Although anxiety over health and finances is high, attitudes remain surprisingly resilient. And some behavioral changes—including greater use of digital commerce and tools—are sticking.

This spring’s resurgence of COVID-19 cases due to new variants is keeping consumers in many emerging markets on edge about their economic status, health, and daily lifestyles. But our most recent Consumer Sentiment Barometer survey also found some rays of sunlight that could bode well for a strong economic recovery and rapid vaccine acceptance when conditions permit.

In May and June, as a new wave of contagion was accelerating, BCG’s Center for Customer Insight asked 12,000 consumers in eight emerging markets—Brazil, China, India, Indonesia, Malaysia, the Philippines, Thailand, and Vietnam—about their consumption patterns in approximately 50 product categories and about their daily lifestyles. We compared their responses with those we had obtained in our barometer from August 2020, when cases were generally declining and many people were starting to return to normal life. We also compared them with our findings from a pulse check we had conducted in March 2020, during the initial phase of the pandemic.

Read Other Editions of COVID-19 and the Emerging-Market Consumer

Edition 2: COVID-19 and the Emerging-Market Consumer—The Power of Resilience

Edition 3: Who Is the Emerging-Market Consumer in the Postpandemic Era?

How the Pandemic Did—and Didn’t—Change Indian Consumers

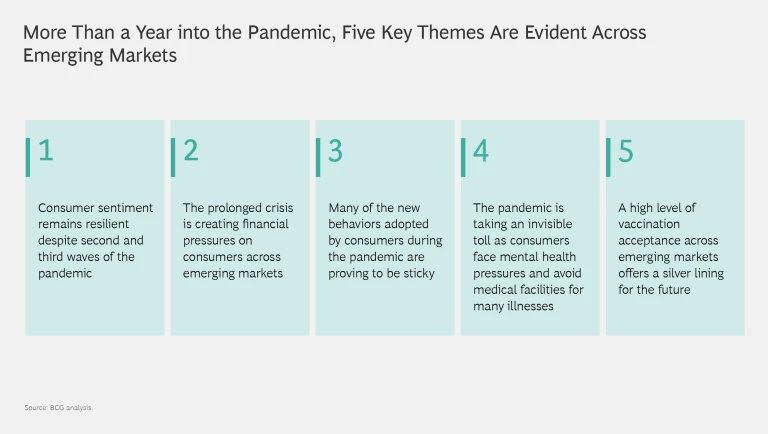

Several themes emerged from our analysis of this rich set of data:

- Consumer sentiment remains surprisingly resilient across emerging markets, even as consumers endure their second or third wave of the pandemic.

- Nevertheless, the prolonged nature of the crisis is creating financial pressures for consumers whose savings and incomes have been under strain for more than a year and a half.

- Several changes in consumer behavior triggered by the onset of the pandemic are enduring many months later, suggesting that they may represent the new normal. Demand is recovering for a range of goods and services that consumers put off buying earlier in the outbreak.

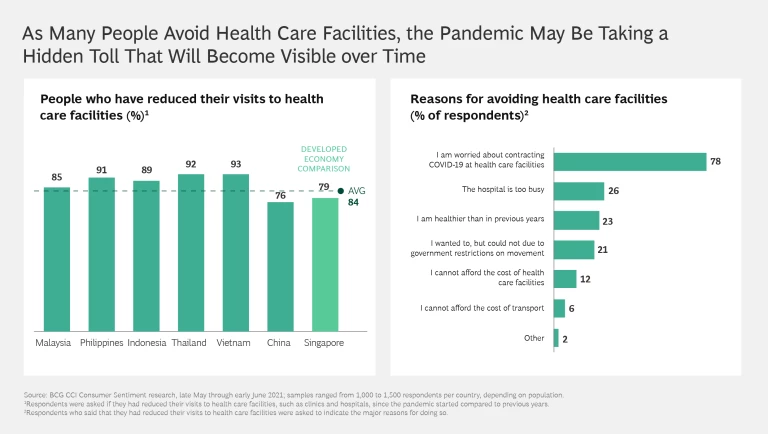

- As many consumers avoid visits to medical facilities for various illnesses and conditions, the pandemic could be taking a hidden toll on their physical and mental health.

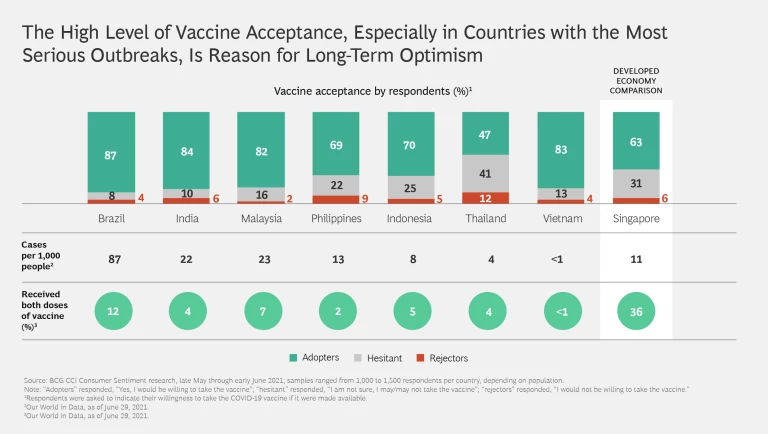

- Acceptance of vaccines is quite high across emerging markets, improving the prospects for bringing the pandemic under control when doses become available.

Resilience Amid Rising Cases and Financial Worries

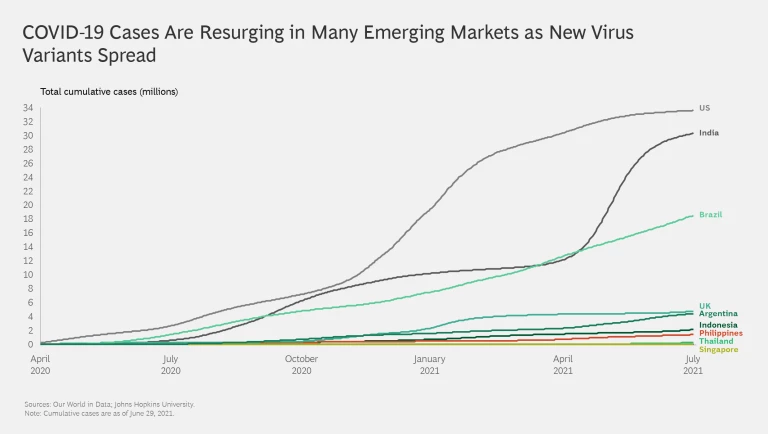

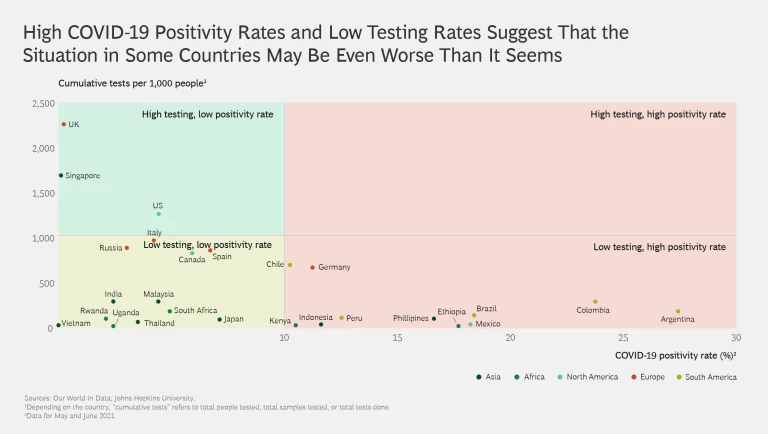

As COVID-19 cases declined and lockdowns eased from October 2020 through March 2021, life began to return to normal in most emerging markets. But then the contagion raged back, reaching terrifying levels in some countries, with the spread of new and more communicable virus variants. In fact, the intensity of the outbreak may still be understated in some nations—including Argentina, Brazil, Indonesia, and the Philippines—where low percentages of the population have been tested, and high percentages of those who are tested show positive results.

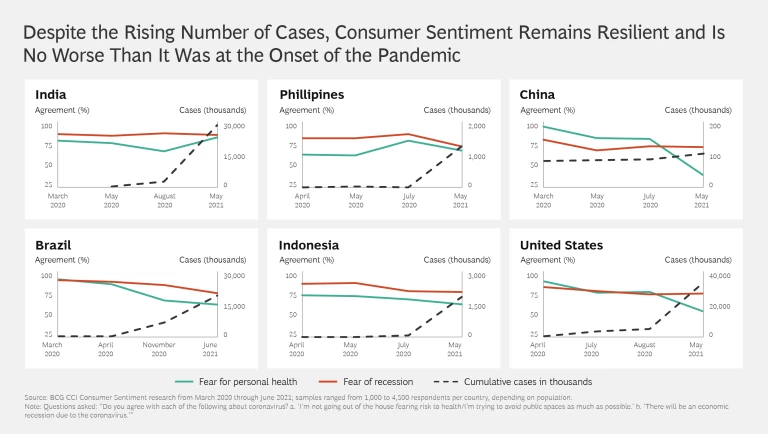

Despite the severity of these waves, however, consumer sentiment remains surprisingly resilient in most emerging markets and is no worse now than it was at the onset of the pandemic. For example, in Brazil, India, Indonesia, and the Philippines, where new cases have surged this year, the percentage of consumers saying that they fear a recession was actually lower in May 2021 than it was when the outbreak began in March 2020.

This resilience is impressive, given the grave concerns that many people have over the direction of the pandemic and its impact on their lives. In India and Malaysia, for example, nearly 90% of consumers we surveyed in May and June said that they believe the world is in “serious danger.” Roughly 70% of Thai and Vietnamese consumers reported that they don’t leave their homes except for work and that the pandemic poses a serious threat to their jobs or businesses.

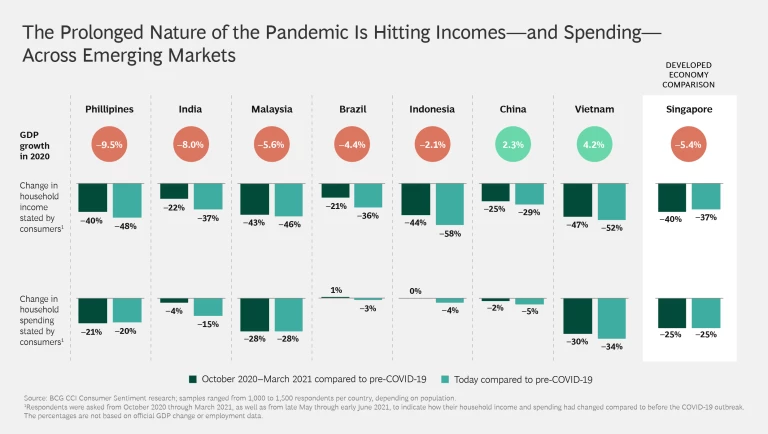

Not surprisingly, our survey found that the prolonged nature of the pandemic is putting financial pressure on emerging-market consumers. In the Philippines, where GDP contracted by 9.5% in 2020, respondents in our survey reported an average drop in household income of 48% from pre-COVID-19 levels; and in Indonesia, respondents indicated a 58% decrease in household income since the onset of the pandemic. The resulting financial concerns have translated into lower spending by consumers in some emerging markets.

Changes That Are Sticking—and Some That Aren’t

We also assessed how the pandemic has transformed consumers’ behavior and spending priorities over time. We wanted to know which changes were driven by temporary necessity—and have proved to be fleeting—and which seem to be lasting and may represent the new normal.

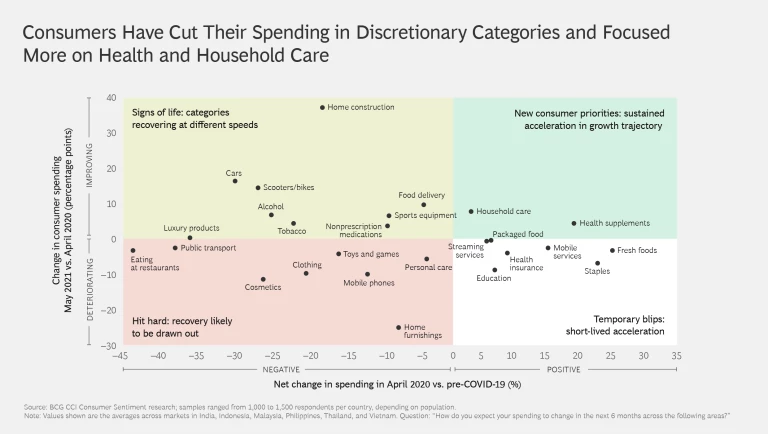

On the basis of responses to our surveys at different stages of the pandemic, we grouped changes in spending into four segments: “hit hard,” “temporary blips,” “signs of life,” and “new consumer priorities.” Where the various product categories fall within these four segments in our analysis reflects averages across emerging markets, and it is important to recognize that the status of a specific category can differ significantly from one country to another:

- Hit Hard. Consumer demand plunged in a number of categories, including clothing, cosmetics, and public transportation at the onset of the pandemic, and the recovery in demand in these areas remains muted.

- Temporary Blips. Sales accelerated sharply in categories such as mobility services, staples, and health insurance early in the outbreak. But the surge in demand proved short-lived and waned through subsequent waves of the pandemic.

- Signs of Life. Demand is recovering, albeit at different speeds, in various product categories that had slumped early in the pandemic. Sales of cars, scooters, bicycles, and home construction services are among those showing the greatest improvement. COVID-19-driven trends—such as consumers’ need for safer, private transportation—may be propelling this growth.

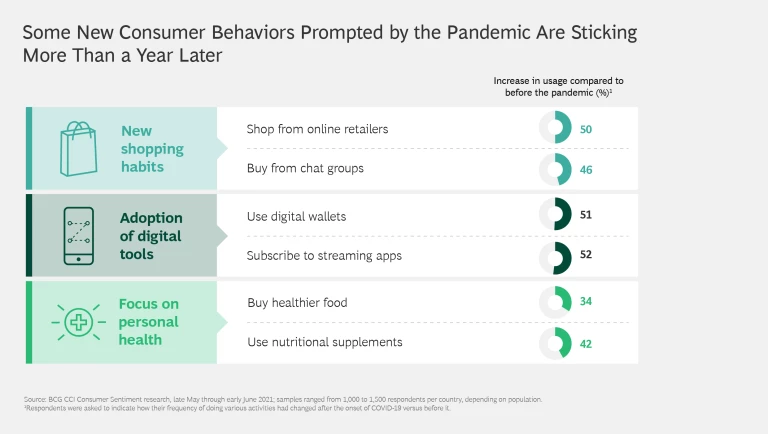

- New Consumer Priorities. Demand in some categories accelerated at the beginning of the pandemic and has continued to grow. Greater consumer concern for health, for example, continues to drive burgeoning demand for supplements and healthier foods. We have observed several other shifts in consumer behavior that are sticking, too. Shopping from online retailers and through chat groups—as well as the use of such digital tools as e-wallets and streaming apps—remain roughly 50% above their pre-COVID-19 levels.

Health Care Concerns and Silver Linings

One big question looming over emerging markets is whether the pandemic will inflict as-yet-unidentified types of long-term harm on the public. Of particular concern is the possibility of a large and potentially invisible impact on physical and mental health, as many consumers remain isolated and avoid visiting medical facilities—even for diseases that are unrelated to COVID-19.

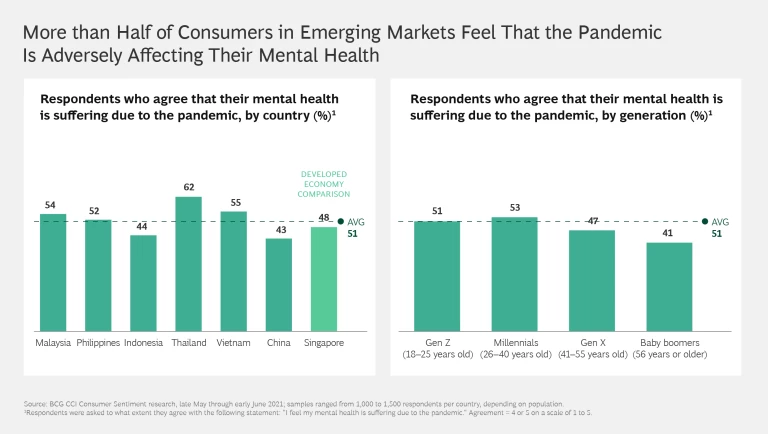

In our survey, more than half of all emerging-market consumers reported that their mental health has suffered due to the pandemic. This sentiment was expressed most strongly by Gen Z consumers (ages 18 to 25) and Millennials (ages 26 to 40). An even more concerning finding in our survey was that in most markets more than 80% of consumers said that they have reduced their visits to health care facilities for a wide range of diseases, due to a fear of contracting the COVID virus. Therefore, it will be important to see whether other serious public health concerns emerge in emerging markets in the months and years ahead.

But we also found a strong reason for optimism: widespread popular acceptance of vaccines. Even though very few respondents in emerging markets had already received both doses of a vaccine as of late May and early June 2021—the numbers ranged from 12% in Brazil to less than 1% in Vietnam—an overwhelming majority of consumers (from 69% in the Philippines to 87% in Brazil) in every emerging market except Thailand said that they are willing to be immunized. This attitude toward vaccination suggests that when vaccines become widely available in these countries, public health authorities have a good chance of bringing the pandemic under control and enabling people to resume normal life.

Our research findings have several important implications for companies. First, even though the COVID-19 crisis continues to exact economic pain and deep anxiety, emerging-market consumers remain relatively resilient. Second, the pandemic has shifted consumer behavior in several ways that are likely to endure, such as in greater emphasis on health and in expanded use of digital tools and retail channels. Third, our research shows that emerging-market consumers are determined to get vaccinated when doses become available. Viewed in combination with the prevailing mood of strong consumer resilience, this portends well for a vigorous resurgence in growth when COVID-19 is finally conquered.

Acknowledgments

A big thank you to Aditi Bathia, Ankur Jain, Deepti Tyagi, Erno Paulinyi, Flavia Gemignani, Prashant Srivash, Shriram Ramesh, and the entire CCI team in emerging markets for their contributions.