Investors are experts at discovering opportunities. Sensing important shifts, putting the right deals together, and executing quickly have long been hallmarks of their success. But the COVID-19 crisis has revealed that the technologies, data practices, and ways of working that investors have traditionally relied on need to be recalibrated to sustain strong performance.

Decisive action will be crucial postcrisis. Deal flow is picking up. Many portfolio companies face acute supply and demand challenges, and the shape of the economic recovery remains uncertain. In addition, until there is an effective vaccine for COVID-19, many employees and stakeholders will continue to work remotely.

Technology and data-gathering pain points that are a source of irritation for principal investors in normal times have become a source of critical risk. A patchwork of systems, complicated processes, and fragmented data often require teams to run a gauntlet to complete routine analyses, with many resorting to manual workarounds.

Although principal investors have been working to address some of these gaps for years, they can no longer put off the systemic changes needed. Guided by the strategic playbook and revised fund strategy and vision discussed in our earlier articles, firms must now adapt their operating models—deeply and systematically. This final article in the series walks through the technology, data management, and organizational practices that can allow firms to enter the postcrisis period with strength and resilience.

Current Operating Models Are Under Strain

Firms have responded admirably to the demands of the crisis, establishing war rooms and emergency response teams, and providing portfolio companies with increased support. Yet those demands have also revealed shortcomings in many investor operating models. Chasing down needed information, coordinating inputs, and providing thoughtful guidance require a smooth interplay among people, processes, and technology. But the investors we spoke with describe a very different experience over the crisis period, with longstanding operational pain points stretching many teams, systems, and processes to their limits. A number of challenges in the postcrisis environment are likely to add to these pressures.

Lots of Opportunities, but a Smaller Window in Which to Act. Market disruption can create important new avenues for growth. But the fluid environment means conditions can change quickly. Pulling the right structures together in the right timeframe takes effective choreography. One investor told us, “In the past, it took us eight or nine months to add a new asset class to our portfolio, and we were among the fastest. Now my team has four weeks to add three asset classes and make the process, technology, upskilling, and other changes needed.”

Often Fragmented Data Management. Investors recognize the time value of insights, but cobbling together the necessary information, validating the underlying data, and sharing information with those who need it can be a headache. As one investor observed, “After implementing CRM, no one had the budget or the bandwidth to go after data management, and now we’re paying the price.” Another said, “I have to go through multiple loops to share information and data with a portfolio company. There are no set guidelines, no shared view of what metrics to track, and no real help to analyze the data that we’re collecting. It seems like we are constantly tripping on control measures that force us to ask for exceptions.”

Over the crisis period, longstanding operational pain points have stretched many teams, systems, and processes to their limits.

Weak and informal knowledge capture processes compound the difficulties. One investor told us, “When a key member of our team was home sick with COVID-19, no one could access the deal information that he had on his laptop. To make matters worse, the information was not even in a folder on his laptop, but in his emails. We were unable to access the knowledge or identify the experts who might have mitigated the risk factors in the deal.”

Lean but Not Efficient. Many principal investors have embraced lean teams but have not adopted new ways of working or made the right organizational changes to harvest their new-found flexibility. Typical investment planning may involve five or six steps from initial due diligence to funding. Cumbersome approval processes can result in people-related bottlenecks as teams wait for leaders and committees to render decisions. Siloed structures concentrate pockets of expertise, giving firms limited leeway to manage excess workloads. In addition, many routine processes feature multiple handoffs that require manual intervention. Such handoffs are exacerbated by fragmented technology and software solutions that hinder coordination and interoperability—such as the typical trade-booking cycler, which requires users to log on to several different systems to input data.

To succeed in the postcrisis period, investors need to enable new ways of working and accommodate a workforce and client base that have become more reliant on remote collaboration and digital engagement. Excel spreadsheets and layered decision making must give way to advanced modeling, real-time knowledge sharing, and robust, digitally enabled processes.

By shifting to a modern and modular technology platform, establishing a centralized data governance structure, and embracing agile ways of working, investors can gain the operational resilience they need.

Designing a New Operating Model for a New Normal

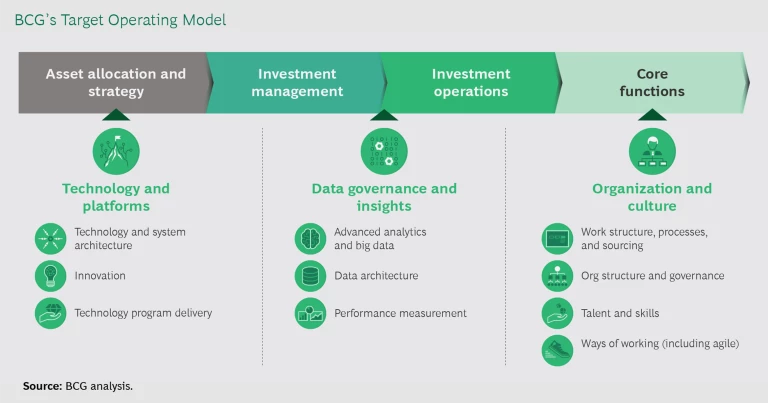

An operating model functions like a central nervous system. Inputs are captured, processed, and shared synergistically to allow the organization to respond quickly and efficiently. The core elements of BCG’s recommended target operating model are technology and platforms, data and insights, and organization and culture. (See the exhibit.)

Firms don’t need to pursue a massive overhaul all at once. Instead, they can lay the groundwork by focusing on the specific capabilities they need in order to gain resilience in the postcrisis environment. Our case work shows that addressing these core topics comprehensively can help firms improve assets under management by an average of 5 to 7 basis points. Here’s what we recommend.

Move Toward a Modern Platform Based on Modular Architecture

Shifting to modern platforms can help firms reduce their sprawling technology footprint from about 30 systems on average to between 5 and 8. In addition to greater functionality and agility, the streamlining can deliver improved cost performance: our data shows that firms can realize average cost savings of 7 to 10 percentage points. The modular architecture makes it easier for firms to integrate systems end to end, allowing data to be shared across systems and manual tasks to be automated.

In addition, because these applications are designed to “plug and play” with others in the cloud, investors can access an expansive catalogue of services and solutions to support new asset class and investor strategies. Many of these software-as-a-service subscription offerings can be less expensive to acquire and maintain, since updates are managed by the software provider and require significantly less IT involvement on the investor side. Many also come with user-friendly interfaces and mobile extensions that can facilitate remote work.

For example, taking advantage of its modular architecture, one firm was able to quickly implement a specialized COVID-19 human resource app and dashboard that allowed it to keep track of employees in quarantine and perform contact tracing while protecting employee privacy. Instead of the firm’s having to rely on ad-hoc, email-based reporting, the app allowed it to protect employee health and safety and ensure compliance with local regulations by building on the data from the HR, finance, and physical space management systems that were already in use.

Greater system integration can also relieve another management headache, namely, the need for enhanced risk reporting and valuation monitoring—a need that the pandemic makes more important. New systems can automate these activities to a much greater extent, allowing teams to spend their time uncovering next-level insights instead of data gathering.

Although creating and implementing a modern platform is a long-term play, investors can begin by doing the following:

- Map the systems, processes, and data flows involved in each step of the investment decision-making process. Leaders should identify critical data needs as well as key bottlenecks such as systems that don’t “talk” to each other, applications that lack required functionality, and manual handoffs across teams.

- Ensure that the right controls are in place. Although most business-critical processes are well tested, some middle- and back-office processes may need to be reinforced. Firms should also speak with their data and service providers about the quality of their controls and whether they are fit for purpose.

- Prioritize quick fixes. Some relatively easy, short-term changes, such as the expansion of maker-checker (dual approval) processes, can help firms mitigate acute challenges while their longer-term system implementation unfolds. Firms can build on this framework over time, zeroing in on nonvalue-adding components and creating or acquiring digital alternatives.

Unlock Insights by Formalizing Data Governance

To close the knowledge gap and make data easier to access, firms should establish a data governance function led by a senior leader with the authority to bring investment, risk, finance, and other departments together so they can align on a “single source of truth” and enforce data management changes across the organization.

To succeed in the postcrisis period, investors need to accommodate a workforce and client base that have become more reliant on remote collaboration and digital engagement.

Under the auspices of this executive, a working team comprising individuals from across relevant departments should begin building an inventory of critical data elements (CDEs)—standardized terms and concepts that allow data to be shared and used firmwide. Agreeing on a common set of data inputs to calculate critical metrics, such as internal rate of return, mark-to-market valuations, and debt service coverage ratios, can be a helpful place to start. Firms can then add other CDEs over time. This activity can be enlightening. For instance, one firm found that its legal documents contained more than 50 definitions of interest coverage and more than 20 “accepted and commonly used” definitions of IRR across the organization.

Creating formal data governance protocols can make it easier for firms to process information from outside sources —such as asset-servicing partners, custodians, and banks—to augment their understanding. In addition, with a common data architecture, investors can collate inputs, such as volume and trade information, and then feed that data into automated analytical processes. As they refine their data taxonomies and libraries, investors can begin to develop more specialized use cases and algorithms.

Leading firms will also look to forge data links with their portfolio companies. Secure data exchange platforms can help firms pull in anonymized customer transaction data, demand assessments, and behavioral analytics from across their holdings. That information can help leaders fine-tune planning, identify cross-sell opportunities, and improve portfolio performance

By shifting to a modern and modular technology platform, establishing a centralized data governance structure, and embracing agile ways of working, investors can gain the operational resilience they need.

Over time, firms can expand their data governance footprint. Some may choose to create a data center of excellence as a single resource. Others may set up a hub-and-spoke model, with a centralized unit in charge of core data governance and data stewards housed within the business who work with teams to develop and deploy analytics.

Create an Organization and a Culture That Embrace New Ways of Working

To win in the postcrisis environment, firms need to move quickly from ideation to action. Adapting their organization in the following ways can help them gain this dexterity.

Embrace agile. Agile ways of working can give firms the accountability, transparency, and resiliency they need. With agile, managers engage directly from the start. Teams work in sprints of two to four weeks, iterating on outputs rapidly and soliciting feedback early. Daily stand-up meetings and shared team whiteboards allow members to report on progress and flag problems, giving leaders the ability to intervene early to address issues and bottlenecks.

In cases we have seen, agile practices can increase productivity substantially. One investment firm was able to launch several new technology ventures within a six- to nine-month period, significantly faster than the two years it used to take to enter a new business area.

Success with agile requires thoughtful senior-management coaching, especially since many of the shifts can feel uncomfortable to leaders accustomed to traditional management approaches. Identifying leaders who can be champions of new ways of working, training them in agile techniques, and having them serve as visible owners can also spur wider cultural and behavioral change.

Organize teams based on value. Instead of structuring teams by process or asset class, as is commonplace at many firms, we recommend that investors consider assembling teams around a specific set of business and customer objectives. That broader and more strategic orientation allows firms to pool insights across functions—building knowledge and broader career paths and fostering a shared sense of purpose.

This orientation around outcomes also allows individuals to see more clearly how their actions contribute to the firm’s overall success, which, in turn, boosts employee satisfaction. For example, at one firm, a combined middle- and back-office team comprising finance, operations, accounting, and funds served as a “one-stop shop” resource for the front office, a shift that made it much easier for the front office to get the information and support it needed. The changes led to improved functional outcomes.

Employ cross-training to build flexibility. By making cross-training a standard operating practice, team members can easily pick up where an absent colleague left off. For example, a firm might want to provide extended support to portfolio companies facing severe liquidity strain. That effort might include realigning leadership teams to bring in specialists from other areas. Effective cross-training can avoid leaving other functions short-handed. In addition, rotating team members among assignments gives them a chance to learn from more experienced colleagues. Mentorship programs can also help. The opportunity to expand professional skillsets is appealing to many employees. A culture that allows them to grow in place often results in higher rates of retention and greater recruitment success.

Whatever shape the postcrisis recovery takes, principal investors need to be prepared for a more dynamic environment. Now is the time for leaders to update their target operating model. Those that do will create a more resilient and responsive organization, capable of managing through adversity and delivering sustainable growth.