For decades, export manufacturing has played a critical role in powering remarkable socioeconomic development across Southeast Asia. Yet while several other Asian manufacturing economies have evolved into global leaders in advanced industries and innovation, most of Southeast Asia is still viewed primarily as a location for low-wage assembly work.

The ten-nation Association of Southeast Asian Nations (ASEAN) now has a golden opportunity to move up the manufacturing value chain. A confluence of major trends is prompting companies across the world to rethink where and how they make and source their goods. As companies seek to make their supply chains more resilient against disruption, those in sectors ranging from medical technology to consumer electronics are looking to diversify their manufacturing footprints away from single sources and to produce goods closer to end markets—a focus that has intensified during the COVID-19 crisis. Next-generation Industry 4.0 technologies and mounting pressures on companies to lower their greenhouse gas emissions, meanwhile, are creating new opportunities by changing the game.

If manufacturers act boldly and imaginatively now, they will be well positioned to capitalize on these shifts. The region offers one of the world’s largest, fastest-growing markets and has an extensive manufacturing base that spans light, heavy, and high-tech industries.

What’s more, a new trade pact—the Regional Comprehensive Economic Partnership (RCEP)—is expected to significantly accelerate the flow of finished goods, inputs, and investment between Southeast Asia and trade partners such as China, Japan, South Korea, and Australia. This will create greater access to Asia’s biggest and most developed markets, lower the costs of importing manufacturing inputs, and make it easier for companies to build supply chains that leverage different advantages and skills across the region.

If ASEAN can take full advantage of these trends, we estimate that by 2030 the region can generate up to $600 billion a year in additional manufacturing output, increase annual foreign-direct investment in manufacturing by up to $22 billion, and create up to 140,000 new jobs a

A Strong Manufacturing Foundation

ASEAN already has a range of well-established manufacturing clusters. These include electronics in Malaysia and Vietnam, automobiles and packaged foods in Thailand, machinery and petrochemicals in Indonesia, packaged foods and apparel in the Philippines, and semiconductors, biopharmaceuticals, and aerospace components in Singapore. The emerging economies of Southeast Asia have long been destinations for manufacturers seeking abundant low-cost labor, while Singapore has served as a hub for high-value R&D-intensive industries and trade-supporting services such as finance and logistics.

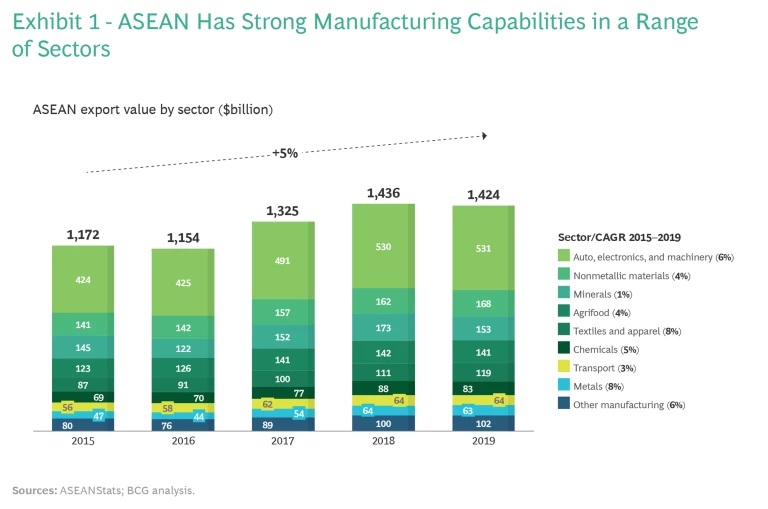

From 2015 through 2019, manufacturing exports from ASEAN’s ten member states averaged 5% annual growth—outpacing the global average of

Foreign-direct investment (FDI) has been a key driver of manufacturing growth in the region, accounting for 8% of gross capital formation in the Philippines and 23% in Vietnam in 2019, for example. The US, EU, and Japan have traditionally been the biggest sources of FDI. But investment from Asian economies has risen sharply since 2015 as manufacturers have sought new low-cost sites and looked to more deeply penetrate ASEAN markets. Chinese consumer appliance giant TCL, for example, recently built a TV plant in Vietnam to serve both ASEAN and global markets. South Korea’s largest business groups have invested in a range of industries in Vietnam.

Investment from Asian economies has risen sharply since 2015 as manufacturers have sought new low-cost sites and looked to more deeply penetrate ASEAN markets.

Domestic investment has also become an increasingly important driver. While FDI dropped in Indonesia in 2015 through 2019 compared with the previous five-year period, for example, domestic capital formation expanded by 14% over that period. Indonesia’s Salim Group invested $956 million to expand domestic manufacturing capacity for vegetable oil, margarine, and other food products. The Vietnamese conglomerate Vingroup has poured $3.5 billion into its automotive subsidiary Vinfast, starting with a factory in Haiphong capable of producing 250,000 cars annually.

The Tailwinds Favoring ASEAN Manufacturing

The convergence of a number of global trends is creating opportunities for ASEAN’s manufacturing sector to leap to the next level. These tailwinds include the following:

- A Growing and Dynamic Domestic Market. The ASEAN region represents one of the world’s most important growth markets. The region has a combined population of 660 million people—more than two-thirds of them of working age—and a GDP of $3 trillion. As it recovers from the COVID-19 crisis, the combined regional economy is forecast to average 5% annual growth for the next decade. In addition, BCG projects that the number of middle-income and affluent households in economies such as Vietnam, Indonesia, and the Philippines will grow by around 5% annually through 2030. That makes ASEAN an attractive market for goods such as consumer electronics, packaged foods, automobiles, and medical technology.

- An Increasing Shift Toward Regional Supply Chains. Rising economic nationalism and persistent trade frictions between the US and China have been leading companies to reassess their global manufacturing and sourcing footprints. As a result, some companies are exploring alternative production sites or are adopting what is known as a China Plus One strategy. This means they are maintaining a strong manufacturing presence in China—which remains a crucial, fast-growing market—while looking for additional manufacturing locations. COVID-19 added further impetus to this trend by prompting companies to pay greater attention to the resilience of their supply chains and the risks of concentrating too much production in too few countries. A 2021 Gartner survey found that 87% of supply chain professionals plan to make investments that will improve resiliency; 84% of Japanese companies with domestic manufacturing operations are planning to diversify their supply chains, according to a Nikkei survey.

Southeast Asia is a prime candidate for new factory locations because it offers a blend of low costs, specialty skills, and relatively free access to Western and Asian markets. In terms of productivity-adjusted wage rates, ASEAN economies such as Indonesia, Malaysia, the Philippines, and Thailand rank among the most cost competitive in the world. Ecosystems are also emerging to support industries beyond those seeking labor arbitrage. Among the reasons Samsung cited for selecting Vietnam as a new regional manufacturing hub, for example, were the quality of its young and educated workforce, widespread internet access, a domestic venture capital ecosystem, and government incentives and support.

- Technological Trends Enabling Multi-Local Supply Chains. Industry 4.0 technologies and systems—such as advanced robotics, 3D printing, augmented reality, and real-time digital factory simulation—not only will enable manufacturers to significantly improve speed and productivity but will also enable companies to reimagine their current approaches to global manufacturing and sourcing. Rather than having a few massive factories in a handful of locations, for example, it will become increasingly economical to fabricate more-customized batches of products in smaller, more flexible facilities that are located near end consumers. While few factories owned by MNCs or Southeast Asian companies are currently at the Industry 4.0 forefront, they could capture big new opportunities to become globally competitive by moving early to embrace next-generation digital technologies.

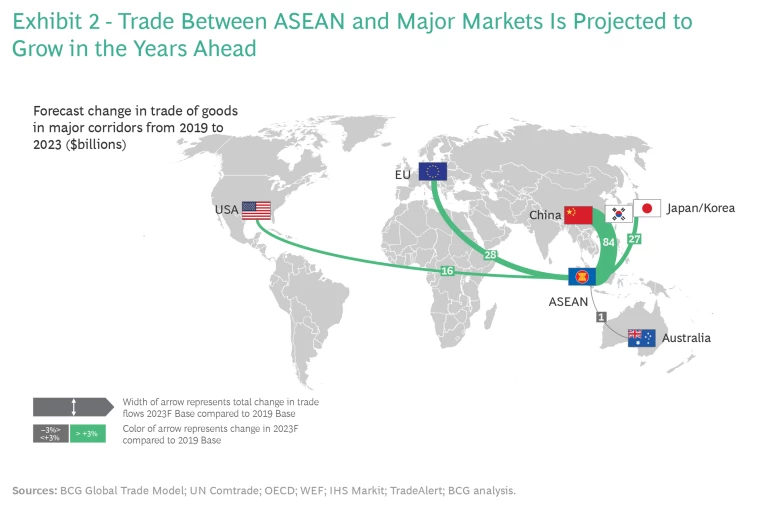

- The Creation of the RCEP Trade Area. Since 1992, when ASEAN’s six original members agreed to form a regional trade bloc, governments have made significant progress in reducing barriers to flows of goods and capital within the region. That has enabled manufacturers in sectors such as automobiles, food products, and electronics to establish regional footprints. The RCEP, signed on November 15, 2020, by all ASEAN members as well as by Australia, China, Japan, New Zealand, and South Korea, will strengthen the region’s competitiveness as a manufacturing base and in global trade. BCG estimates that trade between ASEAN economies and many of the world’s biggest markets is likely to experience strong growth as the global economy recovers from the COVID pandemic. (See Exhibit 2.)

The deepening integration of Southeast Asian economies will create opportunities for companies to develop multinational value chains that benefit from each location’s competitive strengths.

RCEP member countries, which have a combined population of 2.2 billion and account for around 30% of global GDP, committed to providing duty-free access to goods that represent 92% of tariff lines. They also pledged to harmonize many rules and regulations that affect e-commerce and trade. If implemented, these measures will make it easier and less costly for Southeast Asian manufacturers to source materials, components, and machinery from the rest of Asia and to export to these markets. Higher intellectual property standards and protection, meanwhile, will create more certainty for companies in high-tech sectors. The deepening integration of the region’s economies will create opportunities for companies to develop multinational value chains that benefit from each location’s competitive strengths. It will also enable companies to transport goods and materials seamlessly within the region.

How ASEAN Can Seize New Opportunities

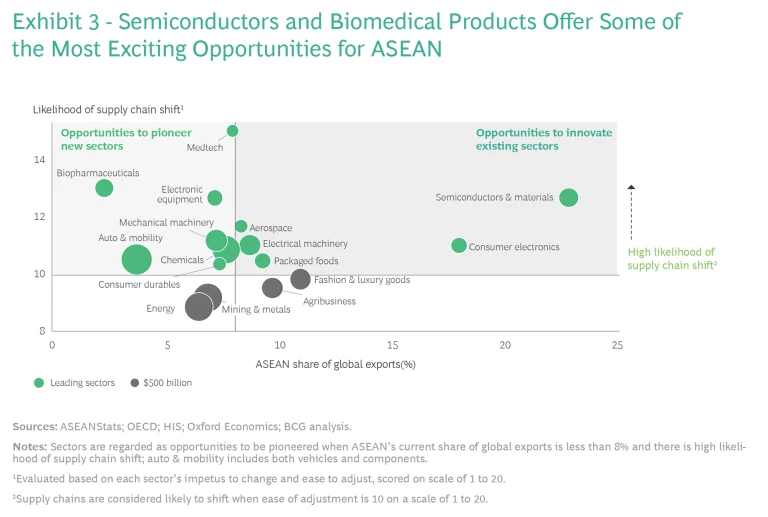

To identify which ASEAN industrial sectors are most likely to benefit from these megatrends, we assessed supply chains along two dimensions: the likelihood that supply chains will shift and the region’s current strength in each of those sectors.

To assess the likelihood that supply chains in a sector will shift, we considered changes in trade flows between ASEAN and the world’s biggest markets caused by factors such as rising protectionism and measures to reduce import dependency and supply chain risk. We also considered barriers to change, such as high capital costs or a lack of alternative sources of supply. As a benchmark of ASEAN’s current export strength in each sector, we used the region’s share of global exports.

This analysis highlighted several types of opportunities for ASEAN manufacturers. For well-established sectors in which supply chains are most likely to shift, manufacturers can leverage growing interest in the region to become more competitive by innovating their sourcing networks. For example, they can adopt new, high-value models of manufacturing to move up the value chain. In more nascent ASEAN manufacturing sectors that are likely to experience supply chain shifts, there will be opportunities to pioneer growth through the establishment of new clusters in the region. (See Exhibit 3.)

Opportunities for Innovating Existing Supply Chains

ASEAN is currently in a strong export position in sectors such as electronics, aerospace, semiconductors, and packaged foods. There is potential for expansion and for the region to move up the value chain in these sectors.

To do so, manufacturers should take advantage of ASEAN’s economic integration by adopting “twinning” models, pursuing higher value-added segments, and harnessing Industry 4.0 to boost productivity.

- Adopting Twinning Models. Twinning involves distributing segments of the value chain across more than one ASEAN country, enabling companies to leverage low costs as well as advanced manufacturing and logistical capabilities. Yokogawa, a precision manufacturer of instruments for industries ranging from chemicals to steel to aerospace, illustrates how companies can twin. On the Indonesian island of Batam, Yokogawa manufactures components and subassemblies. Parts are then shipped to Singapore, where Yokogawa has an innovation center and its regional logistics hub, for final assembly and testing. Semiconductor manufacturer Infineon uses a similar strategy. It assembles and packages more than 400 million semiconductor devices each year in Batam and ships them for testing to Singapore, where Infineon also has R&D and Industry 4.0 centers.

- Pursuing Value-Added Segments. MNCs can also use ASEAN as a manufacturing base for more technologically advanced, higher-value products. Several food product manufacturers are already doing this as they seek to meet growing demand for healthier, more sustainable offerings. Omnipork, a plant-based protein startup, does value-added processing—such as adding flavors and mixing ingredients for plant-based “meats”—in Thailand, for example. The US company Eat Just has announced that it will produce cell-cultured chicken bites in Singapore, which is promoting food innovation and is the first country to approve the sale of lab-developed meat.

- Harnessing Industry 4.0. The ASEAN manufacturing sector can also become more globally competitive and create opportunities to move up the value chain by aggressively harnessing Industry 4.0 systems. Singapore, Malaysia, and Vietnam are among the countries that have made advanced manufacturing systems a priority. They have published industry roadmaps and strategic plans and invested in areas such as smart factories, the industrial Internet of Things (IoT), advanced robotics, and cloud computing applications for manufacturing. Samsung has already installed 6,000 robots in its assembly lines in Bac Ninh, Vietnam, despite the nation’s low labor costs. In Singapore, the upcoming Hyundai Motor Group Innovation Center will incorporate technologies such as AI and industrial IoT into manufacturing processes for cars.

Opportunities for Pioneering New Sectors

ASEAN currently plays a relatively small global role in higher-value industries such as medical technology, biopharmaceuticals, and chemicals. But shifts in global supply chains arising from trade tensions and the COVID-19 pandemic are creating opportunities for ASEAN manufacturers to break into or greatly expand their market share in such sectors.

The ASEAN market for medical technology and biopharmaceutical products is growing by around 8% annually and is projected to reach a combined $53 billion in 2024. Abbott Laboratories already produces defibrillators and cardiovascular products in Penang, Malaysia, leveraging the area’s skilled labor and growing medical technology ecosystem. Still, Southeast Asia remains heavily dependent on imported medical technology and biopharmaceutical products. There is growing pressure, therefore, to create robust regional supply chains to avoid the kind of supply disruptions and shortages of such products as personal protective equipment and small-molecule active pharmaceutical ingredients, which were both in critically short supply during the pandemic. If an indigenous industry could be created within ASEAN, there is good reason to believe that manufacturers could export such things, given the region’s low costs.

Opportunities for ASEAN will also grow in the next-generation automotive and mobility space. The Asia-Pacific market outside of China, Japan, and South Korea for all kinds of electric vehicles (EVs) is projected to reach $64 billion by 2024, according to Allied Market Research. Nissan, Hyundai, General Motors, Ford, BMW, and other major OEMs with extensive production in the region are betting big on EVs. Chinese automakers pushing aggressively into EVs are also looking to expand in the region. Great Wall Motor, for example, began production in Rayong, Thailand, in 2020. ASEAN could leverage not only its huge domestic market but also its reserves of nickel—a key raw material—to become a low-cost production base for EV batteries. Hyundai, for example, began construction in 2020 of a $1.5 billion plant in West Java to build EVs and is reported to be working with LG Chemical on a lithium-ion battery plant in Indonesia. Hyundai is also building a $400 million mobility innovation center in Singapore.

The supply chains of some industrial sectors are less likely to undergo major shifts because by nature they are anchored to specific locations, as in the case of mining, agriculture, and oil and gas. But changes in the global economy are still creating attractive export growth opportunities. For example, rising support around the world for environmental sustainability—illustrated by the EU’s plans to implement a carbon border tax —will force companies selling everything from cars to chemical products to assess the greenhouse gas footprint of their entire value chain, rather than focus only on cost. This is a source of concern for companies in Southeast Asia: carbon dioxide emissions have risen rapidly in the region. Manufacturers that place a high priority on adopting green practices and improving efficiency could find new opportunities in global markets.

Even for sectors that are not as prone to supply chain shifts, there are significant opportunities to boost growth through digitization, manufacturing innovation, and the embrace of sustainability. Singapore-based agribusiness giant Olam International, for example, is developing Jiva, an innovative digital platform that transforms the agrifood supply chain by helping small farms access high-quality inputs and sell produce directly to end buyers.

Estimating the Economic Impact

If ASEAN manufacturers take full advantage of the tailwinds and new global supply chain models, the economic impact could be significant.

We estimate that ASEAN manufacturing output could grow by an additional $400 billion to $600 billion a year by 2030 from 2020 levels. More than half of that growth would be generated by increasing the region’s share of global exports, with the rest created by meeting a greater share of demand within the region for goods that currently are imported. Manufacturing FDI would rise by $14 billion to $22 billion a year by 2030, or a cumulative increase of $75 billion to $115 billion over the coming decade; around 90,000 to 140,000 jobs would be created annually, or a cumulative 400,000 to 700,000 over the

An Agenda for Enabling the Manufacturing Transition

To fully capture the opportunities presented by changing global supply chains, trade developments, and technological advancement, action will be required from MNCs, Southeast Asian companies, and the region’s governments.

MNCs should leverage ASEAN’s diverse landscape to take advantage of the unique supply chain advantages offered by different sites that, combined, offer competitive labor costs, educated talent, physical connectivity, and easy access to a growing market within and beyond the region. They should consider innovative supply chain models, such as twinning, to situate different links of the value chain across the best-suited locations in ASEAN. This will require a change in perspective from focusing on individual countries to viewing the region as an integrated network. MNCs should also consider local companies as suppliers that can build regional ecosystems and help mitigate exposure to future supply chain disruptions.

Southeast Asian companies currently focusing on their local markets should expand their horizons within and beyond the region. To do so, they should leverage technology and emerging digital ecosystems to upgrade processes, efficiency, and quality—and ensure that their products meet global standards. This will increase their competitiveness in a world where digitalization and sustainability are becoming key economic considerations. Southeast Asian companies should also seek to collaborate with MNCs and tap into global networks, particularly in sectors that large foreign companies dominate. There are a range of opportunities to partner with MNCs that are pursuing twinning or China Plus One strategies within the region. Southeast Asian companies should also explore partnerships with leading Chinese companies that are entering the regional market or seeking to diversify their production footprints.

Governments also have critical roles to play in vaulting ASEAN manufacturing to the next level. The most immediate priority should be to ratify the RCEP agreement to reduce regional trade barriers and ensure that flows of goods and capital are as frictionless as possible. Policymakers should also help create business-friendly conditions for up-and-coming sectors by harmonizing regulatory standards, reducing local content requirements and other non-tariff barriers, and facilitating infrastructure investments. This will be particularly valuable in developing a globally competitive manufacturing ecosystem in such highly regulated, technology-intensive industries as medical technology and electric vehicles.

The many forces that are redefining the economics of global manufacturing present Southeast Asia with a golden opportunity to move up the value chain in a range of sectors.

Governments should increase investments in workforce development, as doing so can speed deployment of Industry 4.0 and enable more people to enjoy the benefits of economic progress. Environmental sustainability must become a top priority so that ASEAN manufacturers can be at the forefront of the global trend toward greener supply chains. Governments could provide stronger incentives for investment in renewable energy, for example, and implement a regionwide carbon-trading system and emission-reduction targets similar to those of the EU and Japan. This would help provide a roadmap for meeting global standards.

The many forces that are redefining the economics of global manufacturing present Southeast Asia with a golden opportunity to move beyond low-cost labor arbitrage and up the value chain in a range of sectors. But this potential will only be realized if companies and governments reimagine their approach to manufacturing and move proactively on a number of fronts. And they must act now, while there is opportunity for ASEAN to leverage its competitive advantages and capitalize on the current winds of change.

The authors thank Holly Sze, Sue Xu, Yu Lin Ong, Joe Lee, Andrew Chua, and Ethan Choi for their contributions to this article.