As painful economically as the COVID-19 pandemic has been, it can provide a critical reset for travel distributors to address persistent challenges in their offerings when it comes to customer experience . Most travelers find the process of researching and booking a trip particularly unpleasant. Fragmentation across the travel industry means customers must research each component (flight, rental car, hotel, tours) individually, and in the end they often base purchases on price.

As the industry begins recovering, travel will likely be significantly altered, with new preferred destinations, types of travel, booking processes, and other changes.

That’s a problem—but also an opportunity. Moreover, as the industry begins recovering, travel will likely be significantly altered, with new preferred destinations, types of travel, booking processes, and other changes. (See the sidebar “The Implications of COVID-19 on the Travel and Tourism Industry.”) Travel distributors will need to understand those shifts and adapt to them in order to capitalize on the eventual recovery.

THE IMPLICATIONS OF COVID-19 ON THE TRAVEL AND TOURISM INDUSTRY

THE IMPLICATIONS OF COVID-19 ON THE TRAVEL AND TOURISM INDUSTRY

The coronavirus pandemic has shut down virtually every industry, but its long-term implications may be greatest on the travel and tourism industry. Even after the crisis ends and travel resumes, consumers’ booking and travel preferences will likely be dramatically different, and many of those changes could be permanent. As a result, some travel distributors and operators may think this isn’t a good time to make investments to improve the customer experience. We disagree. Once travel resumes, most organizations—and most travelers—will operate in an environment in which understanding and delighting the customer is key. Personalization and tailored customer insights will be more important than ever.

Already, we’ve seen that although many travel organizations are cutting costs, they are keeping their high-caliber employees in areas such as data science, software development, and user experience design. The out-of-pocket investment required for change, therefore, might be smaller than expected. In fact, today’s decline in travel is a chance to build the groundwork for a more customer-centric approach, so that organizations are ready once travel picks up again.

To that end, travel distributors should keep several aspects of consumer behavior in mind:

- Travelers are going to be very fearful of traveling again post-pandemic. Distributors need to reassure them that they have done all the worrying and vetting to ensure that their offerings are safe. In part, that requires showcasing in-depth knowledge of local, on-the-ground circumstances in target destinations.

- Distributors will also need to show sensitivity by not resorting to aggressive sales pitches, but rather supporting customers in ascertaining if they are ready to travel and, if so, then helping find the right travel destination specifically for them. This kind of sensitive communication applies to all channels: digital marketing via the web or app, in-person at physical locations, and call center interactions.

- Agents and algorithms must be up-to-date with the latest statistics and travel restrictions so that destinations still considered (potentially) “risky” are not proposed to customers.

- Cancellation and refund policies will need to be completely transparent and fair, so that customers understand the impact of canceled or delayed travel. Some distributors may opt to waive change fees or include travel insurance coverage at no cost to customers.

- Perhaps most important, distributors should show that they can win back the loyalty of existing customers and acquire new customers through personalization—truly understanding the needs and concerns of customers and tailoring solutions individually for them.

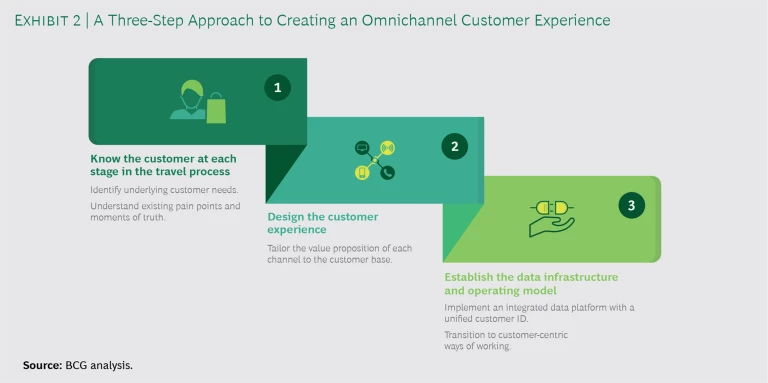

We believe success comes down to three critical steps: knowing customers at each stage in their personal travel journey , designing a tailored customer experience, and establishing the supporting data infrastructure and operating model.

By creating a customer experience across both online and offline touch points that is consistent, convenient, and customer- centric, travel distributors can forge greater loyalty and win in the market.

In a Price War, Everyone Loses

The case for change among travel distributors is clear. The rise of online travel agents (OTAs) and more transparent pricing has turned travel bookings into a commodity. Price-sensitive consumers scour the internet and buy the least-expensive provider, with little brand loyalty from one trip to the next. And new entrants keep crowding the market. Google’s continued penetration into the travel space is threatening even the OTAs that first disrupted the industry. (Google is now the second-most-popular option for travel search worldwide, after Expedia.)

Those market dynamics are a formula for financial ruin, with OTAs needing to spend more and more on marketing to attract new customers. Consider Booking.com, which in 2018 spent $4.4 billion on marketing—about 3% of Google’s advertising revenue for the year—while also charging less for its service in order to win in a price-competitive market.

To build a more sustainable business model, travel distributors need to transition away from focusing on individual bookings for a flight or a hotel to focusing on the total trip value through a bundled offering and—longer term—capturing more repeat business and customer lifetime value.

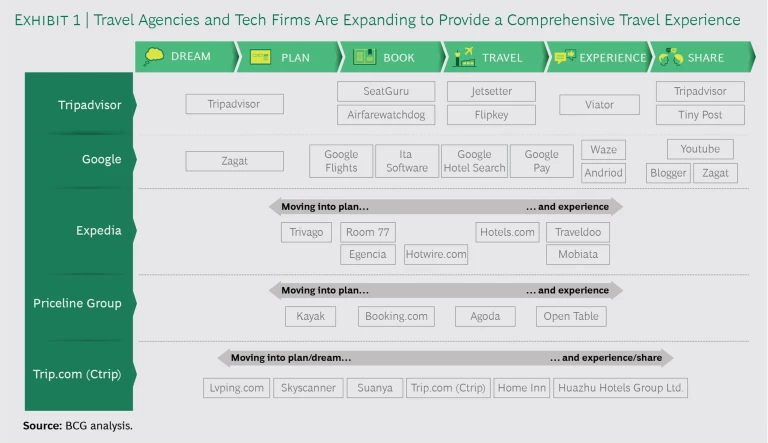

Already some travel distributors have started expanding to provide a more comprehensive experience—allowing customers to book not just a single component of a trip but all components. By increasing their range of product offerings through strategic ventures and partnerships, these companies are bundling and packaging trip experiences, removing the hassle of booking different travel components at different sites. (See Exhibit 1.) Better still, customers can also get a single customer-service point of contact for all aspects of a trip if something goes wrong.

This approach also generates higher margins for distributors, because consumers are no longer booking based on price alone. More important, it helps move distributors closer to the ultimate goal—becoming the go-to travel brand for customers’ needs, capitalizing on the most profitable repeat customers and spending less on acquiring new customers.

Distributors, and even travel operators like hotels and airlines, must do more than simply assemble the right offerings.

To achieve such loyalty, however, distributors, and even travel operators like hotels and airlines, must do more than simply assemble the right offerings. They can look to industries such as retail and financial services for models on delivering superlative experiences across all channels—from a mobile app to a website to live support via chat or phone, and even physical locations in some markets. Retail and financial services industries also demonstrate ways to offer a consistently positive, seamless experience across all touch points and during the entire customer journey—from initial research through booking, the travel experience itself, and even post-travel. Throughout, the experience should center around the customer’s convenience and well-being and reflect a deep understanding of individual preferences.

Achieving that kind of omnichannel experience benefits customers on many levels:

Integrated Touch Points. Both digital and non-digital touch points allow customers to start their booking in one channel and complete it another. The type of non-digital service can vary by market, from a chat support line staffed by travel experts to an in-destination kiosk to a physical storefront.

Comprehensive Data. This gives companies a holistic view of customers’ prior experiences, trips, and service requests, so that customers feel known and can have their needs be understood, anticipated, and addressed in a hyper-personalized manner.

Greater Transparency. Customers will know exactly which products and services are available and how much they cost. Any disparities across channels due to varying service levels—for example, a small surcharge to change a booking through a live representative rather than a self-service process online—are disclosed upfront, so that customers feel the process is fair.

Better Service. Companies that have bundled offerings are better able to deliver a higher baseline level of service, including tailored advice from a travel expert and full support if something goes wrong.

Tailored Offerings. Because customer preferences and behaviors are tracked more effectively in an omnichannel environment, companies can tailor their offering and deliver relevant marketing messages and promotions, which over time become more accurate and personalized.

In an omnichannel environment, companies can tailor their offering and deliver relevant marketing messages and promotions.

Benefits for travel distributors and operators that deliver a superlative omnichannel experience include:

Improved Conversion Rates. Distributors can encourage customers who abandon a purchase in one channel to resume it in another.

Higher Spending Among Customers. Customers who engage with brands across multiple channels typically spend far more than single channel customers do. In retail, for example, spending among multi-channel customers is two to three times higher.

Increased Customer Satisfaction. Because omnichannel delivers a superior experience, customer satisfaction scores are higher, along with related metrics such as brand advocacy.

Greater Customer Retention. Retailers that have transitioned to omnichannel indicate that improved customer loyalty is the main advantage, leading to repeat purchases.

Lower Customer Acquisition Costs and Higher Lifetime Value. Because companies can spend less acquiring new customers and generate more business from repeat customers during their lifetime, overall profitability goes up.

More Efficient Support Teams. By integrating online support (and giving customers a financial incentive to use it), companies can make their in-person support teams smaller and more efficient. For example, in an effort to reduce complaints, an airline in Asia created a more intuitive digital experience that provided proactive advice to customers. As a result, the number of customers contacting support agents dropped by nearly 40%.

Three Steps to Create a Superlative Omnichannel Experience

There’s no quick fix to start achieving the kinds of benefits we’ve just discussed. Rather, what’s required is a comprehensive solution to fundamentally change how individual travel distributors function. We believe that success comes through a structured approach, consisting of three steps. (See Exhibit 2.)

1. Understand customers at each stage in their individual travel journey. First, distributors need to look at travel not from their own perspective but the customer’s—by mapping the process that a traveler undergoes before, during, and after a trip. Mapping the customer journey helps distributors start to understand the underlying customer needs, existing pain points, and moments of truth in their decision- making process. Through these insights, distributors are able to learn where they can differentiate themselves and generate a competitive advantage—the “right to win” for a given customer or target demographic.

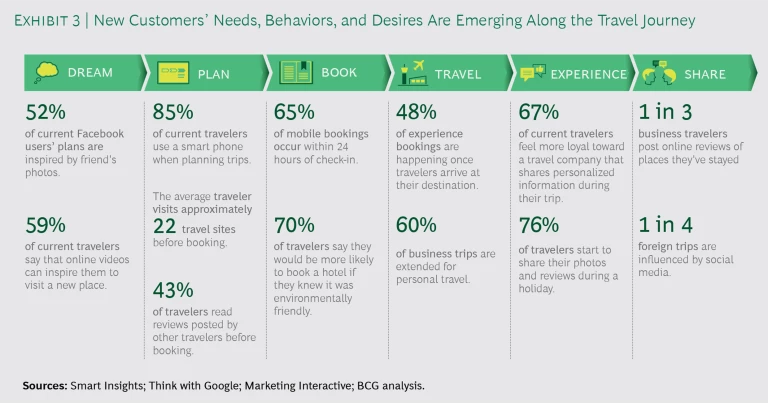

For example, travelers increasingly value things like user-generated photos and videos, along with credible reviews that help a potential traveler get inspired for a given trip and verify the quality of an experience or offering. Increasingly, consumers see those kinds of reviews as more trustworthy than traditional marketing. Similarly, the industry has seen a rise in the number of last-minute and in-destination bookings. Exhibit 3 shows additional emerging trends throughout each stage of the customer journey.

2. Design an improved customer experience. Armed with a detailed understanding of the customer journey and individual needs and preferences, distributors can start to redesign their value proposition to better meet the needs of the target group—or, increasingly, the needs of an individual customer. Crucially, this customer experience should integrate all relevant channels.

For example, brick-and-mortar travel agencies are fading away in developed markets, but they are a critical part of the customer journey in other geographic regions, where they can provide a human touch or a “try before you buy” concept to boost sales conversion rates. (Some physical locations are incorporating advanced tools such as augmented reality and virtual reality simulations, which give customers an immersive, memorable way to visualize a future trip.)

A Middle Eastern travel agency found that its customers’ greatest unmet need was for inspiration and advice.

A Middle Eastern travel agency found that its customers’ greatest unmet need was for inspiration and advice. In response, it developed travel concept stores in its retail network, devoted to introducing new destinations and providing expert recommendations—as well as helping customers book trips.

Similarly, an Asian OTA faced rising customer acquisition costs in digital channels, in part because some of its target customers in remote populations (along with elderly customers) don’t always have reliable internet and deep digital literacy. For those groups, online marketing alone simply wasn’t enough. To improve, the OTA opened a retail network to help elderly people and those in more remote markets learn to use its website to research and book trips. Over time, those walk-in customers became digital customers.

At the same time, the growth in digital requires that distributors integrate both physical and online offerings. In many markets, distributors can leverage digital to increase the quantity and quality of touch points, enabling more personalized interactions, offerings, and experiences. For example, once customers have made their initial purchase, distributors can use digital to upsell and cross-sell additional components through real-time push notifications, personalized to customers’ trip timing or location, or both. So when a customer checks into a resort, the distributor could offer a menu of additional tours and experiences that are bookable through a single click, rather than putting the burden on travelers to research and book their own add-ons.

Digital can also offer travelers a valuable support channel on their trip, generating higher levels of customer service and ultimately making them more loyal to the distributor. Perhaps most important, digital generates a wealth of customer data at each touch point, which distributors can use to create tailored interactions and more richly detailed customer profiles. (All data should be handled according to privacy regulations such as Europe’s General Data Protection Registry.)

3. Establish the data infrastructure and operating model. Critically, companies need to put the right internal foundation in place in order to deliver a seamless customer experience. That includes both digital architecture and the operating model.

In terms of digital architecture, distributors need an integrated data platform with unified customer IDs. This serves as a single repository of both structured and unstructured data that AI engines can use to generate targeted sales opportunities. Distributors also need a set of channel-agnostic business services that can ensure a consistent product and price offering. And they need a means to track customers throughout their various touch points with the brand and deliver 360-degree customer visibility to all relevant parts of the organization.

Regarding the operating model, distributors need to ensure that they stay focused on the customer in all decisions. That requires regular customer research and feedback, to ensure that new initiatives are defined by how they improve the customer journey (and that the success of those initiatives is measured accordingly). Distributors should also realign key business metrics and performance incentives to focus on long-term customer profitability (repeat purchases with increasing trip values comprising a larger share of high-margin products), rather than short-term targets such as transaction volume.

Because omnichannel success requires integration among multiple business units and functions, organizations should be redesigned to break down channel silos and instead form multi-functional teams that bring employees from different parts of the organization together.

Distributors can leverage digital to increase the quantity and quality of touch points, enabling more personalized interactions, offerings, and experiences.

The travel industry is changing rapidly, and the coronavirus pandemic has only accelerated the need for travel distributors to rethink their approach. Rather than continuing to focus on individual transactions—paying ever more to acquire new customers and competing on price—they can differentiate themselves by creating a seamless, omnichannel experience that puts customers’ needs first. When customers feel known and understood, they become more loyal and spend more. That concept has been proven in other industries like retail and financial services, and it holds just as much potential in travel.