This is the first of two articles about the impact of COVID-19 on the hotel industry. It discusses medium-term measures that leadership teams should take in response to the crisis. In the second article, we will discuss longer-term steps that companies can take to thrive in the post-COVID-19 environment.

The COVID-19 pandemic has hit the global hotel industry like a meteor, and its impact will be broader, deeper, and longer lasting than the effects of previous crises were. In the US, national occupancy rates have fallen to around 20% as of late April 2020, and revenue per available room (RevPAR) in the US and Europe has dropped by 80% and 90%, respectively. Although demand has started to return in some markets, such as China, a quick and painless recovery is unlikely, as countries around the world prepare to navigate at least 12 more months of struggle against the coronavirus before a vaccine or treatment will be available. When travel does begin to come back, both the market and the nature of traveler demand will likely look vastly different for a long time.

In a recent publication, BCG framed the current pandemic environment in terms of three phases : Flatten (slow the virus’s exponential growth), Fight (restart the economy), and Future (adjust to a new normal). For hotel leadership teams—whether representing hotel brands, ownership groups, or property management companies—we believe that the upcoming Fight phase of recovery poses a critical opportunity. To that end, we recently surveyed US travelers to understand how the market has changed and how demand will recover. The results quantify the ways in which preferences and behaviors among travelers are evolving in response to the crisis. Armed with these insights, smart leadership teams can position their companies to capitalize.

A Different Kind of Crisis

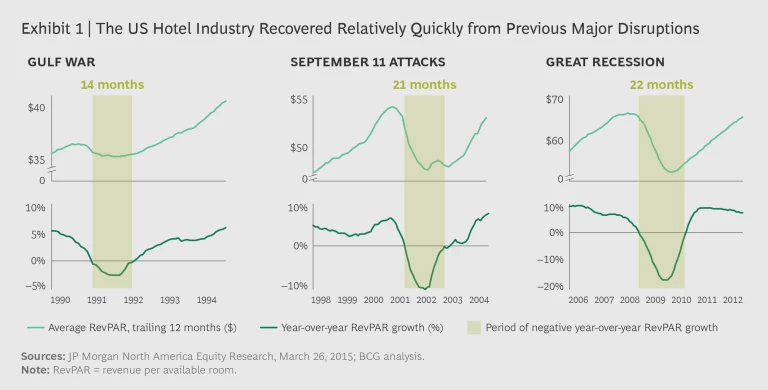

After previous global crises—such as the Gulf War, 9/11, and the Great Recession—the hotel industry bounced back to previous growth levels within two years in each case. (See Exhibit 1.) The timeline for recovery from the COVID-19 pandemic, however, could be far longer.

The Flatten phase of the COVID-19 pandemic saw unprecedented disruption of the hotel industry. Both business travel and leisure travel declined dramatically, coming to a near halt worldwide. In the US, as of late April, more than 90% of the population was under some form of lockdown. Similar lockdowns in the Asia-Pacific region led to a decline of about 65% in average occupancy rates there. In Europe, RevPAR was 90% lower in late April than in the same period in 2019, a year-over-year decline more than three times as steep as the worst period of the 2008 recession. Many hotel companies responded by aggressively conserving cash, managing liquidity, and reducing nonessential spending. Asset-light hoteliers worked proactively with franchisees, deferring enforcement of brand standards and providing fee relief to help those most adversely impacted by the crisis.

How to Win the Fight

As governments slowly begin to ease quarantine restrictions, an early view of the Fight phase is emerging. China, for example, has experienced gradual occupancy gains, led primarily by weekend leisure travelers who live within driving distance of their travel destination. As flight capacity increases, businesses start to reopen, and consumers become more comfortable traveling, hotel leadership teams face a complicated and tumultuous scene. There is little precedent for managing the business while navigating the hundreds of disjointed, diverse markets that will serve as battlegrounds during the Fight phase. Nevertheless, we believe that management teams should focus on eight priorities.

- Recalibrate demand indicators to understand how, when, and where bookings will resume.

- Prepare to win with local, domestic travelers among shifting demand pools.

- Position properties to differentiate on key traveler concerns.

- Shift to agile revenue management tactics.

- Support the furloughed workforce.

- Reimagine loyalty in a world with suppressed travel.

- Reenergize property development.

- Seek opportunistic mergers, acquisitions, and divestitures.

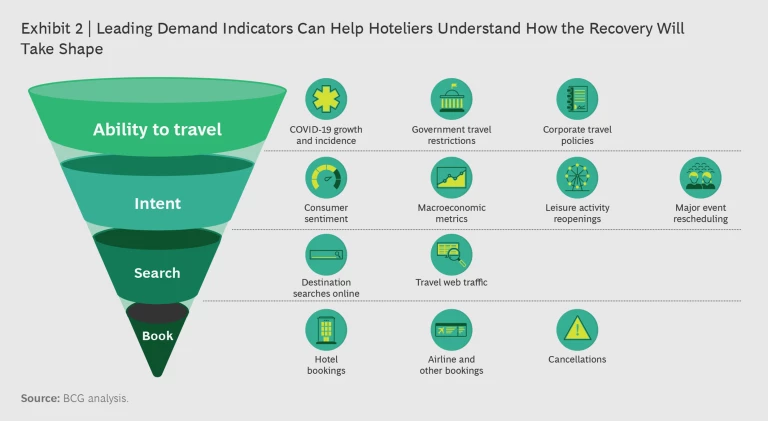

Recalibrate demand indicators to understand how, when, and where bookings will resume. Companies will not have the benefit of receiving a global “all clear” signal. Instead, they must gather and analyze granular information from an array of sources—including travel data, epidemiological information, and updates on consumer behavior—to gain insight into how demand will resume. Hoteliers will have to break down this information by demographic segment, brand, geographic market, and individual property. As Exhibit 2 shows, these demand indicators span the entire customer journey, starting with guests’ ability to travel and proceeding through their intent, search, and booking behavior. This kind of market intelligence requires more-complex data than many hotels currently track, but it will prove invaluable in enabling companies to track nascent demand. With uncertainty over a coronavirus resurgence, this capability will be more important for monitoring and reacting in real time. (For more information about how demand for travel is slowly returning, see our Travel Recovery Insights Portal .)

As of late April 2020, demand indicators suggest that international travel will remain at near-zero levels as a result of continued governmental restrictions on cross-border travel and declining air carrier capacity. In China, the initial recovery shows a slow rebound rate of approximately 6% per month in bookings from a trough of –81% year-over-year; domestic demand is the chief driver of that trend, however, as international inbound and outbound air travel continues to decline. There are, however, some promising signs for the industry. As of late April, 64% of US respondents indicated that they would be willing to fly if certain conditions involving antiviral cleaning and social distancing were met—an improvement of 7 percentage points since April 13.

Prepare to win with local, domestic travelers among shifting demand pools. Travel and transportation choices will look different during the Fight phase as people fly less, drive more, and weigh their travel options differently than they did in the past. As of mid-April, roughly half of respondents said that they plan to reduce or avoid international travel for at least six months, compared with 32% for domestic travel and 22% for local leisure activities. Travelers in China and Europe show a similar pattern. As governmental restrictions slowly ease, consumers will counterbalance their pent-up desire to travel with tentative behavior caused by a need to feel safe and by recessionary concerns that will limit leisure spending. (Notably, consumers rank leisure travel as the activity they miss the most.) In the same BCG poll, about one in four US respondents said that they would spend “a lot less” on hotels even if the virus were under control in three months, an indication that continued concerns about economic uncertainty will restrain travelers’ willingness to spend.

To win with consumers in these altered demand pools, hoteliers must optimize their channels and messaging to simplify the booking process and promote new forms of local escape. Local leisure demand will return with less lead time and shorter booking curves, requiring hoteliers to anticipate and take steps in advance to capture families and excursioners who are planning to travel for the first time since the crisis began. Marketing should cater to local browsers, and add-ons such as local activities and services should be easy to bundle.

Position properties to differentiate on key traveler concerns. Once leadership teams have a clearer understanding of the nature of demand within a market, they must take steps to uniquely position their properties to appeal to new traveler expectations. In the Fight phase, brands will likely play a changed role, as companies need to invest in and promote new attributes to win (or at a minimum, not lose) demand. This includes having brands flex outside their natural demand pools to offer different amenities and features. For example, could a brand that in the past typically marketed to conferences and large events reposition itself to attract families for shorter stays?

Cleanliness is a key concern as well. In our research, 84% of US consumers surveyed in late April said that they would resume visiting public spaces if some hygiene measures were in place, identifying enforced social distancing, increased hand sanitizer use, and regular antiviral cleaning as primary drivers. Research into European travelers’ concerns has yielded similar findings. It thus appears that hoteliers can leverage trust as an asset by ensuring that properties are not only clean but sanitized and safe—a point of differentiation that may boost demand as travelers slowly become less fearful of public spaces.

Some early movers have already begun to adapt to these new priorities, as in Hilton’s new partnership for CleanStay with Lysol and the Mayo Clinic. Most hoteliers, however, are not performing well in this battle of perception, particularly in relation to home-share brands. As of late April, 48% of US consumers said that they were concerned about catching a virus from staying at a hotel, compared with 33% who had the same concern about staying at an AirBnB property. In Europe, travelers show the same heightened concern about catching a virus at a hotel (34%) versus at an AirBnB (27%), though the gap is smaller there than in the US. In China, too, hotels (34% concerned) lag behind AirBnB (20% concerned) on this metric. Given that hotels have steadily lost share to disruptive home-share competitors over the past several years, the Fight phase of the pandemic offers a crucial opportunity to reverse that trend.

Shift to agile revenue management tactics. As the recovery of RevPAR lags, hoteliers must find ways to achieve gains in occupancy without eroding their average daily rate (ADR). Although stimulating demand can improve occupancy relatively rapidly, ADR gains in previous industry crises have been much more gradual. Compounding this challenge for revenue management functions during the Fight phase is the fact that a number of typical reference points—including historical booking patterns, KPIs, and trends—will no longer be relevant.

Just as leadership teams staffed up liquidity war rooms during the Flatten phase, they should build revenue war rooms for the Fight phase. These teams should focus on several key priorities to help companies prepare for the rebound : applying best-in-class data science to forecast volatile demand, deriving new price elasticities that reflect post-COVID market conditions, recalibrating revenue management systems instead of ignoring outputs, resetting promotions for a new segment mix, and setting up processes to ensure a rapid response.

Setting up revenue management teams to adopt an agile, test-and-learn approach can help companies effectively identify and capitalize on early trends from recovering pockets of demand.

Support the furloughed workforce. Nearly every major hotel company has announced unpaid leave or furlough policies for its corporate and hotel staff, and many have taken steps to support their people through the crisis. Although the need to furlough people is understandable, companies risk leaving themselves understaffed for the coming rebound and unable to preserve institutional and operational know-how that would allow them to resume operations quickly (especially since many franchisee-operators cut their workforce as well). One example of mitigation involves Huazhu Group, which developed an internal information platform to communicate with employees and provide franchisees with timely information, emergency safety supplies, and training on virus prevention procedures.

Reimagine loyalty in a world with suppressed travel. In BCG’s survey, 66% of respondents said that they expected to stay in a hotel “somewhat less” or “a lot less” than usual over the next six months—a figure on a par with the reduction in expected air travel (69%). Travelers in key European markets—including Germany, France, Italy, and the UK—express similar reluctance to stay in hotels in the near term. But even if people aren’t booking, hotel companies must find ways to engage with them through loyalty programs and other digital marketing channels. One option is to forge retail partnerships that allow members to redeem smaller numbers of points by shopping. Another is to foster goodwill by enabling members to donate points to relief organizations. Streaming content, games, and other means of driving traffic to brand apps and sites will be key to maintaining engagement during periods of low travel. One example of travel companies adapting loyalty programs is Air Canada’s Travel at Home initiative, which invites members to earn miles and status through retail, financial, and travel partners, as well as to buy or donate miles.

As restrictions ease and people begin to travel again, hotel loyalty programs must be reimagined to make them relevant for a different pattern of travel throughout the Fight phase. Current programs that reward members for multiple stays and high annual spending levels are unlikely to engage meaningfully with domestic leisure travelers who seek more accessible, less expensive destinations. Further, owing to the continued reduction in business travel, the highly valuable “road warriors” of the pre-crisis period may not return rapidly or book at their former levels of frequency.

During the Fight phase, hoteliers must play an active role in shaping where and when demand will return. They should proactively promote destinations that complement their portfolio, and they can collaborate with other impacted industries—such as theme parks, casinos, and sporting events—and local tourism bureaus to influence travel decisions.

Reenergize property development. Project pipelines have slowed dramatically and are unlikely to significantly restart until lending markets can operate with more solid economic assumptions. According to research firm STR, the hotel industry had 214,704 rooms under construction in the US in March 2020, a record high. However, as the COVID-19 crisis escalated, companies deferred or abandoned numerous projects that were still in the planning stage. Many deals that had been scheduled to close were instead put on hold, and sellers that were in the development phase prior to the outbreak will require new valuation before moving forward.

In this environment, hotel companies need to assess a wide range of possibilities for stimulating development, including extending fee discounts, assisting franchisees in obtaining bank loans, providing legal counseling services, and offering options from the balance sheet. Simultaneously, hoteliers must plan for a prolonged period of sluggish demand throughout a Fight phase that is likely to last for 12 months or longer. They should follow the steps that airlines and cruise operators have taken to reshape their asset portfolio, evaluating which properties are necessary to enable them to compete. Hoteliers must take a calculated approach in order to compete with the right properties and manage the slowdown in pipeline development without excessively hampering future growth.

Seek opportunistic mergers, acquisitions, and divestitures. Brand, portfolio, and capability acquisitions—including the deals between Marriott and Starwood, Wyndham and La Quinta, and Aimbridge and Interstate, among many others—defined the past decade for the hotel industry. The COVID-19 crisis could present an opportunity for leading players with vision to look beyond making urgently needed tactical moves in the short term. As scenarios play out across the globe and as the Fight phase impacts players disproportionately, some brand companies, management companies, online travel agencies, and real estate investment trusts will face dwindling cash reserves and looming near-term debt obligations. Already, some private equity firms have taken steps to boost solvency and take an increased ownership stake in companies across the industry. Companies should also evaluate unique partnerships that in the past they might not have considered, to assess their potential to drive demand, expand loyalty, and develop digital capabilities. Companies that operate from a strong starting point and manage the Fight phase well will find that they have a window of opportunity to make bold moves at good valuations—but it won’t last forever.

The COVID-19 pandemic presents a massive challenge to the hotel industry, prompting a widespread reset of travel patterns and behaviors for both leisure and business travelers. The sheer scale of disruption gives hoteliers an opportunity to make bold, transformational moves that can sow the seeds of advantage and success now for a future that seems distant at the moment but will come sooner than many management teams expect.