Contrary to what skeptics believe, it’s not necessary to go all in when applying agile methods. A selective approach can promote efficiency and effectiveness.

CFOs should overcome their skepticism about applying agile methods in the finance function . Agile can be a game changer by boosting the efficiency and effectiveness of the function’s everyday activities, as well as by accelerating a transformation toward finance excellence.

The frontrunners in deploying agile in finance have seen substantial improvements, allowing them to shift capacity to value-adding activities. The benefits in flexibility, speed, stability, and knowledge sharing help finance personnel become trusted advisors to the business.

Contrary to what many skeptics believe, it isn’t necessary to go all in when applying agile in finance. The key to success is identifying which areas will benefit the most from agility. Finance functions can start by applying agile in those areas and then scale and accelerate deployment later.

The Basics of Agile

Agile was born in the software industry. Its defining characteristic—small, empowered cross-functional teams—has successfully migrated to companies in a variety of industries and functional areas . The agile approach combines aspects of culture, ways of working, and organizational setup to empower those who are closest to customers and to vital information. When implemented well, agile accelerates processes and decision making, boosts innovation, and shortens time to market.

In agile operating models, the organization is made up of squads, tribes, chapters, and guilds . The primary unit is the squad, a small team that possesses fit-for-purpose expertise across disciplines and functions. This diversity of expertise allows squads to be autonomous and to own their deliverables from end to end with few outside dependencies. Teams work iteratively, rather than according to a sequential, “waterfall” model. To achieve their specific mission, they develop a minimum viable product, engage with stakeholders to collect feedback, and incorporate the feedback in the next iteration with the goal of maximizing value.

Because agile teams comprise all the people required to develop a solution, they can be empowered to make decisions within the scope of their work and the guardrails set by the activity’s sponsors. This empowerment reduces the need for multiple layers of middle management. However, senior management must trust the teams to achieve their goals. To earn that trust, people need to work collaboratively, autonomously, and without complexity.

To staff agile teams, companies must allow talent to flow to where it is needed. Employees are no longer necessarily tied to a specific team and specific manager, but rather become part of various efforts depending on what the work at hand requires. This allows an organization to greatly improve how it allocates resources to achieve short- and medium-term priorities and to elevate its responsiveness to shifting priorities.

Agile Boosts Finance Transformations

Today, many finance functions do master the basics, such as supporting the business with the right reports, managing the planning cycle, or closing the books on time. But beyond those table stakes, they have a clear need to increase the value they offer to the organization. For example, finance functions often struggle to apply digital technologies in their core processes or to react fast enough to help the business adapt to new conditions, such as a changing competitive landscape.

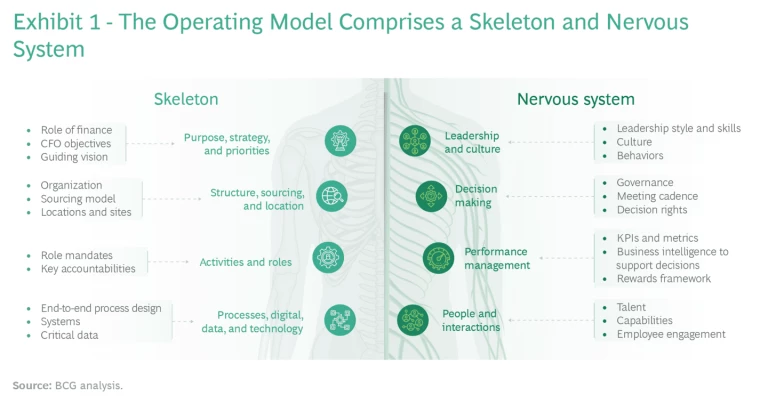

Recognizing these challenges, many finance functions have embarked on a journey to transform themselves. A typical finance transformation covers all areas of the operating model, encompassing its “skeleton” and its “nervous system.” (See Exhibit 1.) Agile has the potential to generate impact in each of these areas.

In many industries, however, finance functions have been slow to adopt agile methods. Even when the rest of the company pursues an agile transformation, finance teams tend to stick with traditional setups and working methods and only make urgently needed changes (such as adjusting budgets more frequently in response to fast-changing business needs). To justify their adherence to traditional ways of working, leaders often point to the complexity of finance processes or the need to meet legal or risk requirements.

Being Agile and Applying Agile

In our view, there are no limits to the ability of finance functions to apply the core concepts of agility and thereby capture the full benefits of an agile transformation. This is true even if the rest of the organization has not adopted agile, although the overall benefits are greater when a company employs these methods across the organization. Indeed, finance can take a leading role in the transformation, establishing the necessary backbone that will help the rest of the organization adopt agile.

When infusing agility into a finance function, a company should distinguish between being agile and applying agile:

- Being agile means adhering to the principles that guide an agile operating model. This includes how the organization empowers teams and individuals, ensures customer centricity, and instills innovation and creativity. Adopting these guiding principles is a prerequisite to infusing agility into a finance function and becoming a networked organization.

- Applying agile relates to how teams and individuals work. This includes how teams form and operate as well as how the finance function prioritizes work and enables talent to flow to the right needs. Each finance function, or department within the function, may take its own approach to applying agile while adhering to its overarching principles.

Infusing agility effectively—being agile as well as applying agile—requires changing the finance function’s nervous system and its skeleton.

Adapting the nervous system is crucial but often overlooked. As with any function, the key to transforming how finance operates is to change the way people think and lead—in other words, they must start being agile. For example, leaders must fundamentally change their behaviors. They need to shift away from day-to-day supervision and focus instead on coaching and enabling team members to solve problems collaboratively and work toward the most relevant outcomes. If leaders do not adjust, there’s a high risk that traditional reporting lines or hierarchies will impede the pace of innovation or stifle efforts to solve problems creatively.

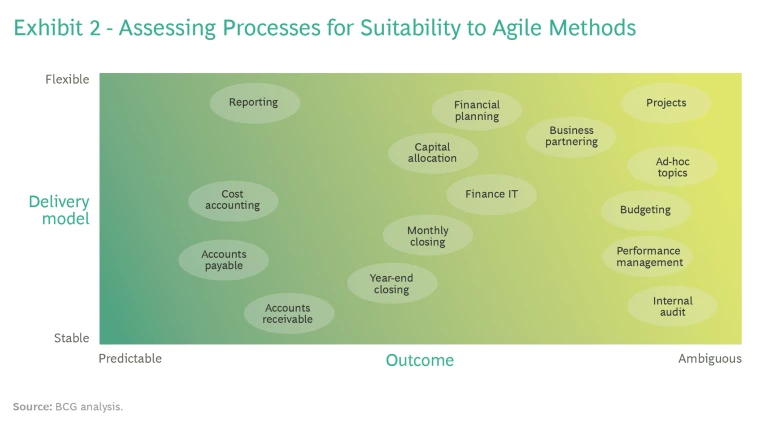

Finance teams are typically reluctant to adapt all at once because they view their processes or setup—the skeleton—as too complex to accommodate rapid change. One approach to starting the journey incrementally is to discuss agile’s potential in specific processes. By viewing processes along two dimensions—the delivery model (that is, how teams work) and the outcome—teams can focus first on those that are most amenable to agile. Processes with the most flexible delivery models and ambiguous outcomes, such as those related to completing projects or addressing ad-hoc topics, are often the best to start with. Later, finance teams can turn their attention to processes with stable delivery models and predictable outcomes. (See Exhibit 2.)

As an alternative to considering processes, we have seen finance teams initially focus on the outcomes they want to achieve—such as the use of finance insights to improve daily business decisions. Applying agile in this way has helped them take bolder steps to reach their goals earlier and faster.

To launch agile successfully, finance teams must rethink their organizational setup. Teams that take a process-based approach tend to overlay a cross-functional setup on the existing hierarchy, while those that take bolder approaches tend to introduce the full spectrum of agile teams (squads, tribes, chapters, and guilds).

Agile Finance in Action

The examples below illustrate how finance functions are infusing agility into their processes and setups.

Planning and Budgeting. At a global health care company, the finance function sought to adapt its medium-term planning and budgeting process to respond faster and more flexibly to rapidly changing circumstances and priorities. It introduced an event-based approach that combined agile methods and value driver logic.

Agile can be a game changer by boosting the efficiency and effectiveness of the finance function’s everyday activities.

Events such as the outcome of a clinical trial sometimes require the company to reassess its short- or medium-term plans. When that happens, the finance function forms a cross-functional team whose sole purpose is to assess the event’s impact and discuss whether and how the company needs to update its plans. The value driver logic provides the basis for the team’s discussions by linking financial and operational KPIs to the company’s core KPIs. If an update is required, the company changes the relevant parameter (without waiting for the annual planning process) and reallocates funds.

To complement this approach, the function adapted its incentives and performance management system to be more directional and team-based rather than detailed and individualized. By transitioning from a traditional annual planning cycle to an event-based approach, the function can deploy capabilities and funds where needed, as well as address risks and opportunities proactively.

New-Product Approval. At a US financial services provider, the finance function’s risk department fundamentally reshaped its new-product approval process to facilitate the use of agile methods by product design teams.

Traditionally, the company performed product risk reviews annually at the end of the year. This hindered the ability of the agile design teams to quickly innovate and create real value, often leading to extensive rework as products neared launch.

In response, the risk department adopted a more flexible model in which the need for its support was assessed much earlier in the product development process. The company also included risk managers on its agile design teams. The new approach has helped to increase productivity and innovation while ensuring the continued robust management of risks.

Organizational Setup. A global semiconductor company exemplifies how finance functions can infuse agility into their setup to reduce complexity, eliminate siloed thinking, and streamline iterations across core processes. In this case, the function’s setup was dominated by manual work, which impeded its ability to keep up with the organization’s fast growth and share information across business domains. Job satisfaction suffered as a result.

It isn’t necessary to go all in when applying agile in finance; the key is identifying which areas will benefit the most from agility.

The new, agile setup enables a faster response to business needs by embedding finance more deeply into the business, thereby strengthening the function’s ability to serve as an advisor. The function leverages the power of data and analytics across disciplines to codrive the business and promote broad-based improvements in transactional services.

Other finance functions have infused agility into their setup by dedicating cross-functional end-to-end delivery teams to business units, especially for transactional processes (such as order to cash). These teams are empowered to focus on both execution and improvement. Their responsibilities include defining clear performance KPIs and ambitions for execution and tracking them regularly (in daily standups, for example). Additionally, they devote a share of their efforts to developing and implementing their own ideas for process improvements, promoting continuous improvement in the end-to-end process.

Harvesting the Value

Having an agile finance function leads to significant benefits. In BCG’s CFO Excellence Index database, the finance functions that rank among the top 25% in terms of agility are approximately 20% more efficient and approximately 20% more effective than other finance functions. Those that have taken bolder approaches have increased efficiency by more than 30%. Additionally, finance functions in the top quartile have approximately 10% fewer finance FTEs while their costs are approximately 10% lower. They expend approximately 10% less manual effort to compile data for reports, allowing them to devote more time to analyzing data and applying the insights in value-adding activities.

And those numbers don’t tell the whole story. A company can also capture significant qualitative benefits in a variety of areas:

- Flexibility. The fluidity of resources allows teams to devote time to activities where they can add the most value at any given time.

- Transparency and Speed. Agile “ceremonies” (such as standups or sharing sessions) enable finance teams to raise issues and be honest about progress. Colleagues can rapidly see initial results and recommend course corrections as needed.

- Expertise. By exchanging knowledge and improving collaboration with colleagues in the business units and other functions, finance specialists can enhance their expertise and know-how.

- Impact. Empowering decisions at the appropriate level and focusing on output rather than process allow agile teams to have significant impact.

- Talent Attraction and Retention. Companies that apply new ways working are more attractive to high-caliber job candidates and more likely to retain their most talented workers.

CFOs that infuse agility into their finance function transform its ability to serve the business. BCG’s benchmarking demonstrates that the value is tangible and verifiable. By capturing the benefits, finance functions can focus on tasks that really matter, increase the value that they add to the business units, and create new opportunities for their employees. Ultimately, an agile function is more productive and adaptable and thus more capable of helping the business thrive in a fast-changing environment.