Although pharma companies frequently speak to health care professionals and patient advocacy groups about patients’ needs, they seem to spend far less effort on asking patients themselves what they want. Thus, patients’ wishes and preferences often remain unclear, posing a real problem for pharma companies looking to better engage patients. It’s particularly critical to solve this problem in countries such as the US and China, where the prevalence of private health care means that patients are playing a more influential role in their own treatment decisions.

To better understand what patients want from pharma companies, we surveyed 3,200 patients and other health care industry stakeholders in five markets—the US, UK, Germany, China, and Japan—looking to answer two main questions: What do patients want from pharma companies? and How well are those companies meeting those needs? (The survey was cofunded by AstraZeneca.) What we found was enlightening both in terms of what patients wish to see and also the benefits that pharma companies stand to gain if they can become patient centric. These findings will help pharma companies address the key areas that matter to patients and are even more important in crises such as the current coronavirus pandemic—when patients’ needs are most urgent.

What Matters Most to Patients?

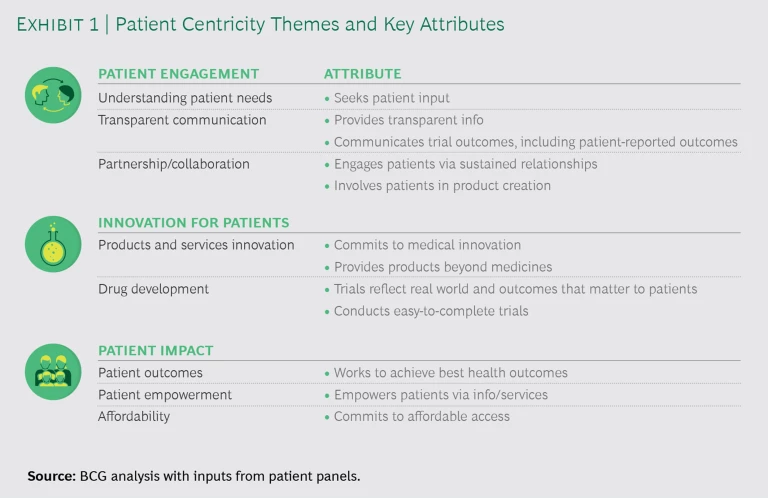

Our survey focused on three important themes: patient engagement, innovation for patients, and patient impact. Grouped under each of these themes are key attributes that matter most to patients. (See Exhibit 1; for more on the survey’s methodology, please see “About Our Survey.”)

ABOUT OUR SURVEY

ABOUT OUR SURVEY

As part of our survey design, we gathered input from patients, health care professionals (HCPs), and representatives from patient advisory groups (PAGs) to identify patient centricity attributes across three categories: patient engagement, innovation for patients, and patient impact. Our survey design makes it possible to conduct a very detailed analysis of disease areas, stakeholders, and markets by patient centricity attribute and company without force-ranking companies. The survey also makes it possible to compare what patients say their needs are with how their needs are perceived by those who care for them (HCPs) and those advocating on their behalf (PAGs). Our 3,200 respondents came from five markets—the US, UK, Germany, China, and Japan.

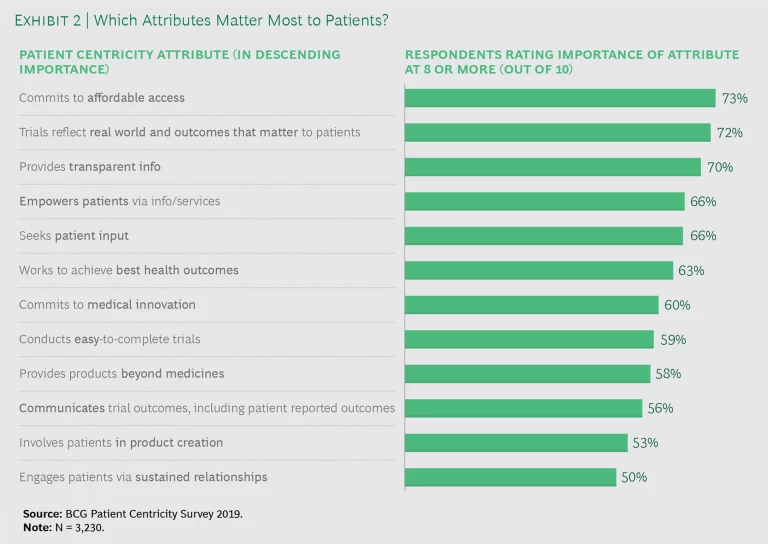

The survey yielded major insights into what patients want from pharma companies. First, patients, health care professionals (HCPs), and patient advisory groups (PAGs) seem to be quite pragmatic about what these companies should be doing for patients. The three most important attributes are “Commits to affordable access,” “Trials reflect real world and outcomes that matter to patients,” and “Provides transparent information.” (See Exhibit 2.)

Second, these responses are remarkably consistent across markets and therapeutic areas (TAs). At present, many pharma companies have a fragmented approach, where efforts to engage with patients differ widely by region. But our findings suggest that pharma companies could benefit by building a core patient-centric capability with common programs, which could in turn be scaled effectively across markets and TAs. Of course, tailoring patient offerings to the local culture and the nature of the disease will always be necessary, but our survey suggests that these offerings can be fundamentally similar.

Are Pharma Companies Delivering What Matters to Patients?

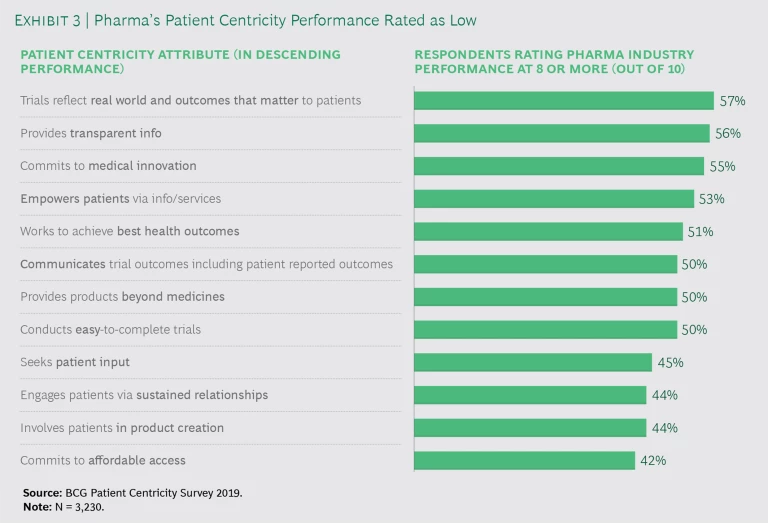

We also asked patients, HCPs, and PAGs to assess how well pharma companies are meeting the needs of patients by market and TA. (See Exhibit 3.) Respondents noted relative strengths, such as “Trials reflect real world and outcomes that matter to patients” and “Provides transparent information.” However, their responses also reveal some notable areas for improvement, including “Commits to affordable access,” “Engages patients via sustained relationships,” and “Seeks patient input.” Some pharma companies already have initiatives in place to address these areas, but they might need to attend to additional issues and to communicate more transparently about what they are doing and why.

About half of all respondents observed that pharma companies are meeting their needs. However, the views of patients alone are less positive; only 44% report their needs are being met. The largest gaps are in attributes related to engaging directly with patients and HCPs, which are areas where pharma companies should focus their patient centricity efforts.

Interestingly, patients in the survey who could identify the pharma company that manufactured their medicine tended to view the industry as more patient centric than those who could not. Unfortunately, only 18% to 27% of patients could make this identification. These individuals tended to come from markets with high out-of-pocket health care systems, such as China. That makes sense—patients paying directly for their medicines will be more engaged. This is a clear opportunity for pharma companies: if a patient knows the name of the drug manufacturer, that represents the start (no matter how basic) of a relationship. China provides a particularly interesting opportunity, given its higher levels of patient engagement and increasingly available private health care.

If patient knows the name of the drug manufacturer, that represents the start of a relationship.

One intriguing side note: among all stakeholders, the survey responses of nurses were the most similar to those of patients, underscoring their understanding of patient needs and the nature of their relationships to patients. This suggests that working more closely with nurses is one way for pharma companies to improve patient centricity.

Pharma Company Performance Varies

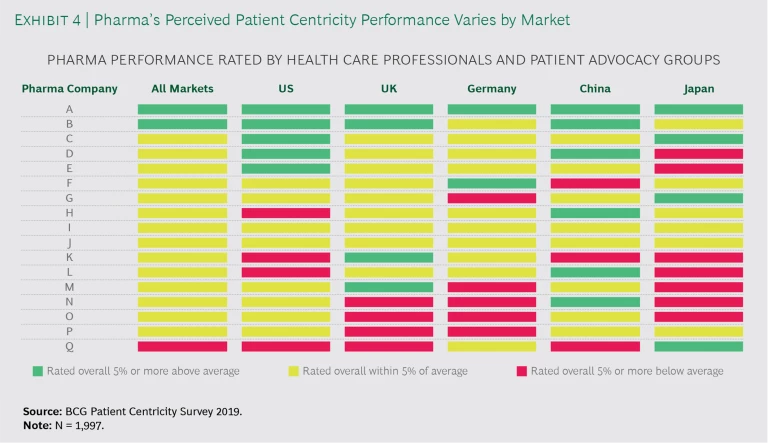

We also developed insights on how HCPs and PAGs view the performance of specific pharma companies. They noted significant variation in patient centricity between companies and across markets. (See Exhibit 4.) Notably, we were struck by how few pharma companies are perceived to have delivered truly breakout performance.

The top pharma performers in the survey tend to be highly focused in a specific disease or TA and to invest heavily and play a high-profile role in conjunction with these special areas across the health care system. We know from our other work in the industry that PAGs and key opinion leaders also view these top performers as the partners of choice in addressing a particular medical condition. This level of investment and depth of expertise create a virtuous cycle and raise the bar for other pharma companies looking to stand out among patients and HCPs in regard to those diseases or TAs. This challenge is particularly acute for pharma companies with large portfolios of disease areas.

The Benefits of a Patient-Centric Agenda

Patient centricity is not just a noble goal; it offers clear benefits to pharma companies. HCP respondents said they were more willing to engage and work with pharma companies that they perceived as more patient centric. In addition, more than 50% of doctors said that, all else being being equal, they were more likely to prescribe medication from a pharma company they considered more patient centric. Notably, doctors in China seem particularly inclined to favor companies that they perceived as patient centric.

Doctors were more likely to prescribe medication from a pharma company they considered more patient centric.

Our survey highlighted some key agenda items for any pharma company’s patient- centricity efforts.

- Create a clear corporate identity and develop a cross-geography approach that emphasizes direct engagement with patients. Focus the approach on the attributes that matter most and/or where the company is performing worse.

- Ensure consistent execution in each local market and across functions, from R&D to commercial, to deliver consistent patient-centric outcomes.

- Engage key members of the health care ecosystem, especially nurses, to understand patients’ needs and what is and isn’t working.

- Act on the tremendous patient centricity opportunity in large private-pay markets.

Pharma companies must have clarity into what patients want and how well they are delivering on these fronts in order to design the right initiatives, set goals, and measure performance. Without this clarity, patient centricity efforts are much more likely to falter. But this new annual BCG survey makes plain that there are enormous opportunities for pharma companies to open up new avenues of engagement with patients.