The 2020 holiday season will be unlike any that retailers anywhere in the world have experienced. To prepare, retailers should invest in the resources that provide a clearer image of what the future may bring—and give them a larger share of the market this holiday season.

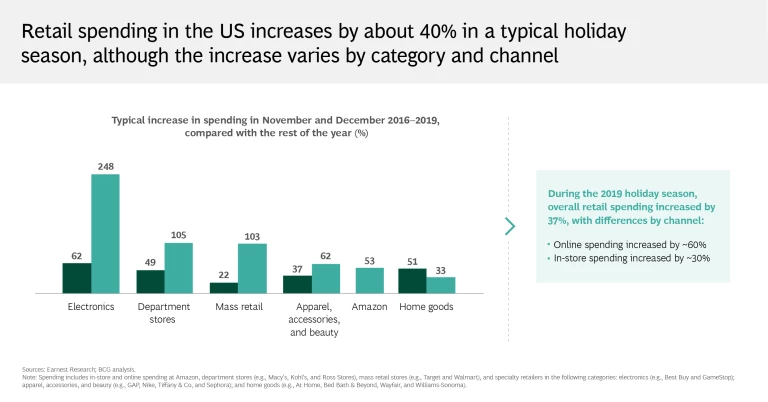

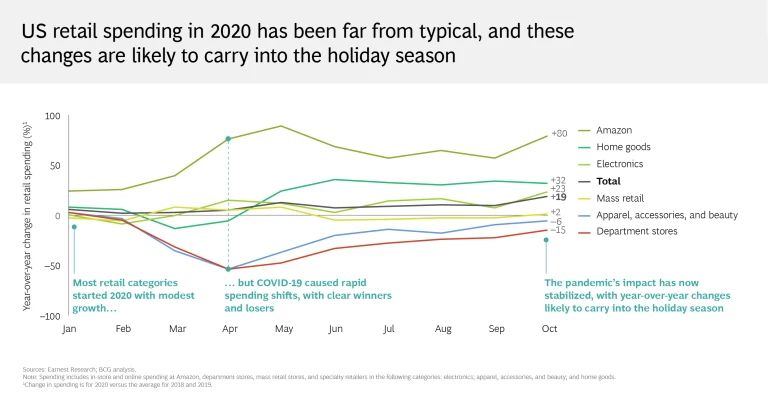

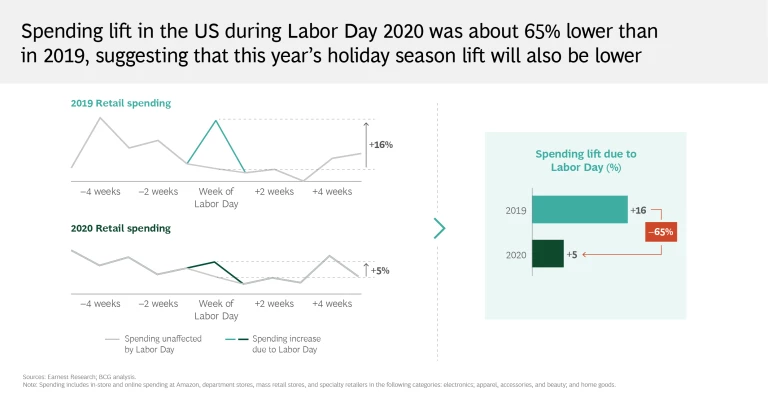

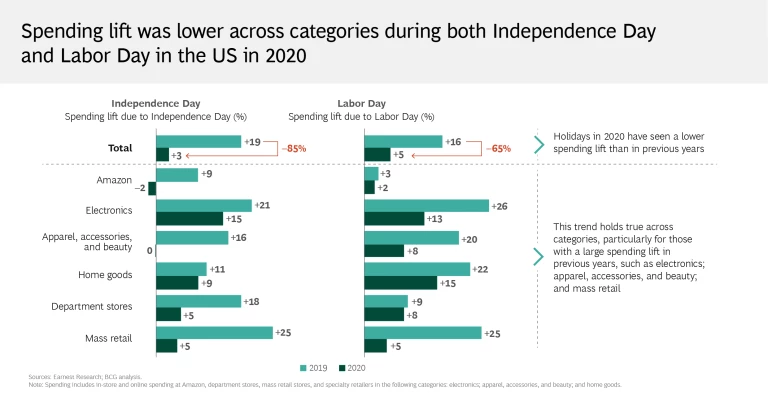

In past years, spending in the US during the holidays has been about 40% higher than during the rest of the year, although the increase has varied by channel and sector. But that lift will be lower in 2020, given the weaker economy. We have already observed smaller spending increases during earlier holidays this year, including Independence Day and Labor Day; this data suggests that the boost for the upcoming holiday season could be as little as 15%.

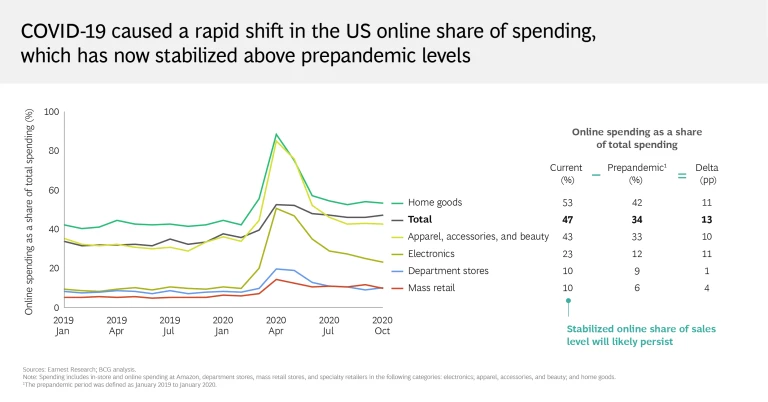

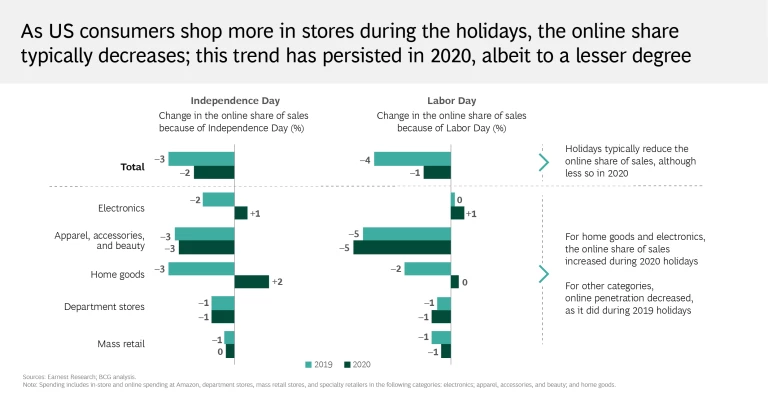

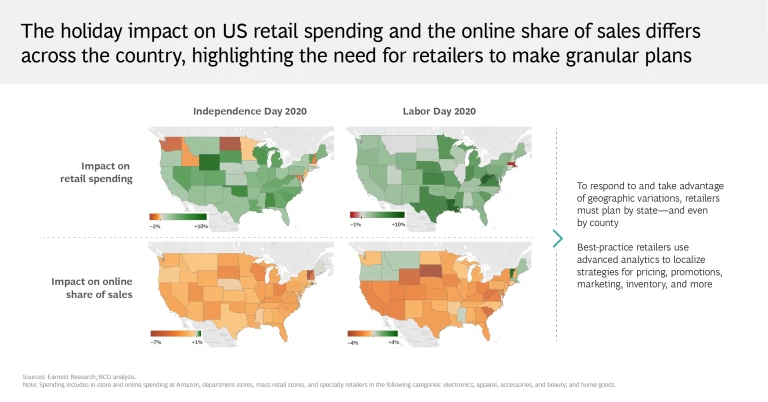

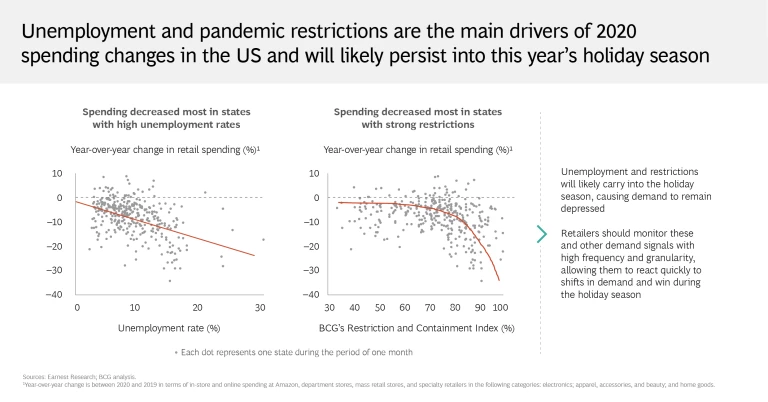

In addition, results will vary more significantly than usual by channel and sector. Some sectors, such as electronics and home goods, have grown during the pandemic, while others, including department stores, have suffered unprecedented lows. Spending will vary by geography too, as viral infection rates shift, restriction measures are implemented or lifted, and unemployment rates change.

Given that the holiday season will depend on so many new and evolving variables, retailers’ past experiences will offer little guidance on how to weather the imminent challenge. Retailers will need to introduce more frequent and granular demand predictions and use every resource—combining internal data with a broad range of external sources and utilizing artificial intelligence—to generate extremely precise forecasts .

Retailers, and even consumer brands, can use these forecasts to make decisions that improve their buying tactics, inventory positioning, digital marketing, and pricing and promotion strategies. If holiday spending in a category looks as if it might fall sharply, for example, retailers can cut procurement or, if the inventory is already on hand, introduce new markdowns. If customers are unlikely to shop in person on Black Friday, choosing to buy online instead, retailers can shift inventory to warehouses that are closer to demand. They can also begin promotions earlier or spread them out over a longer period. Such decisions will allow retailers to capture value and win market share, even if customer demand continues to be depressed.

You can explore some of our detailed findings in the slideshow below.