The industry needs a new approach to growing revenues and meeting customer needs. Carriers that embrace offer management can achieve those goals—but transformation is needed.

This article is the first in a series, coauthored by BCG and the International Air Transport Association, on the airline industry’s transition from revenue management to offer management—a new approach to retailing products and improving the customer experience.

The International Air Transport Association’s New Distribution Capability is a new data transmission standard that enables airlines to retail customized products through multiple channels. Combined with advances in AI and machine learning, it provides carriers with an enormous source of value and a key competitive advantage. Given the pandemic’s ravages on the industry, these developments couldn’t come at a better time. There’s money on the table, but to collect it, airlines will have to go beyond adopting new technologies. They’ll have to reimagine their approach to generating revenue.

For many years, airlines operated with advanced ticket distribution capabilities, but these systems no longer meet the expectations of today’s e-commerce consumers. Meanwhile, siloed organization structures are preventing airlines from optimizing the customer experience. A more holistic strategy is needed, one that can satisfy customers’ wants and needs while increasing top-line growth.

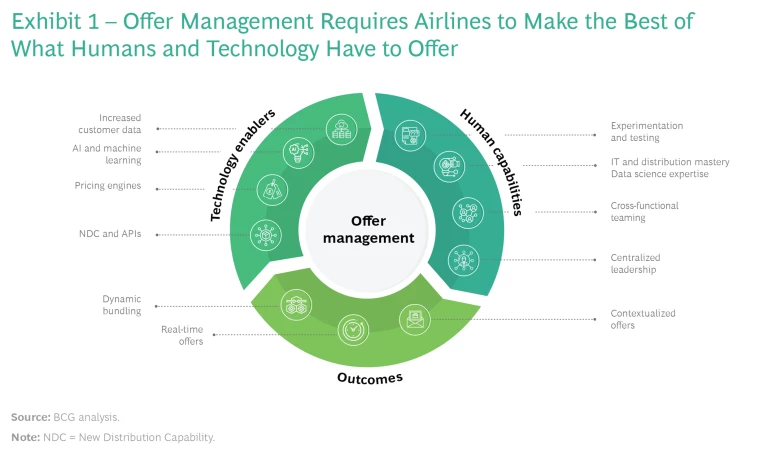

Offer management is a new strategy that can help meet those goals, and some of its key elements are gaining ground among airlines today. It allows airlines to generate and sell contextualized offers—products that are customized and priced in real time—and combine ticket fares with ancillary products such as in-flight meals and priority boarding. Offer management promises to revolutionize the industry, but to make the most of it—and outperform their competitors—many airlines will have to transform themselves into bionic organizations , combining the best of their human capabilities with the latest technology. (See Exhibit 1.)

Current Constraints

While the need for evolution is clear to many leaders, several operational and technological constraints are holding airlines back.

Legacy Distribution Ecosystem. A significant portion of the bookings in the industry rely on legacy pricing and distribution processes that make it difficult to offer more than static bundles, which are typically based on fare families and branded fares. Tailoring bundles to individual customers or microsegments is simply not practical for the average airline selling through indirect channels.

Discrete Pricing. Distribution in the industry is built on a legacy of discrete pricing platforms, which, because of their rigidity, limit the ability to sell diversified products through direct and indirect channels. For this reason, airlines are often unable to adjust pricing at a granular level or to offer the kind of competitively priced bundles that could appeal to certain flyers.

Siloed Teams. For the majority of airlines, the standard procedure is to handle pricing and inventory separately. Pricing analysts define price points for every fare class, while inventory analysts focus on managing seat availability and monitoring demand forecasts. This disjointed approach makes it difficult to tailor pricing to specific demand segments.

A Narrow Revenue Focus. Airlines’ pricing engines typically focus on maximizing the value from ticket sales through advanced optimization techniques—an approach that lies at the heart of revenue management. Many players fail to see the bigger opportunity, thinking of ancillary products as incremental revenue drivers that take a back seat to ticket sales. Holistic pricing engines that can process customer data and generate customized offers in real time on both tickets and ancillary products are not common. And even much of today’s most flexible merchandizing software is built on rule-based engines and can only be used on direct channels.

Offer management allows airlines to generate and sell products that are customized and priced in real time and combine ticket fares with ancillary products such as in-flight meals and priority boarding.

Implementation Challenges. Even some of the most tech-savvy airlines are struggling to get their offer management strategy off the ground. Navigating the multitude of solutions and players in the marketplace can be daunting, as is identifying the key building blocks that could work for a given airline. Many airlines are not equipped to choose the best distribution mix—such as a direct-connect, aggregator, GDS, and proprietary booking tool—and are unable to meet the related standards, processes, and workflows.

From Revenue Management to Offer Management

Nevertheless, some airlines are waking up to the fact that the days of booking-class-based revenue management—and ancillary products with a standalone, separate pricing logic—are coming to an end. They are beginning to enrich their retailing power and improve the customer experience by widening their product offerings. The following capabilities are the hallmarks of offer management, and they are already giving these players a competitive edge.

Tailored, Dynamic Bundling. Most shoppers have by now grown accustomed to tailored retail experiences that account for their preferences, budget, location, and more. Savvy airlines are taking notice: consumers are more likely to fly with providers that offer tailored, competitively priced bundles that meet their specific needs. So rather than offering basic fares and a handful of fixed bundles, airlines that embrace offer management can provide a wider variety of bundles with changing product assortments and prices, informed by shoppers’ preferences (such as departure time) and the airline's flight-specific commercial priorities.

Total Offer Optimization and Customer Lifetime Value. Forward-looking airlines are increasingly focused on holistic revenue and value creation maximization, benefiting both airlines and customers. These players treat ancillary products and services as an integral part of the product offer rather than as afterthoughts. They know that such offerings are most valuable when they are priced dynamically instead of statically. An aisle seat in the front, for example, may be worth more to a business traveler who needs to be able to deplane quickly. The most advanced airlines also know that focusing on customer lifetime value, rather than just the next transaction, yields meaningful long-term gains. Offering a promotional fare to reactivate a customer, for example, or exposing a customer to a new product will pay off over time.

Continuous Pricing. Discrete pricing models and reservation booking designator (RBD) systems have become hindrances that create too many opportunities for competitors to pick up customers. Those airlines that do away with static price points and instead sell tickets within a flexible price range are more likely to fill seats. And thanks to their investments in technology, such airlines are also better equipped to sell the variety of products that traditional pricing engines cannot account for. Some travel players that do not face the same technological or operational constraints as the majority of airlines have already incorporated these elements into their day-to-day operating models. (See Exhibit 2.) Airlines can learn from their example.

Bringing a New Strategy to Life

The ability to provide the right product mix at the right time and price across all distribution channels represents a tremendous opportunity for airlines and their customers. And the New Distribution Capability (NDC) is making it possible.

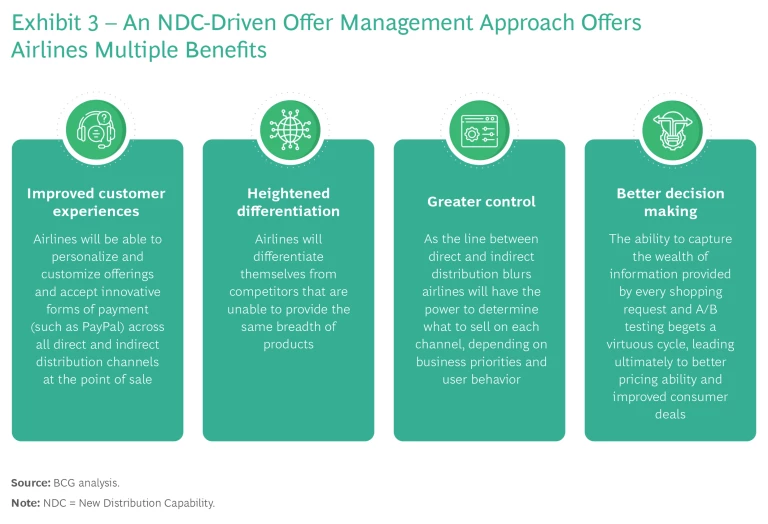

Supported by the travel industry, this new standard is modernizing the way air products are retailed to travel agents, businesses, and consumers. While many of today’s legacy distribution systems compare airlines mainly on price and schedule, NDC enables carriers to provide a wider variety of products, greater pricing transparency, real-time evaluation of shopping requests, and customized options. (See Exhibit 3.) For these reasons, NDC has the potential to serve as a powerful backbone for offer management on all distribution channels.

But implementing NDC-enabled offer management is only part of the equation for carriers. To increase revenues, airlines will also have to adopt new tech platforms and change the way they operate. To make the most of the system’s personalization capabilities, they must invest in the right technological infrastructure and the relevant e-commerce technologies (such as customer relationship management systems) for collecting and managing massive amounts of customer data. Furthermore, historically siloed parts of the organization—such as revenue management, marketing, and sales—will need to communicate more effectively. By leveraging advanced programming interfaces, these teams can exchange data in real time.

Greater access to customer information requires airlines to develop a big-data strategy and adopt machine learning and AI techniques to make sense of the resulting insights. In addition, revenue management techniques will need to be adapted or reinvented. For instance, inventory teams can expand their focus beyond RBD-based demand forecasting to account for more of what customers might be interested in buying. They’ll have to learn how to work with advanced recommender systems that anticipate customers’ demand for bundles and ancillary services.

The end goal for airlines is to become bionic, combining the best of their human and machine capabilities to maximize the success of their offer management strategies. To that end, they must be ready to embrace new ways of working, make the right investments, and reshape their organizations accordingly. Once each carrier has identified the right approach for its unique circumstances, it should build a roadmap for execution and prepare itself for the transformation ahead.

To launch the transformation, they should first appoint a dedicated leader to oversee a new collaborative, cross-functional organization model that will bring together siloed teams. The leader will be responsible for steering the organization’s offer management journey and codifying the processes that will govern how different departments collaborate. Airlines will then have to create offer-management-specific roles, which will call for wide-ranging expertise in revenue management, data science, marketing, sales, and other capabilities.

The ability to provide the right product mix at the right time and price across all distribution channels represents a tremendous opportunity for airlines and their customers.

Agility will be the name of the game throughout the transformation. The switch from revenue management to offer management won’t occur overnight—far from it, in fact—so it will be critical for organizations to build early momentum that can sustain the transformation over the long term. To ensure that value is captured early on, senior leadership should prioritize approaches built around agile sprints (with teams focusing solely on reaching a single goal in a relatively short period), as well as experimentation and quick wins. They’ll have to keep their teams focused, build a resilient culture so that employees are reassured that their efforts will pay off, and—when they hit bumps in the road—help them resist the urge to go back to “the old ways that always worked.”

A move to offer management on the part of the

airline industry

as a whole could represent a bigger leap than the shift from leg-based to origin-and-destination-based revenue management or from standard fares to fare families and branded fares. In the shorter term, airlines that embrace the approach will reap the benefits of greater differentiation and competitiveness, while also shaping consumers’ expectations. The impact on value creation will vary by geography, by player category, and by each airline's existing capabilities, but academic studies indicate that improvements of up to 7% are possible. Of course, the potential for individual airlines remains to be seen, but those that make the transition will undoubtedly see results in immediate revenues and in long-term customer relationships.