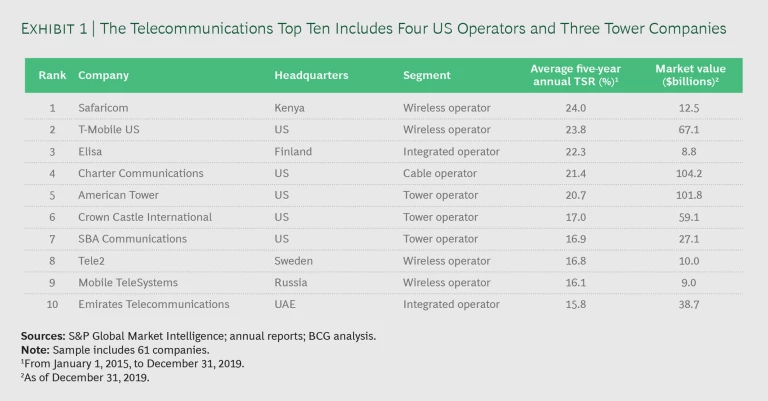

What does it mean that three of the highest-return telecom companies over the past five years are not real telecom companies? Could there be any clearer signal that the industry is under the sway of fundamental transformation than the fact that three tower companies—companies that own passive telecom infrastructure —generated higher shareholder returns from 2015 to 2019 than almost all operators? (See Exhibit 1.)

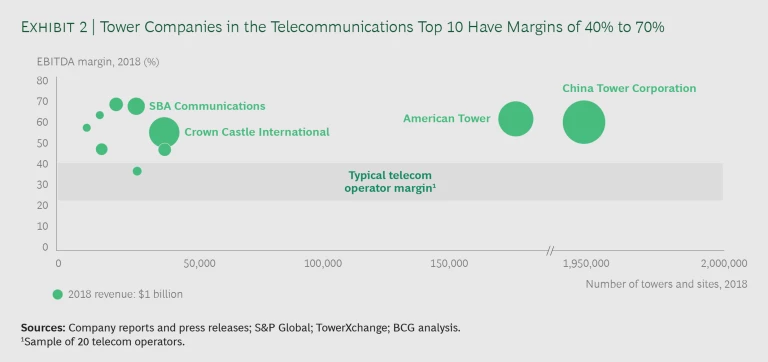

The apparent moral here is that it’s more profitable to own passive telecom assets than to operate wireless services. Investors view American Tower, SBA Communications, and Crown Castle International as relatively clean plays on mobile data growth next to traditional operators. (See Exhibit 2.)

The real moral, however, is that operators need to break free from the familiar constraints of regulation, legacy, and often-unfavorable competitive dynamics. Rather than bleed outdated business models dry, they need to be bolder in strategy and execution.

The industry’s challenges are well known. Telecom companies lack the global scale of the digital giants in rolling out new services, an area where operators have lost revenue over the past two decades. They face daunting network investments and a lack of financial flexibility due to a debt-laden capital structure and sky-high dividend commitments. And although they are making progress, operators still have room to improve their culture and ways of working.

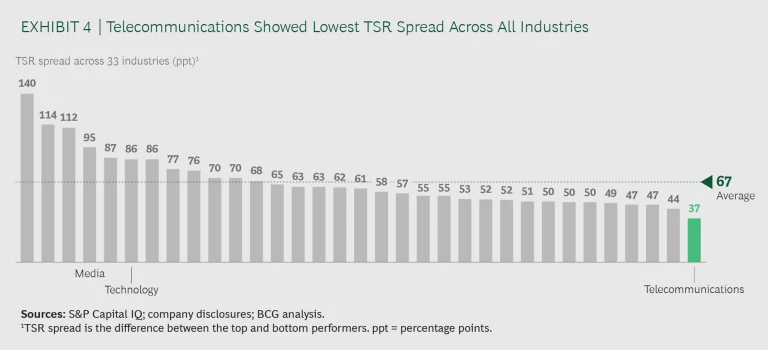

What would it take to flip the switch? What would cause investors to bet on the transformational potential of the telecom industry, which finished 28th out of 33 analyzed industries in value creation, with a five-year average annual TSR of 6.3%?

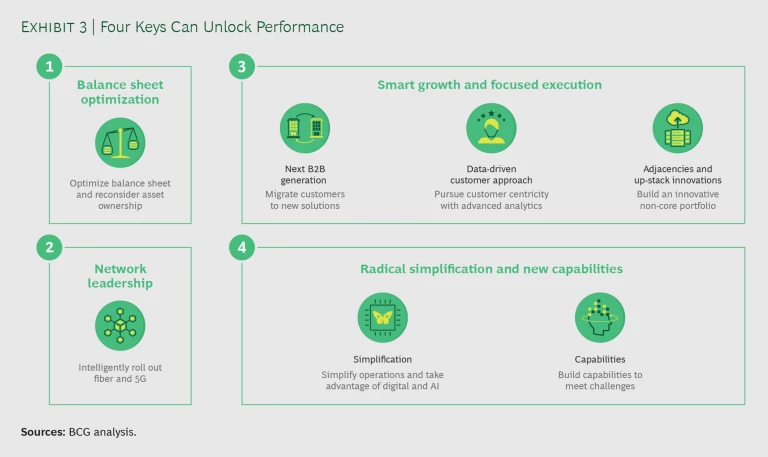

To win in the next decade, operators must take advantage of four prime opportunities, as illustrated in Exhibit 3:

- Optimize the balance sheet by unlocking the value of infrastructure assets, exploring new ownership models such as network or tower sharing, or taking advantage of activities such as debt restructuring and M&A.

- Create network supremacy by smartly rolling out 5G and fiber to the premises, integrating precision analytics and marketing, embedding intelligence, and eliminating legacy systems. (See “Elisa’s Smart Play.”)

- Find growth in select B2B plays, and truly leverage data and digital to build new businesses and shape ecosystems.

- Transform the operating model with drastic simplification, digitization , and modern, streamlined ways of working.

Elisa’s Smart Play

Elisa’s Smart Play

Elisa, the largest Finland-based telecom operator, became the number-three telecom value creator globally, with a 22% average annual TSR from 2015 to 2019, despite operating in a highly competitive environment marked by unlimited mobile data subscriptions. Elisa’s performance is built on a strong customer focus, attractive yet straightforward offers, operational excellence, and selective risk taking in areas that offer a clear competitive advantage. The company has followed a judicious, focused, and strategic approach to M&A and has demonstrated financial discipline.

Elisa has also been early leader in introducing new digital services and in undertaking a digital transformation of its operations. For example, the company put significant effort into building leading capabilities in network management automation more than a decade ago. Consequently, Elisa recorded higher-than-average mobile service revenues while maintaining flat spending and managing a 16x increase in data traffic from 2012 to 2018.

Automation enables Elisa to prevent and resolve nine out of ten network faults before they become visible to customers. Its network automation has been so successful that Elisa has started to offer these services to other telecom operators, such as Orange Spain and LG Uplus.

These are not necessarily new lessons. But they are urgent. In addition to having bottom-quartile TSR, telecommunications had the lowest spread between top and bottom performers among the 33 analyzed industries, an indication that investors do not detect much difference among operators in their pursuit of risk-averse, in-country fiber and 5G strategies. (See Exhibit 4.) At this point, relying on a business-as-usual approach will not cut it. Operators need to be willing to take risks.

Balance Sheet Optimization

The success and high valuations of tower companies and private-equity-funded fiber companies such as Inexio, Deutsche Glasfaser, and Hyperoptic suggest a way for operators to unlock latent value in their towers and fiber networks. They can capture this value through sharing, joint ownership, and spinoffs. The cash infusion to be gained by selling off assets entails a tradeoff in the form of a subsequent decrease in operating and strategic flexibility and the loss of a key control point—so a careful analysis is worth doing. Most operators will benefit from a nuanced rather than binary approach toward both scope and operating model.

Investors are aware of the subtleties involved. With regard to M&A, they favor domestic consolidation but not necessarily diversification into new businesses. Even in an era of cord cutting, for example, Charter Communications jumped five spots to become the number-four telecom value creator by buying other US cable operators. Meanwhile, the number-eight telecom value creator, Tele2, has been successfully consolidating assets in Sweden and divesting them elsewhere.

The low-interest-rate environment challenges assumptions about debt ratios that have served the industry for a decade or longer. Does it make sense to finance 5G and fiber-to-the-home (FTTH) rollouts with higher debt levels than operators would traditionally carry? This is a question worth pondering.

If telecom companies do not make these moves, an activist investor might do it for them , as investor Elliott Management’s recent pursuit of changes at AT&T foreshadows.

Network Leadership

The long-awaited rollout of 5G , with its promise of innovative services and revenue growth, has begun. Operators will not participate equally in this opportunity, however.

Not all new 5G uses—telemetry, remote surgery, and real-time traffic management, for example—will be ready at the same time, or applicable, or profitable in all markets. The rollout challenge for 5G is more complex: do you build on anticipation of future growth, or do you roll out selectively while offering a thin coverage layer? The second approach is less costly and risky in the short run but may cap long-term opportunities.

This is more than an engineering challenge. In deciding on a cadence, operators must juggle strategic, financial, and operational issues. Their technical, business, and finance staffs need to cooperate to pursue the best approach, market by market, often in partnership with both telecom and non-telecom companies.

In deciding on a cadence for rolling out 5G, operators must juggle strategic, financial, and operational issues.

5G is just one network challenge facing operators. Their ongoing FTTH rollouts are equally costly and necessary. At the same time, operators should build intelligence into their networks to balance traffic, manage devices, and heal failures—all while decommissioning copper and legacy networks. Cable operators and telecom operators that offer TV must also seek to slow cord cutting through pricing, packaging, and other adjustments.

Smart Growth and Focused Execution

Despite their mixed record when they step outside the core, operators should seek fresh growth spots. Growth continues to be the key driver of value for the best-performing companies, such as operators Safaricom, T-Mobile, and Charter. It’s the best option for replacing core revenues lost to the digital giants. We consider three opportunities to be the most promising:

- Next-Generation B2B. Small and medium-size businesses increasingly need help upgrading their infrastructure and managing cloud and software-defined services. Although operators may need to change their business model, talent, and commercial offers to handle such services, they are in a good position to win this business.

- Data-Driven Customer Centricity. Operators can help commercial and retail customers navigate, bundle, and integrate digital and entertainment services. They can provide a personalized segment-of-one customer experience with the goal of becoming customers’ lifetime partners.

- Adjacent and Up-Stack Opportunities. Taking risks is not a bad thing. Operators should be willing to consider pursuing a focused set of plays, either organic or through M&A, that meaningfully take advantage of their core strengths to create value-added services. Number-one telecom value creator Safaricom demonstrates this potential with its M-Pesa mobile money service, which has contributed nearly one-third of Safaricom’s annual revenues while growing at a 22% annual clip for three years running. The fact that other operators have not replicated this success demonstrates both the challenge and the potential of value creation.

Radical Simplification and New Capabilities

Operators have spent the recent past lowering cost. It’s now time to build organizational and operational muscle in three interrelated areas:

- Dramatically simplifying products, customer journeys, processes, and systems

- Making foundational improvements in data and analytics and artificial intelligence capabilities

- Focusing on people, talent, and ways of working, especially in developing new capabilities and fast learning

Having spent the recent past lowering cost, operators must now build organizational and operational muscle.

T-Mobile US has shown what this type of transformation can accomplish. The number-two telecom value creator disrupted the market with a simple offer that did away with everything consumers hated about their plan, especially lengthy contracts, monthly data limits, and add-on prices. The carrier has also focused on team and employee engagement.

It’s hard to overemphasize the importance of people. In stark terms, without talent transformation, operators will not be able to master business transformation. And without business transformation, operators will not break away from old strategies that are unsuitable for the new decade.

The opportunities are clear. CEOs who create a bold vision and execute ruthlessly against that vision can break away from the pack.