The acceptance and financial upside of artificial intelligence (AI) continue to lag far behind the hype, except in one surprising and often-overlooked area: pricing.

The speed, sophistication, and scale of AI-based tools can boost EBITDA by 2 to 5 percentage points when B2B and B2C companies use them to improve aspects of pricing that have the greatest leverage within their organizations.

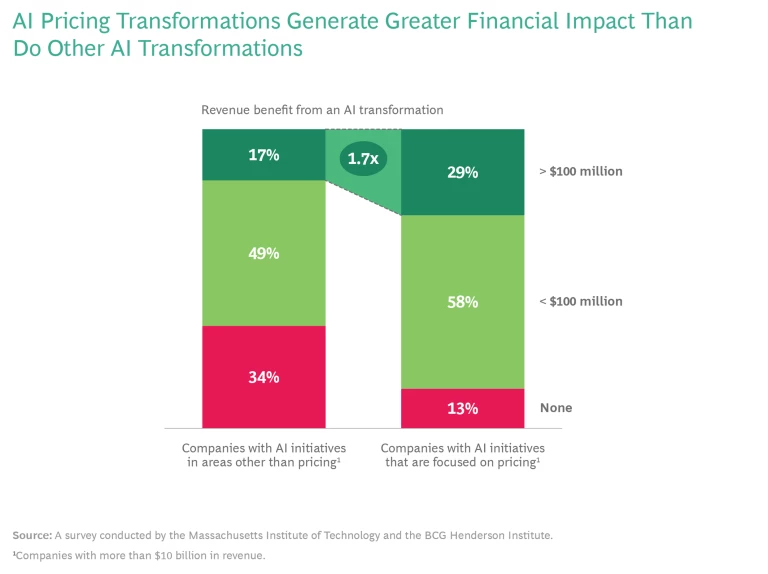

A large-scale global survey, conducted by the Massachusetts Institute of Technology (MIT) and the BCG Henderson Institute (BHI), revealed how successful AI-driven pricing transformations can be and also how infrequently they are pursued. In the technology sector, for example, only 12% of the companies surveyed used AI to improve their pricing, but their initiatives succeeded twice as often as the efforts of companies that applied AI to other functional areas. (See “About the Survey.”)

About the Survey

Why Pricing Is an Excellent Target

Success in boosting the top and bottom lines isn’t the only reason that companies should focus their AI initiatives on pricing rather than on other functions or processes.

Pricing already relies on processes and tools. An AI transformation can vastly improve a company’s existing data flows and processes, and those related to pricing are ideal starting points because they are usually well established but often lack sophistication. A pricing maturity assessment, conducted by BCG and the Professional Pricing Society, revealed that more than 50% of all industrial goods companies still use Microsoft Excel to build their primary pricing tools, and 25% of B2B companies use static, one-size-fits-all pricing with limited inputs and infrequent updates. These companies are ripe for the kind of step change that AI can provide.

Large companies often have a patchwork of pricing processes, and AI can enable them to raise and then scale their level of sophistication. The MIT-BHI survey showed that large companies (those with more than $10 billion in annual revenues) that undertook AI-driven pricing transformations achieved more than $100 million of revenue improvement 70% more often than companies that focused on another area. (See the exhibit.) Their struggle rate was also much lower. Only 13% that pursued AI-driven pricing initiatives failed to see any benefit, compared with 34% of companies whose AI initiatives did not address pricing.

Companies can win many pricing battles with AI. Across industries, companies can tackle pricing’s complexity using advanced analytical approaches that take advantage of AI. Consumer packaged goods (CPG) companies, for example, can use insights from AI-based analytics to rethink pricing for their overall brand portfolio, refine their pack-price architectures , and improve their mix management by doubling down on products and channels that have higher margins. CPG companies can also use AI-based tools to improve the efficiency of their promotions and tighten their trade terms. B2B companies can employ AI-based analytics to mine rich transaction data to find quick wins in terms of incremental price differentiation and improved discounting. They can also use AI-based tools to determine price metrics, set price levels, and manage price implementation. Companies should identify the battles with the clearest and fastest upside relative to the investment—and begin their AI pricing transformation with those.

The bionic approach often quickly allays employees’ fears that AI will eliminate their jobs.

A pricing transformation is easier for employees to accept. Some members of the pricing team may fear that AI applications will eliminate their jobs. However, such concerns are often quickly allayed, because AI initiatives equip pricing teams with more powerful, user-friendly tools that require their subject matter expertise and business judgment to deliver optimal performance. This human-machine or bionic approach not only addresses team members’ fears but also shows how such initiatives can accelerate or improve what they do, even when these initiatives create new areas such as demand centers or a yield management function. The bionic approach also frees up their time to take on more value-added tasks and to address the more far-reaching challenges that often get crowded out by acute short-term priorities. As a result, AI pricing transformations tend to cause less organizational disruption, even though they involve marketing, sales, finance, and revenue growth management (RGM).

A CPG Company’s AI Pricing Transformation

At the explicit urging of its CEO, a large CPG company assessed various areas of its organization to determine which AI initiatives offered the best opportunities for securing quick returns, advancing tools and processes, winning battles, and gaining team acceptance and confidence. The company determined that pricing offered the best opportunities, and then it narrowed the scope to promotions—their performance, timing, and range. But even that scope was too broad because of the differences across regional, national, and local markets.

The company finally chose to focus on promotions in established channels in two large markets. The plan was to start small, build a minimum viable solution, prove the value, and commence with change management. Only then would the company scale the initiative to more markets and teams.

This intense, very specific focus helped the company build concrete solutions that delivered value in two ways: first, by providing faster, fact-based answers on how to improve existing promotions, and second, by testing and implementing ideas that the company had either lacked faith in or never considered. The company estimates that after scaling up the initiative, the full impact will yield 2 percentage points of EBIT improvement.

From the beginning, the change management effort focused on demonstrating that AI pricing is a bionic approach and that the advanced analytics would still require the team’s skills and experience, applied to different tasks. This was critical, because some team members feared that AI would diminish their roles or make them redundant. Early successes, however, proved to be the biggest motivators for the team to sustain its progress.

Three Key Steps to Success

The success of AI pricing transformations generally hinges on the quality of three factors: data, vision, and change management support. We built on this insight to create three recommendations for companies that want to take advantage of the significant upside potential of AI-based pricing.

Focus on data early, and sustain the effort. Conducting an upfront data assessment will help the company select the right focus area within pricing as well as the right region or market in which to pilot a program. A niche market, for example, may have rich accessible data and a large potential return but limited opportunities to scale. An established market may have solid data and less potential upside locally but offer opportunities to scale a solution quickly.

Perfect data does not exist, so there is no need to wait for it or make it an excuse to delay an initiative.

Once the initial AI pricing solution is built and launched, the company’s focus should shift to gradually improving both the quality and availability of data in order to unlock the full potential of the solution. Perfect data does not exist, so there is no need to wait for it or make it an excuse to delay an initiative.

Have a clear target vision, but also invest in less advanced solutions. The AI vision for a pricing transformation will represent a step change for most companies. Although many companies still manage to get by with Microsoft Excel-based solutions and basic pricing strategies, competitive pressures and customer demands will eventually force a move to the faster, more dynamic, and more scalable tools and techniques that AI enables. Companies need to develop their aspirational AI vision early on. Those that have limited data availability or a lower level of pricing maturity in some markets should start their journey with a less advanced approach in those areas. But at the same time, companies should develop a longer-term vision to work toward, or they risk AI being viewed solely as an incremental change.

Emphasize the change effort. The development and implementation of AI pricing initiatives will demand cooperation from day one between the pricing team and the sales force. They will also require an investment in capabilities to build up advanced analytics teams. The initiatives may also shift the balance of power with respect to pricing decisions, because pricing has no natural owner in most companies. Responsibility may rest with finance, marketing, or sales, or an emerging area such as RGM. The explicit support of C-level executives will make it easier for teams to cooperate and develop a comfort level with new tools.

Increasingly, companies are seizing the opportunity to apply AI to pricing and launch a transformation. They recognize that the improvements are not only financial but also strategic. Companies can free up resources to focus on longer-term issues rather than short-term tactical firefighting, and they can build on this success to launch other AI initiatives.

The authors would like to thank Sara Benjelloun for her contributions to this article.