The Internet of Things has arrived and is rapidly becoming entrenched in the activities we all do every day. But what will it take for the IoT to start benefiting providers of commercial property and casualty insurance ?

The potential is certainly there. As of last year, there were 30 billion connected devices in the world; that number is expected to jump by a third, to 41 billion connected devices, by 2025. Today’s devices are already producing 14 zettabytes of data, with numerical or visual information on people, things, and environmental factors. A lot of this data is being generated by equipment and infrastructure that commercial carriers already insure.

Several P&C insurers in Europe and the US have begun experimenting with new services leveraging IoT devices. But a lot remains to be sorted out in what is still a very new area. Carriers that establish a lead in this early period may find themselves with an advantage later on .

THE INTERNET OF THINGS’ IMPACT ON INSURANCE

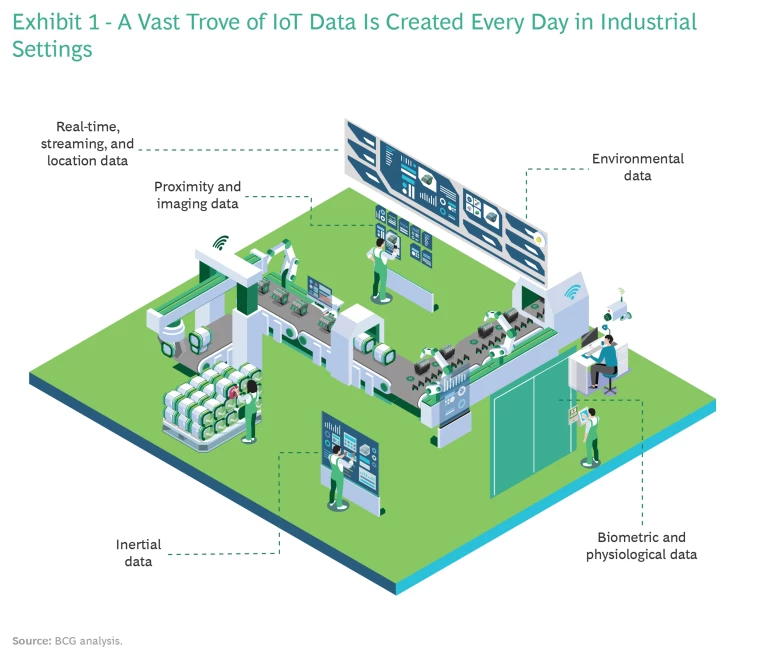

The quantity and variety of data that businesses produce each day create some sizable opportunities for commercial P&C insurers. (See Exhibit 1.) Here’s a look at the areas of P&C insurance that could benefit the most.

Underwriting. Typically, P&C insurers price risk by looking at statistical models of past loss trends. The IoT builds on that in two ways. First, it creates a situation where real-time data, not just historical data, is part of the risk assessment. Second, the IoT can bring new, potentially very insightful, types of data to the business of calculating risk.

Take the example of aircraft turbines. In the past, the number of cycle hours was one of the most important data points for a carrier insuring a turbine. With the IoT, many other factors can be analyzed—the amount of time the engine is idling, on full throttle, or on cruise throttle—and at which temperatures and outside humidity levels. All of these have an impact on an engine’s longevity and its risk of breaking down.

Or consider another kind of commercial insurance—for vehicle fleets. The pricing of coverage for a fleet of commercial trucks used to be based just on the accident record of that fleet manager. Now, the pricing can go up or down in response to the behaviors of current drivers, as captured by onboard sensors. A driving score for each driver and the monitoring of how many hours each driver is on duty can be statistically more relevant than the past loss trend.

Claims Processes. Commercial P&C carriers employ large staffs to evaluate and adjudicate claims; the fact-finding and pinpointing of damages after an insurable event can cost 6% to 10% of premiums and drag on for weeks or even months in the case of a large claim. The process often has a negative impact on customer satisfaction.

Bionic approaches —where machines do the tasks that can be automated and human beings handle the higher-level problem solving—are starting to reverse some of these inefficiencies. Technology is helping claims adjusters offer better or faster service to claimants in situations that involve ongoing danger. This can include flood or fire scenes where drones and other aerial-capture machines must take the initial image. Several companies are developing AI-enabled computer vision tools that can fill this need. Bionic tools are also making important strides in risk prevention and mitigation services, enhancing insurers’ ability to partner with clients.

Bionic tools are making important strides in risk prevention and mitigation services, enhancing insurers’ ability to partner with clients.

With claims as with underwriting, the changes brought about by the IoT won’t mean a wholesale replacement of people by machines. Instead, the technology will do the repetitive work and the work to which it is uniquely suited. That could include some fact-finding and data collection processes, which would add precision to the assignment of fault and rigor to the assessment of economic damages. A more data-driven adjudication process would also reduce the problems created by human bias. Meanwhile, the people in the claims department would continue to handle the things that humans do especially well, such as complex problem solving and process innovation.

Customer Value Propositions. In the past, P&C insurers have predominantly played a risk-transfer role, helping clients offload selected risk exposures. With IoT technology, carriers can move into the area of risk prevention: providing timely advice and alerts to prevent claim events from happening in the first place. This could range from relatively small situations—an alert about an autonomously operated industrial asset that’s about to fail because of a worn-out motor—to much higher-value insights, such as a buildup of temperature or pressure that suggests a plant explosion or leak is imminent. In short, thanks to the IoT, risk prevention may become another arrow in the insurance quiver.

New Pay-per-Use Business Models. With the proliferation of connected devices, insurers have the opportunity to reinvent an aspect of their value proposition by moving to per-unit pricing. For instance, a carrier could price insurance for a summer rental property according to when the place is actually in use, the number of people vacationing there, and the risk profile of the renters (adults versus children, say). Sensors could determine all these things, adding a type of flexibility that would benefit both the property owner and the insurer. The pay-per-use trend is already cropping up in personal-insurance lines, including for cars outfitted with telematics devices. But the concept could work for irregularly used commercial assets too, so long as they have sensors attached to them.

Sales and Distribution Partnerships. Finally, IoT partnerships could open up new channels for insurance sales. All carriers devote substantial parts of their sales budgets to broker and agent commissions. In the IoT-enabled future, P&C insurers could find themselves with other go-to-market options and additional ways of securing business. For instance, manufacturing customers may be able to buy accident and uptime insurance at the same time that they’re purchasing IoT solutions or signing equipment and facility maintenance contracts.

THE BEST USE CASES FOR INSURERS IN THE INTERNET OF THINGS

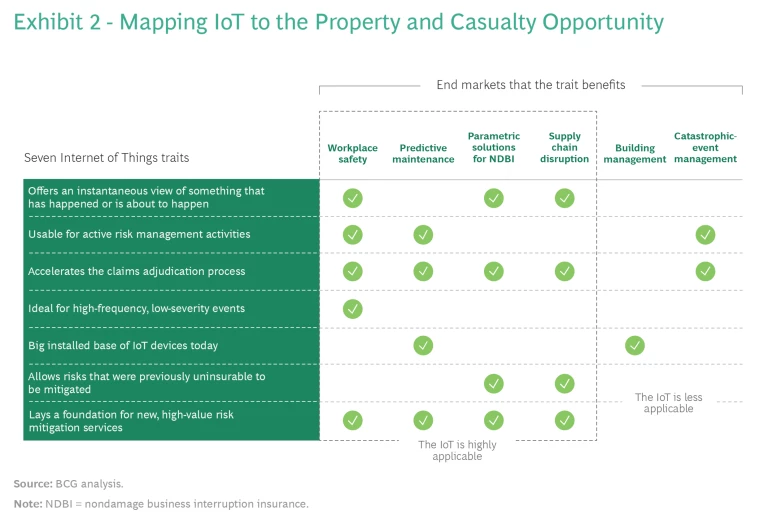

To provide a sense of the IoT opportunity, we looked at the most common use cases and their characteristics. (See Exhibit 2.) Predictive maintenance and parametric solutions are among the use cases that take advantage of the greatest numbers of IoT features. Workplace safety is even higher on the list, and its suitability for IoT technology is clearly illustrated by two examples: manufacturing environments and construction sites.

Manufacturing Environments. IoT clearly has potential in job safety applications. The workers in industrial-manufacturing environments are often exposed to hazardous materials and operate heavy equipment that can cause injuries. A risk engineer visiting such a site would see a lot to be concerned about: barrels where the pressure or heat creates an explosion risk, machine parts prone to shattering when they reach a certain level of use, and so much moving equipment that accidents are an ever-present possibility.

In the past, plant managers had no cost-effective way of mitigating these risks. That could change with IoT and, particularly, with improved analytics capabilities. The tank could be outfitted with a sensor and trigger an automatic shutdown if the pressure or heat got too high. A maintenance light could snap on when a machine part prone to shattering got within 20% of the usage level where breakdowns occur. Workers’ safety helmets could be outfitted with sensors that would cause a moving vehicle to automatically stop if a machine-on-machine or machine-on-worker collision were imminent. P&C insurers can play a role in developing these risk prevention services, which would reduce their own exposure and payouts.

Construction Sites. Another promising target for IoT-enabled insurance is the commercial-construction site. Such sites face many risks—involving heavy equipment, unsafe worker practices, and inclement weather. Another type of risk, of something going wrong in the supply chain , can wreak havoc on a construction project’s schedule, leading to losses that have nothing to do with physical injuries or equipment damage at the site itself.

The average construction site today may well have some devices and some level of IoT technology. But such sites are unlikely to be producing real-time insights into all the human and machine risks that exist at any given moment. Most things that could go wrong probably aren’t tracked by devices, and even if such tracking is happening, the information may not be available to the P&C insurers that are providing insurance for the site. In addition, many P&C carriers are not set up to take advantage of real-time data.

IoT technology can alleviate a number of construction site risks. For instance, wearables can alert site managers to worker fatigue and sound alerts in the case of imminent danger. Computer vision can provide a first notice of loss, and sensors can detect wind levels that make certain kinds of equipment vulnerable. Site managers could get early insight into scheduling issues by arranging for information alerts in the supply chain and could buy parametric insurance contracts to hedge those risks.

Three Hurdles That Must Be Overcome

To capture the opportunities of the IoT, carriers must address many challenges, including three we discuss in more detail here.

Infrastructure Gaps. How might insurers facilitate a broad adoption of IoT sensors in insured properties or high-risk work environments? And who will guarantee the uptime and accuracy of the sensors themselves? While data from IoT-connected devices is increasing exponentially, we are still below the penetration level needed for commercial P&C insurers to be comfortable making major investments in the IoT area.

Unproven Economics. In some client industries, the economics aren’t yet in place for a carrier to drive the deployment of IoT solutions for risk-mitigation purposes. The price points on the necessary technology may still be too high, the tradeoffs unfavorable, or the business models untested. P&C executives must decide where their IoT investments will go—into which industries, clients, and tech partners—and when they will make those investments.

Immature Data Analytics Capabilities. Here too, the timing of investments is uncertain. Most P&C insurers do not have in-house IoT expertise and can’t convert IoT data into insights about the frequency and severity of claim events. AI systems can only do what they’re best at—recognize patterns and learn—if they’re continually being fed more and more data. Eventually, P&C carriers will have to amass the required analytics expertise if they are to build robust AI systems and capture the IoT’s value.

Getting the Data Needed for INTERNET OF THINGS Solutions

P&C insurers have three options for acquiring data in an era of connected devices. The first and lowest risk is to tap into data sources that already exist. For instance, P&C carriers could buy data from clients that have existing IoT investments and are willing to share the data in return for a lower premium or some other in-kind consideration, such as a risk prevention service. In addition, a growing number of IoT data aggregators are gathering and sharing data collected by a variety of IoT sensors, such as those that track weather changes. This tactic—capitalizing on what’s already available—has the advantage of simplicity. But it relies on others (clients or data aggregators) to acquire the data in a usable format and be willing to transfer (or sell) such data to the insurer.

The second option for obtaining IoT data is to partner with a third-party IoT solutions provider, which could include major hardware or software companies. These organizations may be willing to collaborate with P&C insurers in order to add insurance coverage to their products and enhance their own value propositions. But there are a lot of IoT device manufacturers—not all of them familiar names—and the fragmented, rapidly developing nature of the industry could make partnerships time-consuming and high risk. For that reason, this strategy might best be seen as a temporary bridge to be replaced with something more permanent.

The final option for getting data is to build the capabilities needed to generate IoT-enabled insights in-house—or acquire a company that can become the insurer’s data analytics arm. This approach has the benefit of forcing the carrier to develop skills it will eventually need anyway. It does, however, require an upfront investment, as well as the ability to attract and retain talent that may not consider insurance their best employment option.

Monetizing the Data from Internet of things Solutions

Commercial P&C insurers can benefit from IoT data in several ways. The most basic is through better pricing and more accurate underwriting, to reduce the expected loss ratio. Indeed, in some high-risk industries, the underwriting upside may be so great that carriers can subsidize the cost of devices. For example, an insurer may share the cost of telematics with commercial trucking companies.

IoT data may also give P&C insurers the opportunity to expand into different markets or create new products. One such product area involves parametric insurance, which is widely used in industries that face weather threats. Agriculture, transportation, and construction companies have been increasing their use of this type of insurance to control costs and reduce production volatility. (Parametric insurance is also referred to as nondamage business interruption insurance, or simply NDBI.)

Another monetization strategy is for carriers to charge fees for noninsurance services. This is more of a long-range opportunity for many insurers but is in line with a broader strategic goal to monetize data assets. As an example, a carrier could consider partnering with an IoT sensor manufacturer to offer a fee-for-service solution to a manufacturing plant that would help reduce the risk of stockouts (a form of supply chain risk).

Finally, commercial P&C insurers could look to generate referral fees. These could come from a device manufacturer that agrees to pay the carrier if an introduction to an insured client leads to the manufacturer making a sale.

The Imperative for Insurers to Build New Ecosystems

One big challenge for insurance companies in offering products for IoT on a large scale is visibility. Carriers aren’t the ones sending out hardware and software engineers to install sensors or answer questions about data capture and data delivery. Insurance products are the last thing that gets thought of, after the devices are installed and the analytics have been sorted out.

And yet, the role carriers play (and the value they provide) puts them near the center of IoT ecosystems. Commercial insurance is a prerequisite in today’s world, to protect the value of property and assets and guard against third-party claims. As such, insurance companies have the opportunity to build or join new ecosystems that include all parties with an economic stake in an asset’s successful functioning.

To do this, insurers must develop a capability in “ecosystem conversations.” This implies a move toward consultative selling, with a focus on the total economic benefit for every player in the ecosystem—a departure from carriers’ usual role of just getting involved when something goes wrong. Insurers must have something to offer players that don’t buy insurance and that have exposures because of their responsibility for operations, for managing asset life cycles, and for the economics of production.

Insurers’ ability to derive value from the IoT will depend on their willingness to dive in and start experimenting with IoT technology and data.

In our view, insurers’ ability to derive value from the IoT will depend on their willingness to dive in and start experimenting with IoT technology and data. There are several reasons that a fast start is better than a delayed one. Commercial P&C carriers that move quickly to offer IoT-enabled coverage will likely end up with clients that have the best risk profiles to begin with (they will benefit from positive selection). This has certainly happened in personal P&C insurance with telematics and usage-based products. First movers in IoT-enabled insurance could also benefit from greater pricing accuracy, more efficient claims processes, and better customer segmentation and targeting.

Conversely, commercial P&C insurers that lag in IoT technology could fall behind on certain fundamental measures and remain at a disadvantage to carriers with more accurate real-time data for pricing or claims evaluation. This could open up a gap in profitability in certain kinds of P&C insurance between the IoT haves and have-nots.

GETTING STARTED

We know that even many carriers that have been studying the IoT’s potential are not ready to make big bets on it just yet. But our research suggests there is a smart middle position for companies, which can best be summed up in three steps.

Develop a learning agenda. Start by creating a small digital-learning team. This group’s job would be to track IoT solutions and players, gain an understanding of the data analytics involved, and monitor the actions of competitors. The team should also work to identify the talent and infrastructure gaps that may prevent you from succeeding as IoT-enabled insurance gains momentum.

Experiment. Decide which of your client industries has the most potential given their level of adoption of IoT technologies today. Identify a few use cases that lend themselves to small-scale tests and learning pilots. For example, if you see a chance to do something dramatically different for your construction clients using IoT, try it out in just a few sites. Be ready to scale it up quickly, if you see early evidence of success.

Explore partnerships and IoT ecosystem roles. We talked earlier about how partnerships with IoT aggregators and device manufacturers may help insurers get access to the IoT data they need. The same mindset, of working with outside parties, is essential if P&C carriers are to join ecosystems and have their insurance policies be part of platforms that—along with the devices and data—become part of the customer value proposition. This is a new muscle for many insurance companies and worth developing not just for today’s IoT challenge but for other changes that are sure to come after the turbulent beginning of this decade.