The process of shopping for groceries today is radically different from what it was a decade ago. Products are fresher, cheaper, more healthful, more locally sourced, higher quality, more innovative, and more convenient. They are also available through a wider range of channels, including online shopping, club stores, and discounters, and increasingly they reflect the proliferation of private brands. The old mindset about private brands—that they’re similar to but not as good as national brands, come in plain packaging, and carry a lower price—is outdated and changing fast. Grocers that don’t rapidly adapt their private-brand strategy will soon be left behind, without a way to differentiate their offer or give customers the value they demand. And the pandemic has only intensified the need for them to change.

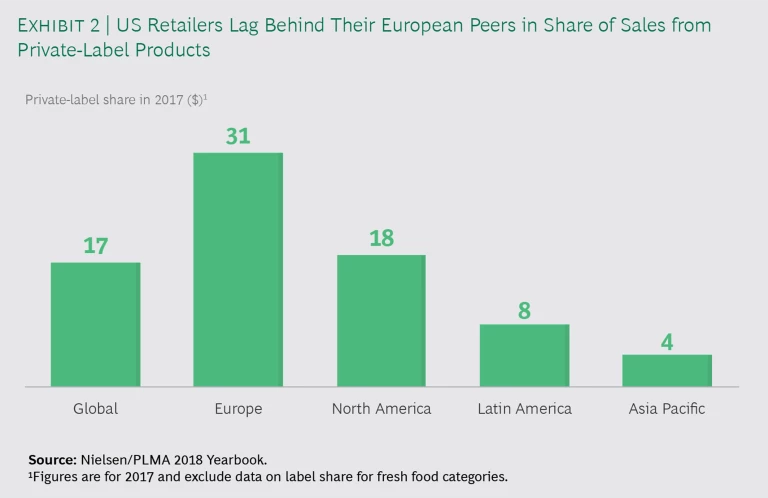

In the US, private brands now account for $120 billion in sales each year, which amounts to 18% of the overall market. In Europe, private brands achieved even higher penetration levels two decades ago and now often rank as market leaders in their categories. In this context, many top-performing established grocers are investing in private brands. The move comes in response to a growing threat from new competitors, such as discounters, and as part of an effort by grocers to deliver more value to consumers, in the form of better products at a better price, as well as to differentiate themselves through unique products and to strengthen their brand equity.

Developing a winning private-brand proposition requires long-term investments and new capabilities. It isn’t a simple process. Although some companies are further along in this journey than others, all grocers can—and indeed must—improve their offering in order to win in a fast-changing market and at a time when supply chains, product availability, and traditional consumer behaviors are threatened by a global pandemic.

A Changing Industry

Several converging trends—many of which are being accelerated by fears of the coronavirus— are contributing to the current evolution in grocery retail. Consumer preferences are changing, particularly among millennials, who make up about 27% of US shoppers aged 18 and older and whose influence will continue to grow.

Millennials demand offerings that are more convenient (especially as restaurants close), innovative, healthy, and environmentally sustainable. More broadly, grocery consumers tend to be better informed and more demanding, and their response to economic volatility is to seek value in the grocery products they buy—not necessarily the lowest price but a unique experience and the best quality for the price they’re willing to pay. Value for money is the fundamental principle. Consumers are more open to trying new products, and they have a stronger appreciation for convenience and fast access. In this vein, consumers are increasingly likely to shop for their groceries online, both because it is easy and to maintain social distancing.

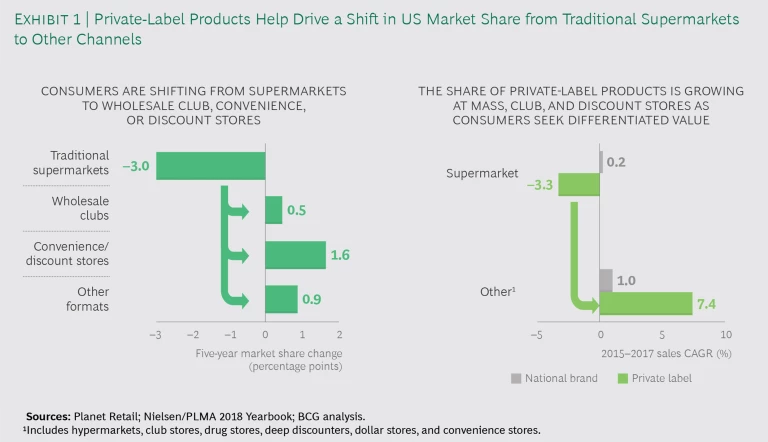

These trends have encouraged the growth of alternatives to traditional grocers, including wholesale clubs, discounters such as Aldi and Lidl, convenience stores, e-commerce players, and mass merchants like Walmart and Target. This growth, in turn, has led to increased competition. Over the past five years, all of these channels have seen their market share in the grocery category in the US rise, as traditional grocers’ share has declined. (See Exhibit 1.) A look at the disaggregated numbers behind the macro trend reveals that private brands have driven most of the shift. In the US market, $3 billion per year of private-brand sales has moved from traditional supermarket players to other formats, although there has been no corresponding shift for national brands.

As we look at the overall rise of discount and other formats in the US, the correlation is clear: traditional supermarkets are in decline, and channels that rely more heavily on private brands are gaining share.

Private brands used to be nothing more than lower-priced copies of national brands, but that has changed dramatically over the past decade. Today, private brands are trendsetters in the grocery industry. They are increasingly on-trend, high-quality, innovative, and exclusive products that meet the demands of shoppers for fresher, more convenient, and more sustainable offerings. They also benefit from operational advantages: private brands enable grocers to reduce their dependence on national brands, narrowing their assortment of national-brand products and focusing on a smaller number of SKUs with higher sell-through rates. Grocers can create a unique value proposition by selling brands that customers can’t find elsewhere—or whose equivalents can’t be found in supply-constrained grocery aisles—and they can build stronger partnerships with a select set of national-brand suppliers.

For these reasons, retailers in virtually all geographic markets and all price tiers are investing to take their private-brand capabilities to the next level. Here are five publicly available examples from different geographic markets around the world:

- Walmart is vertically integrating the supply chain for many of its private brands, allowing it to control the entire process from farm to shelf.

- Aldi has used its private-label offering (responsible for about 90% of total sales) and extremely efficient store operations to lower costs and build a loyal following. An ongoing US expansion will put the company on track to become the third-largest grocer in the US by 2022.

- Lidl has built a dynamic, modern assortment of offerings with a large lineup of private-label products that can compete with national brands. It was one of the first retailers to introduce different tiers of private-label products—good, better, best, premium—and it emphasizes responsiveness to customer needs.

- Texas retailer HEB has become a destination for innovative private-label products, which now make up 28% of its online sales. The company even promoted its brand during the 2019 Super Bowl.

- In Europe, Tesco and Carrefour have formed a buying alliance to jointly source their private-brand products in order to compete more effectively with discounters and to reset their relationships with consumer packaged goods (CPG) companies.

Overall, European grocers generate a larger share of sales from private brands than US grocers do. (See Exhibit 2.) Both European and US players are investing in private brands and will see continued growth in penetration, but we expect the US private-brand share to grow at a higher rate, narrowing the gap between them.

Challenges in Implementation

Although grocers may aspire to build a strong private-brand proposition, achieving this goal can be challenging, for several reasons. The most successful private brands essentially operate as CPG companies —a transformation that calls for steep investment and the right organizational structure, including new roles, decision rights, and incentives to support private brands. It takes time and marketing investments to build a brand, and grocers need to rethink their overall portfolio and ensure that their brand architecture can support the breadth of products needed to compete.

In terms of new capabilities, successfully introducing private brands requires a product development process that can identify consumer needs and trends and respond quickly, as well as a base of suppliers and partners that can provide the right quality at the right cost.

In some cases, the challenges are economic: some grocers depend on CPG funding to support national brands—and reducing sales of those products reduces the CPG funding. In other cases, increasing sales of lower-priced private brands leads to a drop in top-line sales and profits.

A Structured Approach to Build Private Brands

No single formula effectively addresses these issues. The right approach varies from one grocer to the next. However, the strategic objectives involved in developing private brands are consistent: they are a way for grocers to differentiate themselves by offering a unique selling proposition, increase margins, and control a greater share of the product range in key categories.

Our experience working with leading players in the industry leads us to believe that grocers need to focus on three key elements in order to succeed with private brands.

Set the vision and strategy, with the right organizational structure to support it. First, grocers need to establish a clearly defined vision and strategy for how private brands will fit into their overall offering and business model. Strategic brand decisions include how many brands and tiers to offer, whether to use the retailer’s banner as a brand or instead create a new brand, and how to balance quality and value in comparison to national-brand products. There is no one right set of universally applicable answers, because these decisions affect a customer’s perception of the product’s quality and value—and thus the customer’s willingness to try the product. Grocers must also set the right level of ambition and appropriate targets, being realistic about their starting point, their right to win, and their desired destination.

In addition, grocers need to put the right organization in place to champion private brands. Different models have been successful, depending on the retailer’s aspiration, maturity, and culture. We have identified three potential organizational models for private brands:

- Some retailers give a dedicated and entrepreneurial category management team full responsibility for making all decisions about private-brand products and merchandising—including assortment, pricing, space, sourcing, and quality—so that it is accountable for its own sales and net margin results.

- In other organizations, a center of excellence leads the private-brand business. The center of excellence supports the broader category management teams in such processes as product development, specifications, sourcing, and merchandising for private-brand products. Managers hold economic accountability and make decisions at the category level.

- Finally, some retailers opt for a hybrid structure, in which specialized category managers below a head of merchandising oversee private brands and national brands separately. Each manager has some latitude to run processes and make decisions, but coordinated support and more strategic category planning come from higher levels in the organization.

Build up capabilities in innovation and new product development. The second critical priority is to build up strong innovation and product development capabilities. Leading grocers have introduced significant innovations to help make products more healthful, fresher, more environmentally sustainable, more convenient (including packaging for ready-to-drink or ready-to-eat use), and better differentiated from the competition overall in terms of quality and price. But others need to improve their ability to capture consumer insights and to use data to identify unmet needs, assess the relevance of their private brands, and spot emerging trends to capitalize on.

Retailers often base their assortment decisions entirely on the national and private brands within their own stores. Yet innovation starts with a holistic view of the market that extends beyond the retailer’s four walls. The first step toward creating a differentiated private brand that attracts loyal customers is for retailers to identify categories that they want to be known for and that are important to customers. Then, through a systematic review process that entails quantitative data and a hands-on assessment of actual products, retailers can assess their offerings (of both national brands and private brands) against those of key competitors to identify opportunities. This type of side-by-side comparison of similar products can often uncover unmet needs in areas such as product quality, form, and packaging—or additional products themselves.

Customers are only one side of the equation. In a store where private-brand products appear on the same shelf with national-brand products that meet the same customer need, the retail merchandising organization must have an incentive to support sales of the private-brand products. This means finding the right balance between cost and quality on the supply side to ensure that selling a unit of a private-brand product has the same or a better bottom-line impact than selling a comparable national-brand product, even at a lower retail price.

Strengthen the supplier network. In order to succeed, retailers need strategic supplier partnerships, not just transactions. Today, it’s not enough to solicit bids on individual items and award contracts to the lowest-cost supplier. Instead, retailers need to review a supplier’s capabilities holistically and identify the right key partners to grow with—organizations that can bring CPG-like insights across categories, invest in innovation, and reliably provide high-quality products at the right cost, so that retailers can price them competitively and deliver value to the consumer.

When retailers can’t find suitable manufacturing and innovation capabilities in their markets, they need to adopt a longer-term perspective and make the investments required to build these capabilities internally. Another option is to co-invest with suppliers to jointly develop such capabilities.

Together, retailers and suppliers can create a mutually beneficial partnership by sharing information, jointly seeking efficiencies to reduce costs, and tailoring the merchandising strategy to maximize sales and grow together. For these reasons, successful retailers often maintain preferred or exclusive relationships with strategic suppliers.

The changes affecting the grocery industry aren’t going away. Millennials will exert greater purchasing power, nontraditional formats such as discounters and mass merchants will continue to put pressure on incumbent grocers with highly competitive prices, and customers will continue their relentless search for value. The pandemic will continue to shape consumer behavior—even after vaccines have been developed and distributed.

For established grocers, one fundamental way to address these challenges is to invest in private brands. These products are no longer just higher-value copies of national brands; instead, they are a means for grocers to become more innovative and to set industry trends. Retailers with winning private brands have invested systematically to build their own new product development capabilities and are consistently ahead of the curve. Getting there isn’t easy, but the rewards of success—stronger customer loyalty, improved operations, and better financial performance—justify the effort.