Thanks to digital technologies and digitally savvy customers, companies across industries can create a customer experience unlike anything ever seen before. CEOs, take note: this could be the biggest growth opportunity to come along in decades.

That’s because an exceptional customer experience (CX) is as good for companies as it is for customers. It’s the kind of customer insight that differentiates market leaders like Amazon, Apple, and Google. According to BCG research, companies with the highest customer satisfaction scores have generated twice as much shareholder value over the last ten years relative to the average score. These companies have seen not only better earnings but also higher price-to-earnings ratios and, therefore, greater total shareholder return. (See Exhibit 1.)

Most CEOs readily acknowledge the need to improve their CX and have already invested heavily in doing so. They also acknowledge that progress is slow and often fails to meet expectations. The key reason, in our experience, is that CX outcomes are not explicitly linked to business benefit and financial targets. So companies by default make incremental fixes to the status quo—rather than the bold innovations that are required to power real progress.

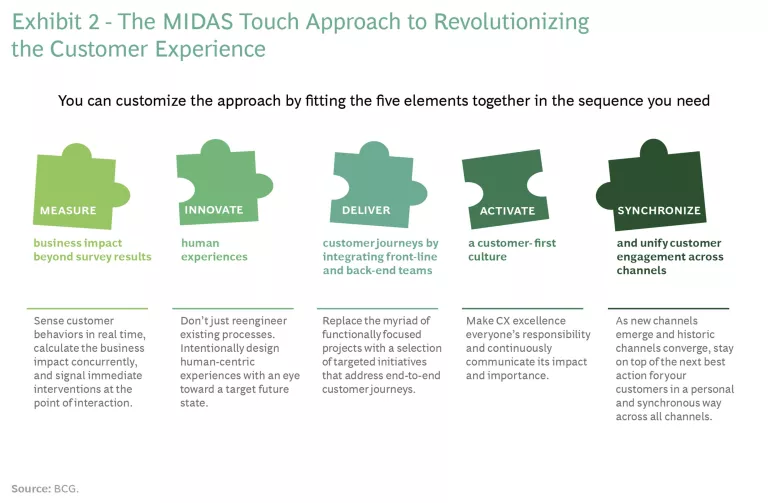

To achieve a truly differentiated CX that realizes business value, CEOs cannot rely on incremental evolution alone. They need wholesale revolution—a paradigm that changes the way their organizations think about, develop, implement, sustain, and monetize their CX program. Our paradigm, “the MIDAS touch,” has five key elements: measure, innovate, deliver, activate, and synchronize.” (See Exhibit 2.)

Here’s what CEOs should be thinking about as they adopt the MIDAS mindset.

Measure Business Impact Beyond Survey Results

When it comes to measuring CX, companies are accustomed to looking in the rear-view mirror—they rely on CX metrics from surveys conducted after the experience has happened. But survey findings don’t necessarily shed light on the causes of CX issues or their business impact. And because the metrics lag the experience, there’s minimal opportunity to course-correct in real time.

A smarter approach, BCG’s CX measurement system, provides the digital capabilities lacking in traditional listening programs. It measures, in real time, every interaction the customer has with the company as well as with third parties; moreover, it generates insights for developing real-time interventions and ties actions to business outcomes.

Building this more advanced system requires a thorough understanding of key customer journeys. As an example, a typical retail bank has six such journeys: joining to save or transact, funding purchases, buying a home, using account services, making transactions, and resolving problems. Each journey has a balanced scorecard with real-time metrics like cycle time, error rate, and funnel leakage. Most importantly, these metrics are explicitly linked to business metrics that align with business impact and KPIs. For instance, cycle times would be linked to cost and control outcomes, and funnel leakage would be linked to churn rates and attrition.

Once the metrics are identified, companies need to build a data source that they can continuously monitor and, through that process, refine core metrics. An analytical engine can then be built to identify issues along the customer journey and recommend corrective actions. Applying these interventions to the relevant physical and digital channels, companies can improve the customer journey in near real time and boost balanced-scorecard outcomes. By understanding the impact these interventions have on business outcomes, companies can create a learning system for improving the customer journey over time.

Innovate Human Experiences

Incremental improvement is a trap. For years, companies have relied on process reengineering, lean, and customer-journey-mapping techniques to understand current processes and experiences. The objective: to solve for pain points, eliminate inefficiencies, and generally improve the CX. But this approach ties up the best talent and dollars (both of which are often in short supply) in small improvements, and it has marginal impact: in our experience, it brings only 5% to 7% improvement year over year. For meaningful impact, improvement in the 30% to 50% range is required.

To develop a customer experience that is a true game-changer, companies need to embrace human-centered design. This means building a robust design function that hires, trains, and nurtures human-centric designers. With a deep understanding of the customer in context, experience designers make use of zero-based-design techniques—the proverbial clean sheet of paper—to find solutions that challenge the status quo. This method allows for breakthrough improvements that start by targeting a future state and work backwards to meet that target, as opposed to less impactful incremental methods that apply Band-Aid fixes to the current state. For this reason, human-centric designers need to be part of almost every change effort, not just digital builds.

To develop a customer experience that is a true game-changer, companies need to embrace human-centered design.

Take, for example, a retail bank that wanted to improve the process for replenishing checkbooks. Instead of mapping the journey and implementing efficiency initiatives, such as reducing the need for manual data entry, the bank implemented a new process using human-centric, zero-based-design techniques. An algorithm would proactively identify when the customer’s checkbook was running low and trigger the process for replenishing it without much customer or employee intervention.

This innovation significantly improved the experience for the customer, and it made checkbook replenishment less prone to security issues and more efficient for the bank. The results were significant: costs were reduced by more than 30% and cycle times by more than 75%, while customer satisfaction was boosted by 30 points.

Deliver Customer Journeys by Integrating Front-Line and Back-End Teams

When it comes to innovating and organizing change initiatives, many companies are in a rut: they allocate funding to various functions based on the prior year’s expenditures. For example, one retail bank had 220 different, uncoordinated initiatives to improve the CX running simultaneously across 30 functional departments. Since departments seldom shared projects or budgets, the changes delivered were not material for either the customer or the business.

To realize change that is truly transformational, companies need to consolidate their many change initiative budgets and projects into fewer and better-coordinated efforts, each of which integrates product, functional, and strategic perspectives to focus on customer journeys or customer-centric value streams. To make this approach work, companies need to adapt the way they handle governance and funding. A customer journey approach requires pooling talent and financial resources from various parts of the company to create multifunctional teams that eventually deliver results that are more than the sum of their parts. Teams should be empowered to make design and implementation decisions, while leaders set the direction and authorize the release of funding.

A robust transformation addresses customers’ needs at each step of the journey.

While a robust transformation is rooted in optimizing the CX, it also aims to deliver an optimized workforce, a better employee experience, stronger regulatory controls, and profitable revenue and cost outcomes. It addresses customers’ needs at each step of the journey (from consideration to fulfilment of a request) and the activities needed to support each step from front to back (from marketing and sales to back-office operations).

A customer journey transformation done right consistently delivers substantive benefits for both the customer and the company. An Australian bank, for example, was able to improve its customer advocacy scores from lagging to leading in the market, refresh its employee value proposition, and surpass its peer group in shareholder returns.

Activate a Customer-First Culture

All too often, CEOs launching a CX initiative neglect to bring the full organization along. Rather than creating a broad umbrella of accountability, they assign the responsibility for the transformation program’s success to a small number of people, either a specially created CX department or the relatively few employees who interact directly with customers. But this approach does not embed the necessary level of customer focus throughout the organization and frequently leads to suboptimal results.

To create transformation that is deep and sustainable, it’s critical to foster a customer-first culture.

To create transformation that is deep and sustainable, it’s critical to foster a customer-first culture. This means making the delivery of an outstanding CX the responsibility of every leader and employee, rewarding behaviors that drive good customer outcomes. Companies, therefore, need to take deliberate action on three levels: the executive leaders, the transformation teams, and the front-line leaders:

- Executive Leadership. The role of senior executives in the transformation is to activate other leaders and to set the example for the organization to follow. So, every senior executive should be measured against CX outcomes along with traditional metrics. Companies should set action plans that encourage senior executives to “walk the talk” and model the new behaviors in regular routines like staff meetings so that they can pass the culture down to their teams. Deploying world-class coaches can help leaders change ingrained habits and work in new ways.

- Transformation Teams. The teams engaged in delivering the change have the unique responsibility, privilege, and burden of executing on both business needs (inside out) and customer needs (outside in). They need to be fully cross-functional, with representation from the marketing, HR, finance, technology, and risk departments. Ways of working need to emphasize the importance of being close to customers and understanding their needs, while linking customer goals to financial and business outcomes.

- Front-Line Leaders. To activate the organization, it’s essential to create a dialogue between senior executives and front-line leaders on what they’re learning from customers. Nontraditional channels like events are a good way to strengthen this dialogue as changes are being rolled out. Companies should also assess leaders based on the new target behaviors, identifying “heroes” whose behaviors are worth emulating. Conversely, if some leaders miss the mark, companies shouldn’t hesitate to make whatever talent changes are necessary.

Synchronize and Unify Customer Engagement Across Channels

It’s become critical to engage with customers through seamless, personalized interactions across multiple touch points. But many companies are still facing two basic, confounding issues: disconnected channels and siloed management. Reliance on multiple, nonconnected databases makes it difficult to create a true 360-degree view of the customer that is consistent across the organization. Furthermore, interaction channels are managed independently of each other, which is likely to lead to conflicting messaging.

To address these issues, companies first need to create a centralized database and put all information on every customer’s interactions across all channels and business lines there. That way, everyone in the organization has the same level of customer understanding, thus removing friction. A centralized database should be a priority even in businesses like automotive and insurance, where an intermediary has primary access to customers and their data.

Next, companies need to develop a highly automated solution, usually powered by artificial intelligence, that can continuously gather and analyze the data for each customer and recommend the next best action. Companies can use various metrics, depending on the particular business objective; they include propensity to buy another product or service, price sensitivity, and preferred channel.

Then, companies should launch the recommended actions in the recommended channel. Call centers, branch staff, and marketing teams must be completely aligned in order for actions to be fully coordinated and the right content activated.

A telco that wished to increase its revenue from top-ups (prepaid charges for mobile phones) invested in an AI platform to understand why customers buy them—or not. The platform made it possible to test several different reasons for these purchase decisions, including the particular channel used for the communication, the content of the message itself, and the time of day when the message was sent. The company sent targeted messages to consumers who had used up nearly all their credit. Moreover, it prevented customers from dropping the service by calling and offering a discount. The first of these two actions boosted revenue from top-ups by 15%, and the second reduced the churn rate by 20%.

To turn your CX into gold, we’re advocating nothing less than a revolutionary overhaul of most companies’ CX programs: an operating model that puts humans at the center of the business. Like any major transformation, it’s critical to begin with a broad vision and assess how current CX capabilities measure up against it. Once the gaps are identified, companies should develop a roadmap to address them systematically.

Customer experience is not a fuzzy, feel good thing; it is a business imperative and CEOs need to treat it as such. Companies that don’t will be left behind.