Over the last few decades, just about everything private equity has touched has turned into gold. Assets under management (AuM) and dry powder levels are at historic highs, and despite fears of an economic slowdown, the industry’s average internal rates of return are poised to significantly outperform the S&P 500.

PE’s growth trajectory is likely to get even more gilded in the years ahead. If anything, the forces that contributed to the industry’s success have only gathered strength. Ready stores of capital, superior market returns, and fund sizes that have grown to eclipse the gross domestic product of some small countries have acted as an accelerant, putting PE on course for an astonishing rise. It’s not far-fetched to imagine that in ten years, PE could operate at the center of multiple financial and commercial ecosystems and rival public markets in scale and scope.

Such predictions might seem overblown were it not for a confluence of trends that play directly into PE’s strengths. They include shifts within the business landscape that give the edge to those willing to place bold bets, value creation levers like digitization that advantage those able to make and sustain needed investments, and scale effects that benefit players able to apply insights from across businesses, disciplines, and geographies. PE sits at the intersection of many of these forces. As a major investor across industries, and one with the ability to plan and advise over a longer investment horizon, PE has an opportunity to use its resources and influence to be an agent of change and a driver of long-term prosperity.

Yet mining the growth potential of the next few years will require firms to transform in ways that cut to the core of their business and operating models. What worked in the past will not work going forward. Leaders can either go for gold or settle for scrap. Those that want to win over the next decade must rethink their traditional strategy-setting, deal-making, and management approaches and craft a new leadership agenda.

PE Is at an Inflection Point

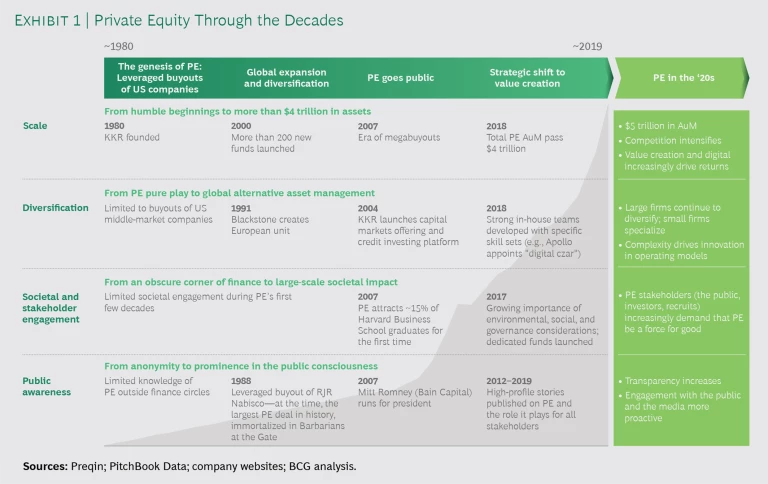

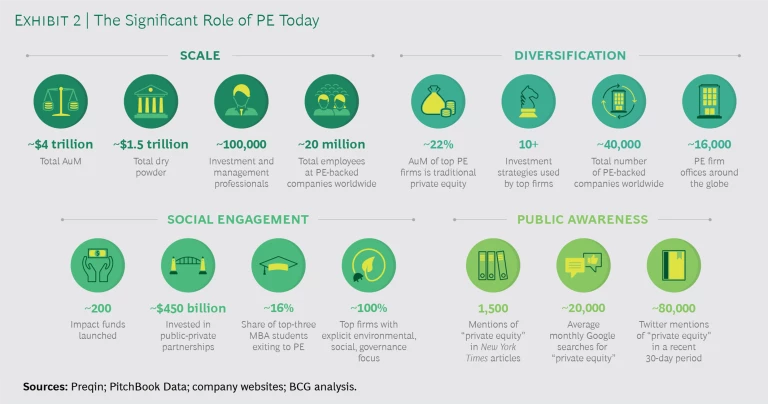

The modern PE industry has come a long way from the junk bonds and leveraged buyouts that characterized its early days. In 1980, only a handful of firms existed, none of them household names at the time, and private placements were little understood. Since then, the industry has grown exponentially. In less than four decades, this once obscure corner of finance has become a $4 trillion global sector and a major source of capital formation, whose diverse offerings now include everything from traditional buyouts to alternative asset management. (See Exhibits 1 and 2.)

There is much to celebrate. Yet the industry’s success to date is a drop in the bucket compared with what the next ten years could hold. PE currently represents less than 5% of total AuM globally and less than 2% of total investable capital. Not only is there plenty of room to grow, a combination of factors could give leading players a major bounce.

First, the industry is accumulating capital at an unprecedented rate. PE raised more than $1 trillion in the past three years alone, and AuM are growing at two times the rest of the private capital market. With liquidity strong and funds outperforming most other asset classes, forward price earnings analyses now place a higher value on alternative asset managers than on traditional ones.

Second, PE is gaining influence across major sectors of the economy as fund sizes grow. “Megafunds,” each with more than $10 billion in AuM, are becoming a fixture of the PE environment, with more than 50 launched since 2010. In recent years, those funds have gotten even larger. In 2017, Apollo stunned the investor world when it launched a buyout vehicle totaling $24.6 billion. Blackstone is the latest to reach nosebleed heights, with its September 2019 announcement that it had raised $26 billion for its newest flagship buyout fund.

Third, business and investor sentiment is shifting in favor of private placements as short-term earnings pressure and share price volatility sour some companies and backers on the public markets. With stock performance for newly public companies slumping and the postponement of several high-profile IPOs, including WeWork and Endeavor, we expect the public-to-private trend to gather momentum.

Finally, the near-term economic outlook, though poor for some, could be a boon for PE. With underperforming companies forced to devote attention and resources to shoring up balance sheets, well-positioned PE firms and portfolio companies can take advantage of the slack to advance their market position, embrace new investments, and fast-track business and operating model improvements.

Big Returns Will Require Bold Changes

All told, PE has the potential to occupy a very different and far more powerful position in the business and financial markets by 2030. But firms will have to work a lot harder than before to capture that growth. Moreover, the forces roiling the broader business landscape will change what it takes to win. Leaders cannot hope to succeed using their current business practices and operating structure.

If AuM swell by five times in the space of ten years, existing PE models will come under enormous pressure. As capital floods in, firms will have to work differently to deliver the strong returns and outperformance that investors have come to expect. Boosting returns amid ongoing economic, geopolitical, and market uncertainty will require leaders to think, plan, and invest in new ways—with a focus on value, an emphasis on digitization, and a commitment to evolving their internal and portfolio company organizational models.

The rising tide will not lift all boats. We’re likely to see greater bifurcation between huge funds and niche specialists. Since 2000, top-tier PE firms have delivered an internal rate of return (IRR) 7.5 points greater, or 60% higher, than that of median players, and that spread is only likely to grow. In addition, organizational models for most firms will be pulled between the need to achieve scale on the one hand and diversification on the other. Given the speed of change, it will no longer be enough to improve by increments or to overhaul functions or capabilities individually. Firms must develop the ability to pull multiple transformation levers in parallel, combined with massive upskilling and reskilling to build critical capabilities—within their own organizations and across their portfolio companies.

PE has the potential to occupy a very different and far more powerful position in the business and financial markets by 2030.

In the meantime, technology continues to advance. If time is money, earning it will require firms and portfolio companies to catch up with digital leaders and acquire the tools and capabilities to use information to their advantage. Firms will have to think deeply and more creatively about how to attract and retain the needed skills—and more fundamentally, about what they want to be. Are they content with becoming “boring asset managers,” or can they capture and scale the smart, competitive energy that defined their early success—and do so in ways that align with rising environmental, social, and governance expectations?

The ‘20s are just beginning, but the most attractive opportunities will go to players that start the decade with eyes wide open. We believe success will hinge on taking the following five actions.

1. Create a Differentiated Go-to-Market Strategy

Over the next ten years, competition for deals will increase, and—if past experience is any guide—many firms will face pressure to boost returns through higher deal multiples and leverage. With megafunds like SoftBank, large sovereign wealth and pension funds, and select PE funds like Carlyle and Blackstone allocating landscape-shifting sums of capital, we will see greater strategic stratification. Big firms will get bigger and the gap between them and the rest of the field will widen, with smaller firms forced to specialize.

To protect growth, PE leaders need to make an honest assessment of their market position and prospects, and develop a clear and differentiated go-to-market strategy. For large funds, that strategy should emphasize deeper diversification, not just across industries but also across geographies and asset classes. Blackstone, for instance, has added new real estate and debt funds over the last five years and entered new geographies. That expanded reach has allowed the firm to use its insights and expertise across asset classes to the advantage of its buyout teams.

Big firms will get bigger and the gap between them and the rest of the field will widen, with smaller firms forced to specialize.

Few small and medium-sized funds will be able to amass the scale and resources to compete effectively with large funds. But they don’t need to. Rather than diluting their efforts in a vain attempt to service the entire value chain, they should seek to dominate high-growth niches and tailor their strategies to become specialists in a particular geography, industry, or asset class. Vista, for instance, has focused almost exclusively on US enterprise software companies, delivering an IRR of 22% over the past decade; others, like Nordic Capital, have successfully focused on technology angles in select verticals like health care and financial services, while Navis and Affinity have concentrated on family-owned businesses in Southeast Asia.

2. Design the Firm of the Future

Capturing and managing the growth opportunities of the next ten years will require firms to evolve their organizational practices and structures and become flatter, more collaborative, and more nimble. As funds get larger and investment more diverse, PE firms will require expertise from multiple domains. Cross-deal team integration around assets that have complementary characteristics (for instance, combining growth in technology and real estate with leveraged buyout teams) will be crucial. An asset with significant technology or real estate holdings, for example, will need a deal team that can assess the value or risks associated with those technologies or properties, just as deals with asymmetrical downside exposure will need teams with both debt expertise and traditional equity muscle.

Leaders need to establish practices and incentives that encourage collaborative teaming and design processes that improve sourcing and thesis development. Organizations also need to manage the tension between longer holding periods and near-term value creation.

Capturing and managing the growth opportunities of the next ten years will require firms to become flatter, more collaborative, and more nimble.

That balancing act requires building out the processes that enable a fail-fast-and-learn-quickly culture, while continuing to back transformational capabilities within the firm and across portfolio companies.

With information efficiency rapidly becoming a differentiating attribute, firms should use the current period, when many are flush with capital, to design robust knowledge-sharing processes. That includes codifying best practices and making them easier to access and apply at scale so that firms can leverage crucial insights—and act on them before their rivals do.

3. Achieve Digital Transformation at Scale

Digital competencies will play a significantly greater role in value creation. To help targets incubate new products and services, achieve competitive cost performance, and fine-tune their commercial strategies, firms must aggressively implement those capabilities. PE leaders are uniquely positioned to pinpoint high-value opportunities. What they must do now is scale those insights across their targets—tapping advances such as machine learning, natural language processing, and process automation—to gain needed reach and dexterity.

Portfolio companies will have varying degrees of digital maturity. How far and how fast to push the transformation will depend on their industry, competitive position, and balance sheet health. But all firms, regardless of their baseline, need to help their portfolio companies articulate a clear digital strategy that encompasses which products and services to digitize, which data and analytics use cases to advance, and which supporting technology infrastructure to build or acquire.

The results can be transformative. One PE firm turned a 2x deal into a 9x deal by taking advantage of the digital investments it had made in the company, transforming an old manufacturer into a new big data business. Likewise, a PE-backed company focused on the coffee industry created a hyperpersonalization platform that sent tailored offers to, and increased engagement with, millions of customers, boosting net incremental revenues by three times per customer and creating a $120 million uplift in revenue.

To ensure that such events are not a one-off, firms need to build the capabilities and tools to manage complex transformations—with the ability to meet several needs at once. In the years ahead, leadership in digital change management is likely to become one of the most defining characteristics of industry outperformers.

4. Embrace the Business Imperative of Diversity

The next ten years will see a war for talent as big firms scale and smaller ones diversify. Technology and digital skills will be at a particular premium. Strong hires will have their choice of workplace. While PE firms, investment banks, and management consultancies were once the most sought after destination for the best and brightest, technology leaders and high-profile startups are now the go-to path for many promising recruits.

The combination of rapid growth, fierce competition, and a “buyer’s” market presents challenges for PE. Leaders need to be careful how they manage their growth lest they stultify and lose the cultural “mojo” that attracted so many bright young people to the industry. They also need to get creative and develop career paths that will help build the digital competencies and provide the innovation edge that firms need.

The ambitious, can-do culture that attracted the sharpest minds over the last two decades will stale unless firms find a way to rejuvenate and redefine it for a new generation. Firms need to think proactively about the future of work to avoid falling victim to their own success. Building teams that feature greater diversity in terms of background and expertise will be crucial.

Doing so effectively requires the ability to access a range of perspectives. PE, like much of the financial services industry, has suffered from a lack of diversity. Firms need to widen the recruiting funnel to generate richer cognitive and social diversity, and set standards for diversity and inclusion within their portfolio companies. Research shows that How Diverse Leadership Teams Boost Innovation have EBIT margins that are nearly 10 percentage points higher than those with below-average diversity. Firms that take the lead on diversity initiatives can create a virtuous cycle that allows them to attract strong talent, nurture innovation, and lay the foundation for sustained growth.

The next ten years will see a war for talent as big firms scale and smaller ones diversify.

5. Optimize for Both Social and Business Value

As PE becomes an increasingly important player in shaping business performance, scrutiny over how and for whom it generates value will grow. Perceptions that the industry prioritizes financial returns at the expense of job retention, organizational growth, and negative environmental impact remain pervasive. As a direct and indirect employer of millions of workers globally, firms need to embrace their role as holistic value creators and industry stalwarts.

Good corporate stewardship will be essential. Firms need to demonstrate that their environmental, social, and governance (ESG) frameworks are more than just a superficial overlay. Greenwashing—overstating an investment’s impact—remains an ongoing investor concern. To demonstrate credibility, managers need to make a more concerted push to incorporate ESG metrics into their investment methodologies—and demonstrate the financial value that comes from this approach. At Permira, for instance, ESG considerations are now part of its screening and due diligence processes, and they also influence its postacquisition approach. Having acquired Dr. Martens, for example, Permira is now working with the company to develop a more sustainable supply chain.

Leading firms will build on these steps, deeply embedding ESG metrics across the investment life cycle and launching targeted-impact funds that allow them to use their funding and expertise to enable large-scale social impact. Making the most of ESG opportunities requires considering which metrics and frameworks to adopt, which sectors to track and which to exclude, and what type of reporting structure and frequency makes the most sense.

As a $4 trillion industry that represents 5.5% of all equities, PE has become a behemoth on the financial stage. Its superior performance over the past decade shows no signs of abating. However, winning the future requires preparing for it now. Leaders that embrace the five imperatives outlined here can turn PE into a force for good, with virtually no limit to how much they can grow.