Companies entering the hot IPO market are looking for an advantage in their pursuit of a successful listing. Among the actions that issuers should systematically consider is onboarding a supporting investor. We distinguish two types: anchor investors buy a stake before the IPO process begins, while cornerstone investors acquire shares after the process is initiated but before the formal book building.

Supporting investors are typically known and respected players—whether large corporations or financial investors. A company should consider taking on supporting investors whenever it plans to sell a relatively large equity stake in its IPO. Their presence as shareholders helps to mitigate the risks of an IPO by building other investors’ confidence in the issuer, boosting the IPO valuation, and, ultimately, driving higher total shareholder return (TSR). Supporting investors, for their part, can benefit from early access, value realization via the stock market, and strategic flexibility.

BCG’s analysis shows that these benefits are tangible and empirically verifiable. However, an issuer must carefully select its supporting investor in order to ensure that each party fully realizes the potential rewards.

In a Booming Market, Issuers Gain Crucial Benefits

In 2020, despite the COVID-19 pandemic, the number and proceeds of IPOs increased sharply across the globe. The IPO boom was especially evident in China and the US for much of the year, while Europe saw significant activity in the fourth quarter. The global proceeds were $227 billion, a 29% increase versus 2019 and the highest level since 2010. The surge in activity was driven, in part, by new listings of special purpose acquisition companies (SPACs) . (See “SPACs Versus Supporting Investors.”)

SPACs Versus Supporting Investors

The motivations to go public via a reverse merger with a SPAC are similar to those underlying the decision to onboard a supporting investor. Common motivations include gaining an external stamp of approval for the business model, reducing execution risk, and pressure-testing the company’s valuation before approaching the broader investment community.

In light of this, following the traditional IPO route with the addition of a supporting investor could be seen as a viable alternative. The issuer gains the advantages of a true public offering while enjoying the benefits of having a respected player onboard to support the offering.

For the overall IPO market, the momentum has continued into 2021 and is expected to persist for the rest of the year and beyond thanks to a strong pipeline of candidates from all regions. In the first quarter of 2021 alone, companies raised $104 billion through IPOs globally—nearly half the full-year value in 2020. In this context, having a supporting investor is especially beneficial for companies that enter the IPO market without a track record of profitability, such as many tech startups.

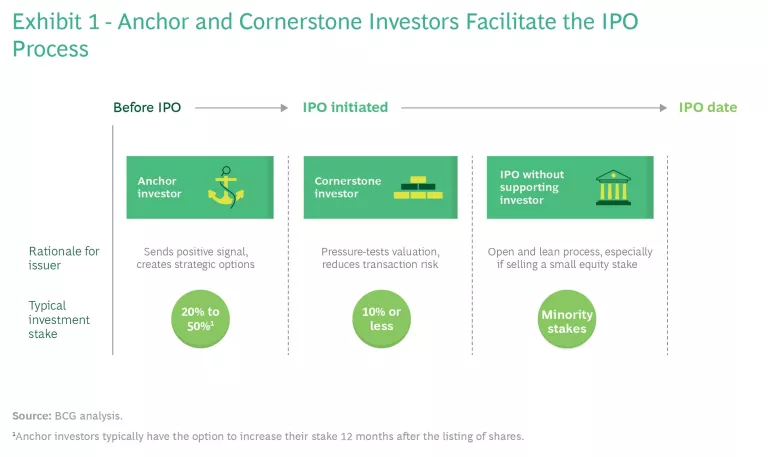

The key differences between the two types of supporting investors are timing and size of investment. (See Exhibit 1.) Anchor investors come onboard before the issuer initiates the IPO process and typically acquire a 20% to 50% stake in the issuer. Cornerstone investors enter the picture later (after the issuer initiates the IPO process) and typically acquire a smaller stake (up to 10% of the issuer’s shares).

Issuers can benefit in several ways by taking on supporting investors. These benefits are especially important for IPOs involving a relatively large portion of the issuer’s shares:

- Building Confidence Among Potential Investors. Having a known and respected investor onboard builds confidence among other potential institutional and retail investors and will likely facilitate the book building process.

- Maximizing Value. Joining forces with a supporting investor can help to maximize value. Onboarding an anchor investor creates a market-tested valuation base, such as through jointly realizing a full-potential plan or combining buy-and-build capabilities in M&A. A cornerstone investor’s entry price can send a strong indication of a realistic value for determining the IPO price. Indeed, BCG’s research indicates that issuers backed by private equity or venture capital firms, common types of supporting investors, receive higher IPO valuations , on average.

- Onboarding a Potential Acquirer Without a Lock-In. If the issuer or its majority owner plan to sell an additional stake after the lockup period, a supporting investor is positioned to be a natural buyer—without a fixed lock-in for either party. Anchor investors are especially well positioned because they already own a significant share of the issuer.

An important caveat: Issuers should be wary of selling a stake to an anchor investor if they are simultaneously preparing for an IPO and a full sale to a third party and intend to decide which track to follow at a later date. If an issuer takes on an anchor investor but then decides to pursue a trade sale instead of an IPO, the anchor investor could become a roadblock, such as by refusing to sell its stake.

Supporting Investors Secure Access, Value, and Flexibility

Several types of entities have emerged as supporting investors in recent years. Strategic investors from the issuer’s industry or a related industry are pursuing commercial objectives, such as solidifying a supplier-customer partnership or capturing synergies. Financial investors—private equity and venture capital firms—seek to secure an ownership stake in an attractive target when facing a competitive, seller-friendly market. Sovereign wealth funds and public pension funds are looking for IPO candidates that fit their criteria for asset allocation and investment size, among other deal requirements. Additionally, multiple entities can join forces within these categories (such as financial investors forming a group) to be anchor or cornerstone investors for a particular issuer.

Buying a stake in an issuer allows supporting investors to pursue several objectives:

- Gaining Early Access. Supporting investors secure a “foot in the door” and mitigate the risk of being underrepresented in the allotment of shares during the book building process.

- Realizing Value. Supporting investors benefit from any value increase after their entry. Once the issuer goes public, they have a direct channel to realize such value enhancements by selling shares in the capital market.

- Maintaining Strategic Flexibility. Anchor investors, in particular, have an opportunity after the IPO to gradually pursue a majority takeover—or, conversely, a full divestment—through the purchase or sale of shares in the capital market. They can observe the issuer’s performance and act accordingly.

A Closer Look at Value Creation

Issuers that take on supporting investors create more value than those that do not, according to our analysis of IPO performance. They are less likely to experience underpricing, as measured by the difference between the final offer price and the price per share after the IPO (for example, after the first day of trading). They also have superior TSR, as measured over various time frames after the listing. Moreover, these listings generally feature superior risk-return profiles, as measured by the lower volatility resulting from greater investor confidence.

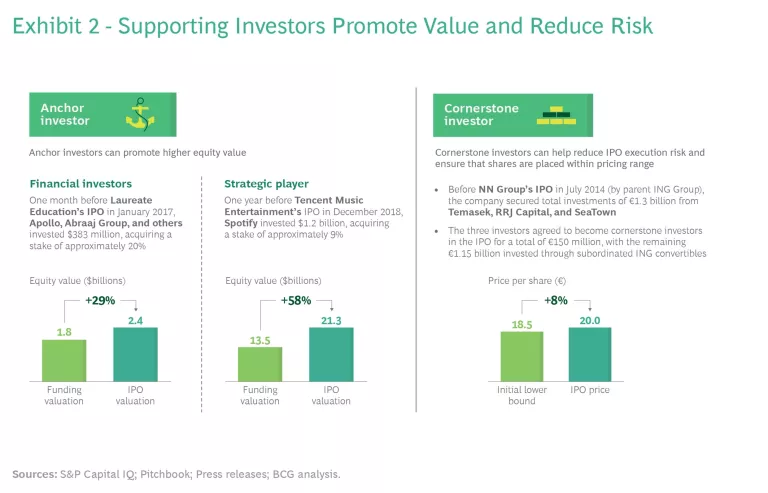

Recent examples illustrate the potential for issuers to boost IPO valuation and price by taking on supporting investors. (See Exhibit 2.)

Although supporting investors generally have a positive influence on value, their presence does not guarantee a successful listing. Each IPO is a complex undertaking. Various factors—including the macroeconomic sentiment, industry-specific outlook, soundness of the equity story, investor appetite, and lockup periods—influence the offer pricing and the first day’s trading results. Achieving the anticipated benefits also requires overcoming several hurdles. (See “Minding the Obstacles.”)

Minding the Obstacles

- Address legal requirements. The parties must address the legal requirements in the relevant jurisdiction—for example, German financial institutions are subject to “holder control” procedures.

- Give shareholders consistent information. The due diligence information that the issuer provides to investors in the IPO prospectus should not conflict with the information provided to supporting investors.

- Avoid pricing pitfalls. In price negotiations with a supporting investor, the issuer should consider the impact on the IPO’s book building process. Retail investors could regard the price paid as a signal of what they should be willing to pay per share.

Finding the Right Supporting Investor

To select the optimal supporting investor, an issuer should consider criteria that include a prospective investor’s overall reputation, industry experience and expertise, and the cultural and strategic fit with existing investors. There are generally three approaches to finding the right match:

- Focus on one investor. The investor may have contacted the issuer to discuss an investment, or the parties may know each other through a prior interaction. The main advantages of this one-on-one approach are confidentiality and speed.

- Conduct a broad and open search. By creating competition among bidders, the issuer has greater assurance of maximizing the price for the investment. This approach is especially well suited to finding an anchor investor before the IPO process. However, the benefits may come at the expense of confidentiality and speed.

- Target a few interested investors. The golden mean is to focus on a few investors that are highly likely to be interested. The issuer can create competition with less risk of compromising confidentiality and speed.

Issuers are looking for ways to stand out and reduce risk in today’s hot IPO market. Taking on an anchor or cornerstone investor is an important option to consider whenever a company intends to offer a large equity stake in its IPO. But careful planning and well-executed negotiations are essential. Issuers that find the right match can reap the rewards of having a supporting investor onboard for their entry into the public market.