This is the second of two publications by Boston Consulting Group and Siemens Healthineers that discuss the benefits and challenges of digitizing the finance function.

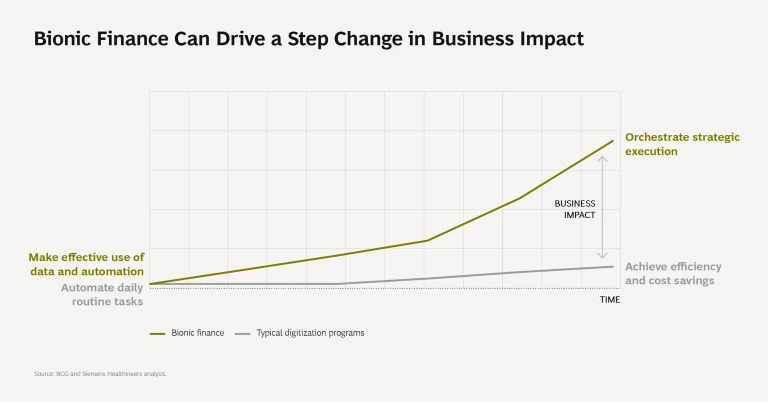

How a finance function approaches digitization makes a big difference. Automating routine finance tasks increases efficiency, but the business impact falls far short of the value that the finance function could potentially create. By skillfully combining data with automation, however, the finance function can become the orchestrator of strategic execution and unleash substantial business impact.

To achieve that goal requires transforming finance into bionic finance —using digital technology to augment human capabilities with the clear purpose of supporting the company’s strategic objectives. Transitioning to bionic finance is not simply a matter of implementing new IT tools. Fully integrating human and digital capabilities within the finance function requires reimagining the function’s role in the company, making fundamental changes, and managing many interdependencies.

Here, we discuss the challenges that companies must overcome to implement bionic finance. Applying the lessons of Siemens Healthineers’ successful implementation, we offer practical advice for clearing the hurdles.

A Multifaceted Approach

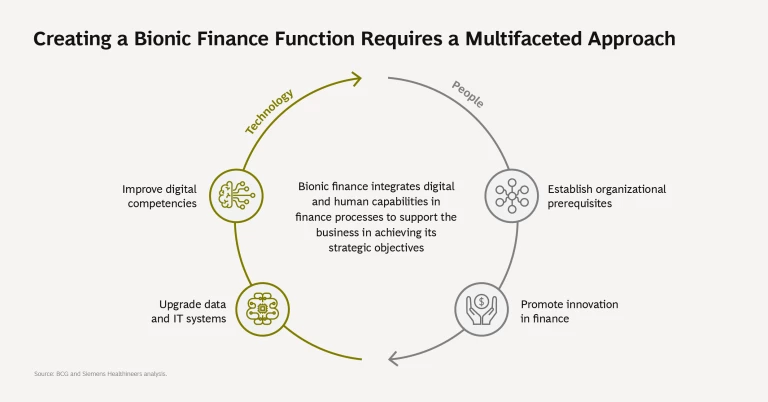

The basic building blocks of bionic finance include not only improving digital competencies and upgrading data and IT systems but also establishing organizational prerequisites and promoting innovation in finance.

To accomplish each of the four main goals of this multifaceted approach, the finance function needs to achieve many smaller objectives. That, in turn, requires implementing a daunting list of capabilities and initiatives. It is not surprising, then, that many leaders underestimate the complexity of scaling the transformation and get lost in the details.

Three Stages

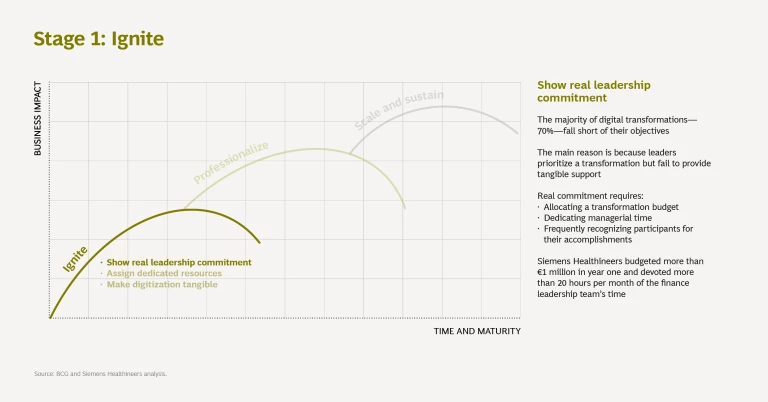

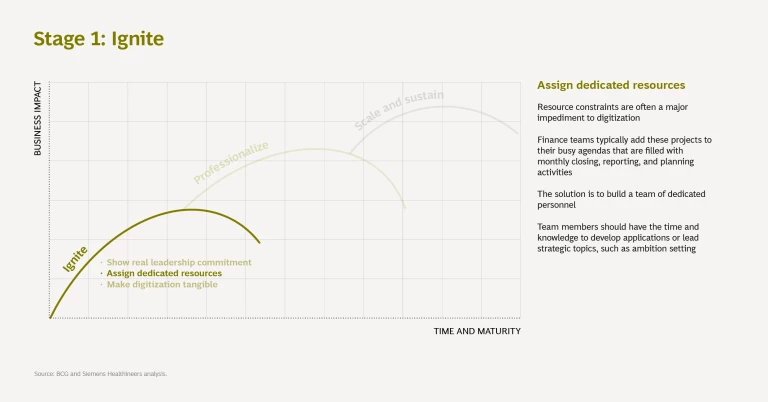

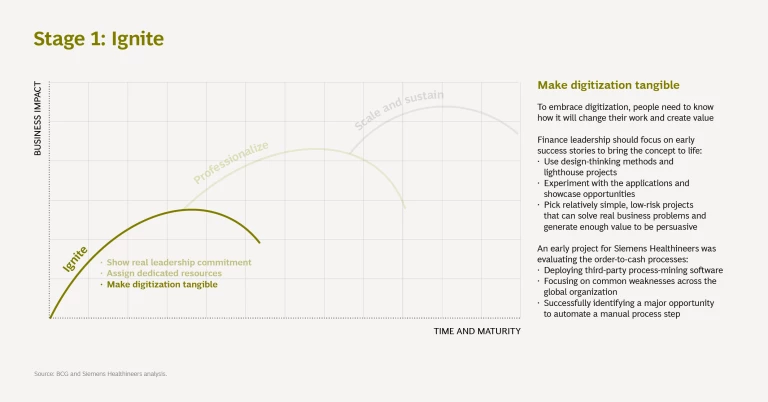

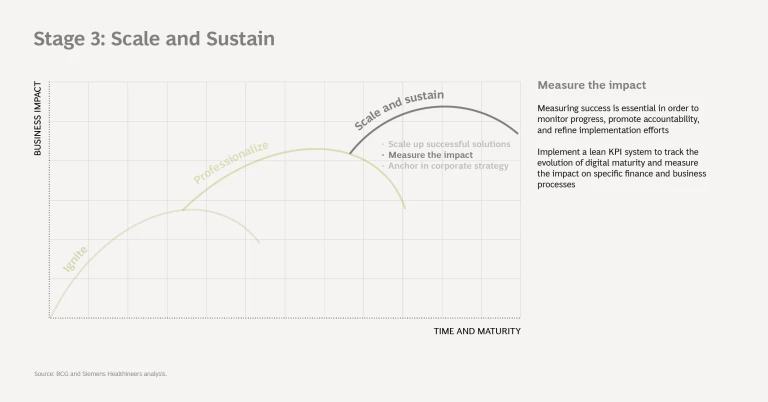

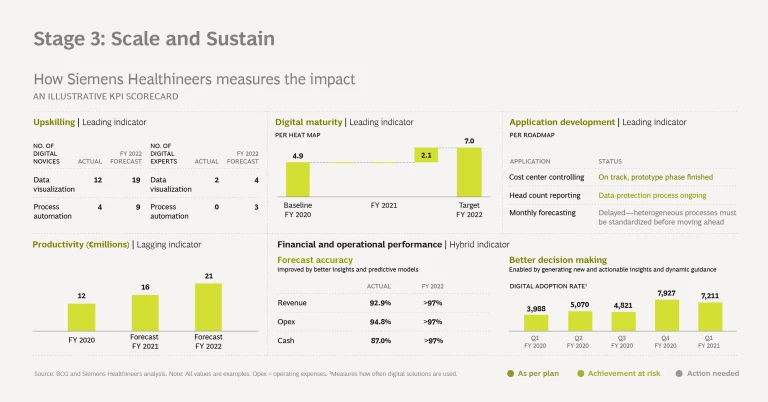

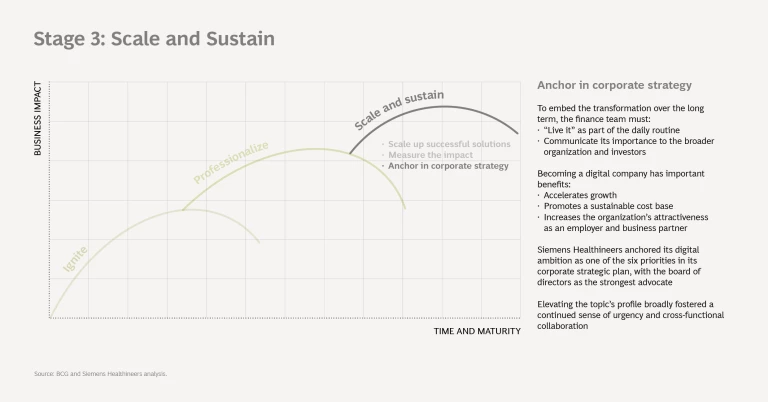

In practice, the journey to bionic finance occurs over a period of years across a continuum of increasing maturity. Navigating such a journey—understanding the challenges and implementing solutions—is best done in three stages: ignite, professionalize, and scale and sustain.

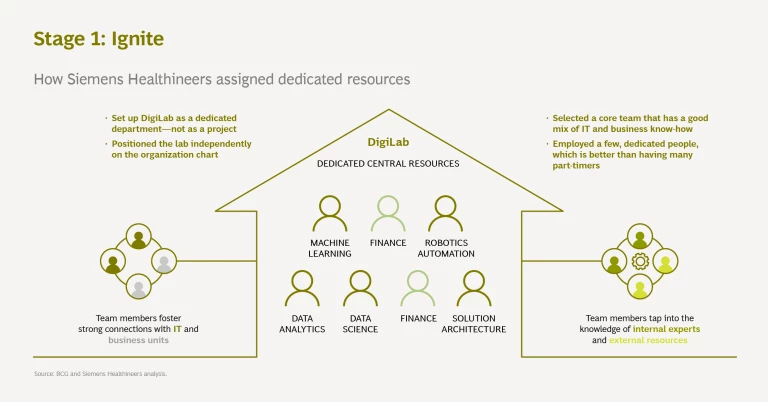

The ignite stage is about building momentum—through leadership commitment, dedicated resources, and demonstrations of tangible value.

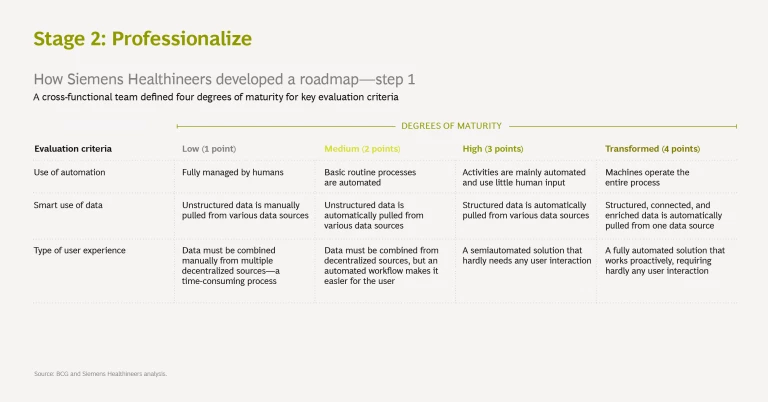

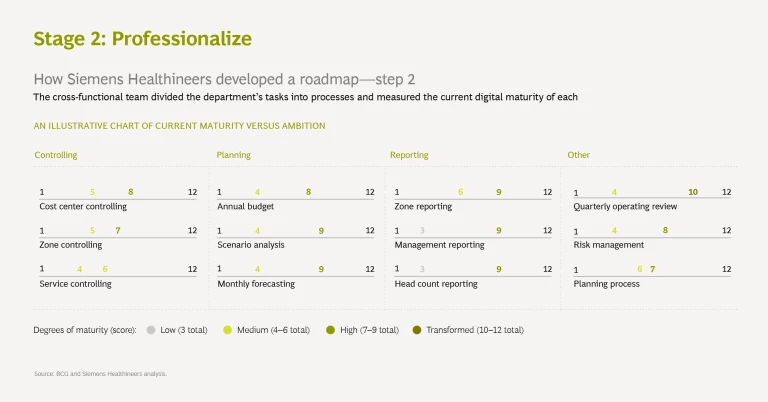

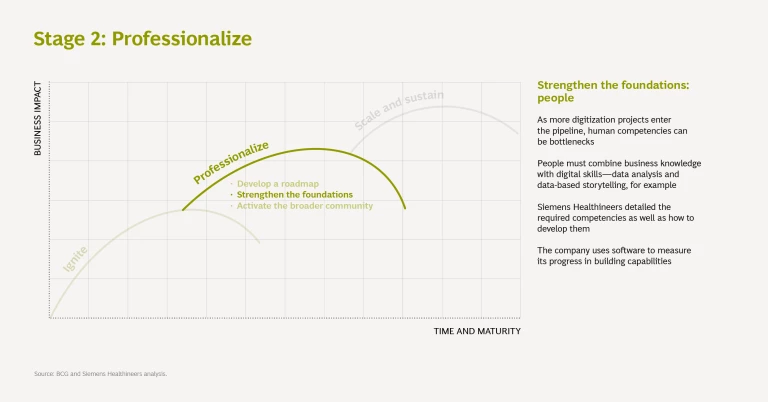

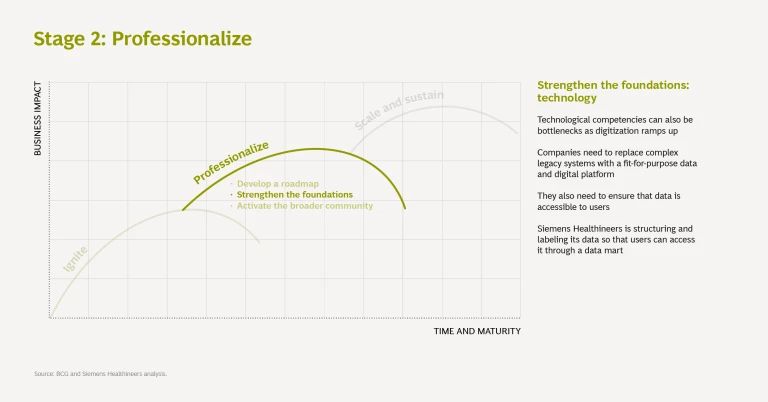

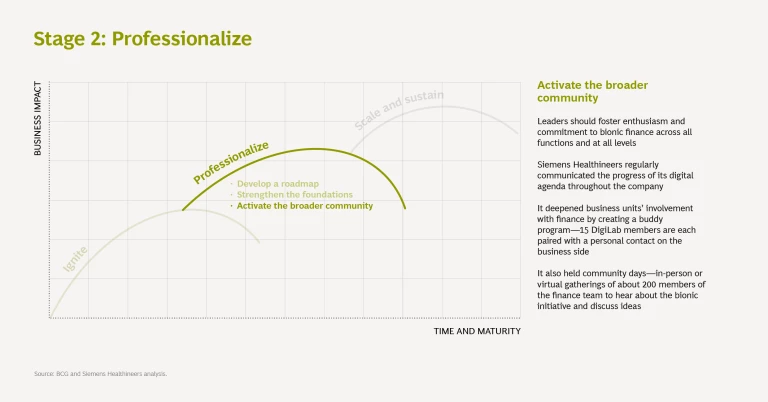

In the professionalize stage, the finance function establishes the structures and capabilities needed to expand the effort from the initial enthusiasts to the broader organization.

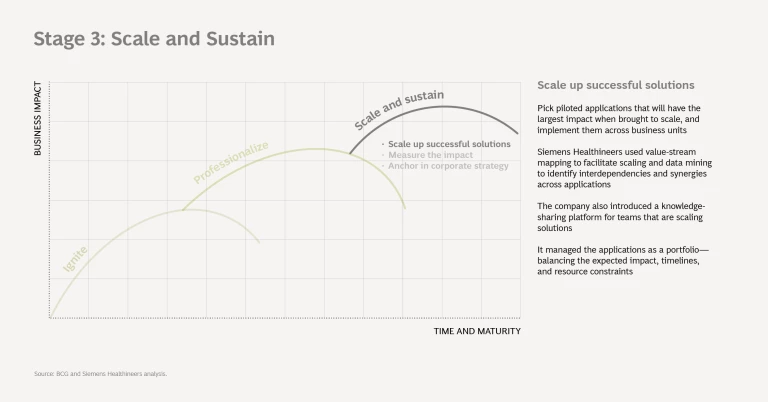

During the scale-and-sustain stage, leaders unleash the power of bionic finance organization-wide and ensure that the impact keeps building.

Each stage represents the focus of activities for a given phase of the finance function’s maturity in the journey to full-scale implementation. These stages overlap to some extent and do not have fixed starting or endpoints—a finance function should proceed to stages two and three even as it continues to pursue activities in the previous stage.

Ultimately, companies that succeed in transitioning to bionic finance will reap the rewards of having a finance function that is innovative, business-minded, and strategically focused.