When it comes to building data capabilities, most companies worldwide are making steady headway. Yet a comprehensive survey shows that while some are gaining a clear advantage from data, many still fall short of their goals—leading to a growing advantage for leaders. Laggards that are investing in data need to review their approach before slipping further behind.

Data is now akin to oxygen in most industries, and companies know they need to build core capabilities in order to capitalize on it. BCG’s latest Data Capability Maturity Assessment (DACAMA) survey shows that in the aggregate, companies are making headway and becoming more mature in their data capabilities. Yet some companies are making much faster progress and pulling away from the pack. Moreover, many organizations continue to set extremely high aspirations for data maturity—potentially setting themselves up to fall short as they’ve done previously.

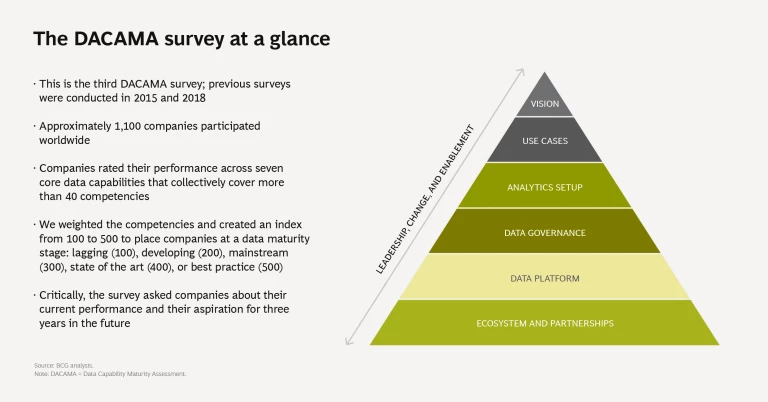

This is the third DACAMA survey. As in the past, we asked companies to rate their current level of maturity and set a target aspiration level—where they hope to be in three years. More than 1,100 companies worldwide participated, representing nine major industry clusters. The companies assessed themselves on seven core data capabilities—including an overarching vision and use cases, as well as data governance, a data platform, and an ecosystem and partnerships—which collectively encompass 40 competencies. The companies also participated in expert interviews.

Accelerating and Broad Progress

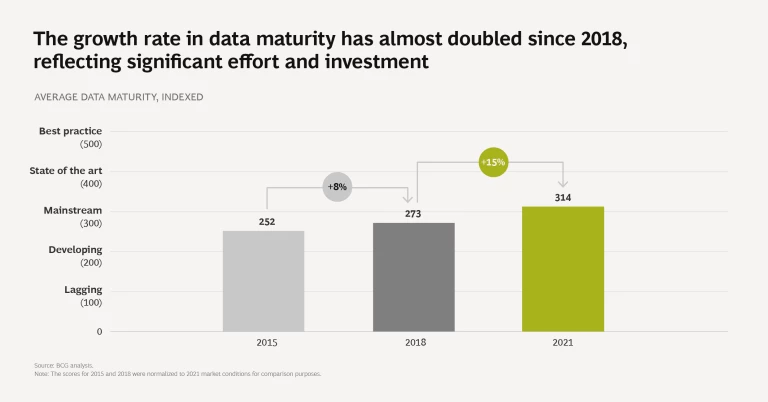

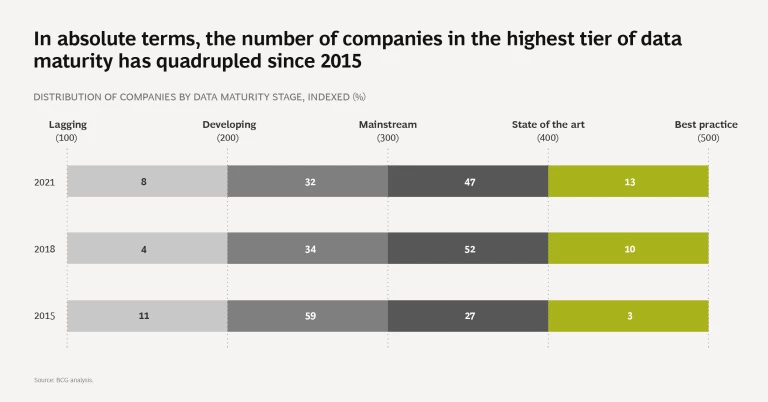

The biggest takeaway from the findings is that progress is accelerating. The overall index for all respondents increased to 314 (out of 500), a 15% improvement over 2018’s results, and nearly twice the 8% growth rate from 2015 to 2018. Similarly, the number of companies claiming state-of-the-art data capabilities more than quadrupled—albeit from a low starting point.

Both data points clearly signal that data maturity remains atop the leadership agenda for companies worldwide, and the subset of companies that successfully build data capabilities are giving themselves a significant edge over less-mature organizations. These companies are using data to generate insights—faster and at scale—about their operations as well as their customers, employees, suppliers, and other stakeholders. They are also using those insights to make smarter decisions, rethink processes, and modify their portfolio of products and services.

Data maturity remains atop the leadership agenda for companies worldwide.

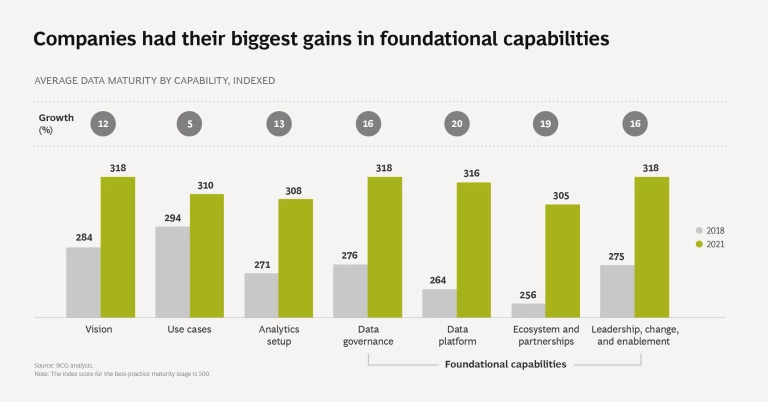

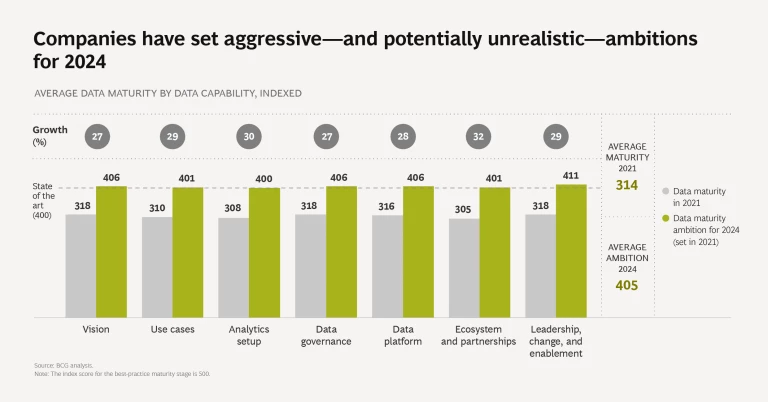

The gains in maturity were relatively broad; companies showed higher maturity index scores across all seven data capabilities. However, the biggest gains were in foundational capabilities: data governance, data platform, ecosystem and partnerships, and leadership, change, and enablement. The strong performance in data governance is possibly due to increased government regulations regarding the collection and handling of data, along with the huge reputational risk from data breaches or other types of incidents. In addition, new companies are emerging with innovative data governance products that offer services across multiple sectors. However, companies need to go beyond meeting baseline regulatory and security standards in order to translate data investments into value in their core business.

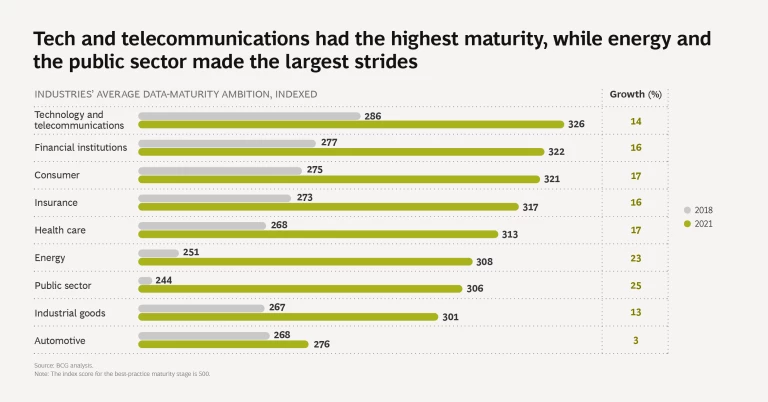

Among industries, the top performers in 2021 were the same as the ones in 2018. Technology, telecom, financial institutions, and consumer (which includes consumer packaged goods manufacturers and retailers) continue to outpace other industries as they did in the previous survey. In all of those industries, data is a critical source of competitive differentiation. The industries registering the biggest gains since 2018 include energy and the public sector, both of which improved their aggregate index scores by approximately 25%. Public-sector organizations are increasingly aware of the value of e-government in improving the efficiency and effectiveness of government services, and many policymakers are focusing their effort and resources accordingly.

The industries registering the biggest gains since 2018 include energy and the public sector.

A somewhat surprising finding is the lack of progress in data maturity for the automotive industry. Vehicles are increasingly digital, with advanced entertainment and communication systems. At the same time, automakers are investing in new systems to make cars and trucks more autonomous. As vehicles get smarter and more connected, they are generating a greater volume and variety of driver data. But thus far, many manufacturers do not have the capabilities to capitalize on the emerging data opportunities—primarily because most have been mainly focusing on internal functions such as engineering and production.

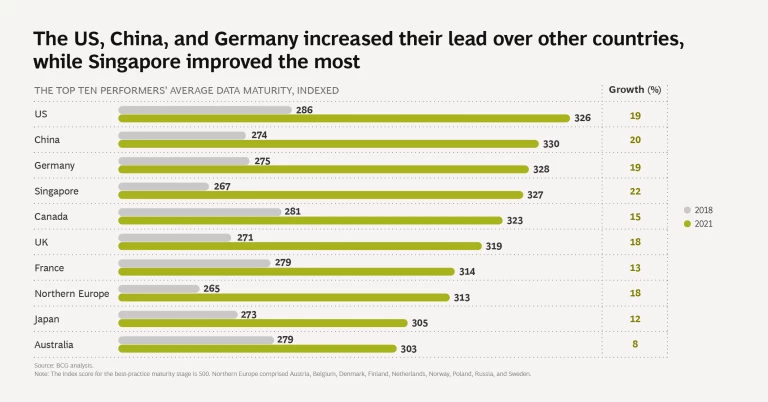

Among individual country rankings, the US has been the top performer in previous studies, and it retained its lead, followed by China. Singapore made the largest improvement, registering a gain of 22% in the maturity index among companies based there.

Ambitious—and Possibly Unrealistic—Targets for the Future

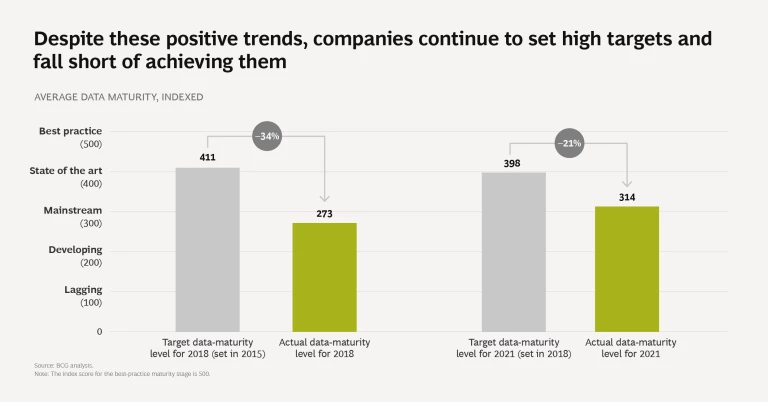

A recurring theme from DACAMA surveys of the past is that companies frequently set ambitious targets for their future maturity level and fall short of achieving them. In 2018, the average maturity level was a full 34 percentage points lower than companies had predicted in 2015. That phenomenon shows up in this year’s results as well, though at a less pronounced level—the gap is 21 percentage points. The good news is that the gap between ambition and achievement shrank, suggesting that companies are becoming more realistic about the difficulty of developing data capabilities. The bad news is that they haven’t made more progress.

The gap between ambition and achievement shrank, suggesting that companies are becoming more realistic about developing data capabilities.

Regarding the future, companies continue to have high ambitions, with an average index score of 405. That represents a 30% increase across all seven core data capabilities. Viewed in one light, that is an encouraging sign. Leadership teams clearly understand the importance of data in creating a competitive advantage and differentiating themselves in the market, and they want to improve. At the same time, a 30% gain is twice the growth rate we observed over the past three years, and it may not be realistic for many companies.

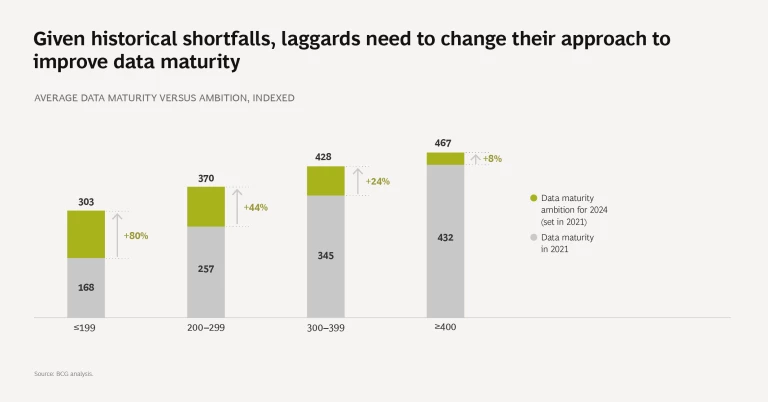

Drilling down one level, we see an inverse relationship between the overall maturity level of a company and its ambition. That may seem counterintuitive, but it’s borne out in the data. The top-performing companies set realistic, achievable targets that will lead to an improvement of approximately 15% over three years—and successfully hit those targets. They aim for what they can achieve. Companies in lower tiers of performance, in contrast, set extremely high ambitions and fall short. And they don’t adjust their approach over time.

Recurring shortfalls can have a significant impact on the credibility of management, erode morale, and hinder companies’ attempts to implement future digital transformations. Quite simply, companies that continue to fall short of their aspirations need to learn from the past, rethink their approach to building data capabilities, and set more realistic, achievable goals.

We believe the following key success factors are critical:

- Focus on business outcomes. Data capabilities are a means to an end, rather than a goal. Their real value lies in generating insights that lead to smarter business decisions and improvements in business and financial performance. Rather than investing in data capabilities for their own sake, companies should identify specific business problems that they are trying to solve and direct their efforts to specific use cases with the potential to unlock value.

- Apply a broad-based approach. Rather than overemphasizing a particular data capability, the best companies invest to build their maturity in all seven core capabilities of the pyramid. There is no magic bullet, and if companies underperform in one area, overperforming in another will likely not be enough to compensate.

- Build incrementally over time. Rather than aiming for a “big bang,” companies should build data capabilities in a deliberate, incremental manner over time. Teams should adopt a mindset of test, learn, and improve. This approach will build momentum and credibility throughout the organization as others see successes mount.

Our DACAMA research over the years has pointed to a consistent insight: companies that develop the right data capabilities give themselves a huge advantage. Given the accelerating pace of technological development and the ubiquity of data, that advantage can become self-reinforcing over time, as companies become smarter in their use of data and more efficient in how they tailor future investments. Conversely, laggards may find that the gap in performance becomes too large to overcome.