This is the first of two articles that offer advice about the priorities and agenda for incoming CFOs.

When taking the helm of the finance function, CFOs must come to terms with a new reality. Gone are the days when the CFO was a numbers person who supplied other leaders with data to inform strategic decisions. Today’s CFOs are strategists and value creators in their own right, with broad mandates and continuous responsibilities to drive strong performance.

Given the scope of the role, new CFOs’ agendas should be shaped by their organization’s strategic priorities and financial performance. This means that before focusing on execution, new CFOs must get to know the organization. The first 90 days of their tenure provide a unique opportunity to gain this knowledge and apply it to set a vision for the future. CFOs can then use the vision as the basis for pursuing a prioritized agenda during the rest of their first year.

Here, we discuss a plan for the first 90 days. The next article in this series will explore the agenda for the rest of the first year.

A Unique Platform with Many Challenges

The CFO’s role today is a unique platform for creating sustained value and impact. CFOs, along with a small group of C-suite leaders, are at the very top of the decision-making pyramid, heading the function with arguably the broadest vantage point across the company. Their strategies often determine whether the organization succeeds or fails. As an executive at a large tech company told us, “The CFO’s true mission today is to be the ultimate owner and champion of value creation for the company.”

The CFO’s role today is a unique platform for creating sustained value and impact.

This unique platform comes with a wide variety of challenges. CFOs must help to shape the company’s agenda, engage with investors and capital markets, ensure strong financial performance, and partner with business colleagues to support operations. CFOs also must oversee the finance function’s core audit, regulatory, and risk-management responsibilities.

With such a broad mandate, new CFOs are understandably keen to make their mark on the organization and to mold the finance function according to their ambitions and aspirations. However, many CFOs fall into the trap of trying to tackle everything at once, simultaneously attacking a variety of improvement areas. This often stretches a CFO too thin and creates challenges in delivering tangible value that justifies the costs.

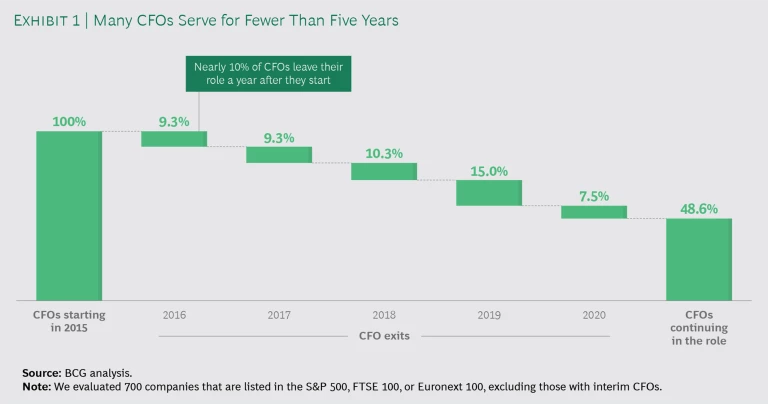

The scope of the challenges appears to be taking a toll on the tenure of some CFOs. A BCG analysis found that nearly 10% of CFOs at top companies leave their role within a year after they start the job. And more than 50% have left by the end of the fifth year. (See Exhibit 1.) A brief tenure does not give a CFO enough time to fully understand the company or its industry and the trends affecting them. As a result, the CFO is not able to have a meaningful impact on the organization and leave behind the desired legacy.

How can new CFOs lay the foundation for a successful and sustained tenure? Simply put, new CFOs should prioritize careful planning over speed of execution when taking the helm. This means using the first 90 days to form relationships, understand current performance, and develop a vision that guides setting the agenda for execution.

Start with the Basics

As an initial step, it is critically important for new CFOs to assess the company’s financial health in three areas:

- Cash Flow. Ensure that there are no liquidity issues that the company needs to urgently resolve.

- Accounting Practices. Work with the lead partner at the company’s auditing firm to confirm that there are no regulatory issues or accounting practices that require immediate attention.

- Audit Issues. Collaborate with the company’s audit committee to review practices related to auditing, internal controls, and cybersecurity in order to identify pressing issues.

New CFOs should address any identified issues upfront, so that they do not dominate the agenda at the expense of other priorities.

It is also essential to meet the key stakeholders. CFOs should set up one-on-one meetings with all direct reports within the first two weeks and all peers and key external stakeholders (such as investors and the lead partner at the company’s auditing and tax firms) within the first four weeks. The objective is to identify and understand each stakeholder’s most pressing concerns, as well as what they want—or do not want—to change in the organization.

New CFOs can benefit from having a mentor to help them transition into their role.

Additionally, new CFOs can benefit from having a mentor to help them transition into their role. The ideal mentor is external to the company but knowledgeable about the company or its industry. He or she should be people oriented and have a wealth of experience that the new CFO can tap into. “I wish I had had a mentor that was external to the company that I could call upon,” noted the CFO of a midsize food company. “It was lonely at the top, and much of what I was doing was new to me.”

Pursue the 90-Day Plan

An effective 90-day plan begins with getting to know the finance function and establishing a vision that provides a North Star to guide the improvement efforts. It culminates in developing a roadmap for realizing the vision.

Assess the Finance Function’s Current Performance

New CFOs need to develop an objective picture of the finance function’s organization and its strengths and weaknesses. This helps CFOs to set their agenda for the remainder of their first year and prioritize areas where finance can demonstrate additional value and credibility.

Incoming CFOs should aim to understand, as well as shape, how the finance function is perceived in the broader organization. Key issues include:

- The level of interaction and partnering between each business unit and finance

- The value delivered by the finance function

- Whether business leaders consult with finance leaders before making decisions or inform them about decisions after they are made

- Whether the organization views finance as inefficient and bureaucratic

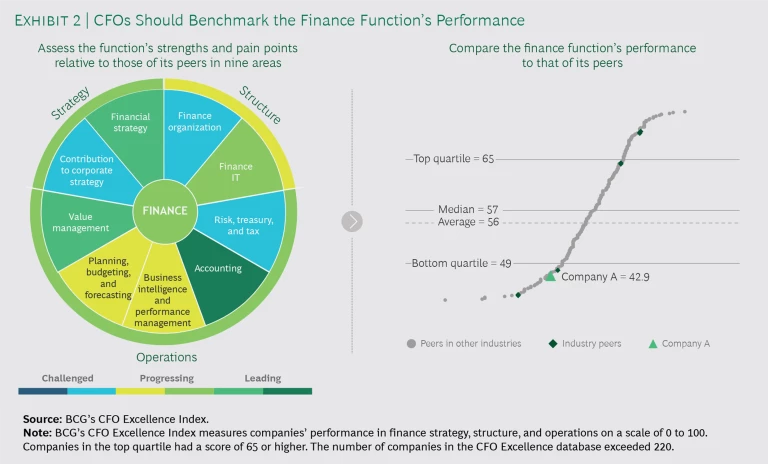

CFOs should measure the finance function’s performance against that of its peers. (We define peers as finance functions in companies of a similar size and complexity.) For example, BCG’s CFO Excellence Index assesses a finance function’s performance relative to that of its peers in its own industry and in others across nine areas. (See Exhibit 2.) This assessment helps to identify the challenges and sources of competitive advantage. By highlighting gaps between the finance function’s current performance and that of its peers, some of which may rank in the top quartile, the analysis reveals potential improvement opportunities.

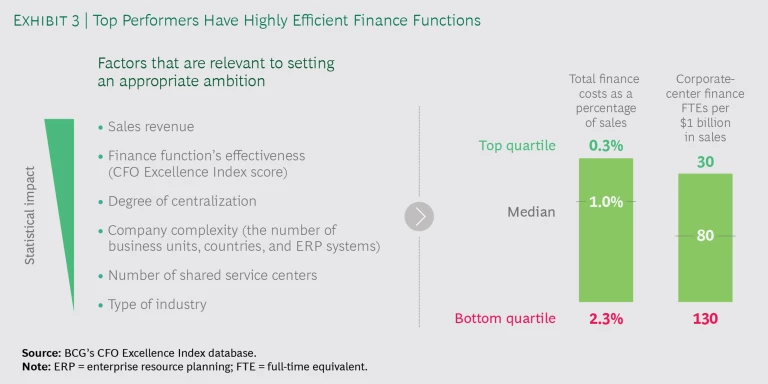

CFOs should also compare the finance function with its peers on the basis of head count and costs. This benchmarking can reveal departments or areas that are currently lagging in cost-effectiveness. Analyzing the database for BCG’s CFO Excellence Index, we find that best-in-class finance functions ’ total costs are consistently in the range of 0.3% to 1.0% of sales. (See Exhibit 3.)

A critical element in assessing the finance function is to obtain a holistic view of its talent, capabilities, and skills. Poor performance in any area could arise from a lack of expertise.

New CFOs also need to spend significant time interacting with people at all levels of the finance function. This will help to build an informed perspective on how people work, their top-of-mind concerns, and their career trajectories and aspirations. It is equally important to understand whom the rank and file regard as the top leaders within the function—the people they go to in tough situations and whose advice they respect and act upon.

While assessing the finance function, CFOs should also be thinking about a vision for the future. This vision can begin to take shape by answering questions such as the following:

- Which hot spots of innovation are most critical, and where should change be actively pursued?

- Which people have the new ideas? Which ideas are acted upon and which fall by the wayside, and why?

- Which teams are at the forefront of business partnering?

- Which processes and activities have been digitized, and where is more technology needed?

- Which people are key to the future of the organization, and who should be part of the finance leadership team?

Define the CFO’s Vision

To succeed in the first year and beyond, new CFOs must have a clear view of the objectives that they wish to achieve and the kind of finance function that they intend to build under their leadership. Developing a vision helps new CFOs think through the role that they want their finance function to have in the organization. The vision should encompass the main roles that CFOs should assume to create value. (See “How CFOs Create Value.”)

How CFOs Create Value

Co-creator of Strategy. The CFO, along with other C-level executives, helps create the company’s overall strategy and drive the achievement of strategic objectives across the entire organization. CFOs create value through their capabilities for assessing the risk and reward of potential objectives and conducting financial due diligence. The CFO’s role in strategy creation is in some ways similar to the role of an activist investor who applies an analyst’s perspective to assess a company’s strategy and performance.

The CFO should also have a role in the creation of the company’s digital strategy. Technology enables the integration of finance into the day-to-day operations and enhances insight and transparency across the organization. The CFO, as the steward of financial data, must consider how best to leverage technology tools, dashboards, and other digital accelerators to improve business partnering and value delivery.

Effective Business Partner. CFOs need to enable the business to achieve its goals, while pushing the business to achieve higher levels of performance and growth. In successful companies, the CFO and business leaders share joint responsibility for ensuring alignment with strategic priorities, enforcing compliance with standards, driving cost efficiency, and enhancing business productivity.

Trusted Finance Custodian. CFOs have a mandate for delivering value and growing the bottom line, often expressed through metrics such as total shareholder return or total societal impact. As stewards of the finance organization, CFOs lead the development of the company’s equity story and investor strategy. And under the CFO’s leadership, the finance function is responsible for managing financial resources and adding value through expertise.

Risk management is another critical aspect of custodianship. This includes identifying risk factors and monitoring risk exposure across the organization. CFOs also need to take an active role in addressing macroeconomic uncertainty—developing responses to adverse market scenarios and designing business continuity plans.

Best-in-Class Finance Operator. CFOs must ensure that the finance function collaborates internally to fulfill its responsibilities to the rest of the organization. This includes building an organization structure that balances flexibility and accountability, ensuring clear roles and responsibilities, streamlining processes to reduce the number of activities that don’t add value, and establishing the right skills and talent to achieve the vision for finance.

A vision should be not only aspirational but also achievable over a clear time frame. It determines the ambition for the value that the CFO wants to promote when the company is creating its strategy as well as subsequently, across business and finance operations. It also helps to establish the finance function’s ways of working, the level of delegation, the collaboration models, and the career paths for finance talent. And it should reflect the CFO’s aspiration for what kind of leader he or she wants to be.

Additionally, the vision should take into consideration the key enablers that the CFO intends to establish in order to ensure an effective and efficient finance function. These enablers could be digital tools, agile teams, gold-standard performance measures for specific roles, or a flatter organization structure.

As new technology and the millennial workforce reshape the workplace, companies are adopting agile norms of working, communication, and digital collaboration. When defining the vision for the finance function’s people and culture, new CFOs should adapt their plans according to these evolving norms to ensure that the vision is fit for the future.

Ultimately, the vision should be framed and communicated in a manner that inspires and unites the finance function in order to achieve the strategic priorities. A shared vision promotes a culture of business partnering and value delivery within the finance function, as well as greater collaboration and the use of a common language among a fragmented group of departments. It motivates people through a set of aspirational goals, while also providing finance employees with a view on the trajectory and potential of their own career paths. And it reinforces the value proposition of the finance function to the rest of the organization.

Define Priorities to Achieve the Overall Strategy

New CFOs need to decide on the top priorities for the finance function, focusing on initiatives that will create the most value for the organization. These priorities form the basis of the vision for the future finance function and will have long-term impact extending far beyond the first year.

As a first step toward defining priorities, a new CFO should work with other C-suite executives and the board of directors to agree on their expectations and the desired outcomes. Often, CFOs are brought on to achieve specific objectives—for example, to modernize the finance function or to introduce new ideas and ways of working. The expectations and desired outcomes should be key considerations in setting the agenda for the finance function.

The company’s current business performance also plays a large role in determining the CFO’s priorities. If the company is undertaking a turnaround or restructuring effort, the CFO should focus on investment management, sustainable cost reduction, and efficiency. If the company is in a stable but stagnating economic environment, the CFO must support the search for and pursuit of new growth opportunities. In a business experiencing high growth in a competitive industry, the CFO must arrange for new financing, optimize the capital structure, manage investor relations, and enter into partnerships with lenders.

Lay the Foundation for C-Suite and Board Relationships

During the first 90 days, building good relationships is worth more than delivering value. CFOs need buy-in from other C-suite leaders and the board of directors in order to run their function successfully.

Building good relationships is worth more than delivering value during the first 90 days.

New CFOs must quickly demonstrate that they understand the business and have an informed view of the industry’s trends. Once CFOs establish credibility, they should work with the CEO and the board to align on the company’s overall strategy and codevelop a plan to tackle the objectives.

This initial collaboration is a pivotal moment for new CFOs and often sets the tone for future collaborations. New CFOs must show what they can bring to the table—their unique value proposition that makes them invaluable to the organization. A new CFO who is an external hire can bring a fresh perspective, suggest innovative solutions, and challenge the status quo. In contrast, a new CFO who has risen through the ranks can provide an on-the-ground perspective and reality check that help to refine and enhance strategic decision making.

Showcasing a willingness to work collaboratively to fulfill the organization’s purpose is crucial to building strong relationships. A commitment to driving value from day one establishes the new CFO as a collaborator and confidant in the organization’s strategic journey.

A great way for the new CFO to build credibility is to support the organization’s existing growth efforts. The CFO is well-positioned to add value in organization-wide transformation initiatives , because the finance function is spread across, and interacts with, the entire organization.

Craft a Compelling Story Line for Investors

As a strategic leader and a financial custodian, the CFO has a critical role in investor relations, which makes developing a strong understanding of the company’s investor profile and related expectations a priority in the first 90 days. New CFOs need to listen closely to investors to understand how they perceive the company, as well as to identify the key fundamentals driving performance. These insights will support efforts to communicate the company’s equity story, dividend strategy, and total societal impact to investors in an engaging and reassuring manner.

Financial stewardship also includes building relationships with banking partners and financial institutions. The objective is to optimize the capital structure and secure economical financing for growth investment, while maintaining or improving the organization’s credit ratings.

Develop a Roadmap to Realize the Vision

To advance from the current state to the vision of the future finance function, the new CFO needs to define a roadmap for the transformation. The roadmap should set out priorities for the first year of the transformation, as well as the subsequent two to four years. Collaborating with the finance leadership team to develop the roadmap will ensure buy-in and make implementing it a team sport.

Each initiative in the roadmap should be linked to a value target, and CFOs must continuously monitor the value delivery across the planned timeline. The roadmap must also include several initiatives that are quick wins to demonstrate value and positive impact in the first year. It is critical to choose the right finance talent to implement these initiatives.

To build a comprehensive roadmap, CFOs must consider potential roadblocks and develop plans to address them. For example, if the current finance organization is too fragmented to effectively collaborate to achieve the vision, it may be necessary to first clarify reporting lines and responsibilities before kick-starting initiatives. If an outdated IT architecture is hindering the function’s operations, CFOs may need to evaluate an investment in new digital tools.

New CFOs must recognize that it’s the people who will make the vision a reality.

New CFOs must also recognize that it’s the people who will make this vision a reality. People at all levels of the finance organization need to feel like they are co-owners of the vision in order to be strongly motivated to execute the roadmap. This makes it essential to align career paths and incentive targets with the roadmap’s milestones. As with any strategy, constant communication and frequent repetition of messages are essential to change people’s minds and hearts.

With a roadmap in place, the focus for the rest of the first year turns to delivering value. Transitioning from planning to execution requires setting a clear agenda, which we will explore in the next article in this series.

The new CFO is an agent of change who questions the status quo and brings in new ideas. However, translating these ideas into tangible results requires extensive planning and prioritization. “Balancing the priorities is probably the most important thing we do in helping the company create value,” said the CFO of a midsize consumer company. “The key here is to maintain an open mind and actively listen to all sides and then to ultimately weigh the decisions through the lens of long-term value creation.” During the first 90 days, new CFOs have an opportunity to lay the foundation for this critical role.