Risk—identifying, modeling, and managing it—is at the core of the insurance industry. And today there is no greater long-term risk than that posed by climate change. It’s hardly surprising, then, that forward-looking insurers are taking the lead in pushing for climate progress. The industry is in a prime position to catalyze action through both insurer engagement with clients during the underwriting process and the manner in which insurers invest the trillions of dollars in their portfolios.

Of course, any discussion of climate change and business has always included the insurance industry. Until recently, however, much of the conversation has focused on the impact of rising global temperatures on insurance risk. Some $12 trillion to $15 trillion in assets are projected to be at risk from coastal flooding alone, according to the CRO Forum. Less attention has been paid to the flip side—how insurers can actually advance efforts to address the climate challenge. But that is changing.

Through our work with some of the leading players in the industry, we have identified four areas in which insurers can take action to advance the battle against climate change:

- Underwriting Portfolio. Drive change through the customer base and adapt product and service offerings to support climate action.

- Investment Portfolio. Adopt investment practices and tactics that drive climate progress. These can include engaging with portfolio companies; integrating environmental, social, and governance (ESG) factors, such as carbon emissions, into investment decisions and targets; and investing in specific sectors, such as renewables.

- Internal Emissions. Measure and actively work to reduce emissions for internal company operations, including those that involve suppliers.

- Regulatory and Reporting. Offer transparency around the company’s climate-related risk, carbon footprint, and efforts to support climate action.

Right now, insurers mobilizing to combat climate change are also confronting the disruption wrought by the COVID-19 pandemic . In many ways, the pandemic is intensifying—not diminishing—the sense of urgency around climate change . A recent BCG survey of 3,000 people in eight countries found that 70% of respondents are more aware now than before COVID-19 that human activity threatens the climate. What’s more, 87% said that companies should integrate environmental concerns into their products, services, and operations to a greater extent than they have in the past. Meanwhile, investors are accelerating their sustainable investing efforts, and companies in many industries are using the disruption of the current crisis as a catalyst to rebuild their business models and supply chains to be greener and more sustainable.

In this environment, insurers have an opportunity to redouble their climate change efforts. Those that do so can sharpen their competitive advantage in the market and help society address one of the key challenges of our time.

The Challenge—and Opportunity—for Insurers

Climate change, driven by rising greenhouse gas emissions, is proceeding at a rapid pace and will create a world that looks very different than it does today. The Global Risks Report 2020, by the World Economic Forum, identified the failure to mitigate climate change as the number-one risk in terms of worldwide potential impact. As that threat comes more clearly into view, insurers are increasingly pushing for action. Insurance industry players, for example, constitute 12 of the 26 members of the United Nations–convened Net-Zero Asset Owners Alliance, a coalition of institutional investors with $4.6 trillion under management that are committed to making their portfolios carbon neutral by 2050.

The failure to mitigate climate change is the number-one risk in terms of worldwide potential impact.

Those insurers understand that climate change has significant, direct impacts on their industry. For example, a warmer planet is already leading to an increase in the frequency of natural disasters and the corresponding claims in certain product lines, with such events projected to rise even further in the decades ahead. In addition, insurers are reassessing their risk models, especially their reliance on historical patterns, given the changing severity and frequency of climate-related events. And a large portion of assets in certain industries will become “stranded”—meaning that they will no longer have value or produce income, particularly if countries around the world adhere to the Paris Agreement. For example, some $1 trillion to $4 trillion in assets in the oil and gas sector are expected to become stranded by 2030, according to a 2018 study published in the journal Nature Climate Change. Such a hit could have significant impact on insurance companies’ financial performance. For one thing, it would translate into lower premiums for the insurers that had underwritten those assets. In addition, if an insurer holds the stocks of companies that own stranded assets, then those holdings could become a drag on investment returns.

Nevertheless, insurers also have an opportunity to strengthen their business as action related to climate change builds. Those that develop a coherent climate strategy, and apply it across all facets of their business, stand to reap several benefits.

Insurers that develop a coherent climate strategy, and apply it across all facets of their business, stand to reap several benefits.

First, a sound climate strategy can bolster the underwriting business, such as by spurring the development of new types of insurance and targeting new customers. Global electricity demand, for example, is projected to increase 30% by 2030, spurring $23 trillion in renewable energy investments in emerging markets over the next decade, according to the IFC. The new businesses and assets in those markets will represent a sizable and growing underwriting market for insurers.

Second, evidence is mounting that insurers that factor climate and other ESG issues into decision making are likely to improve their investment performance.

Third, insurers that take a leading role on climate, integrating climate risk into their investment processes, will be more competitive in winning third-party investment mandates, especially from institutional investors, such as pension funds.

Fourth, insurers with ambitious climate strategies and transparent disclosure will likely burnish their brands and improve their ability to attract and retain talent.

A Framework to Lead on Climate Change

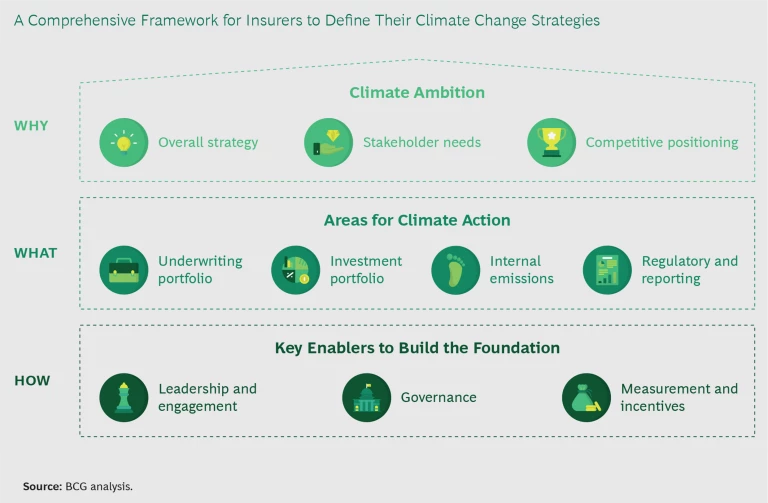

An insurer that wants to develop a coherent climate strategy should articulate a clear ambition for its effort, identify steps to incorporate that ambition into the company’s core business and operations, and make sure that it has the right enablers for success, including strong leadership and engagement, governance, and robust measurement and incentives. (See the exhibit.)

Creating the Climate Ambition

A clear ambition for the company’s climate efforts should be presented as a vision or rallying cry for how the company wants to take action on climate change. This should include creating appropriate guardrails to ensure that employee actions across regions and lines of business are consistent, thus maximizing the company’s impact.

The climate ambition is shaped and informed by three factors:

- Overall Corporate Strategy. An insurer’s climate ambition must align with its overall business strategy and be integrated into the core business, including underwriting and investments. A climate strategy should not be at odds with the business in any way.

- Stakeholder Needs. Insurers must assess the needs of all key stakeholders, including but not limited to investors, employees, brokers, insurance clients, investment clients, regulators, and nongovernmental organizations. Investors in insurance companies, in particular, are playing a significant role. Recent interviews reveal, for example, that investors are increasingly putting pressure on insurers in a few ways, often related to disclosure and divestments.

- Competitive Positioning. Each insurer should start by benchmarking its current climate strategy against that of its peers, both in terms of recent performance and commitments made. This will help the company understand what actions are viewed as table stakes and, in turn, what is required to be a leader.

Areas for Climate Action

A clear climate ambition will help leadership identify the actions needed to incorporate that vision throughout their core business. Insurers can advance progress on climate change in multiple areas.

Underwriting Portfolio

Insurers can promote climate progress through their underwriting portfolios in two ways: change the makeup of their customer base or change the composition of their product and service offerings.

Drive change in the customer base. To shift the business toward companies with lower carbon footprints, insurers are increasingly using exclusion to remove clients with high greenhouse gas emissions from the underwriting portfolio. Engagement with clients during the underwriting process, on the other hand, can take various forms—such as adjusting premiums or terms and conditions on the basis of a client’s climate action and inviting clients to share their perspectives on climate-related topics. Swiss Re, for example, has used both exclusion and engagement in its underwriting and asset management business. The company announced that, by 2023, it would stop providing insurance and reinsurance to, and investing in, the world’s 10% most carbon-intensive oil and gas producers. At the same time, Swiss Re will work with the remaining 90% of producers to support their transitions toward greener energy sources.

In some cases, engagement is driven by industry partnerships and coalitions. For example, Swiss Re is also on the advisory board of the Global Maritime Forum, a nonprofit focused on improving the sustainability of the global shipping industry. The Forum is exploring how to drive a shift in the industry away from traditional carbon-based fuels and toward greener alternatives, including green ammonia. One incentive under consideration is to offer lower marine insurance rates to shippers that make the change. Such offers are likely to become commonplace in the future as sustainability is increasingly factored into risk models. Insurance data and analytics provider Concirrus, for example, is integrating a number of new factors, including engine types and the amount of time spent in waters with limits on pollution emissions, into AI-driven ratings models that insurers use to make risk assessment and pricing decisions. Ultimately, the company expects to be able to assess the environmental footprint of every shipping vessel in operation.

Insurance players are also trying to attract more customers on the cutting edge of climate action. For example, Munich Re’s Green Tech Solutions business specializes in reinsurance for early-stage green-tech companies, driving greater planning certainty (by making cash flows more predictable) as they bring their technologies to the market.

Expand and adjust the suite of offerings. Insurers can also adjust their existing and new product offerings to support climate change progress. Most are creating offerings that promote climate-friendly action, allowing customers to choose to participate. Travelers, for example, offers premium discounts to hybrid car owners and people who own energy-efficient homes, as well as a suite of corporate insurance products for owners of energy-efficient commercial buildings.

Less common—but potentially burgeoning—are insurance products that allow policyholders to direct the investment of funds they pay toward premiums or to purchase an annuity. Société Générale and Entelligent, for example, formed a partnership to create a fixed-income annuity product that helps investors direct their capital toward companies that are working to lower their carbon footprints, such as through investments in energy efficiency.

Insurance brokers can also adjust their risk solution offerings to reflect challenges created by climate change. Willis Towers Watson, for example, created a solution called Climate Quantified to help companies manage their climate risk. The product fully integrates weather and climate analytical experience, the latest thinking from academia, institutional investor relationships, and risk transfer expertise.

Industry collaboration drives new solutions as well. Consider the UN’s Principles for Sustainable Insurance (PSI), for instance, which was founded in 2012. PSI asks participants to disclose their annual progress on its four principles: embedding ESG issues in insurance decision making, raising awareness about ESG factors, managing risk, developing solutions, and working with governments and regulators to promote action. Today, PSI participants collectively underwrite 25% of global industry premiums.

Looking ahead, insurers should begin to study whether there are correlations between the climate record of companies and their underwriting risks. Other ESG factors, such as health and safety, have long been integrated into insurance company risk analysis. Companies that are successfully reducing their emissions may, in fact, pose better underwriting risks, particularly with regard to policies that have long time horizons. Insurers that understand those correlations may create a competitive advantage in pricing.

Investment Portfolio

Within insurance companies, investment decisions are shaped on two levels. The investment office for the company typically sets general principles, while the captive-asset management arm integrates those principles into its investment process. (The principles are also incorporated into asset management agreements with third-party investment firms). When it comes to climate change, insurers have adopted a variety of tactics:

- Exclusion. A longstanding approach is to remove from the investment portfolio certain companies or industries that have a negative impact on the climate. The coal industry, for example, is the subject of exclusion policies set by more than 20 insurers. However, individual exclusion policies can vary, in some cases defined by the types of coal companies (for example, mining companies versus coal-fired power plant operators), the relationship status (such as new or existing customers), or the proportion of revenues the customer derives from coal.

- Engagement. This practice attempts to support high emitters in their efforts to reduce emissions and accelerate their transition to become more climate-friendly businesses. Many insurers today leverage their engagement teams to discuss climate-related topics with their portfolio companies. Exclusion and engagement are not mutually exclusive. Insurers can use a combination of both levers—for example, starting with engagement and ending with exclusion if the company or industry is not taking material action within a reasonable period of time.

- Target Setting. Insurers are also increasingly setting carbon emission targets for their portfolios, including those outlined in the Net-Zero Asset Owners Alliance.

- ESG Integration. Insurers are increasingly integrating the ESG performance, including carbon emissions, of individual companies into their investment analysis and decision making. BCG and others have found that companies outperforming in ESG areas that are material to their industry have higher valuations than companies underperforming in those areas. And a recent analysis by BCG focusing on carbon emissions in three critical industries—chemicals, energy, and mining—found that, all else being equal, the valuations of companies with the lowest carbon emissions were 12% to 13% higher than those with average emissions and 22% to 25% higher than those with the highest emissions.

- Investments in Specific Sectors. Just as investors are proactively divesting in certain sectors, they can proactively increase investments in others, such as renewable energy, that play a major part in addressing climate change.

Internal Emissions

Insurers, like other services firms, have relatively small carbon footprints. Greenhouse gas emissions from their internal operations, known as scope 1 and scope 2 emissions, are mainly driven by their real estate footprints, utility use, and owned-vehicle fleets. The largest source of insurer emissions typically involves their suppliers, or scope 3 emissions, such as an employee’s share of a flight taken for business travel.

Today, most leading insurers are working to reduce their footprints and are reporting them to the Task Force on Climate-Related Financial Disclosures (TCFD) and to ESG data collection firms. MetLife, for example, became the first carbon-neutral insurer in 2016, signaling the importance the firm places on integrating sustainability best practices across its global operations. Companies can take a variety of steps in this area, including retrofitting real estate with energy-efficient upgrades, purchasing renewable energy, converting their fleets to hybrid cars, and adjusting travel policy to reduce frequency.

More recently, the COVID-19 pandemic has prompted insurers to adopt new ways of engaging with employees and clients, such as by shifting to remote work and expanding the use of virtual tools. Nationwide, for example, has established a permanent shift to remote work for approximately 30% of its total workforce. These workplace changes are causing insurers to rethink how much office space or business travel—both of which significantly contribute to an insurer’s carbon footprint—is really needed. Coming out of the COVID-19 pandemic, there is a real opportunity for insurers to adopt innovative working models that meet the needs of their stakeholders while also bringing down their own internal emissions.

Regulatory and Reporting

Investors and regulators are requesting a higher degree of transparency and robustness in reporting. The reporting standards are converging, but there remains a proliferation of coalitions and task forces at global, regional, and national levels. There is an opportunity for insurers to take a more active role in shaping the regulatory and reporting standards for the industry. Clearly, there is room for improvement: in a 2019 survey of global investors by the Global Sustainable Investment Alliance, 59% of respondents felt either somewhat or very dissatisfied regarding the climate-related disclosure for publicly traded companies.

Transparent disclosure of climate-related risks is the minimum level of reporting expected today. While not mandatory, the guidance outlined by the TCFD is emerging as a preferred framework for such reporting across industries, with many global insurers releasing TCFD reports annually to highlight their climate-related activity. AXA, an initial cochair of TCFD, was an early champion of increasing climate disclosure transparency and consistency.

Some regulators are pushing for even more detailed disclosure on both investments and liabilities. The Prudential Regulation Authority in the UK, for example, has mandated insurers to pressure test their UK-based investment portfolios under different global-warming scenarios. As China, Japan, the US, and other major markets continue to study the issue of disclosure and potential implications, requirements are likely to become more expansive in the future.

Three Enablers to Build the Foundation

Successful execution of a climate strategy requires the right foundation in place.

First, insurers need strong leadership and engagement. Executive leadership must be out in front on the climate effort in order to maximize the return on investment in climate programs. Insurers can amplify the impact of their climate actions by striking partnerships and joining coalitions as well. A number of insurers have joined prominent coalitions, including in investments (such as the UN’s Principles for Responsible Investment), insurance (such as the Insurance Development Forum, the Geneva Association, and PSI), and in the general area of climate action (such as the UN Global Compact).

Insurers need strong leadership and engagement, the right governance model, and clear incentives for action.

Second, insurers need to create the right governance model. Strong governance includes oversight by representatives across the various components of the business. It also maximizes and coordinates climate-related efforts and holds leaders accountable for their commitments. Allianz Group, for example, has a comprehensive ESG strategy that includes climate and spans the organization’s insurance and investment businesses. To ensure a consistent ESG approach across Allianz, the firm established a dedicated board to strategically define and continuously develop the organization’s ESG ambition and guide its overall approach. ESG activities are integrated across Allianz via group-wide corporate rules on risk management, underwriting, and investment.

Third, insurers must ensure that they are setting clear targets, measuring progress, and creating the right incentives for action. Companies should establish quantifiable KPIs to assess their progress toward climate goals, such as becoming carbon neutral in their own operations or within their investment portfolios, and measure the costs associated with those efforts. And they should look for ways to align employee incentives with the outcomes. Executive performance reviews at Dutch insurer a.s.r., for example, include the assessment of an individual’s progress toward realizing corporate social-responsibility objectives. Among them: achieving 100% carbon-neutral business operations and further developing a distinctive sustainable investing policy position. AXA, meanwhile, integrates company performance on the Dow Jones Sustainability Index into compensation for about 7,000 executives.

Taking the Lead

Insurers have a clear opportunity to become leaders in the climate fight, given their expertise in appreciating and assessing risk. They should move now to create a comprehensive climate strategy that will not only provide clarity for employees, clients, and other key stakeholders but also ensure that the firms are well positioned to capitalize on the opportunity in the transition and are prepared to withstand business impacts from climate change.

To chart that course, insurers should consider a series of questions:

- Climate Ambition. What areas do we want to impact on climate change? Where do we want to lead our peers? What are the needs of our key stakeholders?

- Underwriting Portfolio. How well positioned are we to take advantage of emerging climate-related opportunities and mitigate climate-related risks?

- Investment Portfolio. How resilient are our investment portfolios to the impact from climate change? How can we integrate climate into our investment decisions to lower the global greenhouse gas emissions profile of our portfolio?

- Internal Emissions. What is our current emissions footprint? What is our appetite for an ambitious target? How robust is our plan to achieve it?

- Regulatory and Reporting. How do we communicate our ambition and climate action to all stakeholders?

- Leadership. How can the company contribute to improving climate progress globally, and what coalitions or groups should it support?

Insurers that can answer these questions clearly will be well positioned to lead in response to society’s greatest challenge.