Fending off damaging climate change is like a timed game of chess humanity can’t afford to lose. Our odds of avoiding checkmate improve significantly if we keep cumulative carbon dioxide (CO2) emissions under 350 gigatons between now and 2050. The problem is that if nothing changes, we will already deplete this CO2 “budget”—based on the Paris Agreement—by 2030.

A strategy known as “net zero,” which many companies, institutions, and governments are considering, buys the world time to transition to low-carbon technologies and for behavioral changes to take hold. The basic concept behind net zero is simple: reduce emissions aggressively and balance out the remaining CO2 with removals.

But there is a catch. The nature-based forms of removals available today cannot be relied on to keep CO2 permanently out of the atmosphere (forests could die, for example, leading to the release of once-stored CO2). They are in that sense temporary, so while important in slowing climate change, they can only serve as a stopgap.

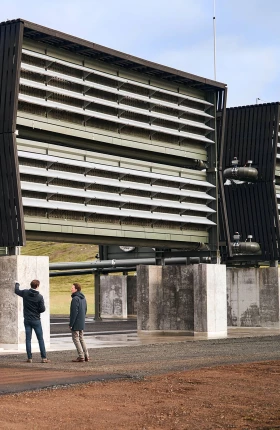

The best course of action is a strategy of “true net zero” that combines highly aggressive emissions cuts with permanent removals. The challenge is that it requires nascent technologies, such as direct air capture, that are not yet available on a commercially relevant scale. Reaching a meaningful global capacity will take decades, and it will only be possible if we soon begin to grow the demand for permanent removals—rapidly.

The best course of action is a strategy of “true net zero” that combines highly aggressive emissions cuts with permanent removals.

Fortunately, a small set of companies is already uniquely positioned with the incentives and resources to commit to true net zero. For them, the benefits could significantly outweigh the costs, and their actions would have an outsized long-term climate impact. As early adopters of true net zero, these companies will lower the price of permanent removals and allow others to follow, thereby driving the scaling needed to help us stay within our carbon budget. (See “Getting Technical.”)

Getting Technical

Getting Technical

This article deals exclusively with CO2, only one of many greenhouse gases (GHGs) whose emissions the world should reduce. But it is by far the most important to tackle today, given how much of it we emit and because CO2 accumulates in the atmosphere, where it can remain for centuries, or even millennia. In contrast, most of the methane emitted today will break down in the atmosphere within decades. Therefore, the long-term impact of current CO2 emissions far exceeds that of other GHGs.

We need to manage and ultimately cap cumulative emissions of CO2. According to the Intergovernmental Panel on Climate Change (IPCC), staying within the remaining 350-gigaton carbon budget will provide us a 66% chance of keeping global warming below 1.5°C. Exceeding that budget would lead to greater warming, and managing to stay below it—or recovering from temporarily going above it—depends on removals at a large scale.

Six CO2 removal technologies could achieve large-scale capacity by 2050. Forestation, soil carbon sequestration, and biochar are temporary forms, and they are expected to be the cheapest. Bioenergy with carbon capture and storage, enhanced weathering, and direct air capture are permanent, but more expensive. Each has its own outlook and pros and cons, and we need them all. This means that we need to quickly deploy the nature-based removals available to us today, while also scaling permanent removal technologies that will be critical in the future.

To achieve true net zero, the permanence of removals should match the impact of emissions—an idea that is not clearly addressed in current standards and certifications. In our view, permanent removals should be required to compensate for CO2 emissions from fossil fuels and for all emissions of other longer-lived GHGs. Temporary removals are acceptable for emissions of shorter-lived GHGs like methane, as well as to compensate for transient impacts such as those from aircraft contrails. We intentionally do not specify how to compensate for CO2 emissions from deforestation, since the climate impact of land-use change extends beyond GHGs (and should not be considered only in the context of balancing emissions with removals).

We Need True Net Zero

In addition to their risk of being temporary, today’s nature-based removal technologies face practical constraints, such as competition for land. According to the Intergovernmental Panel on Climate Change (IPCC), devoting land to large-scale forestation, for instance, would lead to food prices in 2050 that are 80% higher than they would otherwise be.

Without mainstream technologies that remove CO2 from the atmosphere for good, humanity will face a dilemma: either eliminate emissions from fossil fuels completely, or rely on temporary removals for any emissions left over after significant reductions. The first option would cause severe economic and social disruption. Countless activities emit at least some CO2, and prohibiting all emissions would even preclude critical mitigation technologies, such as carbon capture and storage for power, steel, and cement production (which typically are incapable of eliminating emissions entirely). Meanwhile, the second option risks only delaying climate change—and shifting the burden of mitigation to future generations.

Since emitting CO2 from fossil fuels creates a permanent problem for the world, the only way to truly undo those emissions is with permanent removals. True net zero is how we escape the mitigation dilemma, but that critical option will only become available if early adopters emerge to take the lead.

True Net Zero Needs Early Adopters

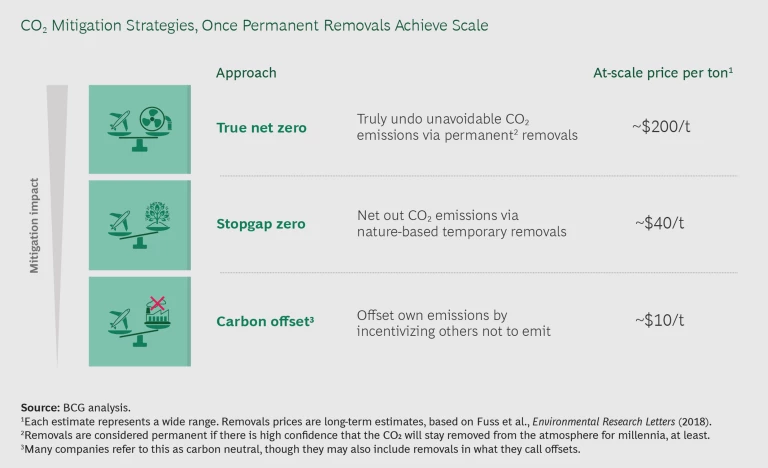

The strategy of true net zero aspires beyond the two currently available CO2 mitigation strategies of “carbon offset” and “stopgap zero.” (See the exhibit.) The carbon offset approach entails balancing emissions by incentivizing others not to emit. But the price of such carbon offsets is so low that it encourages some companies to buy their way out of the need to change behavior and cut emissions. Getting to a middle-ground stopgap zero is a more effective mitigation approach, though it is more expensive and relies heavily on nature for temporary removals.

When permanent removal technologies achieve scale, they will be priced around $200 per ton, and potentially less. Today they are more expensive. Companies choosing the true net zero approach will need to carefully weigh the high price of permanent removals against the cost of cutting emissions. Adopting this strategy will yield the best mitigation outcome, but it costs more than the other two approaches. In the near term, true net zero adds a high-end option for a small set of companies that have both the ability and untapped willingness to pay.

Prime candidates for this high-end option would have high margins and relatively low emissions intensity. Such companies include technology, professional services, and luxury goods firms, whose reliance on top talent and strong brands enhances the direct benefits their organizations can gain from climate leadership. By opting for this ambitious and expensive mitigation strategy, these companies can create an enhanced sense of purpose that comes from doing the right thing for the planet. True net zero provides early adopters—and society at large—the following key benefits:

- It enriches their offering and appeal to customers. Companies can integrate the commitment into their branding, assuring customers that they design, produce, and sell their products and services with true net zero practices. This appeals to business customers and consumers who share a commitment to climate change mitigation and purchasing in accordance with their beliefs.

- It makes them more attractive to talent. The commitment to true net zero makes for a more attractive employer at a time when purpose and the desire for sustainability play an increasingly important role at organizations everywhere. Early adopters can leverage the influence they have in their supply chains and markets to show others—potentially even competitors—the merits of true net zero.

- It enables the permanent removal companies to scale. With a new set of customers, companies that provide permanent removals can finance construction and innovation through actual sales, instead of investment or subsidization alone. As they accelerate their move down the experience curve, prices will come down, opening the market to other buyers who can then afford to commit to true net zero.

- It reduces the burden on current and future generations. Everyone benefits from permanent removal technologies reaching scale and becoming cheaper. The world gets a bigger, better mitigation toolkit, and the ability to balance residual emissions without burdening future generations. Emissions still need to be reduced aggressively, and by providing an alternative to some of the more extreme changes that would otherwise be needed, permanent removals can help us reach the goals set by the Paris Agreement.

The amount of money required in the short term to help scale these technologies is well within the collective reach of those potential early adopters that are able to step up their voluntary climate ambition before others can do the same. Fully scaling direct air capture technology, for example, will take decades, but we estimate that a $13 billion investment over the next ten years would suffice to launch the scaling process. Beyond their potential willingness to invest directly, early adopters of true net zero have a key role to play in generating the demand that will give others the confidence to invest themselves.

In most ways, the climate crisis plays out as a tragedy of the commons, where parties undermine a common good by acting in their narrow self-interests. But with true net zero, making the independent decision to be an early adopter—regardless of what other parties do—enables a company to create significant benefits for itself and the world. For companies where the benefits outweigh the economic cost, their self-interest is aligned with the common good, giving them the opportunity to lead. As permanent removals become cheaper, more and more businesses, institutions, and governments will be able to join them in committing to true net zero. The growing demand for permanent removals will drive continued scaling of those technologies, reinforcing efforts to permanently limit the amount of CO2 in the atmosphere.

True net zero enables a company to create significant benefits for itself and the world.

The game is still climate chess, and the power pieces of climate change mitigation (the prevailing means of cutting emissions) will still dominate the board. In contrast, the commitment to true net zero at this moment is akin to moving a pawn early in the game. Any good chess player knows that you should not underestimate the importance of an early, seemingly small move. Playing this way will increase the leverage of the power pieces over the next 30 years and improve humanity’s odds of avoiding climate checkmate. That is in everyone’s interest, and a few pioneering companies can help make it happen.

The BCG Henderson Institute is the Boston Consulting Group’s strategy think tank, dedicated to exploring and developing valuable new insights from business, technology, and science by embracing the powerful technology of ideas. The Institute engages leaders in provocative discussion and experimentation to expand the boundaries of business theory and practice and to translate innovative ideas from within and beyond business. For more ideas and inspiration follow us on

LinkedIn

and Twitter: @BCGHenderson.