B2B customers are increasingly relying on rich content and highly personalized online engagement to guide their purchase decisions. This rapid shift in behavior—accelerated by the COVID-19 crisis—has made it more challenging and complicated than ever for B2B companies to generate demand and manage leads effectively and efficiently.

Success now depends on the quality of a company’s digital engagement, which means offering customers seamless, personalized, end-to-end engagement along their buying journeys. To address this complex challenge, a growing number of B2B companies are turning to advanced digital and data capabilities that enhance ordinary human powers of interaction and engagement.

A rapid shift toward online buying is making it more difficult than ever for B2B companies to generate demand and manage leads effectively and efficiently.

The shift to this bionic approach is becoming increasingly urgent for B2B companies that lack the organization, processes, technology, and data to provide the right level of digital engagement. The gap between leaders and laggards in this transformation remains vast, but the leaders have demonstrated that a bionic approach—often driven by a demand center—is indispensable to creating and scaling the high-quality digital engagement that customers expect. B2B marketers need to decide whether they will lead as this shift accelerates or be left behind.

Transforming the Marketing Function

Digital engagement is essential because, on average, B2B customers now complete 57% of their buying process online, before they ever make contact with a sales representative, according to a study from CES and Google. Yet recent surveys by Demandbase and Adobe highlight the inefficiencies and disconnects that occur when B2B marketers try to identify and engage customers online: some 82% of all website visitors are not potential customers, and 97% of visitors leave without filling out a form. Even when marketing actually generates leads online, sales teams act on only half of them, on average. Overwhelmed by the exploding volume of customer data and the pace of technology innovation, teams risk failing to recognize customer opportunities at all—never mind converting them.

Some leading B2B companies have responded by transforming their marketing functions from passive support roles into active revenue generators. Gone are the days when B2B marketers used primarily trade shows and conferences as a means to engage with their customers. Under the new go-to-market approach , marketing generates demand by creating awareness and consideration at the top of the sales funnel through digital marketing and then identifying, nurturing, and prioritizing online leads.

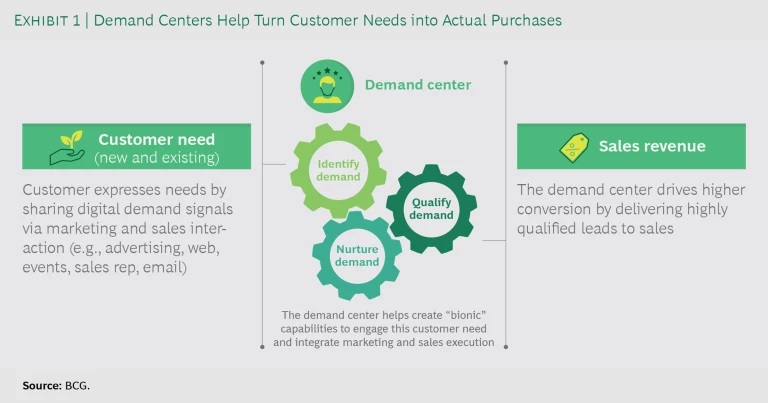

Seamless, personalized customer engagement across the entire journey—both online and offline—requires a full integration of marketing, sales, and service, with all functions serving as equal partners. Many companies have implemented demand centers as a core operational capability within marketing, but in some cases, these centers serve as an integrator between marketing, sales, and service. (See Exhibit 1.)

Demand centers help companies build the necessary bionic marketing and sales capabilities. They facilitate the outbound and inbound marketing, web experience, and always-on nurturing that allow marketing teams to deliver high-quality leads to the sales organization. Internally, they help the business manage the increasing complexity of interdependent marketing and sales processes and integrate customer data to create a single source of truth. They also enable end-to-end tracking of marketing’s contribution and thus the measurement of return on marketing investment by attributing revenue back to the marketing activities that drove it.

Evaluating the Quality of B2B Digital Engagement

BCG used publicly available data to perform outside-in benchmarking of 268 companies across seven global B2B industry sectors: medical technology, building materials, transportation and logistics, engineered products and infrastructure, technology, media, and telecommunications. (See “About Our Research Approach.”) The benchmarking measured the effectiveness of B2B marketing in generating web traffic and providing a high-quality online experience to capture and engage leads.

About Our Research Approach

To measure the ability to generate traffic (identify demand), we looked at the absolute number of global website visits over 12 months (May 2019 to April 2020), divided by the 2019 revenue (in dollars).

To determine the ability to convert a click to a lead (nurture demand), we gave equal weight to three areas: customer attention and navigation, customer engagement, and traffic-to-lead conversion. “Customer attention and navigation” is an aggregate score on three metrics (page size, page load speed, bounce rate) based on quartile rank as well as a fourth metric (state-of-the-art user experience [UX]) rated manually on a 0 to 4 scale. “Customer engagement” is an aggregate score on two metrics (average pages clicked on per visitor, average visit duration) based on quartile rank and a third (product detail content) rated manually on a 0 to 4 scale. “Traffic-to-lead conversion” is an aggregate score based on email address and opt-in generation and on 1-to-1 contact points (such as chatbots, hotlines), rated manually on a 0 to 4 scale.

The data for this outside-in approach came from SimilarWeb, Google, and the respective companies’ websites, as well as our own secondary research.

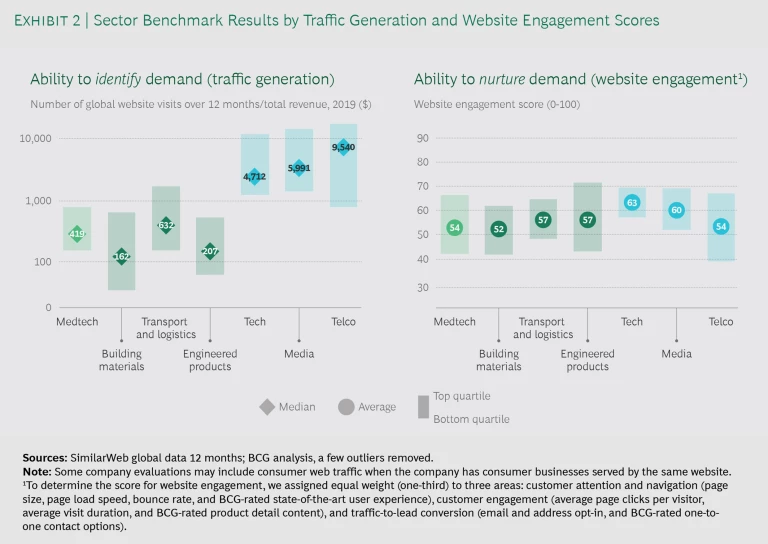

Our research revealed significant variance in performance across sectors, as Exhibit 2 shows. The technology, media, and telecommunications sectors are more advanced in identifying demand. Technology and media are also slightly more advanced than others on web engagement, but the average scores on this measure show less variation.

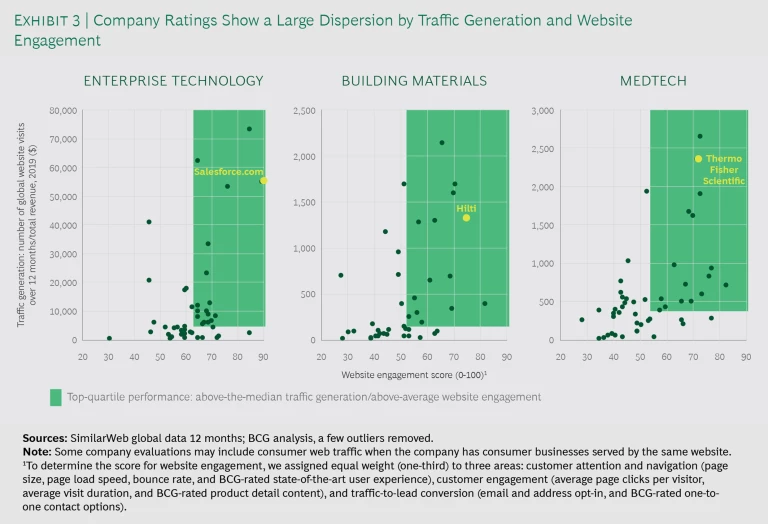

Disaggregating each sector to the company level reveals much greater variance along both dimensions, as Exhibit 3 shows for medtech, building materials, and technology. These large dispersions, which occurred across all seven sectors, beg the question of why certain companies perform so differently in terms of digital engagement.

To explore that question, we defined B2B marketing leaders as companies with both above-the-median performance in traffic generation and above-average performance on website engagement. Then we took an in-depth look at how three outperformers—Salesforce.com (enterprise technology), Hilti (building materials), and Thermo Fisher Scientific (medtech)—have systematically professionalized their digital marketing and demand center approaches in recent years.

How B2B Digital Marketing Leaders Achieve Higher Performance

B2B leaders have built scalable digital capabilities that enable marketing, sales, and service to collaborate better and engage customers in real time. They increasingly strengthen these capabilities through centers of excellence (CoEs) and shared-service centers (both of which we refer to as “demand centers”).

B2B leaders have built scalable digital capabilities that enable marketing, sales, and service to collaborate better and engage customers in real time.

They also carefully weigh the tradeoffs between centralization and decentralization. Centralization creates scale efficiencies from the use of technology and data as well as the management of processes. It also helps the company develop a deeper pool of digital and data science talent, which can be difficult to recruit and retain. Decentralization moves marketing activity closer to the customer and improves the company’s agility to respond to customer needs. Most often, the infrastructure and core expertise to support marketing platforms are developed and managed centrally, while the execution of marketing programs may take place centrally, regionally, or locally, depending on the business model and inherent tradeoffs.

The stories of digital marketing leaders such as Salesforce, Hilti, and Thermo Fisher illustrate how companies have built bionic capabilities to serve their customers better by implementing demand centers and balancing these tradeoffs.

Case Study 1: Enterprise Technology—Salesforce.com

As Salesforce grew rapidly in the early 2000s, its marketing model became increasingly decentralized in order to support greater complexity across products and regions. But decentralization eventually led to fragmentation and inefficiencies, prompting Salesforce to reverse course. Starting in 2015, the central marketing organization took greater ownership of company-wide marketing spending, brand awareness, and demand generation metrics.

The company created a central campaign-and-creative group that acted as an internal agency to support the business units and regions. It also established CoEs to develop deeper expertise and greater scale in digital marketing channels, events marketing, account-based engagement (ABE), customer stories, marketing operations (analytics and reporting), and digital infrastructure.

These core digital capabilities contributed significantly to the company’s recent success. For example, over the four years since the launch of the ABE CoE, ABE for high-priority midsize accounts drove a 212% jump in unique visitors to the website and a 15% increase in close rate. For large accounts in 2019, it led to a 45% year-on-year boost in the pipeline, which includes all sales opportunities far enough along to be included in the sales forecast with a probability of closing.

COVID-19 then forced more changes to the company’s go-to-market approach. It brought Salesforce’s heavy reliance on in-person events to a “screeching halt,” as Katie Foote, Salesforce’s vice president of marketing strategic initiatives, explains. Marketing engagement shifted entirely to digital interaction—including experiments with new types of purely virtual events—accompanied by content focused on helping customers with their current challenges.

This shift led to some renewed decentralization. “We had to break up the central campaigns team and push campaign development much deeper into the cloud and industry marketing groups to optimize further for increased speed, relevance, and agility,” Foote says, adding that field marketing now executes the campaigns.

The tight alignment between marketing and sales, however, has been one constant throughout Salesforce’s marketing evolution. The two functions use joint planning and business reviews to align on strategies and on pipeline and revenue targets, and share joint accountability for those targets. They also map spending to all marketing programs and tactics, and then calculate the return on marketing investment using a proprietary multitouch attribution model that ties revenue back to those programs and tactics. This approach gives Salesforce a transparent view and firm grasp of how marketing spending contributes to sales and how to adjust spending to ensure the maximum return.

Case Study 2: Building Materials—Hilti

Hilti is one of the world’s leading manufacturers of construction products and systems as well as a provider of services and software solutions for the industry. One of the 80-year-old company’s most vital sources of competitive advantage is its deep, direct, and multilevel customer contacts and relationships, nurtured by a direct sales force that understands customer needs across the entire workflow. Two-thirds of all Hilti team members worldwide have direct customer contacts, resulting in more than 250,000 customer interactions every day.

At first glance, Hilti might therefore seem an unlikely candidate for the transformation to state-of-the-art digital marketing. But since 2018 it has built a growing organization of more than 200 people focusing on digital marketing while generating over 25% of its sales transactions online.

Given that the company already has robust market penetration—thanks to its strong customer relationships—Hilti has focused most of its efforts on expanding and deepening its footprint with existing customers rather than acquiring new ones. Because customer behavior continues to migrate online, Hilti has found it increasingly critical to effectively combine digital with physical touch points. As a result, the company continues to build its direct sales teams while, in parallel, investing in digital demand generation, which Hilti calls “engagement marketing.” The company decided to invest in this area as way to differentiate itself in the construction industry as a premium, high-touch provider.

Today, Hilti has built a centralized engagement-marketing organization to develop advanced digital marketing capabilities and create a more seamless connection across the online and offline parts of the customer journey. This team works with its global, regional, and local counterparts in product, trade, and segment marketing to deploy programs across all ten Hilti regions globally. The centralized team handles data management, technology development (including cross-functional integration), content management, and the design of the marketing program process and flows, including the connection to sales. The team’s advanced global tech infrastructure helped it accelerate that build-out. Development and operations for the website are also fully globalized, though regional and local organizations may make some adaptations.

Similar to Salesforce, Hilti relies on clearly defined KPIs for sales and marketing that help foster internal alignment and cooperation and steer the business. There is already evidence that this move to one global, coordinated setup will be a success. Carsten Takac, Hilti’s chief marketing officer, notes that “we only launched our efforts in July but are already seeing a measurable impact on sales per head and expect this to grow over time.”

Case Study 3: Medtech—Thermo Fisher Scientific

Thermo Fisher is a leading global provider of laboratory instruments, specialty diagnostics, life sciences solutions, and pharmaceutical services for sectors including diagnostics and health care, pharma and biotech, academic institutions and governments, and industrial and applied markets.

Because of the company’s growth by acquisition, its marketing organization was decentralized, with nearly every business operating as a silo with its own embedded marketing teams and limited corporate marketing support. But as customers increasingly adopted digital sources for company and product research and for decision-making support on purchases, Thermo Fisher realized it needed to improve its digital marketing capabilities. To begin the process, the company decided that it needed a central marketing group to help build and manage the infrastructure in order to scale and coordinate digital marketing activities more effectively across the enterprise.

Lesley Battalini, senior director of digital marketing operations, explains that the company first focused on creating a CoE with the mandate to develop and implement a company-wide marketing-technology strategy to consolidate systems. That consolidation had two objectives: reduce costs and better support marketing activities. As the group’s role expanded over time, it needed to make more strategic decisions on what to centralize and what to leave with the businesses and regions.

“The corporate marketing group moved to take on a more consultative role with our businesses in advising them on how best to leverage this infrastructure,” she says. “We made a clear decision not to become a shared-service center, though, where the central team would be executing on behalf of the business, feeling execution should reside closer to the customer.”

This approach positioned the company well to respond quickly and effectively to shifting customer needs during the pandemic, without having to implement significant organizational changes. The company pivoted by shifting investment to support digital selling and immersive online events. Marketing and sales had to become much more tightly linked, as sales effectively became an extension of digital marketing efforts. COVID-19 created gaps in the customer experience, and marketing needed to work closely with sales to fill those gaps with new digital interactions.

Corporate digital marketing also supported the rollout of account-based marketing (ABM), initially piloted in one business unit, to develop its digital marketing capabilities even further. The program focused on better addressing the needs of approximately 12,000 “long-tail” accounts that had high potential but were underserved. Luke Liberty, Thermo Fisher’s senior digital product manager for omnichannel engagement, notes that “by waking up these accounts, we are definitely seeing an uptick in engagement metrics of about 10% to 15%, as we expand the number of decision makers and influencers we touch.” He attributes significant growth in business unit revenue to this ABM program over the past year.

Demand Centers as Bionic Enablers for Digital Marketing Excellence

Demand centers ensure alignment, communication, collaboration, and speed of response by serving as the vital interface connecting marketing, sales, and service. They act as a bionic accelerator, helping to resolve the tradeoff between the cost efficiency of centralization and the agility of decentralization so that companies can achieve the best of both.

In our experience, B2B leaders that have used demand centers to optimize their digital marketing have seen improvements of 10% to 20% in return on advertising spending. They have also built robust lead generation capabilities, driving gains of 20% to 100% in inbound lead volume, at costs that are 20% to 50% lower per lead. In addition, these B2B companies have significantly improved their ability to manage leads through the sales funnel, achieving a 10% to 20% boost in cycle time from lead capture to closed deal and a two to eight times greater rate of lead-to-close conversion.

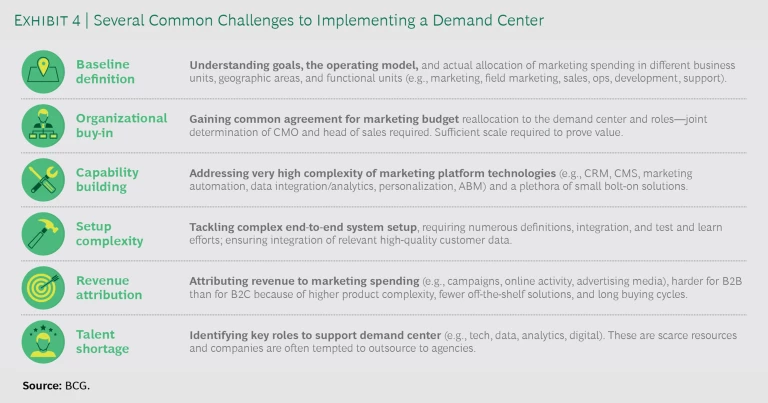

But the majority of these companies needed to overcome a number of organizational, technological, and implementation challenges in order to achieve and sustain these improvements. (See Exhibit 4.)

Implementing a fully operational demand center is a transformation that affects all elements of the go-to-market model. Navigating these complex challenges may require aligning goals, gaining organizational buy-in, developing new capabilities, managing implementation complexity, attributing revenue to marketing spending, and building talent to support new roles. Success in orchestrating the response to these challenges often depends on an investment in modern change management techniques.

Even when the organizational and technology pieces fall into place, measurement remains more challenging for B2B businesses than for B2C businesses. B2B companies generally have greater product complexity, fewer off-the-shelf solutions, and long buying cycles. This makes it harder to attribute revenue to marketing spending such as campaigns, online activity, and advertising media. Most companies use various measurement techniques to “triangulate” on the answer to return on marketing investment. These techniques include A/B testing, customer research (focus groups, surveys, interviews), and multitouch attribution modeling to figure out how to tie revenue back to the activities that generated it. In our experience, a company is better served by an easy-to-use process that yields acceptable results than a process that strives for a perfect answer.

The digital transformation of marketing has already impacted every B2B sector. As the importance of digital engagement grows, so does the urgency for B2B marketers to respond to these rapid and fundamental shifts in customer behavior. But the depth and success of responses still vary widely. The COVID-19 pandemic did not trigger the underlying customer trends but has certainly accelerated them and increased the risks associated with not getting the response right.

The leaders in this transformation—such as Salesforce, Hilti, and Thermo Fisher—all use demand centers as a tool to create bionic marketing capabilities, strike the right balance between centralization and decentralization, and implement a new go-to-market approach with much tighter sales and marketing integration. These capabilities enable significantly more effective customer insight and engagement, deeper customer relationships, and ultimately, accelerated revenue growth, enhanced customer lifetime value, and long-term customer retention and advocacy.