Principal investors have entered a strange interim in the COVID-19 crisis. Having weathered the first dislocating phase of the outbreak, they now have a chance to take stock of its aftermath and begin contemplating what the next few months and quarters might hold.

There is much to do. For fund leaders and their teams, whose schedules typically leave little room for detailed forward planning, this “found” time presents a chance to regroup as an organization, evaluate current performance, and develop strategic responses at the fund, portfolio company, and, where appropriate, national level.

To manage the still unfolding effects of the crisis and gird their organizations for the challenges and opportunities ahead, principal investors need to plan in layers and across multiple time horizons. This article—the first in a series—offers a framework for what that planning should look like.

A Fundamentally Different Kind of Crisis

The COVID-19 pandemic, staggering in its human toll, has been viral in all respects, dealing severe blows to nearly every industry, ravaging cash flows, upending global supply chains, and rendering millions of people unemployed—all in a matter of weeks. Its effects are totally unlike the widespread damage caused by the financial imbalances and failures of the past, which were more easily contained and required interventions that were better understood.

The virus is novel as well, and so are the crises it has triggered. Before April 2020, for example, few could have imagined a scenario in which the price of a barrel of oil went negative and entire sectors, like travel and hospitality, ground to a halt nearly overnight. In an interlocked global economy, system shocks in one area can quickly set off a chain reaction, exploiting preexisting vulnerabilities and tipping once-stable industries into distress.

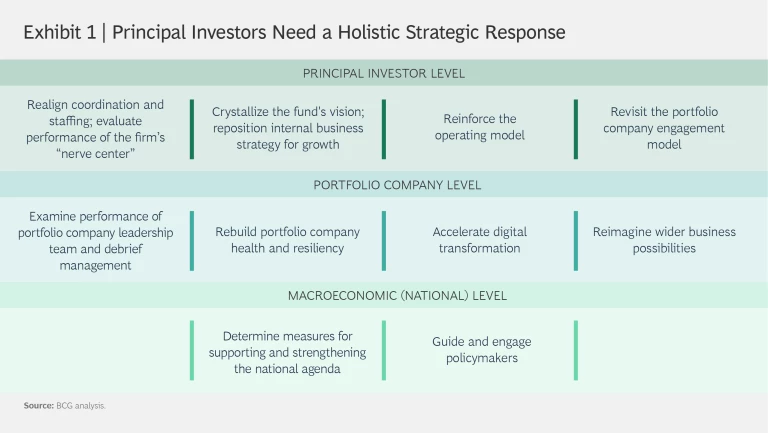

Given the wide-ranging impacts of COVID-19 on individual businesses and sectors, principal investors cannot rely on traditional strategic-planning approaches. Instead, they need to adopt a plan that considers requirements at the investor level and at the portfolio company level. (See Exhibit 1.) Sovereign wealth funds that have a larger national or economic mandate also need to clarify their role in a postpandemic society and understand how they can help government leaders and policymakers address the questions and opportunities that lie ahead.

Strategic Planning at the Principal Investor Level

Steering effectively during a period of turbulence requires the ability to learn, adapt, and act quickly. Annual reviews that may have sufficed before the crisis must give way to dynamic planning that allows leaders to set direction, review progress, and validate the path forward on a continuing basis. Being nimble requires thinking holistically, taking into account macroeconomic trajectories and sector health across multiple geographies. The following actions can help principal investors recalibrate their strategic planning for the rebound.

Realign coordination and staffing. Most funds were quick to establish “war rooms” to coordinate response activities during the initial crisis period. Now leaders need to evaluate how well they performed. Was the operating model effective? Did teams have the right level of executive buy-in and sponsorship? And did they make the right decisions? The answers to these questions can help leaders create a more responsive coordination model—one that allows them to go from a reactive war room to a more proactive “nerve center.” Such a center should include access to a “control tower” to support advance planning and logistics. For example, anticipating the next wave of pandemic-related government stimulus and relief programs, the control tower can track key interventions, determine which portfolio companies might be eligible, and prepare the appropriate business cases and filings.

Now is also a good time to evaluate staff mobilization needs. With some communities starting to reopen (and a few that reopened closing down again), leaders need to determine the most appropriate way to allocate human capital and other resources. For example, a fund that may be considering shifting resources from closed locations to open ones would also need to consider how that change would affect workflows elsewhere. Mapping out staffing scenarios and thinking through any downstream implications can help investors make contingency plans and get their operations back on track more quickly.

Crystallize the fund’s vision. Given what is likely to be an extended period of market turmoil, principal investors should explore whether it makes sense to move beyond their core investment theses and embrace new sectors and capital structure opportunities. Traditional investors accustomed to equity interventions, for example, could consider offering debt or situational lending, such as working capital or rescue-driven financing. Any such decisions, however, must be made in the context of the fund’s vision in order to ensure alignment and avoid compromising the fund’s ability to execute elsewhere (for instance, by finding out after the fact that the fund must spend heavily to acquire needed capabilities). The period before the full recovery is a good time for leaders to step back and consider whether they wish to play a different or an expanded role in the future and revise their fund vision and strategy accordingly.

Annual reviews must give way to dynamic planning that allows leaders to set direction, review progress, and validate the path forward on a continuing basis.

Reinforce the operating model. Given the expected heavy demands on their business over the next several months, principal investors also need to bolster their operating model in four key areas. The first is cybersecurity. With more people working remotely, principal investors need to ratchet up their information security protocols and governance, since data breaches and other failures could create material hazards. Second, as current work-from-home conditions have made clear, firms need to create more agile workplace practices and delayer their investment processes. Spending half a day on Zoom calls to complete routine tasks will not be sustainable. Streamlining processes and combining complementary activities, such as due diligence output and discussion, could speed reviews without sacrificing quality, especially when backed up with digital enablers, such as pipeline assessment tools and advanced forms of virtual collaboration. Finally, firms should establish a data command center to gather, normalize, and apply data from across their operations and holdings to inform investment activities and provide better support to their portfolio companies.

Revisit portfolio company engagement. With many company leaders facing the most severe crisis of their careers, principal investors need to play a more active role in portfolio company management. Regardless of the size of the stake held, they need to convey in their portfolio company discussions that “we are all in this together.” Setting up weekly update calls with management, enabling better “cross knowledge” and insight sharing, and facilitating access to the fund’s support functions and other resources can provide companies with a vital hand to hold during this challenging time.

Strategic Planning at the Portfolio Company Level

Principal investors need to apply the same multidimensional planning lens to their portfolio companies. How granular to go depends on the level of portfolio company involvement. For firms that take an active approach to portfolio company engagement, we recommend the following steps.

Examine portfolio company leadership performance. Principal investors had little time for reflection when first determining how to engage with their portfolio companies during the crisis. With the emergency phase behind them, leaders need to revisit these efforts to see if they are fit for purpose going forward. The postmortem should look at the quality of decision making and the effectiveness of the teams assigned to work with portfolio companies. In some cases, for instance, communication and reporting workstreams may need to change to ensure that the right information gets into the right hands more quickly. In other cases, teams may need to be reshuffled to bring in different expertise. To get at these insights, principal investors need to reach out to portfolio company management directly and put periodic checkpoints in place to ensure successful collaboration.

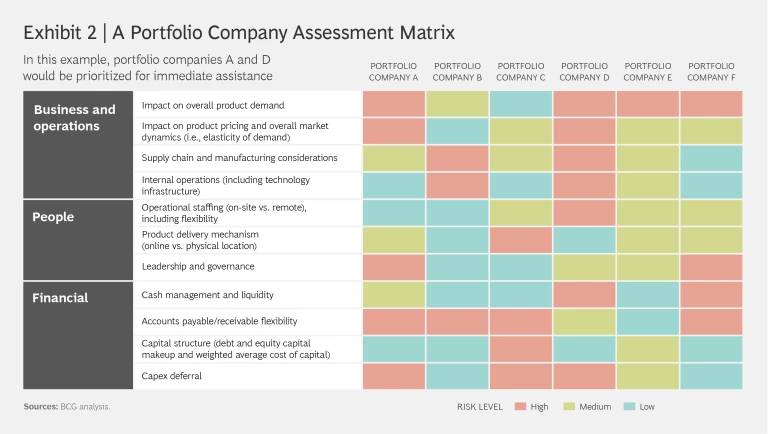

Rebuild portfolio company health and resiliency. Nearly every business has been wounded by the crisis. To triage needs (and allocate the fund’s own time and resources most effectively), principal investors should conduct a weekly risk assessment. A simple color-coded risk matrix can help identify which portfolio companies have the most acute needs and which should get help first. (See Exhibit 2.) The weekly scan will also allow investors to assess whether their remediation efforts are working and where business continuity plans need to be strengthened. To keep companies on a sound financial footing, for instance, funds should review cash management and liquidity forecasts and check whether portfolio companies are adequately stress testing their internal planning models. To improve portfolio company business operations, funds should examine supply chain and customer demand vulnerabilities and ensure that their companies’ technology infrastructure can respond to aftershocks. Finally, to improve people processes, funds should look across their portfolio companies and vet workforce policies, work-from-home infrastructure and norms, and the adequacy of people protection and engagement measures.

Accelerate digital transformation. Investors should also help portfolio companies in challenged sectors fast-track high-value digital initiatives. Given their diverse holdings and operational expertise, investors can discern specific capabilities that can help a portfolio company address performance issues and give it a competitive advantage. Analytics experts within the fund can also help it uncover patterns across its value chain and in the broader market that can allow the company to take advantage of emerging opportunities faster.

Reimagine wider business possibilities. Any market upheaval can create white-space opportunities, whether in the form of strategic acquisitions, innovations to existing products, or expansion into adjacencies. Principal investors can work with their portfolio companies to assess key trends in their industries and develop a viable roadmap so that companies emerge from the crisis in a stronger competitive position. Optimizing performance in the recovery also means staying alert to potential downside risks. By codifying lessons learned in this crisis, investors can develop a playbook that allows them to act earlier and more decisively in the face of future destabilizing events.

Strategic Planning at the Macroeconomic Level

As policymakers and government leaders look to reopen their economies, they’ll need help understanding which strategies and sectors have the best chance of stimulating growth. Sovereign wealth funds are well positioned for this role. They have unique influence born of governance models that give them a seat at the table in high-level discussions. They also have significant sectoral and operational expertise, an arsenal of data, and advanced modeling capabilities, all of which can be brought to bear to surface important opportunities.

Principal investors need to apply the same multidimensional planning lens to their portfolio companies.

As SWFs prepare for the postcrisis world, many have an opportunity to play a broader role. For example, those with a mandate to diversify their country’s economy from hydrocarbon dependence could use insights from their technology investments to engage with policymakers on a national digitization agenda. Likewise, insights gleaned from working with a diverse group of portfolio companies could allow funds to design an education and re-skilling program to enhance domestic productivity. SWFs should use this period to meet with stakeholders and outline the best ways to partner going forward. Formalizing roles and the rules of engagement in a detailed plan can ensure more effective coordination in future crises.

Principal investors are used to managing uncertainty. That’s how returns are built. With this once-in-a-generation crisis bearing down, they’ll need to apply that skill with particular determination. Steering their organization through the next several months will require close handling and abundant foresight. The steering mechanisms that worked well over the past decade are not appropriate now. To deliver the strong financial returns expected of them, provide the guidance that portfolio companies need, and help local and national leaders lay the groundwork for a successful recovery, principal investors will need a new playbook.