Aside from a few exceptions, stores are among the most prominent commercial losers of 2020, with 25,000 new closures currently predicted in the US alone. Before this year, net commercial and retail square footage was still increasing in the US, despite the loss of business to digital channels and platforms. The pandemic has heightened the paradox of an industry that has grown by 4% to 5% annually over the past decade, and yet is losing retail companies to insolvency at an accelerating pace.

To stay relevant, retailers must act differently. They have already done a lot in the past five years, with efforts ranging from investments in technology, digital, and sustainability to close attention to purpose, differentiation, and operational efficiency. Yet most of them have not focused on their foundational asset: their real estate.

To win the future, retailers must get back to opening stores that create profitable growth—and that means rethinking their approach to their store portfolio and retail network. They need a strategic mindset, a fresh approach to the real estate function , and advanced analytics capabilities to support the vision. Retailers that deliver on this vision will be able to compete, innovate, win market share, and resume growth while their traditional competitors continue to struggle.

Why Now

Many retailers that sell essential goods have held their own during the pandemic. For the rest, the coronavirus has underscored the urgency to be bold and innovative. The global crisis has pushed customer behavior even faster toward digital commerce, convenience, and service. It has also introduced new methods to deal with new needs, such as touchless transactions.

Fortunately, investors have signaled that they will not penalize retailers over the next 18 months for actively adapting to the new reality. Reeling from the departure of many key tenants and the delay in rent payments from others, resilient landlords are more willing to partner creatively with retailers, especially those with the financial flexibility to reconfigure their networks and plan for growth. Consumer demand will eventually resume, albeit in a new form. When it does, retailers that have reshaped or realigned their real estate networks will be ready to tap into it. But this window of opportunity will not last forever.

What Way to Manage Retail Real Estate Works Better

Many traditional retailers manage real estate as a fixed cost. Rather than taking a portfolio view, they negotiate over locations as these come up for renewal. Their approach to corporate real estate is fundamentally deal oriented. They often recognize the value in data, analytics, and visualization tools but they lack the internal capabilities to create and integrate these tools.

This nearsighted approach has led to an overreliance on measures that worked in the past but have contributed to recent underperformance. Versed in traditional variables such as occupancy, rent, and proximity to freeways, real estate professionals often miss new signals in the market that better predict the future performance of different locations. Before the pandemic, proximity to popular restaurants, bars, coffee shops, and fitness centers, for example, was often a better predictor of performance than traditional metrics. Relying on what had worked in the past, one retailer prioritized stores close to specialty retailers that were in decline rather than focusing on higher-traffic locations with nontraditional tenants.

Demographics, category spending within a market, and the consumer cachet of an individual brand or banner can shift during the life of a lease. As current consumer behaviors demonstrate, preferences for particular types of real estate—such as outdoor spaces or smaller stores—can shift. When that happens, a retailer may be left with costly and deteriorating individual assets of the wrong size and wrong format, in the wrong location. Locked into deals that fail to reflect current demand, a retailer’s network becomes increasingly resistant to financial adaptation.

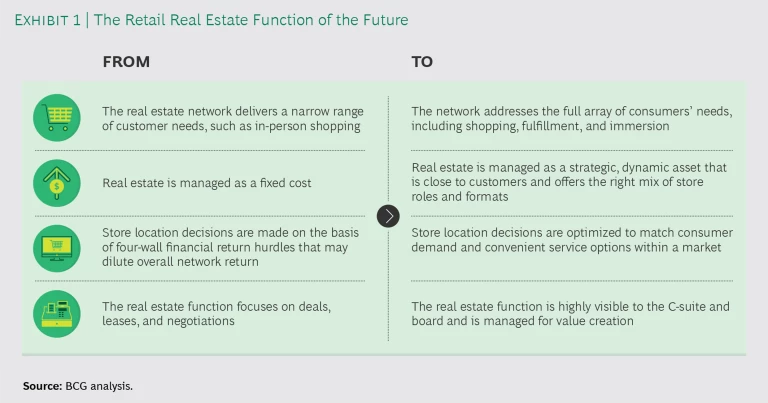

There is a better way. It is built around four principles that collectively consider location, demand, and consumer science. (See Exhibit 1.)

First, store portfolios must efficiently serve customers’ shopping needs as digital and physical channels and national and private brands blur. The future store network—although not every individual store—must deliver immersive customer experiences, relevant store layouts, convenient multichannel options, inspiring merchandising, and timely fulfillment to customers’ homes. The network must pursue and meet demand in local markets.

Second, the retailer should manage the store network as a dynamic asset—a constantly evolving portfolio of opportunities to satisfy customers through new banners, formats, services, and locations. These locations should include a mix of store sizes and services, including curbside pickup and even outdoor venues.

Third, the focus of optimization should be local markets, not individual locations. Optimizing a single location works only if that market can support no more than one location. But many markets have headroom to open new stores, formats, or banners. Through machine-learning techniques, retailers can identify addressable consumer demand, project store and digital performance, and anticipate the operational benefits and costs of legacy decisions. Visualization tools enable real estate professionals to build and vividly portray revenue and margin scenarios involving store openings, relocations, and closings in a market in real time.

Fourth, real estate must become a transformative corporate function, similar to corporate finance, rather than a cost center or passive center of excellence.

Where to Start

To embark on this growth journey, retailers should first perform an overall strategic evaluation of their real estate network and portfolio. This exercise marks the beginning of a new approach that entails constantly reimagining both the retail network and the role of the store. Even for retailers in retrenchment, this approach can inform ongoing negotiations with landlords and plans for future relocations and store openings.

The strategic evaluation is much more than a review of expiring leases. It should answer a key question: Does the network satisfy existing and projected addressable market demand? The evaluation should be oriented toward profitable growth. Retailers need to be prepared to open new stores in the right locations and to enter new neighborhoods with localized formats and product mixes.

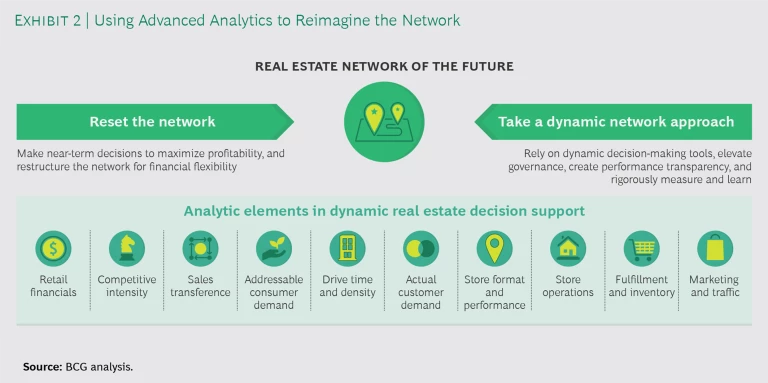

The evaluation should encompass the entire portfolio, including stores, distribution centers, banners, and service offerings, such as store fulfillment and buying online and picking up in store. It should incorporate traditional and nontraditional data sets. Machine learning can uncover the reasons behind many once-mystifying differences in store performance. Evaluations of existing stores should include consideration of corporate and overhead costs that less thorough evaluations often ignore. Assessments of potential store closings should be based on realistic rather than optimistic sales transfer estimates. Finally, retailers should take into account the market’s consumer spending in household categories, as well as drive times, local marketing expenses, and the implications for inventory management. (See Exhibit 2.)

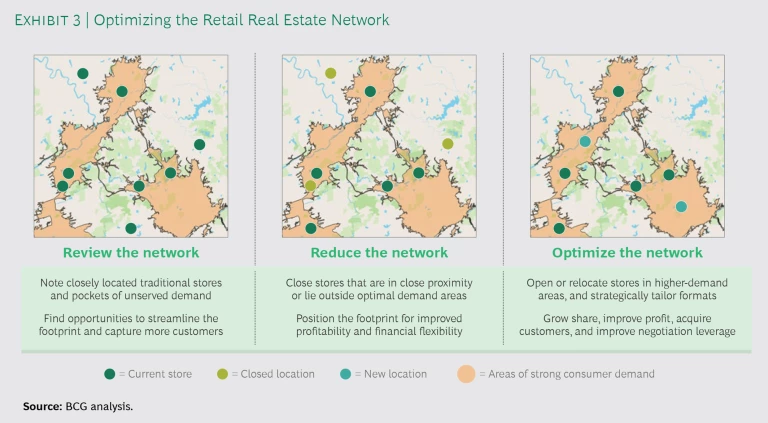

Armed with this assessment, retailers can design an optimal network of retail outlets. The design will identify stores and formats to retain, close, or monitor as well as potential relocations and store openings to address consumer demand. If leaving a location is too costly, retailers should develop a plan to put unproductive space to use through partnering and subletting.

The strategic evaluation will enable retailers to negotiate better deals with their landlords because it will give them a clearer understanding of markets, locations, and demand. As a result, they will not just be negotiating store closings but managing their overall relationship with landlords. The carrot for landlords is more-flexible leases and the potential to keep and win new leases as retailers optimize their networks. (See Exhibit 3.)

Historically, landlords had an information advantage over retailers because of their knowledge of locations, formats, and retailers. They also had access to aggregated traffic data and forecasting capabilities. But retailers that do their homework can flip the informational asymmetry. Retailers understand the value of their real estate portfolio, when properly deployed, better than landlords. They know more about the performance of stores and banners, traffic patterns, the percentage of sales that actually transfer after a closing, and historical customer behaviors and category trends.

Retailers can earn this information advantage by investing in analytics, forecasting, scenario-planning, and visualization capabilities. The investments will pay off many times over in lower and avoided rents and operating costs and in incremental margin from relocations and store openings across the network.

How to Get It Done

The real estate function at most retailers cannot transform itself from within. Although COVID-19 has provided the catalyst, the CEO and leadership team need to stimulate and support the function in its transformation. Several specific actions are necessary.

Radically shift the mindset toward real estate. Elevate real estate from the world of deals, leases, and negotiations to the C-suite where it belongs. The leadership team must treat real estate as a foundational asset that can deliver growth and value creation. It must also hire the right executive to run the function—an executive who can understand and translate deep analysis, talk strategy, manage data scientists and dealmakers, and get things done.

The real estate executive needs to report to the right executive. Real estate functions that report to the CFO tend to receive different management from those that report to the CEO or chief commercial officer. Shifting the reporting line of the function can signal its growing significance.

Annual strategic planning exercises should include reviews of banners; the types of stores and services within a banner; and the effectiveness of the overall store network in achieving financial, operational, and strategic targets. The leadership team should discuss these topics and share them with the board.

Go fast to build capability and create flexibility. To avoid wasting time, retailers should select several priority markets to serve as sites for testing this approach, establishing a multiweek cadence for analyzing, negotiating, and starting to redesign leases in these markets.

During this sprint, some members of the real estate team may not be able to maintain the required pace or may lack the necessary skills, such as analytics and rigorous project management that focuses on value creation, not just timeliness. In the short run, the company should bring in employees from other parts of the organization or third parties to complete the sprint.

Build foundational capabilities. Longer term, retailers need to build real estate teams that have the right digital, data, data visualization, and analytics skills. Team members must understand neighborhood and census block demand, demographics, channel mix, shopping preferences, and the role that stores can play in meeting local demand. The team must also collaborate across many business functions in order to execute the strategy. For team members who can handle the change, the next few years are a great opportunity to take on new skills and more responsibility.

Even amid bankruptcies, store closings, inventory disruptions, and revenue shortfalls, reasonably solvent retailers can find cause for optimism. They have a rare window to reinvent themselves around their most foundational assets, their stores. But the opportunity is fleeting. Here are five guidelines for proceeding:

- Be bold. Retailers have investors’ permission now to be bold and innovative. They should take advantage of it.

- Negotiate to grow. Retailers and landlords need each other now more than ever. They face the same headwinds and must work together in new, creative, and more dynamic and flexible ways for mutual survival.

- Commit to machine learning. Machine learning is fast becoming indispensable in helping retailers understand differential performance among seemingly similar stores and locations. It will be most effective when used to analyze both traditional and nontraditional data sources. Fully deployed, machine learning can improve negotiations and financial and operational planning.

- Invest in growth. Although retailers are now prudently conserving cash and financial flexibility, later—as they obtain more information—leaders will invest in new formats, banners, locations, service models, and M&A to capture demand.

- Build out the team. Retailers should invest in their real estate teams so that they have the leadership, skills, data sets, and analytical capabilities to play a strategic role.

Clear winners and losers are already emerging from the pandemic. Retailers that reimagine their real estate to meet rapidly evolving customer demands will win the future.