This piece was produced in collaboration with CTIA.

There has been a lot of hype about 5G networks—and it’s actually well deserved. With faster data speeds, increased device density, and ultralow latency, 5G will become a foundation for innovation, transforming many sectors of the US economy and creating industry verticals not imagined today. This will have broad and deep economic implications both by industry and by region—far beyond such established tech hubs as New York and San Francisco.

Our research estimates that over the next decade, 5G deployment will contribute $1.4 trillion to $1.7 trillion to US GDP, and create 3.8 million to 4.6 million jobs. At first, 5G will contribute to economic activity directly through network infrastructure deployment. But as 5G networks continue to roll out and improve, an even greater wave of economic activity will occur indirectly as the networks enable new and improved use cases across industries. These will deliver significant socioeconomic benefits through higher productivity, improved cost competitiveness, and better health and safety.

5G-enabled IoT use cases, such as connected vehicles, smart cities, and Industry 4.0, could fundamentally transform industries and drive US competitive advantage in the 2020s.

Produced in collaboration with CTIA, this report is a follow-up to one published in September 2020, in which we laid out the principles for building a 5G economy , examining key success factors and the different phases of 5G growth. To prepare for the next generation of 5G-enabled technologies, US policymakers and corporate executives also need to understand the breadth and depth of 5G’s economic impact. To that end, this second report takes a deep dive into how 5G will diffuse throughout the economy and assesses the effect it will have on GDP and employment at national, regional, and industry levels. (See “Our Methodology.”)

Our Methodology

In the first case, we modeled the economic impact on direct and indirect impacts. We simulated these impacts by industry at the regional level (county and congressional district), taking into account local economic and demographic attributes, including industry composition, age distribution, income and education, and urban and rural population.

5G contributes directly to US GDP via the network build-out. The infrastructure for 5G requires significant investment in equipment and labor, such as the construction of new wireless towers and data centers, upgrades of existing sites to add 5G capabilities, and development of new network architecture and supporting software. The additional labor required will generate an immediate boost to employment.

As 5G networks expand, they will generate indirect economic impact beyond the industries directly tied to the infrastructure rollout. 5G will enable improvements to existing applications as well as the development of new use cases across industries, contributing to employment and adding new revenue streams to the broader economy.

In the second case, in which the US doesn’t expand 5G, economic and job gains are based on 4G’s growth momentum. In this scenario, 4G growth continues but at a slower rate. In the past decade, thanks to a favorable business climate and vibrant talent pool, the US leveraged its 4G infrastructure for growth and fostered a robust innovation ecosystem. Demand for connectivity has grown extraordinarily and is expected continue its upward trajectory over the next decade.

All Regions will Benefit from 5G’s Economic Impact

There is strong evidence that 5G’s economic impact will be significant. In the case of 4G, for example, research from the American Enterprise Institute shows a direct relationship between the pace of mobile adoption and economic activity. By delivering faster speeds, lower latency, and higher reliability, 5G will spur additional activity across consumer, industrial, and public domains. Use cases for the Internet of Things (IoT), such as connected vehicles, smart cities, and Industry 4.0, could fundamentally transform industries and drive US competitive advantage in the 2020s.

Over time, as the networks mature and penetration rates rise, the major drivers of GDP and employment growth will shift from direct infrastructure build-out to indirect impacts from new and improved use cases across industries. (See Exhibit 1.)

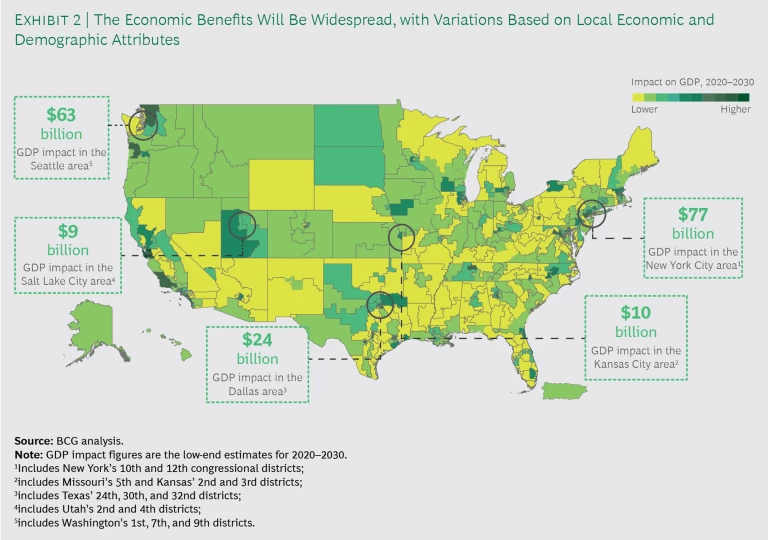

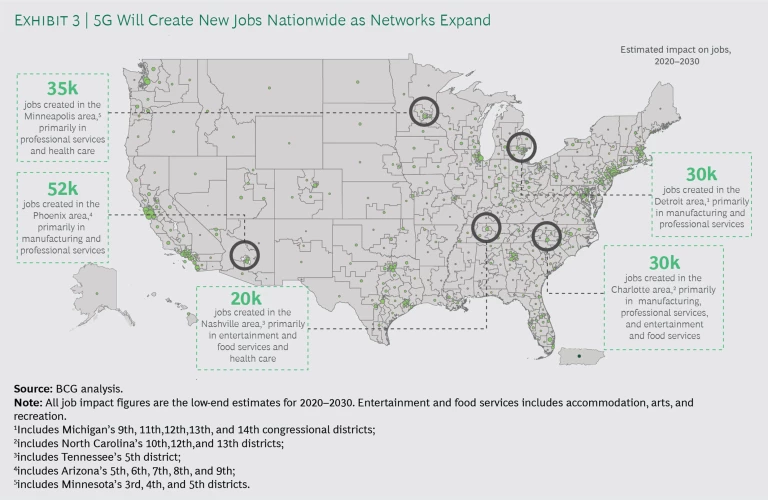

Our analysis shows that 5G will unlock broad benefits across the US. While the more densely populated areas of the country will generally realize the benefits sooner, over time the regional effects of 5G will be far-reaching as innovation enables new use cases across all industries, including agriculture, health care, and education. (See Exhibits 2 and 3.)

The intensity and timing of 5G’s impact in each region will depend on the local economic mix and demographic attributes. Not surprisingly, regions with high concentrations of existing technology companies will see growth almost immediately as 5G networks are built and new services begin to be deployed. Regions with a broader base of industries are likely to see more balanced, indirect 5G growth as those companies adopt new technologies such as smart sensors, virtual and augmented reality, and cloud computing. A region’s demographic characteristics such as age, education, and income will also influence how much and how quickly 5G contributes to the local economy. Our research drills down to assess the GDP and employment impact in each congressional district across the country. (See Exhibits 4 and 5.)

5G’s Direct Economic Impact Across the US

Through direct spending on capital and labor, we estimate that 5G deployment will contribute $400 billion to $500 billion to US GDP and create 800,000 to 1 million jobs from 2020 to 2030. This direct impact represents about 30% of the total value potential from 5G. Three industries will reap most of these direct benefits: construction, as it builds additional access points such as macro sites, small cells, and edge data centers; information services, as network complexity creates demand for engineering and software services; and manufacturing, as demand grows for infrastructure-related equipment.

5G network deployment can be broken into three phases. We expect that these direct impacts will grow steadily over the three phases as operators expand and improve network technologies across communities.

Foundation. In this first phase, operators will deploy a baseline broadband network (low- to midband) for better connectivity to deliver extreme mobile broadband (eMBB) and fixed and mobile wireless access services, as well as initial mmWave deployments in population-dense city areas. This early 5G deployment is occurring now and will generate direct economic activities such as:

- Upgrading software of existing 5G-ready radios, installing new 5G radios, using dynamic spectrum sharing (DSS) to share 4G and 5G in the same spectrum band, and leveraging existing macro grids to increase coverage and capacity

- Upgrading and expanding the fiber footprint for backhaul to the core network

- Developing edge data centers in select areas for first-generation low-latency use cases, such as cloud gaming and early applications of mixed and virtual reality

Expansion. In this second phase, which has begun already, operators will expand 5G networks across the US. 5G coverage is becoming more available along major transit routes using low- band and midband spectrum and in areas with lower population densities, and mmWave densification in urban cores and hot spots such as venues and shopping centers is continuing. 5G’s direct economic activities in this phase will include:

- Expanding centralized and virtualized radio access network (RAN) architectures

- Expanding the network of micro edge computing centers for closer proximity to end users

- Improving network efficiency by deploying advanced end-to-end network slicing at scale

Augmentation. In this third phase, operators will expand mid band and mmWave densification across cities, businesses, and major and secondary transit routes. 5G’s direct economic impact will continue, driven by:

- Deploying micro edge computing centers that will provide ultralow latency and enhanced security

- Enhancing network architecture and software

5G’s Indirect Economic Impact Across the US

As 5G networks evolve and become more robust over time, they will enable new and improved use cases in virtually every part of the economy. By reaching ever deeper into industries across the US, we estimate that these indirect 5G benefits will add $1.0 trillion to $1.2 trillion to GDP and create 3 million to 3.6 million new jobs from 2020 to 2030. This indirect impact represents about 70% of the total value potential from 5G.

Because 5G offers greater bandwidth, less latency, and more secure communications than 4G, new use cases will flourish. For example, real-time communication and AR/VR devices can enhance personalization. This will stimulate growth not only in retail but also in upstream industries such as manufacturing, as well as in adjacent industries such as media. Similarly, 5G-enabled mobile banking and digital wallets will drive product and service innovation in the finance industry. They will also broadly enhance economic vibrancy by providing seamless transaction experiences. Meanwhile, smart traffic control promises to improve transportation; this, in turn, could boost sectors such as travel and tourism, restaurants, and retail.

These are just a few possibilities. When 4G launched, few would have predicted new services such as ride-sharing and food and grocery services on demand. Likewise, 5G will spur innovation that we can’t predict today and will transform everyday life in unforeseen ways. While innovation will occur broadly across industries, our research suggests that three industries, in particular, will benefit from these future use cases: information services, manufacturing, and health care. (See Exhibit 6.)

Information Services. In the past decade, a proliferation of 4G innovations has transformed people’s day-to-day lives. As a result, the demand for workers with expertise in technology has grown much faster than the economy-wide average for other skills. Over the next decade, as demand for digital products and services grow, even more computer- and IT-related workers will be called upon to deliver next-generation data infrastructure and applications. Software developers, data scientists, information security analysts, network architects, and research scientists will all be highly sought after. We estimate that 5G will indirectly boost employment in the sector by 205,000 jobs and contribute $217 billion to GDP.

5G will indirectly boost employment in information services by 205,000 jobs and contribute $217 billion to GDP.

Manufacturing. 5G networks will help manufacturers maximize factory capacity and increase efficiency. The higher sensor density enabled by 5G will optimize production schedules, reduce maintenance costs, and enhance supply chains and logistics management. These improvements could increase the competitiveness of US factories and draw more manufacturing back from abroad. We estimate that 5G will indirectly boost employment in the sector by 380,000 jobs and contribute $165 billion to GDP.

5G will indirectly boost employment in manufacturing by 380,000 jobs and contribute $165 billion to GDP.

Health Care. 5G could revolutionize telemedicine and remote monitoring. Wearables and monitoring devices will connect patients directly to providers, making health-care services more accessible and targeted. These advances, along with an aging population, will boost demand for care and spur job growth. Indeed, the US Bureau of Labor Statistics projects that employment growth in health care will be among the fastest for all industry sectors in the next decade. We estimate that 5G will indirectly boost employment in the sector by 341,000 jobs and contribute $104 billion to GDP.

5G will indirectly boost employment in health care by 341,000 jobs and contribute $104 billion to GDP.

Keeping 5G’s Rollout on Track

In order to bring these robust economic and job benefits to fruition, government at the federal, state, and local levels must work to keep 5G’s rollout moving ahead. Our projections assume a timely rollout of 5G services as well as a strong talent pipeline—especially in fields such as computing and engineering—to deliver next-generation digital products, services, and processes. Both timeliness and talent are critical to realizing the full economic potential of 5G.

It’s crucial that the federal government makes additional spectrum available in a timely manner. The US is a leader in making low- and high-band spectrum available for commercial wireless services but is still behind other countries in allocating midband spectrum. The FCC concluded an auction of 70 megahertz of 5G midband spectrum, its first, in August 2020. The agency began an auction of 280 MHz of midband spectrum known as the C-band in December 2020, and recently announced an additional 100 MHz at 3.45-3.55 GHz will be auctioned as early as 2021 as required by Congress. Continuing this midband progress and developing a pipeline of future licensed spectrum is critical.

Deploying 5G network infrastructure often requires approval from state and local governments. While the US Federal Communications Commission has clarified and modernized key elements of infrastructure regulations to speed up the review process—and over 30 state governments have instituted reforms in their jurisdictions—municipalities need to implement these policies as consistently as appropriate to avoid delays in infrastructure deployment. They should also focus on smart planning to, for example, ensure all new equipment installed along streets and roads is small cell ready with space for equipment, cabling, and power.

Delays in network infrastructure build-out or making more licensed spectrum available would carry significant opportunity costs, according to our analysis. At a national level, every six-month delay in 5G network deployment could, on average, mean missing out on $25 billion of the potential 5G benefits from 2020 to 2030. An extended delay could also erode the comparative advantage that the US currently holds in many industries.

Governments also play an important role maintaining a strong talent pipeline. From a policymaker’s perspective, fostering an ecosystem that increases the skills of the workforce and continues to attract the best talent from across the globe is critical for a successful 5G economy. Based on our research, every 1% shortfall (about 30,000) in talent supply could mean missing out on $20 billion (1.5%) of the potential 5G benefits from 2020 to 2030. If the talent gap were to create any long-term shift in comparative advantage, the opportunity cost would be even greater.

The coming 5G economy promises significant economic benefits for the US, both in terms of GDP and job growth. Moreover, the benefits are likely to be broad and deep, improving business operations and the consumer experience across the country. But these benefits are not assured. It’s likely, for example, that 5G will create economic disruptions outside the existing regulatory paradigm. This was certainly the case with 4G. In response, policymakers, regulators, and the private sector will need to coordinate to ensure the 5G rollout is smooth and the country has the necessary talent to capture the full benefits of the 5G economy.