Crises have historically been the genesis not only of economic downturns but also of immense opportunities, and the current COVID-19 pandemic is no exception. Over the past few months, CPG companies have witnessed internal shocks to the supply chain, constraints on capacity caused by health and safety issues, and profound external shifts in consumer behaviors and customer demands. Yet even as these internal and external forces continue to play out, a window of opportunity has opened—one that offers CPG companies a chance to reset their product portfolios, take advantage of the simplification engendered by the crisis, and spur new offerings.

Companies need to move quickly, however, as this window will close within the next six months. Today, many are still in crisis management mode: aligned on the temporary streamlining of the product portfolio, processes, and ways of working; making more collaborative and expedited decisions; and concentrating on the greater good of the organization and its customers and consumers. And most competitors have yet to step into the momentary gaps left by portfolio simplification.

It’s time to formalize the best of the changes generated by the crisis, examining the forms of simplification dictated by the pandemic and purposefully retaining those that serve the business.

It’s time to formalize the best of the changes generated by the crisis, examining the forms of simplification dictated by the pandemic and purposefully retaining those that serve the business. CPG companies should begin by strengthening their analytical capabilities, using them to review and aggregate internal, customer, and consumer intelligence. They can then identify new “white spaces” of unmet demand and make smart portfolio tradeoffs. They should build strong governance systems to support this effort, including cross-functional teams. And they should engage their ecosystem partners to build a product range and compelling categories that benefit all involved.

Companies that swiftly embrace this opportunity, preserving positive simplification and shaping the narrative before others do, will have a powerful start in the race to maintain and grow market share.

Internal and External Forces Threaten Established Strategies

New forces, both internal and external, are challenging well-defined CPG portfolio strategies. Internally, supply chains have been tremendously strained since the start of the crisis. Many CPG businesses paused 50% of their SKUs almost overnight to maintain their output at high levels despite the heavy operating constraints forced by health and safety issues. Today, while the worst may be over for CPG companies, things are not as they were. Social distancing rules continue, staff safety remains a top priority, and resilience is one of the leading board-level topics—with good reason.

Externally, consumer buying behaviors are polarizing, with two very different shopping patterns appearing. On one hand, consumers have turned to online purchasing as a way to reduce social contact. In the first three months of the pandemic alone, e-commerce achieved three years of channel growth, and a big part of that growth is here to stay. On the other, communities are relying more on their neighborhood stores than ever before, both because consumers are avoiding traveling any distance to shop and because, as recession takes hold, less-advantaged shoppers in both developed and emerging markets are focusing primarily on value.

Retailers, too, are challenging the status quo. They are refocusing their product lines and simplifying their operations, pushing to reduce their product range by as much as 20%. Yet their demand for differentiated offers is increasing as they compete for footfall with discounters and online channels. CPG companies therefore face the challenge of supporting their retailer customers not only in these efforts, but in “pricing-in” differentiation and marketing expenditures while remaining profitable—even as consumers look for lower prices.

Preserve Positive Simplification to Capture New Growth

Some of the simplification created during the pandemic has been positive. The crisis has forced a pause in low-performing SKUs, a consolidation of pack sizes, and pruning of shipping units and ingredients. By some measures, therefore, supply chains have been performing better than ever in the past few months. In addition, the constraints that have been imposed by COVID-19 are encouraging entrepreneurialism, more practical solutions, cross-functional teamwork, and faster decision making.

Many of these changes should be preserved, as they unlock long-sought-after efficiencies for CPG companies, their customers, and consumers. Most important, preserving positive forms of simplification makes room for growth to fill pockets of incremental unmet demand.

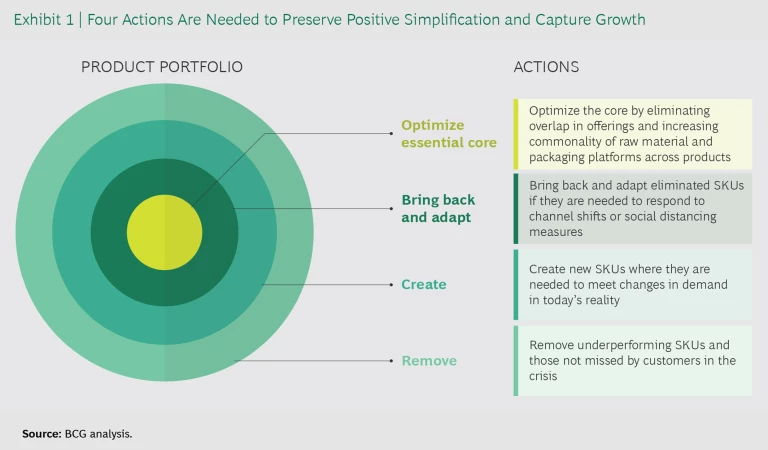

We’ve found four effective actions for preserving the best forms of simplification and capturing new growth (see Exhibit 1).

- Optimize the essential core of the business and promote cost competitiveness by eliminating any significant overlap in product offerings and increasing the commonality of raw material and packaging platforms across products.

- Bring back and adapt any SKUs that were eliminated if they are needed to respond to channel shifts or social distancing measures.

- Create new SKUs where they are needed to meet changes in demand in today’s reality.

- Permanently remove any underperforming SKUs and those that were not missed by customers in the crisis.

The Window Won’t Remain Open for Long

As of this writing, consumers and internal staff are still in crisis management mode. Consumers are therefore less sensitive to adaptations of their most-loved products, and staff have not yet begun to reintroduce paused SKUs or return to previously entrenched ways of working. This creates a window of opportunity for CPG companies to take advantage of their simplified portfolios and make changes that bring little to no topline risk.

Many competitors are still in crisis management mode, creating an opportunity for CPG companies to take advantage of simplified portfolios and make changes that bring little to no topline risk.

This window won’t be open for very long, however. As buyers move to online channels and new customer needs created by the crisis reveal white spaces of unmet demand, many CPG companies and their competitors are rushing to establish first-mover advantage, limiting the options for others. They are stepping into these white spaces even as both online and brick-and-mortar retailers are realigning their SKUs. Any organization that is the first to create a compelling category will have a powerful head start.

Reset the Portfolio and Reach Out to New Partners

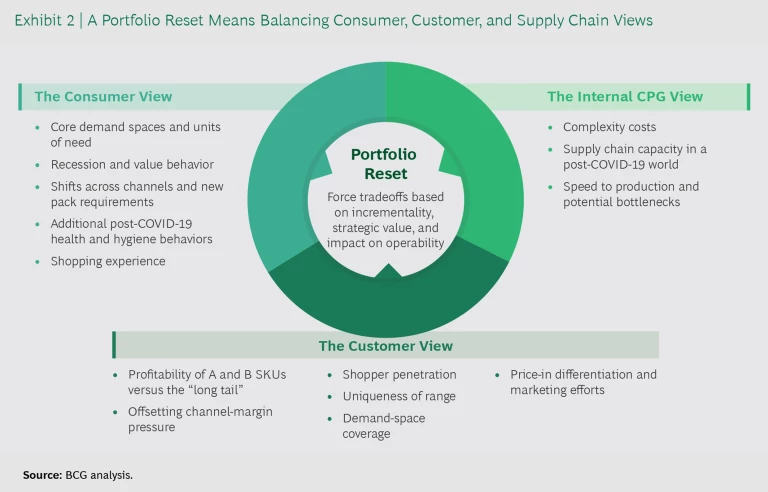

CPG businesses can respond to the constraints imposed by the crisis, first and foremost, by resetting their portfolios for the new reality. To do so, they should move quickly to integrate internal, customer, and consumer intelligence—not only to identify new white spaces but to make smart portfolio tradeoffs and choose their targets with care. Balancing these three perspectives will be imperative to success (see Exhibit 2).

In addition, CPG companies should reach out to existing and potential ecosystem partners, from retailers and wholesalers to suppliers and logistics providers, to share data and make their product offerings more intelligent while ensuring that everyone has something to gain. Digital players, too, will be important, particularly those players that are newer and less entrenched, making them more amenable to sharing data.

Take Four Key Actions for Success

Most CPG companies are making progress in their efforts to curate a simplified product range and set themselves up to maintain and gain market share. However, not everyone will succeed. To win the race, companies should keep in mind these four important success factors.

- Strengthen your analytical and digital capabilities, employing them first to monitor demand in near real time and, with the help of AI, interpret new and lasting customer behaviors early. Next, measure the true incremental margin contributions of different SKUs. And finally, facilitate better portfolio decisions by making more precise, fact-based tradeoffs between customer, consumer, and internal criteria.

- Improve decision making and empower strong governance through the establishment of clear responsibilities and decision rights and the retention of the simplified and accelerated decision-making process brought about by the pandemic.

- Deliberately engage customers and other ecosystem partners to share customer data and understand customer behavior, then work together to define and incentivize a product range that benefits all.

- Encourage and celebrate a pragmatic and collaborative spirit throughout the business, creating cross-functional teams and ensuring buy-in from the board and C-level down to the teams on the ground, converting previously untapped productivity into a lasting competitive advantage.

Companies that successfully reset their product offerings, adopt positive simplifications, and foster innovation will find themselves with a more relevant portfolio—one that is geared toward meeting consumer needs in each demand space, without excess complexity—along with faster, better, and more well-aligned decision making that supports innovation and broadens their circle of collaborative partners. This is an opportunity that can’t be missed—and a possibility of falling behind that shouldn’t be risked.