As large companies scale agile ways of working throughout their organizations, an area that often remains untouched is budgeting. Even when the transformation program includes a complete revamping of the governance and funding process, budgeting is deemed sacrosanct because of its centrality to financial management. This is unfortunate, because one of agile’s key benefits is allocating capacity to business priorities—which is also one of the goals of good budgeting.

Meanwhile, a growing cadre of companies, mostly from the Nordic countries, has embraced another approach, called Beyond Budgeting, which has similar principles and goals as agile, particularly with respect to breaking through organizational silos, fostering employee autonomy, and improving employee performance and satisfaction. As stated on the Beyond Budgeting Institute’s website , the goal is to move beyond “a management culture and a performance management system” associated with “the traditional command and control management model (with the annual budget process at its core).”

Agile and Beyond Budgeting may represent two roads to the same end: greater business agility. Could they together open up the last bastion of traditional corporate management to new, and ultimately much more productive, ways of working—and at the same time transform budgeting into a force for constructive change?

Agile, Beyond Budgeting, the Challenges of Change

The Agile Manifesto comprises 12 principles. (See Exhibit 1.) Initially focused on software development, they describe a culture and ways of working that are designed to get things done through collaboration. Agile at scale seeks to change how companies operate by reorganizing employees into teams—and teams of teams—that are aligned around corporate goals but have the autonomy to determine how to achieve them.

This is a heavy lift for most companies. Done right, an agile transformation affects everything from internal processes to technology enablers to how employees interact with one another. It requires rethinking structures, incentives, and career paths . Some companies undertake an organizational change that they label agile, but they don’t make the kind of fundamental shifts—establishing new governance processes to ensure alignment, for example—that lie at the heart of agile. Others redesign the organization around agile ways of working, but senior management continues to do things the way it always has. Still others shift some functions and processes to agile while retaining some of the old ways of working.

The benefits of agile are lost when the results of agile teamwork—product innovation, for example—run up against traditional steering processes such as budgeting and deliberate, drawn-out management approvals. Employees adopt the new ways of working only to encounter the old funding bureaucracy. The initial enthusiasm stalls. Organizational change is not linear; companies need to reach a critical mass of change in order to reap the benefits.

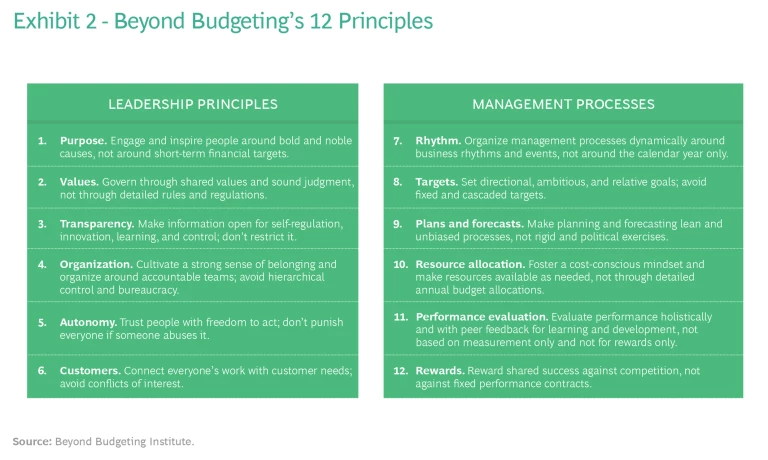

Beyond Budgeting (which was born at about the same time as agile) is based on 12 principles, too—6 about leadership and 6 about management process. (See Exhibit 2.) These likewise encourage alignment, autonomy, and collaboration. The process principles seek to address many of the same issues that agile transformations do, and both approaches ultimately require a new culture built around values and purpose. The main difference between agile and Beyond Budgeting is that the former seeks to spread change from the shop floor upwards (through teams), while the latter starts with a core process at the top of the organization.

Rethink What Budgeting Can Do

Like many corporate processes, the traditional budgeting regime presents some harsh realities. The bank is only open once a year. Income and expenses for the next 12 months are spelled out with strict precision. Any deviation is seen as a problem that must be explained. Employees are micromanaged on the cost of everything from travel to stationery. Performance is reduced to hitting the numbers, and purpose, values, and collaboration get overwhelmed or shoved aside.

Budgeting is an old management technology. A century ago, it helped organizations perform better. Today, in an economy that is about service and information, companies have much different people- and business-related needs, which the COVID-19 pandemic has only intensified. Managing through budgetary control becomes a barrier to achieving the best possible performance.

Agile seeks to spread change from the shop floor upwards (through teams), while Beyond Budgeting starts with a core process at the top of the organization.

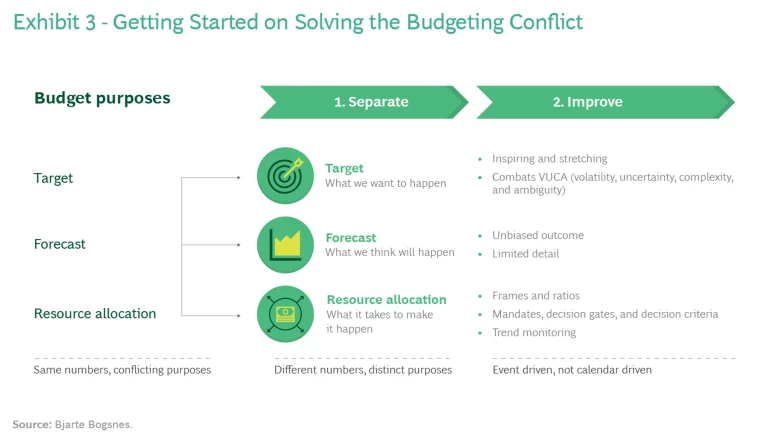

A big part of the problem is that traditional budgeting tries to serve three purposes at the same time. The first is setting targets: financial, sales, and production, for example. The second is forecasting key performance measures such as earnings, costs, and cash flow. Third, the budget helps allocate resources and determine expenditures and investments. Applying one process to all three may seem efficient, but these purposes are actually very different, with different goals and organizational ramifications. A target is an aspiration: what we want to happen. A forecast is an expectation: what we think will happen. And resource allocation is about optimizing resources to make the aspiration a reality.

Money for capital and operating expenses, for example, is the lifeblood of any company—and of any corporate function or business unit. Managers are only human, and they work the system. They know that factors such as last year’s spending can have an outsized impact on this year’s allotment. They know that the numbers they submit often come back as targets and are used to determine bonuses. This kind of process can be managed, but when the numbers that managers submit are also used for forecasting, they are of dubious value because they could have been inflated or lowballed or both.

A Better Way to Budget

The solution, of course, is to separate the three purposes of budgeting, which is a core tenet of Beyond Budgeting. (See Exhibit 3.) It allows managers to use different numbers depending on their purpose (target setting, forecasting, or resource allocation), enabling each process to be improved. Companies can make targets much more inspiring and robust, they can take the politics out of forecasts, and they can allocate resources to greater effect. They can also manage each of the three processes according to calendars and schedules that suit the budget’s purpose, given the business that the company is in.

Purpose separation often becomes a catalyst for even bigger discussions. When setting targets, for example, managers can explore what really motivates the knowledge worker. In forecasting, they can root out the functional or business unit bias and corporate politics that can push numbers in one direction or another. Resource allocation goes to the heart of alignment and autonomy (two basic principles of agile). Does a company need detailed travel budgets when everyone is aligned around the same goals and teams have autonomy in determining the best way to achieve them?

Both approaches ultimately require a new culture built around values and purpose.

Consider the case of Handelsbanken, a Swedish bank with approximately 700 branches in multiple countries and a Beyond Budgeting pioneer. Since 1970, the bank has operated without any budgets or individual targets or bonuses (it has a common bonus system for all employees, with amounts determined by the bank’s performance compared with that of other banks)—with amazing results. Cost control is achieved through autonomy and transparency, with branches benchmarked based on such metrics as return on equity, cost-to-income ratio, and customer satisfaction. The bank has performed better than the average of its competitors in every year since 1972. It is among the most cost-effective universal banks in Europe. It has never needed a bailout because it has never been in trouble. Such great performance over such a long period, with such a radically different management model, can’t be a coincidence.

Or take Equinor (formerly Statoil), Scandinavia's largest company, with operations in more than 30 countries and annual revenues approaching $65 billion. Equinor’s management abandoned traditional budgeting back in 2005 in favor of a separated approach. Capital investments (which can range from $10 billion to $15 billion a year) are not set annually in a traditional, detailed budget. Business units can request approval for projects at any time. Decisions rest on two factors: an assessment of the quality of the project (strategically, financially, and according to other criteria) and the company’s current financial and organizational capacity for new undertakings.

Answering the capacity question depends on forecasts that are updated regularly when needed instead of by a set schedule. This approach helps ensure that Equinor has the ability to approve new commitments based on current assessments and outlooks. The company manages its operating expenditures without a detailed annual budget, instead using a set of alternative mechanisms such as burn rates, benchmark targets (comparisons with peers, if possible), and unit cost targets.

Beyond Budgeting has yet to sweep through the global corporate community, although the pandemic has triggered a lot of interest. Plenty of companies have attempted agile-at-scale transformations, and a good number have largely succeeded. Still, agile remains a daunting proposition for many management teams. Here are two questions for forward-looking leaders concerned about company performance and customer and employee engagement in an uncertain, post-pandemic business environment: Could Beyond Budgeting provide agile a much-needed lift to transform the corporate financial center? And could agile ways of working propel Beyond Budgeting out of finance to create the kind of broad-based organizational and cultural shift that its founders envisioned?