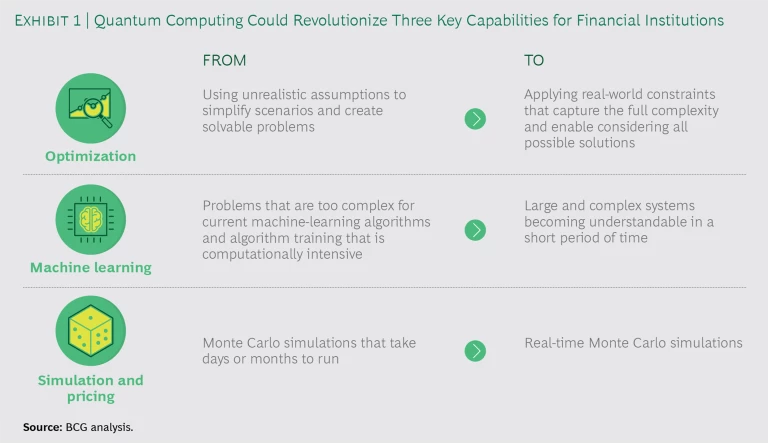

Let’s start with the potential. Quantum computing can deliver a step change in the ability of financial institutions to solve three types of problems. (See Exhibit 1.)

Optimization. Financial institutions have multiple uses for optimization calculations, including portfolio allocation and rebalancing, capital allocation, cash management in ATM networks, financial arbitrage, and yield-curve fitting. The problem is, certain kinds of optimization problems are hard, if not impossible, for traditional computers to tackle. Adding discontinuous, nonconvex functions—such as interest-rate yield curves, trading lots, buy-in thresholds, and transaction costs—to investment models makes the optimization task incredibly complex. As a result, classical optimizers often either crash, take too long to compute, or—worse yet—mistake a local optimum for the global optimum. Myriad approximations are necessary to make sure that a computation will be performed within an acceptable time frame.

A mature quantum computer could perform much more accurate optimizations in a fraction of the time. For example, the quantum approximate optimization algorithm, introduced in 2014, can solve for a good solution in polynomial or practical time (depending on the size of the problem), while the same problem would require exponential time on a classical computer. In addition, another type of quantum computer, called an annealer, has been designed for rapid optimization. In June 2020, Chicago Quantum developed a portfolio optimization of 40 stocks on a D-Wave annealer. “Portfolio optimization is computationally expensive… but there’d be a lot of appetite for quantum simulation that can make any improvement because turnover transaction cost can represent 2% to 3% of assets under management,” said the head of portfolio risk at a large US bank.

Machine Learning. Financial institutions have widely adopted machine learning (ML) to improve numerous business processes and try to find ways to better monetize their data. But for many problems, the time needed to train an ML algorithm on classical computers increases exponentially with the number of dimensions taken into account. Quantum computing could enable the industry to tackle complex analyses more effectively and accelerate existing ML techniques. For example, client clustering performed to predict creditworthiness could encompass many more inputs and identify previously unknown correlations, resulting in improved accuracy. Such capabilities have uses in credit scoring, predictive analytics, profit and loss attribution, and detecting money laundering and fraud. While actual increase in speed will ultimately depend on the problem to be solved, and still hinge on several open questions, quadratic acceleration is widely expected to be achievable, and many hope that exponential increases will follow.

Simulation and Pricing. The primary example here is the Monte Carlo method, which is computationally intensive, especially for longer-term and complex simulations. Arbitration between accuracy and efficiency in this field is both inevitable and common, and it leads to unnecessary risk taking, often of unknown extent. Being able to perform in-depth pricing and risk management computations almost in real time, without the need for model simplifications, would be a game-changer for the industry. “Detecting risk in real time for a bank allows you to allocate your capital better. That is worth billions,” said the director of financial mathematics at a leading US university. JPMorgan Chase has been researching the potential usage of quantum computing for option pricing. It designed the quantum circuits necessary to simulate European option pricing and showed that the accuracy of quantum computing is set to outpace the accuracy of classical Monte Carlo calculations in a quadratic fashion.

Potential Value—but When?

Applying quantum computing approaches to the above use cases would trigger three sources of value for financial-services companies:

- Better Corporate Risk Management. Companies could plan better for, and have more time to react to, market, credit, and operational risk and to position themselves against extreme events. They could also make the most of scarce resources, such as capital and liquidity.

- Improved Client Satisfaction. Companies can customize product offerings to make them more appealing and improve response time to customers’ requests for quotes.

- Operational Excellence and Sustainability. Better predictive maintenance, higher optimal portfolio returns with lower transaction costs, reduced costs, and improved energy consumption all contribute to the bottom line.

We have previously estimated that quantum computing could unlock long-term value of $42 billion to $67 billion for financial institutions. In addition, the significantly lower energy consumption of quantum computing could support sustainability agendas.

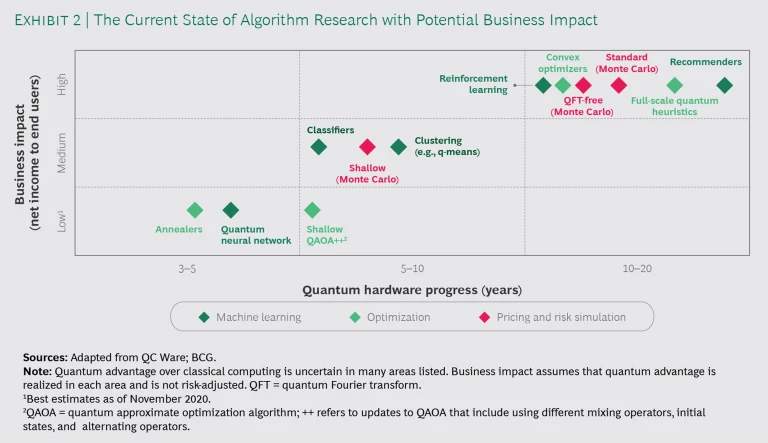

But how quickly can this value be realized? (See Exhibit 2.) In the short-to-medium term—say, the next decade—we expect early, noisy, and error-prone quantum computers to generate a relatively modest $2 billion to $5 billion in operating income for financial institutions worldwide. For example, leveraging a quantum-inspired approach to combinatorial optimization would allow a business to take into account realistic elements of uncertainty that it is unable to consider now. This could result in incremental value for a bank or investment fund of $200 million to $450 million in the next decade. (This figure does not offer a value for the knowledge and experience gained.) As quantum computers become stable and error correction improves, the same institution could unlock value of up to $900 million in the following 15 years.

We think this timeline could prove to be overly conservative given the quickly evolving quantum computing landscape. During the so-called noisy intermediate-scale quantum era, when quantum devices will be plagued by high error rates that limit their functionality, quantum-inspired algorithms (quantum algorithms running on a classical computer) and hybrid approaches (mixing quantum and classical computing) could help businesses create significant value and prepare for the longer-term quantum leap. Carlos Kuchkovsky, the global head of research and patents for BBVA, said in July of this year, “Although this technology is still in an early stage of development, its potential to impact the sector is already a reality. Our research is helping us identify the areas where quantum computing could represent a greater competitive advantage, once the tools have sufficiently matured. We believe this will be, for certain concrete tasks, in the next two to five years.”

More Focus on the Near Term

A few trends are driving near-term progress in quantum computing. One is the industry’s shift in focus from theoretical research to practical applications that are powered either by custom-built quantum circuits running on quantum hardware or by quantum-inspired algorithms running on classical hardware. Companies working on quantum-inspired algorithms, such as Microsoft, hope that these algorithms will deliver incremental value in the near term and translate into meaningful increases in speed when more reliable quantum hardware is available.

Another trend is the advent of a vibrant ecosystem around the new technology, including major tech players (such as Alibaba, Amazon, Atos, Fujitsu, Google, Honeywell, IBM, and Microsoft), generalist startups (such as D-Wave Systems, QC Ware, Rigetti Computing, Xanadu, and Zapata Computing) and finance-focused startups (such as Multiverse Computing). A third is the focus by quantum computing developers on making sure that actual value can be delivered sooner rather than later.

In the latter regard, developers are bringing out commercially available resources to help practitioners test, learn, and share how to leverage quantum computing for real-world applications. These include:

- Easy-to-access quantum cloud-based quantum computing power (Amazon, IBM, Microsoft)

- Open-source quantum software development kits, most of which are interoperable with common programming tools, such as Python, one of the most popular programming languages in finance (IBM’s Qiskit, Rigetti’s Forest, Xanadu’s PennyLane)

- Capability-building tools from software startups, including upskilling programs and explainable and transparent quantum algorithms

- Knowledge sharing and partnerships through networks, such as the IBM Q Network and the Microsoft Quantum Network, as well as numerous conferences around the world sponsored by leading technical quantum participants

Financial Institutions Take Note

The financial-services industry has taken notice. In the past 18 months, several companies—including BBVA, CaixaBank, and JPMorgan Chase—have announced or publicly discussed experiments involving quantum computing applied to use cases in the three areas discussed above. BBVA has been pursuing the advantages of quantum algorithms in portfolio optimization of business-sized datasets, credit scoring, currency arbitrage, and derivative valuation. CaixaBank is using a quantum algorithm to assess the financial risk in mortgage and treasury bill portfolios. And JPMorgan, as mentioned above, has been exploring option pricing.

Banks and others are hiring more people with quantum skills. Our analysis of LinkedIn data found that 21 banks and insurance companies in the US and Europe have hired more than 115 people with quantum expertise as of June 2020. More than 60% of these individuals are based in Europe, 28% in the US, and 10% in Asia. (Note that our insight into the latter is limited by the availability of data, particularly for China; the actual percentage is certainly larger. Moreover, the substantial interest in quantum computing in the hedge fund industry, which is not known for telegraphing its intent, is not reflected in these figures.)

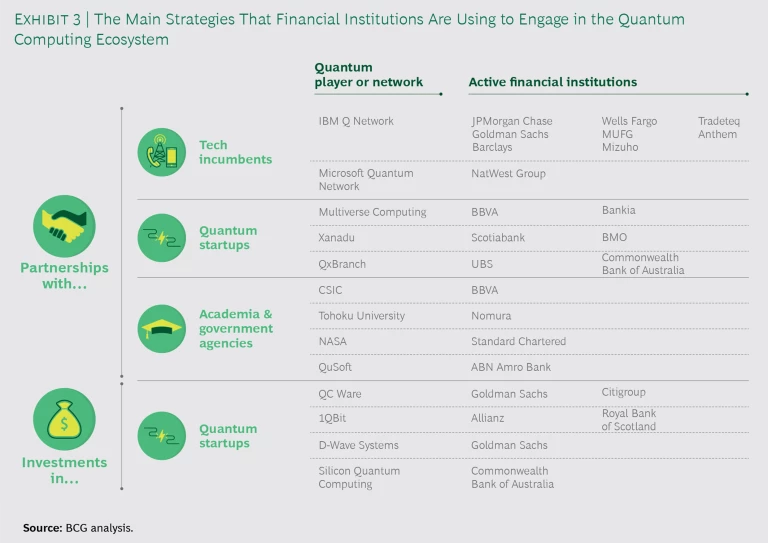

Financial-services firms are also pursuing investments in, and partnerships with, quantum computing companies. (See Exhibit 3.) So far, there are four main nonexclusive strategies.

The most common is partnering with tech incumbents active in the field, such as IBM and Microsoft. For their part, tech companies are putting significant effort into building comprehensive quantum computing ecosystems around their own technological solutions, bringing together academia, innovative quantum startups, and large potential client companies.

A second popular model is partnering with quantum startups. These younger players tend to have a bias for focusing on quantum software and algorithm developments.

A third model is partnering with academia and government agencies. These partnerships are likely to be regional in nature.

The fourth model is direct investment in quantum computing players, which is being pursued by financial firms aiming to get first-hand, and perhaps exclusive or semi-exclusive, access to knowledge and technology.

Financial firms that are actively and publicly investigating quantum computing include global players, such as Allianz, Barclays, Citigroup, Goldman Sachs, JPMorgan, and Mizuho. There are also plenty of national and regional companies, such as ABN Amro Bank, Anthem, BBVA, BMO, BNP Paribas, CaixaBank, Commonwealth Bank of Australia, NatWest Group, Nomura, Scotiabank, Standard Chartered, and UBS. In addition, hedge funds and high-frequency traders, among the most sophisticated industry players, have been actively investigating quantum computing technology for the past several years.

What Next?

Experts disagree on the exact speed and direction of quantum computing’s development. (Indeed, the industry has yet to reach consensus on the technology most likely to enable building quantum machines at scale.) But few doubt that its impact will be substantial and far-reaching. Since it is a true game-changing technology, and one that is not plug-and-play, financial institutions need time to build their quantum capabilities, acquire skills, and explore the quantum ecosystem. Those that move too slowly bear the risk of being sidelined by competitors when the technology translates into a bankable competitive advantage.

Companies can start by defining their quantum vision and strategy and performing an in-depth opportunity and risk assessment of quantum computing in the context of their business models. This assessment should involve an analysis of what is required to adapt the technology stack, build quantum awareness in the organization, and develop a strategic workforce plan, including the right partners to help in this transformative journey. Realizing this vision will likely be a multiyear effort, so while the impact of quantum computing may still be several years in the future, the planning clock is already ticking.

Many firms may need to accelerate ongoing digital transformation programs and make sure that their organizations are ready to act quickly and decisively, bringing together human and technological capabilities to become bionic. Taking advantage of paradigm shifts involves human skills and organizational capabilities as well as new tech. Companies that treat this component purely as a technology task will encounter big roadblocks. Those that have not already made substantial progress toward becoming bionic organizations will be at a disadvantage compared with competitors that have. BCG’s 2019 Digital Acceleration Index research found that more than 25% of financial-services companies worldwide qualify as digital champions. Companies in Asia scored particularly high.

Firms also need to launch specific actions to improve their organizations’ quantum literacy. Exploring quantum-inspired algorithms is a great starting point. A small team of quantum enthusiasts can help a quantum culture take root, which is essential to attract the internal capabilities necessary to overcome what will likely be a sustained talent shortage as the technology gains traction. They must engage actively with the quantum ecosystem to identify relevant partners to work with.

A company-wide quantum playbook and roadmap, updated annually, should detail the quantum opportunities and threats for each line of business. This will provide the basis for developing plans to prioritize software and algorithm development (patenting when possible to build entry barriers). It should be hardware agnostic, at least at the early stages in order to build potential early adopter advantage, but companies should monitor hardware and software breakthroughs to spot when it’s time to accelerate and scale.

In addition to the business benefits, there is one other reason for financial institutions to get into the quantum computing game: the technology is already widely expected to break public-key cryptography, which secures the confidentiality and authenticity of most of our current applications and protocols, within the next 10 to 15 years. By the nature of their activities, banks are particularly vulnerable to this development and need to prepare now for the transition to post-quantum cryptography. Given our experience with transitions that were less demanding (such as those to MD5 and SHA1), we think that the window for upgrading existing cryptographic infrastructure is closing rapidly.