Today’s deeply unsettled business environment is disrupting the realm of corporate venturing, evidenced by a 24% year-over-year global decline in CVC-backed deals in the first quarter of 2020.

Neither inaction nor hasty retreat is the right choice. History shows that innovation during a crisis yields huge dividends when the skies clear. For example, after the financial crisis of 2008 to 2009, the companies on BCG’s list of the 50 most innovative companies in 2007 delivered annual total shareholder returns 4% higher than the market from 2007 to 2012 . In fact, startup innovation during that era gave us many companies that are now household names: Airbnb (2008), WhatsApp (2009), Uber (2009), Instagram (2010), and Zoom (2011).

Moreover, corporate venturing in today’s environment can be a powerful way to accelerate a company’s digital transformation, given the number of startups and digital talent looking for investment and safe havens. (See “COVID-19 and Digital Transformation.”)

COVID-19 and Digital Transformation

COVID-19 and Digital Transformation

Many companies are leveraging startups and digital talent to help with near-term COVID-19 challenges such as remote working, online collaboration, and cloud-based solutions. These immediate challenges are the priority. But we also see venturing activities as a potentially powerful way to boost a company’s long-term digital transformation by snapping up the right assets and talent at bargain prices.

The current crisis is demonstrating that digital transformation is necessary not just to survive COVID-19 but to stake a reasonable claim to the future. With this in mind, we see three principal ways to use corporate venturing during the COVID-19 crisis to digitize the core.

Make smart purchases or investments. COVID-19 is putting a lot of financial pressure on startups, forcing them to the bargaining table and giving well-funded CVC units a chance to take smart risks for lower prices. In fact, digital laggards with strong cash positions have a rare opportunity to play a quick game of catchup by acquiring entire venture teams or units from companies in financial distress.

Acquire digital talent. Startups in financial difficulty will need to let go of some full-time digital talent, and freelancers may be looking for a more stable environment. This gives companies a chance to onboard experienced digital talent and fill capability gaps necessary to digitize the core.

Strike more partnerships. Startups heavily impacted by the COVID-19 crisis are looking for strong business partners as safe havens. This gives companies an opportunity to leverage startups’ digital talent through hackathons and other startup activities without P&L-heavy activity.

Reviewing Corporate Venturing Activities

In this environment, companies need to critically review their venturing activities in the context of their industry’s performance during the pandemic. By venturing activities, we mean both formal corporate venturing vehicles (such as corporate venture capital units, innovation labs, and incubators) and singular venturing initiatives (such as the creation of a virtual reality app or digital marketplace).

There are four distinct corporate venturing strategies in response to COVID-19: accelerate venturing activities, reset them, send them into hibernation, or ramp them down. These can be defined along two dimensions: the past impact on the core business and the expected impact in the next 18 months. (See Exhibit 1.) Note that venturing activities generate impact by meeting three requirements: a clearly defined mandate from key stakeholders; clear, measurable, and actionable KPIs; and a positive impact on the top and/or bottom line and on strategic objectives (such as access to new technologies).

Understanding the first dimension—the past impact on the core business—helps build confidence among senior leaders to continue venturing activities during the crisis. Gauging the second dimension—the expected impact in the next 18 months—gives the necessary weight to venturing activities that can deliver benefits relatively quickly during the crisis.

While a focus on rapid results is important, especially in these times of intense financial stress for many companies, near-term benefits still need to align with long-term objectives.

While a focus on rapid results is important, especially in these times of intense financial stress for many companies, near-term benefits still need to align with long-term objectives, such as a digital transformation or building up a new vertical. For example, an Asian tech company recently invested in an edtech startup to support its long-term goal of becoming a significant player in the online education space and to capitalize on the crisis-driven need for easier access to online education.

Choosing a COVID-19 Response Strategy

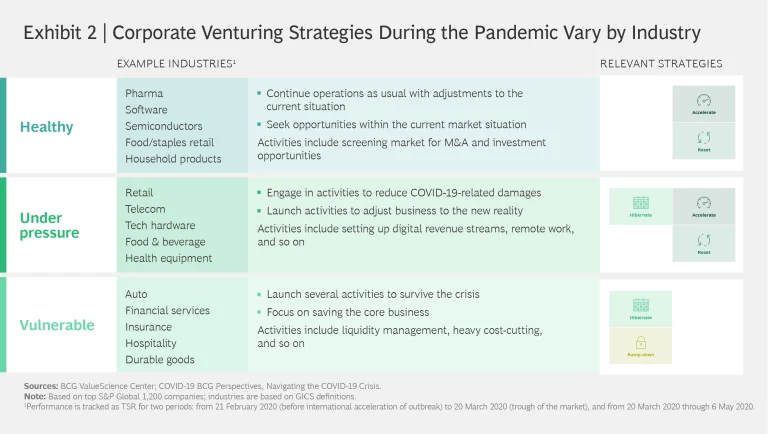

Logically, all four corporate venturing strategies are not an option for all companies. When determining how or whether to continue venturing initiatives in today’s environment, leaders should also assess how the COVID-19 crisis has affected their industry. This view helps to set guardrails. Is the company’s industry still relatively healthy, under pressure, or vulnerable? (See Exhibit 2.)

Healthy. Companies in industries in which product demand has remained robust, such as food/staples, pharma, and household products, should continue venturing activities and make adjustments in light of the new environment. These companies should either accelerate or reset their corporate venturing activities.

- Evaluate the corporate venturing setup to determine if it can have a positive impact beyond 18 months: Do you have the right mandate from key stakeholders, have you defined clear and measurable KPIs to demonstrate impact, and do you have a well-defined strategy?

- For those in a position to accelerate, seek out opportunities among startups and talent.

- For those in reset mode, look for opportunities to invest in interesting startup technologies and pick up digital talent at bargain prices given that startup valuations are down.

- Look for startups that can solve COVID-19-specific problems and might become long-term partners and suppliers.

- But don’t fall into the trap of making cheap investments too quickly. Make sure a short-term investment matches the long-term vision and strategy.

- Even if operations are healthy, always try to optimize operating expenses and drive for operational excellence.

Under Pressure. Most companies in pressured industries, such as retail, food and beverage, and tech hardware, must take immediate steps to reduce damage from the COVID-19 crisis and conserve resources. For some, this will mean putting venturing activities into hibernation until the pandemic passes; other companies may have the operational leeway to reset venturing activities and continue to grow or at least prepare for a rebound. A few of the strongest companies in this group may be able to selectively accelerate their venturing activities.

- Selectively shift activities to help the core business during the crisis. For example, a global building materials company partnered with a startup to set up remote work and manage employee work shifts more efficiently than it could have with regular corporate processes.

- Be willing to pursue investment opportunities that can significantly help the core business within the next 18 months.

- Use the time to re-evaluate and build confidence in the overall venturing strategy. Assess if necessary KPIs are in place, the mandate from key stakeholders is clear, and a clear long-term vision has been defined.

- Take steps to keep talent during the reset or hibernation or risk having to rebuild digital talent before continuing venturing activities.

- Minimize capital and operating expenses in order to ensure survival and keep operations viable until the economy rebounds.

Vulnerable. Companies in industries in which COVID-19 has dramatically curtailed operations and often caused financial distress—such as hospitality, auto, and insurance—need to take immediate action to survive the crisis through aggressive liquidity management and cost controls. For some, this will mean sending their venturing activities into hibernation and, in other cases, ramping down venturing units altogether.

- Deprioritize all venturing activities that will not generate positive top- or bottom-line impact within the next 18 months.

- Refocus venturing activities in the short term to address COVID-19-specific problems. For example, shift the focus of an innovation lab to support remote working and develop digital revenue.

- Scale back the team but retain top digital talent (as it is hard to win them back) and integrate talent into the core business whenever possible. For example, a global airline put its innovation lab on a part-time schedule for the first six months after the crisis hit.

- Do not shut down the corporate venturing unit (the CVC unit, innovation lab, or incubator) if it has some brand value or standing in the market.

- Reduce operating expenses and cut capital expenditures.

Evaluating the Startup Portfolio

No matter what industry a company is in, or whether it chooses to accelerate, reset, hibernate, or even ramp down its venturing initiatives, it must continue to actively manage its existing startup portfolio in a very challenging environment. Companies in desperate need of cash might be forced to sell parts of their startup portfolio, while others need to assess which startups need additional funding to scale their business (such as those in digital health) and which could benefit from other types of corporate support, such as IP, customer networks, R&D, and best practices from other portfolio companies.

A portfolio assessment should ascertain each startup’s exposure to the COVID-19 crisis on the basis of its cash position (is the current burn rate sufficient to survive the crisis or is additional funding necessary?), business model (does it rely on long-term contracts or shorter, more transactional contracts that are more at risk?), customer base (does the startup sell to industries in distress or to high-demand clients such as hospitals?), and the customer acquisition model (does it sell through trade fairs, face-to-face interactions, or digital channels?).

With this information, companies can begin to decide which startups to keep and which to jettison. For example, a few of Asia’s biggest companies with venturing units are already attempting to sell their stakes in some of the region’s most-promising tech startups as they refocus their resources on the core to weather the coronavirus crisis.

Of course, the best option is to delay selling assets until the market has at least slightly recovered. If that’s not possible, it is important to avoid fire sales on the secondary market. One option is a strip sale, which involves dividing the portfolio and selling individual assets or smaller bundles to reduce the size of the startup portfolio. Another option is to offer buy-in opportunities to financial partners such as institutional investors, which dilutes ownership but avoids an outright sale of startups. This allows the company to mitigate risk but continue some important venturing activities.

Venturing Activities Can Speed Recovery and Success

Even before the COVID-19 crisis, venturing initiatives were coming under increasing pressure to prove their value. The pandemic has intensified this trend. If ever there was a moment to reconsider venturing initiatives and focus on what creates real value, now is the time. Early, quick, and smart decisions about how to invest and adapt venturing activities can help all companies—whether in a healthy, pressured, or vulnerable industry—better navigate the current environment and accelerate out of the crisis faster than competitors.