Over the past decade, public and private sources have dedicated impressive amounts of energy and resources to digital agriculture in developing countries. If only the impact on the lives and livelihoods of the more than 500 million smallholder farmers around the world were as large.

Myriad digital agriculture initiatives and startups have leveraged digital tools and technologies in hopes of increasing farmer productivity and incomes , strengthening food security , and enhancing the resilience of food systems. In India alone, capital investments in agricultural technology (digital ag solutions along with other components such as hardware) between 2014 and 2019 have totaled $1.7 billion. Yet few digital ag solutions have reached scale: today, in sub-Saharan Africa, only 15 digital ag solutions exceed the 1 million registered users mark, and in many cases only 15% to 30% of registered users are active users.

To understand why digital agriculture has not yet lived up to its potential—and how countries might accelerate development of the sector—we conducted an in-depth assessment of activity in fourteen geographies across sub-Saharan Africa and South Asia. From that work, we identified three insights that many governments and private- and social-sector players overlook or fail to fully appreciate:

- It’s a journey. Different countries or regions have reached different levels of digital agriculture maturity, and they face different obstacles depending on their maturity level. Without a clear understanding of their maturity level—and a roadmap for tackling the most pressing obstacles—they may adopt a mindset of “digital for the sake of digital” that yields little progress.

- Innovation isn’t enough. From a planning perspective, it is not sufficient to let a thousand flowers bloom and hope that the right solutions gain traction. Until adequate growth-stage capital and a strong focus on developing robust, scalable business models are in place, meaningful impact will remain out of reach.

- Markets matter. Besides limiting farmers’ livelihoods, inefficient agriculture markets in many countries dampen the utility and impact of digital agriculture solutions. Yet digital agriculture efforts in recent decades have disproportionately focused on improving farmer productivity rather than on supporting market development.

When players across the digital ag ecosystem—governments, private-sector entities, and social-sector organizations—factor these insights into their strategies, they can accelerate sorely needed progress. Broad adoption of solutions throughout the agricultural value chain can help mitigate the economic blow of COVID-19 , including the impact of movement restrictions on farming productivity, and advance the UN’s Sustainable Development Goals (SDGs). The question is whether all stakeholders within the ecosystem can work cooperatively to turn the promise of a digital revolution in agriculture into a reality.

The Unrealized Promise of Digital Agriculture

Agriculture forms the backbone of many developing economies, serving as a source of food security and providing income and livelihoods for the world’s smallholder farmer households, which number in excess of 500 million. And as populations rise and appetites for more diverse diets grow, food demand will continue to increase in these developing economies. Nevertheless, smallholder farmers face multiple problems that severely limit their agricultural productivity and income potential, including limited information about proper agronomic practices, poor access to credit and inputs, rudimentary logistics and transportation services, and inadequate planning and risk management. In the decades ahead, smallholder farmers also face harmful repercussions of continued global temperature increases, including smaller yields and greater prevalence of crop and livestock diseases and pests.

Digital agriculture can help smallholder farmers surmount these challenges, increasing their productivity and integration into food value chains and supporting their adoption of climate-smart practices. For example, the emergence of integrated data sets combining satellite imagery and weather and soil data is a significant advance; service providers and development partners could leverage these data sets to provide famers with more affordable credit and insurance, better early warning of crop failures, and improved farm management.

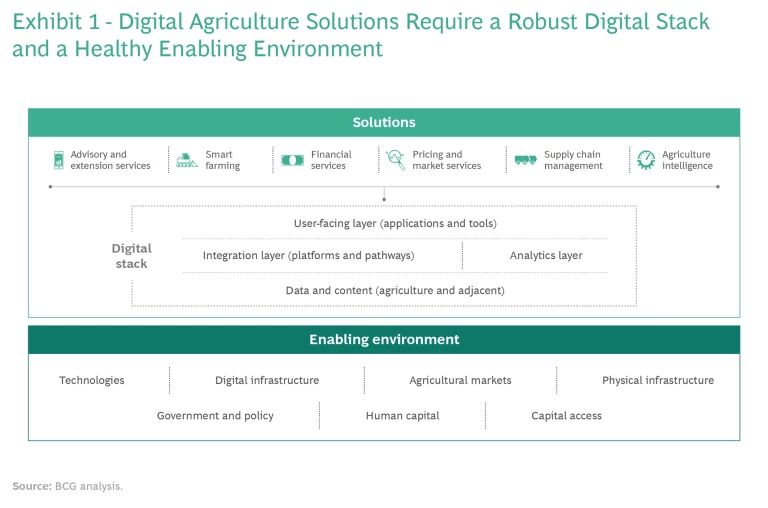

Today, digital ag solutions run the gamut from simple advisory services that send text messages about optimal planting times or imminent pest threats to complex, integrated platforms that aid farmers in managing their supply chain or accessing financial services. These solutions typically consist of elements of a digital stack comprising data and content (such as agronomic guidance), an integration layer, an analytics layer, and a user-facing layer (including apps and tools). Supporting them are such enablers as a solid digital infrastructure, appropriate government regulations and policy, healthy and fully functional agricultural markets, and sufficient human capital. (See Exhibit 1.)

Expanding access to technology in developing countries is setting the stage for accelerated digital ag innovation. More than 80% of people in developing economies now have a mobile phone, according Gallup, and nearly 45% of people living in developing markets used the internet in 2019, according to Statista. Meanwhile, the already low cost of transmitting information via inexpensive texts, voice messages, and videos is declining rapidly in places such as India and sub-Saharan Africa. In that environment, digital ag has the potential to transform the sector much as digital tools have done in industries such as finance and health care.

Despite many individual success stories in digital agriculture, however, evidence that it has had a major, positive impact on smallholder farmer incomes is surprisingly limited. Most solutions that have reached scale have focused on medium-size farmers or intermediaries such as agro-dealers. And users often do not leverage the solutions that do reach them. Safaricom’s DigiFarm, for example, has more than 1 million users, but estimates in 2020 put the share of active users at less than

Three Key Insights

So, what is holding digital ag efforts back? We think that many current digital agriculture efforts by public-, private-, and social-sector players fail to reflect three key insights.

It’s a Journey

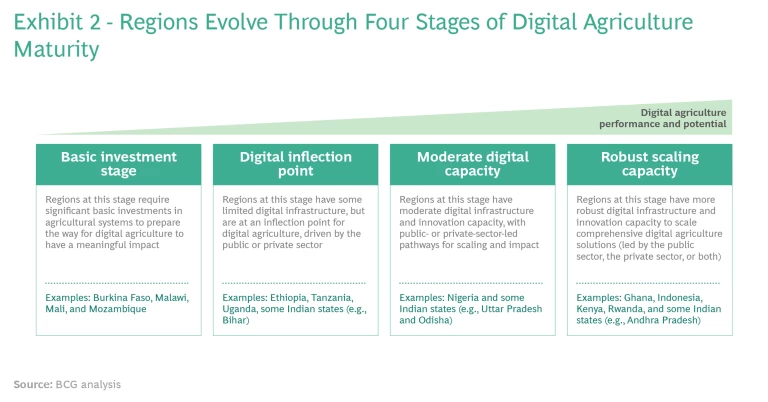

Too many companies and startups try to roll out solutions in countries where the ecosystem is not mature enough to support it. These efforts fail to take into account the fact that digital ag ecosystems evolve along a continuum. We have observed four primary stages: a basic investment stage, a digital inflection point, a stage of moderate digital capacity, and a stage of robust scaling capacity. (See Exhibit 2.) Each of these stages reflects a step change in the digital ecosystem and in the ecosystem’s ability to deliver value and impact for farmers.

The challenges to development, and the elements required to accelerate it, differ at each stage of ecosystem evolution. In particular, different stages require a different balance between investment in solutions and elements such as enablers (including digital infrastructure) and digital stack components (including mobile infrastructure, digital identity layers, and digitization of land records). In fact, 75% of scalable interventions operate in just three countries—Kenya, South Africa, and Nigeria—all of which have relatively well-developed digital ecosystems. Enablers and digital stack components typically don’t create immediate impact, but they are critical to the development of high-impact solutions including digital advisories, supply chain solutions, and e-marketplaces.

Innovation Isn’t Enough

Frequently, even digital ag solutions with promising business models don’t achieve scale. That’s because of limited growth-stage financing (the funding that supports companies in the period between startup and rapid growth) and constrained capabilities to support the scale-up of digital ag solutions, including the ability to articulate a robust business model and product-market fit.

Adequate availability of growth-stage capital and suitable capabilities are critical, given the high risk profile of digital ag in developing markets. Factors contributing to the high level of risk include restrictive regulatory environments in some markets, the challenge of integrating millions of smallholder farmers into the market, and the potential negative impact of climate change on the economics of the ag market in the years ahead. As a result, these businesses often need strategic investments, including bridge capital, and expertise in pushing them forward.

Today, relatively few strategic investors and accelerators are on hand to provide this support and capital, and most of them are international. For example, some 80% of the capital invested in Indian ag-tech in 2019 came from international investors. Such investors often shy away from ventures that carry high levels of risk such as those present in early to middle-stage digital ag plays in these countries. That helps explain why the bulk of digital ag investments in India in 2019 went to late-stage, established deals; very few transactions involved bridge capital.

A few notable exceptions prove the rule. Revenues at Twiga, a digital platform that connects smallholder farmers with mama mbogas (small-scale vegetable vendors) and small stores in urban areas, grew by 500% last year and now serves 5,000 Kenyan outlets daily and works with 13,000 farmers. Jumbo Tail, a marketplace that links local Indian kirana (traditional retail grocery) stores with brands and traders, serves upward of 30,000 neighborhood stores in India. So far, however, such successes are few and far between.

Markets Matter

Domestic agriculture markets in many developing countries remain fragmented and inefficient, owing to such factors as information gaps, price asymmetries, weak systems for aggregating output and quality assurance, and significant logistics and transportation issues. But digital ag efforts are not sufficiently focused on addressing the situation.

Today domestic markets dominate agricultural trade in many regions. In sub-Saharan Africa, for example, some 96% of total farm output goes to domestic markets. As urbanization increases, demand tends to concentrate in large population centers while production centers remain rural. For this reason, agricultural markets play a pivotal role in aggregating demand and supply, facilitating transformation of raw materials into value-added products such as milled rice, and enabling discovery of market prices. Inefficient and weak agriculture markets, however, constrain the agriculture system overall and prevent smallholder farmers from tapping into demand centers where they might sell their products at competitive prices.

Digital ag has the potential to accelerate the development of agricultural markets and connect farmers to buyers who will purchase their outputs. Digital solutions can, for example, offer price information services for inputs and outputs, enable demand and supply aggregation, and facilitate e-marketplaces. In fact, the Technical Center of Agricultural and Rural Cooperation (CTA) estimates that market linkage solutions deliver, on average, a 73% improvement in farmer productivity (including through access to lower-cost seeds and fertilizer) versus just 23% for digital advisories. Our review of dozens of current market solutions revealed a number of successful alternatives, but no one-size-fits-all approach. (See “A Spotlight on Market Solutions.”)

A Spotlight on Market Solutions

Our examination identified winning offerings that have very different profiles—some led by government, others by the private sector and others by a mix of the two; some integrated and some discrete. The following four examples suggest the range of possibilities.

Government-Led Integrated Solution: India. The Government of India is in the process of building a platform dubbed IndEA Digital Ecosystem for Agriculture (IDEA). IDEA is being designed as an open platform whose goal is to use open digital technologies to offer farmers integrated services across inputs, production, and post-harvest, such as soil health monitoring, crop loss/damage assessment, smart logistics and distribution, and market access.

Public-Private-Partnership-Led Integrated Solution: Rwanda’s Smart Nkunganire System. Against the backdrop of a relatively mature, mostly government-led digital agriculture ecosystem, Rwanda's Smart Nkunganire System (SNS) is a public-private partnership between the Rwanda Agriculture Board and BK TechHouse. Targeting end-to-end digitization and supply chain management of Rwanda's public-sector Agro-Input Subsidy program, the platform has registered roughly 1.2 million farmers and more than 1,000 small agro-dealers.

Private-Sector-Led Discrete Solution: Olam’s Digital Solution Suite. Over the past few years, the international agribusiness Olam has expanded its portfolio of digital tools to rethink the way farmers access markets, providing end-to-end traceability over the supply chain and capturing activities at the level of individual farmers. The company has also taken steps to ensure that its solutions are accessible to smallholder farmers, including through training sessions that rely on images and practical demonstrations to reach people who have basic or no literacy skills.

Private-Sector-Led Integrated Solution: DeHaat’s Success in India. DeHaat is an accessible online platform that brings together an ecosystem of partners to provide a range of agricultural services, including access to agricultural inputs and financing, as well as connections to bulk buyers. DeHaat has also developed a network of more than 1,300 micro-entrepreneurs who use the platform to help farmers source inputs and access free agro-advisory services; today these micro-entrepreneurs serve about 350,000 farmers.

Despite those success stories and the clear need for tools that improve market efficiency, digital ag companies continue to overemphasize productivity-based solutions. Agricultural advisories, which focus on helping farmers improve their productivity, account for roughly 66% of all registered users, compared with just 9% for market-linkage solutions, according to CTA.

The Roles of Three Key Stakeholders

Governments, private-sector players, and development organizations and donors all have parts to play in driving the development of the digital ag ecosystem. Those efforts should be coordinated, should reflect the maturity of the markets in question, should aim to drive promising solutions to scale, and should enhance the development of agricultural markets in general. In addition, they should meet farmers where they are (as opposed to where digital ag players would like them to be) in terms of their ability to afford and use solutions.

Governments. It is critical for governments to begin by identifying the maturity level of their country’s or region’s digital ag ecosystem. Armed with that assessment, they should create a roadmap in partnership with private-sector and social-sector players to make the required investments and remove critical obstacles to advance through the maturity spectrum. Progress can look very different at different maturity stages:

- In early-stage ecosystems where mobile penetration is limited—those at either the basic investment stage or the digital inflection point—governments should review their regulatory frameworks, paying particular attention to policies or regulations that may affect private sector investment. Establishing suitable regulatory frameworks can spark investments that are necessary to expand mobile networks.

- As a country’s digital ag ecosystem reaches the digital inflection point, and again as it begins to achieve moderate digital capacity, with a sufficient critical mass of digital solutions, the government can play a critical role in digitizing data to make it accessible and appropriately structured for digital solutions. Such data, including digital identity information and digitization of land records, tends to be in short supply. Strong government leadership in data digitization has fostered the development of a robust digital ecosystem in Rwanda and in the Indian state of Andhra Pradesh. In some cases, the task may entail digitizing existing government paper documents such as land records; in others, it may involve developing new sources of data. Making the digital data available to private-sector players will enable them to focus on developing optimal tools and solutions.

- At the moderate digital capacity and robust scaling capacity stages, governments can introduce incentives to encourage solution providers to make their tools accessible and interoperable with other solutions. Such efforts will promote inclusivity and reduce duplicative design work.

Private Sector. Private-sector players, including mobile network operators (MNOs), large-scale agribusiness companies, and small and medium-size enterprises (SMEs) are best positioned to act in three areas:

- MNOs can drive explosive, cost-efficient growth in digital infrastructure. In India, Myanmar, and Kenya, for example, digital connectivity has grown rapidly thanks to private-sector investments. One company, Reliance Jio, has amassed over 400 million subscribers in the past five years thanks to major investments it has made in India. And Safaricom’s investments in Kenya helped bring more than 35 million people online.

- Large agribusinesses can help develop digital agriculture ecosystems in two ways. First, they can promote the development of robust agricultural markets. This includes using digital tools, developed in house or by other solution providers, to increase the amount of product they purchase from smallholder farmers. In this way agribusinesses can function as an anchor organization, giving farmers reliable buyers at better prices than they would otherwise garner. Second, they can support the scaling of winning digital ag solutions. This may include acting as strategic investors and advisors to solution providers and incubating promising ideas. THRIVE, a US-based accelerator, receives support from large agribusinesses such as Corteva. Besides benefiting the recipients of the funding, such arrangements can help agribusinesses by enabling them to identify promising innovations early on and leverage those themselves.

- Agribusinesses, MNOs, and SMEs can provide last-mile access to smallholder farmers, by creating connectivity via mobile phone networks or via in-person touch points.

Development Organizations and Donors. Development organizations and partners are uniquely positioned to take an ecosystem approach, connecting the dots between promising solutions and the capabilities, capital, and coordination that those solutions need to scale in developing markets.

The specifics of their role will differ depending on the maturity of the market. At the basic investment stage, for example, they can sponsor contests and competitions to spur innovative activity, and they can invest in knowledge hubs that catalog and transfer lessons from mature regions to areas that are at this early stage of development. In later stages of digital maturity, they can aim to overcome specific barriers in ecosystems that the private sector cannot address on its own. This effort may include advocating for improvements in regulatory frameworks, supporting the development of inclusive solutions by making growth capital available to solution providers or agribusinesses, and by offering technical assistance to solution providers and governments.

Digital agriculture has the power to transform life for smallholder farmers around the globe. Digital solutions can help farmers access the best inputs, adopt the most effective cultivation practices, improve the quality of their produce, and connect with the right buyers to maximize their incomes.

But to fully realize that potential, all players—governments, businesses, and development organizations—must work together to support digital agricultural development. This effort should reflect a thorough understanding of the actions and investments needed at a particular time, given the country’s maturity level, and of the role that each stakeholder is best positioned to play. And finally, all stakeholders should develop tools and solutions that advance the development of the agriculture market. When that happens, the promise of digital agriculture will become a reality.