Digital Banks Take Off

Consider the following comments from consumers across Asia-Pacific (APAC):

- “My bank is always on. I can open accounts instantly, just like same-day deliveries from Amazon… only better!”

- “I have not seen my bank branch. My bank simply follows me wherever I am, whatever I need.”

- “My bank has the best offers, personalized specially for me.”

- “I try to maximize the use of my bank to ‘earn’ the most value… just like I use [Amazon] Prime for all my shopping.”

Digital banking in APAC is taking off, and the battle for digital consumers is joined. Of some 250 digital banks worldwide, 20% are in APAC. They operate across the region, and many are growing fast. They have wealthy parents, too: corporate backers and joint venture partners include incumbent local banks, global banks, technology and telecommunications companies, and e-commerce ventures, among others. They seek to serve customers with diversified and personalized offerings, and they share key features such as electronic client servicing, a comprehensive digital infrastructure underpinning their operations, and 100% digital delivery to customers.

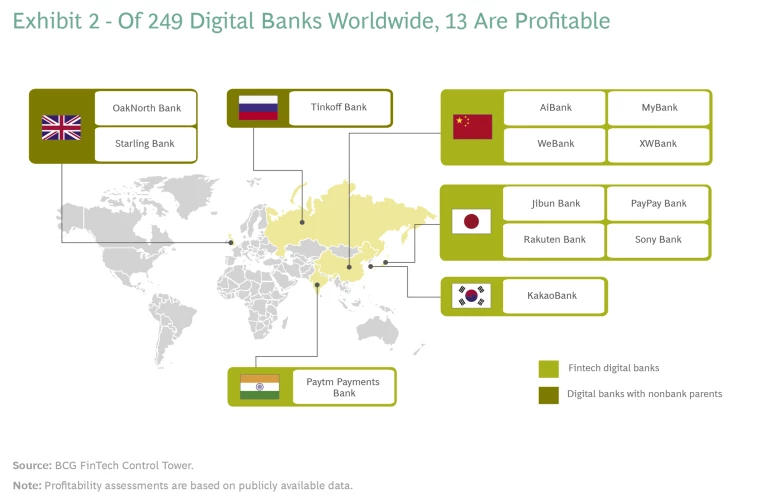

Only a few—about 5% by our estimate—have so far crossed the line into profitability. Although the local markets can be big, attractive, and ripe for growth, they are not easy to crack. Players need strong knowledge of consumers and customs. They must navigate often-complex regulatory landscapes. And they need to persevere. Banking, whether digital or otherwise, is still a new idea for many consumers who are accustomed to alternatives. Earning customers’ trust—and willingness to try something new with their hard-earned funds—takes time.

This report examines the fast-changing digital banking marketplace (or marketplaces) in APAC. It assesses the changes that are under way and the different types of players that are driving them. It also explores the critical components of success for those already engaged in or thinking about entering the digital banking battle.

The Changing APAC Banking Landscape

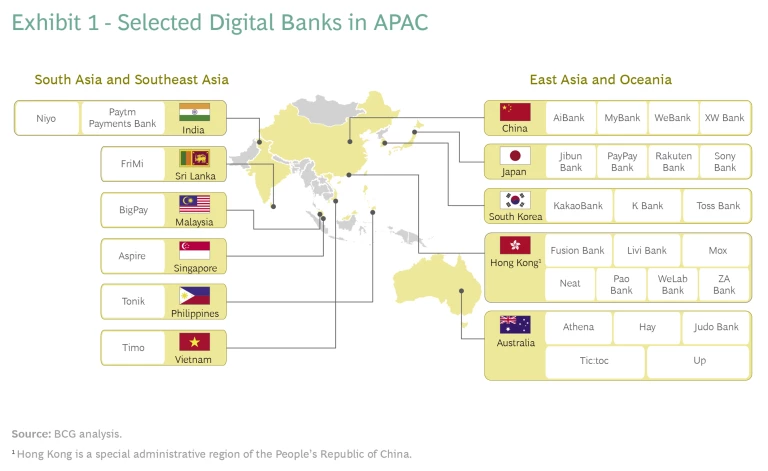

We estimate that APAC is home to about 50 digital banks, most of them consortium players backed by technology giants and nonfinancial institutions such as tech and telecom companies. (See Exhibit 1.) They seek to leverage competitive advantages in existing user bases, data, and technology. Many of these operators are relatively new to the market. More than 70% of them were established during the years from 2016 to 2020.

As the digital insurgency gathers force, incumbent banks face pressure to upgrade their own digital capabilities to cater to evolving customer expectations. Some have taken conservative approaches, typically seeking to improve existing digital operations. Others have moved more aggressively, launching standalone digital businesses that target new or existing customer segments with independent operations. Competition for market leadership remains wide open in most countries, although national requirements governing which ones can play vary. In all markets, though, a strong corporate ecosystem (including a customer base) and good branding are important assets for new banks to have at their disposal.

The Keys to Success at Digital Banks

Our analysis shows that 13 of the 249 digital banks worldwide, about 5% of the total, are profitable—and 10 of these are based in APAC. (See Exhibit 2.) Still, none of these leaders have captured more than 2% of market share in terms of total value of deposits and loans within their target segments (typically retail customers and small businesses). The profitable digital banks have established strong lending propositions. Four entered banking from digital payments.

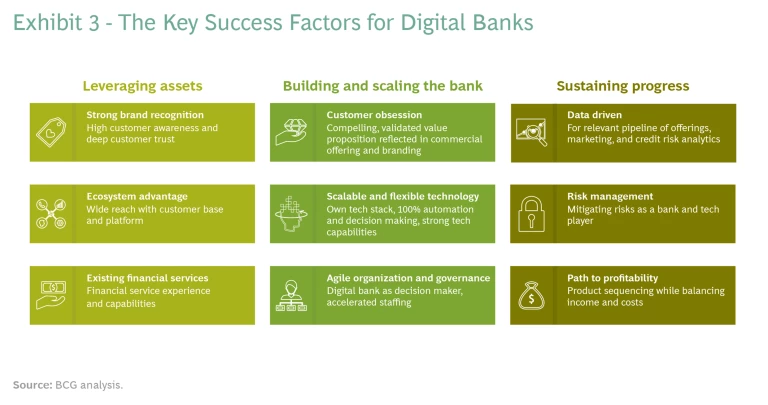

What the profitable players have in common is backing from established companies with significant business experience and substantial ecosystems. This support yields several major advantages including strong brand recognition, established customer bases, and rich data to drive customer insights and customization—all of which the digital banks have used for customer acquisition and operations. Three factors, in particular, have been critical for success: leveraging existing assets, scaling up digital operations quickly, and sustaining progress over time. (See Exhibit 3.)

Leveraging Assets

Existing assets such as brand recognition, customer networks, and financial services experience provide many digital banks with key competitive advantages. Success is often rooted in the capabilities and strong alliances and partnerships of parent companies, which enable players to combine and reinforce strengths in customer access, data, and technology.

Strong Brand Recognition. Since banking relationships depend on trust, operators need strong reputations to reinforce customers’ confidence that they will tightly protect both money and personal information. To this end, some successful digital banks have leveraged the reputation of their parent brands or financial partners to acquire customers at a faster and often more affordable rate than others, while having to devote fewer resources to building brand awareness.

Customer Networks. Access to a large established network of digital customers gives new players seeking to target a digital customer base an invaluable head start. They avoid having to attract users to digital channels, which significantly speeds customer acquisition. Moreover, once a digital bank is fully embedded in an existing ecosystem, providing seamless digital financial service delivery across the ecosystem is relatively easy.

Ecosystem players can also use a wealth of existing data to build better customer insights and more customized service delivery, yielding a highly effective platform for both cross-selling and personalized offers. Access to data adds a further benefit: operators can build higher-quality credit underwriting models.

Financial Services Experience. Existing knowledge of financial service delivery offers another strong advantage by making it unnecessary to climb steep learning curves in such areas as risk management and regulatory requirements. Existing experience also contributes a pool of transaction data and credit scoring models, which give new players an informed starting point.

Building and Scaling a Digital Bank

Successfully building and scaling a digital bank requires a focus on three pillars of success that stimulate customer engagement and ensure critical business agility: customer obsession, scalable and flexible technology, and agile organization and governance.

Customer Obsession. Successful digital banks focus incessantly on what local customers want. They provide a compelling value proposition and appealing product features, which they strengthen through continuous market testing. Successful digital banks employ many of the same customer-focused tactics that consumers have come to expect from leading consumer-oriented technology companies, such as Alibaba, Tencent, Grab, and FlipKart. Digital operators go beyond the simple event-based engagement that traditional banks rely on, to grow and scale at an accelerated pace. Digital banks also embrace an end-to-end approach that covers the full customer journey, including acquisition, engagement, deepening relationships, and customer referral. They focus on much more than product features: a user-friendly and intuitive user interface (UI) and a positive user experience (UX) are prerequisites to meeting digital customer expectations.

Scalable and Flexible Technology. Operators should develop a robust banking architecture built on scalable and flexible technology and cloud-native components. This tech stack should incorporate five key layers:

- Integration, with standard APIs

- Front-end engagement

- Integrated data and advanced analytics

- Operations

- Security, with secure-by-design features

Agile Organization and Governance. Evidence indicates that digital banks work best when run independently so that they can focus on their own success with full-speed decision making and execution.

Organizational structures should enable collaboration between digital talent—including IT staff—and bankers. Management should embrace an agile structure as the bank scales, echoing the growth strategies of successful technology firms. An iterative process of testing and execution will underpin a flexible and efficient organization, but the bank must capture this approach in the governance framework of systems, controls, and processes. A clear division of roles and corresponding decision rights and responsibilities among business functions will legitimize and balance interactions.

Sustaining Progress

Sustaining progress requires maintaining a tight focus on the key facets of service delivery (especially data and analytics), risk management, and profitability.

Data and Analytics. Unlocking the value of insights drawn from consumer data is critical to meeting expectations for personalized and customized product offerings and identifying the best approach to targeting different market segments. Successful banks often leverage both internal and external resources to build out this consumer understanding.

Risk Management. Digital banks must define, agree on, and formalize policies covering end-to-end data access and information security. Operators should adhere to risk management principles tailored to digital banks and incorporate the specific risks around data and technology.

Successful digital banks learn to leverage automation and big data to manage risk quickly and effectively. Automated credit assessments of loan applicants take in such information as social data, online behavior, transaction data, and buying behavior and have proven very effective in limiting exposure to nonperforming loans.

Path to Profitability. As they establish themselves in the market and grow, successful digital banks gradually introduce additional curated products that address the needs of target customers. They avoid bombarding customers (and potential customers) with confusing arrays of products or features at launch. A fruitful path is to start with a simple but essential product such as payments, personal loans, or current account-saving accounts (CASAs). Payments ensure regular customer usage, personal loans generate earnings and hook customers, and CASAs enhance profitability as a low-cost source of funding.

As a bank expands, it should continuously innovate on services and apps to maintain customer engagement and ensure daily usage. Ethnographic research, particularly among consumers who are unaccustomed to using a bank, can identify unmet needs and build understanding of customer pain points. Such understanding is critical to offering the right product features to the right customers. The bank should clearly identify its revenue sources and balance new offerings against maintaining low customer acquisition costs (certainly below those of traditional banks).

Our research shows that the most successful players rely primarily on interest-based income during their early stages, which requires a strong lending proposition. A clear strategy on how to maximize margins while offering low- or no-fee services to underserved segments is crucial. Given the essential role of technology, low IT and operational costs are critical as well.

Potential Markets for Success: Southeast Asia and India

Consumer digital usage and evolving regulatory frameworks in Southeast Asia and India offer notable opportunities for digital banks. COVID-19 has accelerated this potential, driving greater digital adoption and highlighting the pathways to digital banking growth.

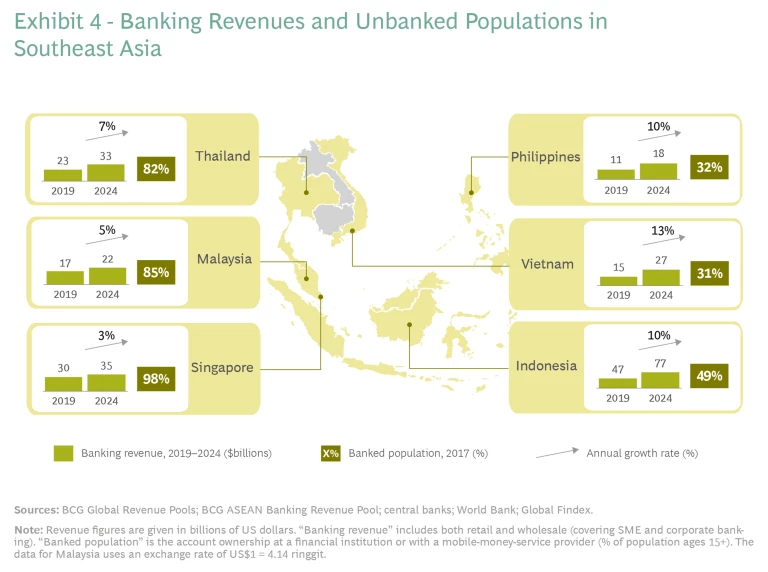

We project Southeast Asia’s banking sector to grow significantly in coming years, with Vietnam, the Philippines, and Indonesia on track to register double-digit growth from 2019 to 2024. (See Exhibit 4.) These countries have large underbanked populations and are ripe for disruption by successful digital banks. India’s substantial population and young demographics present many similar opportunities.

Six markets offer the greatest potential.

Malaysia. Malaysia boasts a digitally savvy population and, despite banking penetration of 92%, still has room for significant growth—particularly in services tailored to underserved individuals and small businesses. With Bank Negara Malaysia, the nation’s central bank, set to award up to five banking licenses by early 2022, numerous bidders are already vying for attention, meaning others that want access to this market opportunity must move fast.

Indonesia. Half of the population in Southeast Asia’s most populous nation is 30 or younger, making it a big potential market for financial services. Indonesia’s middle and affluent classes are expected to expand by up to 130% from 2019 to 2024. The current banking industry is fragmented and competitive, and the government is expected to release new regulations for digital-only banks in 2021. Although new banking licenses could be difficult to obtain, M&A is an avenue for market penetration; however, this route will become more expensive as competition increases.

Philippines. With the second-largest population in the region, a high-growth economy, and a large unbanked population, the Philippines is fertile ground for digital banking players. The government plans to issue five digital banking licenses as part of a push to boost banking participation and digital financial transactions. It has already awarded three of those licenses, so new entrants will have to act quickly to ensure access to the first round of license opportunities.

Vietnam. High GDP growth makes Vietnam an attractive market. The cash economy currently dominates, but formal banking is expanding at a rapid pace and now serves 40% of the population. In the near term, SBV, the central bank, has not expressed an intention to provide separate digital banking licenses; instead, it is angling to issue regulatory documents to guide banks on how to launch specific products online.

Thailand. With a more mature economy than some of its regional neighbors, Thailand offers a steadier market of opportunity. Limits to foreign ownership and the absence of any formal digital banking licensing process make the prospects for market access uncertain for digital banks, but public opinion remains receptive to the concept.

India. India’s enormous population gives its market potential a higher order of magnitude. It also presents hurdles for foreign players related to cost, the dispersed nature of the market, and regulatory rules that seek to promote financial inclusion. The Indian market is easily large enough for domestically focused, balance-sheet-led digital banks to create value, and a substantial pool of local technology talent provides a boost for technology-driven operators. Nevertheless, there is a strong opportunity for foreign as well as domestic players to participate at scale in India.

Winning a License to Operate

In every market, digital banks must demonstrate to regulators their intention to meet the needs of local consumers, which can differ greatly by country. They must also show their capacity and commitment to run a bank. Six qualities are especially important to exhibit to regulators.

Innovation. Digital banks should demonstrate an ability to provide enhanced financial services through innovative features and delivery that improve customer service and the broader industry. Improvement cannot appear to come at the cost of disrupting the existing banking industry.

Commitment. New entrants can show their commitment to digital banking success by demonstrating locked-in funding sources, the in-market presence of key leadership and personnel to run the bank, and the buy-in of their shareholders.

Relevancy. Regulators will look for evidence of a strategy designed to deliver positive economic and societal impact. This must include boosting financial inclusion and making banking products accessible to underserved markets.

Sustainability. Digital banks need to show that their banking model is secure, sustainable, and resistant to volatility. Evidence of these capabilities should include a strong corporate governance plan as well as systems, controls, and processes for effective management and security.

Preparedness. Applicants can show that they are a step ahead of the competition by offering a go-to-market plan that they can execute immediately upon receiving a license.

Engagement. In many instances, regulators are open to shaping the emerging digital banking sector in partnership with industry participants. Applicants should engage collaboratively to understand regulators’ goals with respect to market development, together with the process and requirements for applications and any significant regulatory concerns they may have about new entrants.

Planning a Path Forward

Designing the right strategy for a digital bank is not easy. Incumbent banks should weigh the challenges of transitioning legacy IT infrastructure and long-standing organizational processes to new models against the costs of inaction, which may include lost revenue, customers, and share. Nonfinancial institutions should consider the significant market and regulatory complexity of the financial services industry and how best to leverage their existing skill sets and experience.

Considerations for Incumbent Operators

Legacy banks have begun to realize that they sit on massive lakes of data, which are the basis of success for digital banks. They can also benefit from significant cost savings and productivity improvements, as well as from access to enhanced risk and financial management through data and automation.

But steering a modernization journey is a major challenge. Legacy institutions commonly struggle to make the transition from siloed organizations and aging IT infrastructure to an agile, data-driven approach that is fundamental to success in digital ventures. Rigid governance structures and traditional financial industry mindsets can hamper recruiting or developing digital talent and updating outdated IT.

Many top-tier banks—which account for about 70% of market share in most APAC markets—look favorably on the potential of a free-standing digital bank built from scratch, making it an attractive alternative to a difficult and jarring internal transition. Separate digital ventures sidestep inflated and complex organizational structures, avoiding potential internal conflicts. They also give established banks an opportunity to project a fresh digital brand that can appeal to digitally savvy customers.

Even so, many legacy banks focus on improving existing digital channels rather than establishing a new digital bank. Capital and investment needs for a new venture, customer acquisition costs, and high uncertainty about returns remain key concerns. With their well-stablished market positions, many legacy institutions would prefer to win customers through an omnichannel presence, particularly as full digital penetration is not yet the norm in APAC.

For smaller banks, size is a major consideration. Since smaller institutions operate on a more limited scale, they are less concern about the possibility of cannibalizing market share from the existing bank. As a result, new digital banks have more freedom to target any attractive market segment, which can make it easier to engage digitally savvy customers.

Regardless of their size, incumbent players that are considering building a digital bank must address several questions and concerns:

- Value. Why is the incumbent building a new bank rather than transforming to an omnichannel digital approach?

- Structure. Will the digital bank be a part of a business unit inside a bank, a separate legal entity, or a partnership with other players? Creating a new legal entity may mean having to apply for a separate operating license.

- Position. Where will the digital bank sit in the bank’s omnichannel approach to products, services, and pricing—or will it operate as a completely separate business with differentiated offerings? If operating separately, will it carry the same brand, a sub-brand, or a completely new brand? Establishing an entirely new brand raises issues related to customer acquisition and ecosystem utilization.

- Technology. Will the digital bank incorporate some of the incumbent’s legacy systems, or will it take on the challenges of building a fit-for-purpose technology platform? Answering this question will entail assessing the dynamics of migrating existing digital assets and data to a new platform, as well as the relative merits of operating two systems in parallel versus undertaking a complete transition to a new platform.

- Digital Prospects. What digital assets and unique advantages does the incumbent need to leverage? What ecosystem does it have, and how should this be used? Is the incumbent’s IT architecture sustainable and flexible enough to compete against expert tech-driven digital challenger banks? What should the end-state enterprise architecture be?

Challenges for Other Companies Entering Digital Banking

Nonbank players must identify the right strategy on the basis of their capabilities and preferred model, while recognizing the particular challenges and opportunities of a given target market.

Technology companies should build a platform that integrates users and partners. The benefits and risks will vary depending on the type of products offered and the level of underwriting risk that the company is willing to accept. Establishing a full digital bank, with a full suite of products and a digital banking license, offers access to robust customer financial data and potentially better income opportunities. On the other hand, this approach is far more complex to build, and it requires much higher upfront investment. Reaching breakeven takes time—a fact that potential operators must take into consideration.

Companies should consider several strategic questions when deciding which model to embrace:

- Can we afford to become a full digital bank?

- Why would we be successful?

- How could we accelerate success?

- What alternative strategies to becoming a full banking operation are available to us?

A company’s shareholder structure could affect its assessment of the model of choice. For fintech and e-payment players, building ecosystem partnerships is particularly critical.

What It Takes to Build a Digital Bank

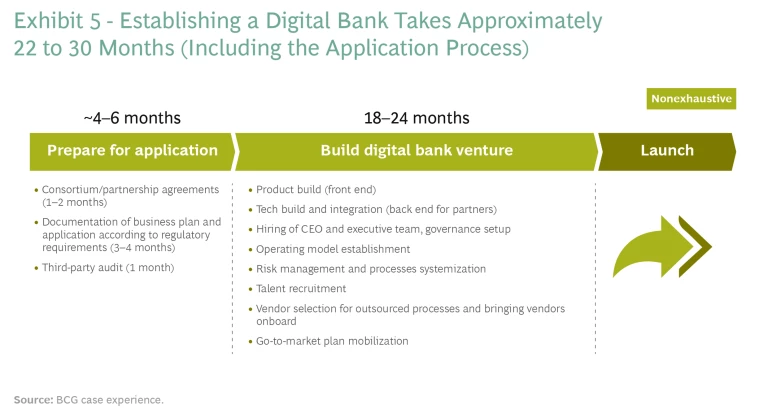

Here are the crucial steps to establishing a digital bank over a 22- to 30-month time scale, based on a vision for a digitally enabled financial services provider with best-in-class customer experience. The roadmap can be divided into three phases: application, build, and launch. (See Exhibit 5.)

Application. New digital banks should plan to spend as much as six months—and in some cases even more—preparing the relevant requirements and organizing internally for a market-ready application. This includes dedicating one or two months to setting up consortium or partnership agreements, three to four months to developing and documenting business plans, and one month to undergoing an external audit (where required by regulators).

Build. The first step at the build stage is to design a minimum viable product, which includes developing the product itself and the accompanying analytics and technology. The company must define the product, product-related processes, and features on the basis of the value proposition for each target market to enable development of the user interface and user experience. It must also test and potentially recalibrate the product’s features, UI/UX design, and integration with any third parties. The process of building out analytics to integrate with the product should follow on the basis of relevant use cases in credit scoring as well as anti-money laundering, know-your-customer, customer due diligence, and foreign account tax compliance act considerations.

It is important to refine the business plan to shape offers and services. The bank should move toward finalizing three-year and five-year plans, with clear targets and KPIs detailed for at least the first year. Once the business plan is in place, the bank should set a product portfolio and roadmap, including targeted market subsegments, unit economics, and product characteristics such as pricing and features. Customer onboarding and service models—including customer engagement, user flows, and service channel definitions—are additional key considerations.

Another goal of the build phase is to ensure that the necessary organization, people, and operations are in place. The company should clearly define and establish the bank’s structure and governance, fill key positions with clearly defined roles and responsibilities, and secure the processes and enablers required for critical operation prior to launch.

Launch. New banks need to set channel strategies, marketing initiatives, and brand positioning in advance of going to market. They should prepare each operational area for rapid growth, work out integration with partners, and lock in and finalize partnerships, pilots, and customers segments.

There is no single defined path to success. Companies must remain flexible and agile, ready to adapt as new insights or opportunities arise. Each new player will face its own challenges.

Although the last decade has seen a remarkable proliferation of digital banks globally, the route to profitability remains challenging for operators. Within this landscape, APAC offers an encouraging outlook. Southeast Asia and India, in particular, present attractive opportunities.

Each market has its own challenges. Prospective new entrants must identify the right model for success—one that leverages existing assets, builds and scales appropriately, and sustains progress with the right data-driven approach and models. It’s a challenging road, but with the necessary commitment, organizational structure, and strategy, incumbent banking operators and nonfinancial institutions can access the digital banking opportunities in APAC’s rapidly evolving financial landscape.

The authors are grateful to the following colleagues for their contributions to this report: Saurabh Tripathi, Ernest Saudjana, Ching Fong Ong, Edwin Utama, Tjun Tang, Pauline Wray, Aniket Kulkarni, and Camille Jasmine Aquino.