E-commerce has grown at an unprecedented rate since the COVID-19 pandemic began, a trend that will likely continue once the pandemic is over. KSA is well-positioned to take advantage of this trend by developing a strong domestic e-commerce market and, with the right policies, becoming an e-commerce powerhouse in the GCC region.

Saudi Arabia and The World’s E-commerce Explosion

During the past two decades, e-commerce has transformed traditional retail worldwide. The process accelerated in 2020 due to the global COVID-19 pandemic, which led to lockdowns, reduced retail operations, and store closures – particularly those deemed non-essential. Customers shifted en masse to safer and more convenient online shopping, including those who would have otherwise remained loyal to brick-and-mortar stores. Now, e-commerce customers are spending more, and doing it more frequently, online – and a new generation of previous non-adopters has converted to the channel. The fastest-growing e-commerce segment has been food and drink or home-related products (more than a 300% increase in 2020), with all other segments also growing at a fast pace.

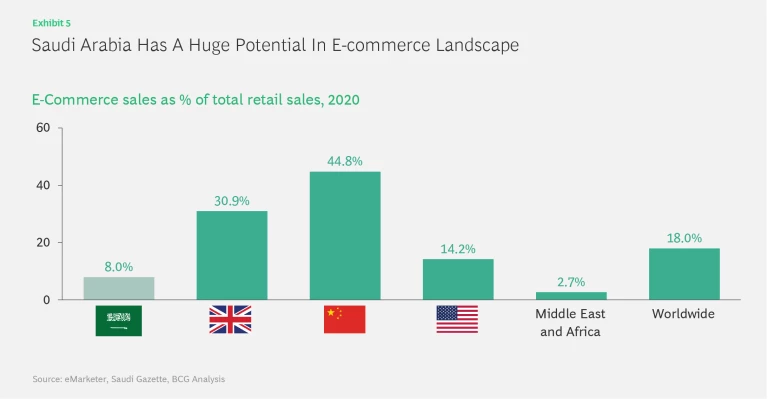

E-commerce addresses the inherent disadvantages of brick-and-mortar retail and taps into the benefits of digital commerce. In the three largest e-commerce markets (the United States, United Kingdom, and China), its share of overall retail now exceeds 20% in the first two countries and has reached an impressive 44% overall share in China

More customers than ever enjoy the benefits of e-commerce (see exhibit 1):

The Middle East-North Africa region, as well as KSA, lag in the e-commerce market share, reaching penetration levels of 2.7% and 5.9% respectively in 2020 – far behind mature e-commerce markets and the worldwide average of 18%.

Access to a larger product assortment

Free from the restrictions of physical space, retailers can showcase their entire assortment online. Even mega-malls with hundreds of stores cannot compete with the range and availability of online marketplaces. The largest international malls, like The Dubai Mall, Mall of America, or the South China Mall, with millions of items,

A tailored and personalized product offering

Advanced search engines and product reviews let consumers access relevant information and find products quickly, without having to sort through lots of items first. “Suggestion” algorithms offer recommendations and highlight promotions tailored to each customer. These algorithms use customers’ past purchase history, online interests (based on their browsing), and behavioral patterns of other customers with similar profiles. Data analytics supports this intelligence, which has become highly accurate. Amazon’s personal-recommendation algorithm, for instance, now drives more than 35% of all purchases on its platform.

Competitive and transparent pricing

Customers can easily compare prices across retailers online. Price transparency leads to more competitive prices. Plus, customers can use their mobile devices to research prices as they shop in a physical store, enabling e-commerce to directly compete with brick-and-mortar.

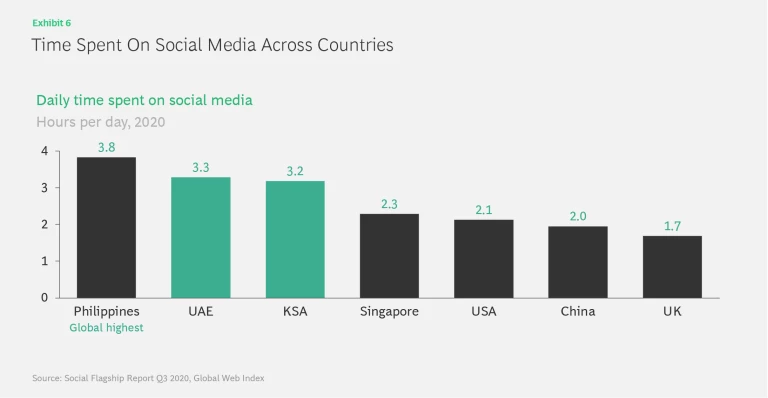

Social commerce

Four key themes

Quick and secure payments

Advanced payment systems let customers make seamless, one-click purchases online with enhanced security. Standard online card payments are enhanced, too, with new payment methods like e-wallets and blockchain, and all of these can be linked to a growing number of financial services, from customer loans to delayed-payment plans.

The seamless experience extends to business owners as well, with technology that enables simple and accessible solutions. Global players, such as Shopify, offer an e-commerce platform with a payment gateway option. Similar and localized solutions are emerging among Meta Business Partners in the Middle East, where they offer an integrated “buy” button with a payment solution on a shop’s social media site.

Fast and flexible delivery

Purchases reach customers faster than ever – in hours or minutes – through advanced distribution systems. German-based grocery-delivery companies Gorillas and Flink deliver orders in cities just 10 minutes after purchase online.

Convenient after-sales services

Hassle-free online return policies enable customers to examine products and ship them back to the seller at no additional cost if they wish. In fact, the level of after-sales service with e-commerce tends to be much higher than that of traditional retailers due to the centralization, coverage, and sophistication of major online players. Technology, including artificial intelligence (AI), and chatbots enhances the customer experience and reduces costs. Businesses can leverage chat platforms, daily used by millions, for after-sales communication and service, and with great success, as research shows that the vast majority of adults (75%) appreciate communication with businesses through messaging.

Technology and Logistics Power of E-commerce

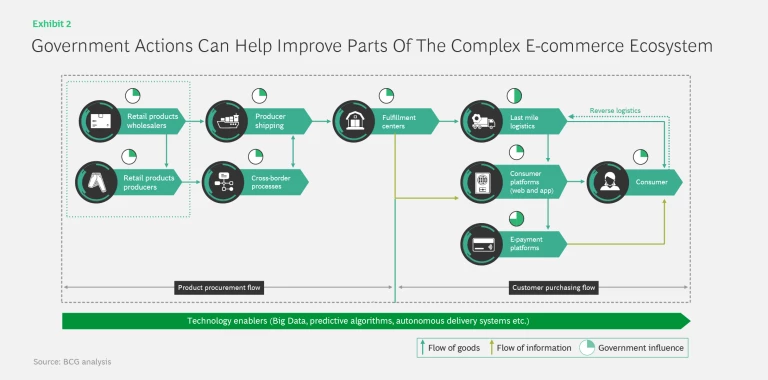

Efficient logistics is crucial for e-commerce along the whole supply chain, from manufacturers and wholesalers to fulfillment centers and the end customer (see exhibit 2). Retailers are using big data and predictive algorithms to direct package shipment and advanced technologies, such as autonomous drones, for last-mile deliveries.

Last-mile logistics (between the fulfillment center and customers) is a critical part of the process, and e-commerce is at the forefront of adopting it for operations and service quality.

Technology supports operational excellence and customer interaction. On the operations side, AI is used for routing and re-routing. Live traffic navigation systems and automated communication with drivers have brought much greater efficiency, and newer technologies, such as drones and autonomous vehicles, could take efficiency even further. The expansion of the world’s largest drone-delivery firm, Zipline, illustrates how technology originally used to compensate for limited transportation infrastructure in Africa can successfully expand in countries like the US.

For customer service, system integration gives shoppers the opportunity and flexibility to book specific delivery slots, view available delivery options live, track their shipment in real-time, and give immediate feedback on quality. Smart chatbots driven by AI can further improve the experience by reducing customer wait time and driving down personnel costs. For example, Aramex (a Dubai-based logistics, transportation, and delivery company) integrated Whatsapp API to improve the last-mile delivery experience.

Fulfillment centers are a vital node in the ecosystem. They are the heart of dispatch operations, the largest of which house vast product assortments across multiple categories, enabling economies of scale and justifying the significant technological investment required. Automation and carefully designed warehouses are key to minimize the time required for picking and packing items and maintaining the quality of incoming merchandise. Using drones and robots can further increase the speed, precision, and cost-efficiency of fulfillment and sorting centers, together with a workforce trained to use supporting technology.

Efficient cross-border custom processes are necessary for continuous, reliable e-commerce across multiple countries. The speed, efficiency, and reliability of customs procedures are paramount to import and export products cost-effectively. More than 70% of customers deem delivery tracking, reasonable shipping time, and easy returns to be of utmost importance when making a purchase decision from foreign countries.

Attractive and safe consumer platforms are the main customer interface. There is a major shift occurring from websites accessible best on laptops and PCs to mobile apps better serving smartphones, as well as sales driven by social media. In 2020, smartphones already exceeded 50% of global website traffic.

Consumer platforms can feature millions upon millions of items spanning a large number of categories. As a result, effective internal search tools or engines, and a comprehensive, yet intuitive, categorization system, are imperative for a seamless online shopping experience. An interactive, engaging display across platforms (PCs, mobiles, or tablets) can make or break sellers’ relationships with consumers. That is precisely why making sure that factors such as site speed and real-time availability of products and delivery options across platforms are so important.

Cutting-edge consumer platforms leverage big data analytics to personalize services and shopping experiences, not only through product suggestions but also by offering tailored, profile-based promotions derived from a specific budget assigned to each customer. Smart chatbots and human sales assistants can ensure full customer service using a range of communication platforms. For example, Nissan Saudi Arabia has launched an AI-based chatbot service over a verified Whatsapp Business channel to support customers 24/7, while catering to their automotive needs securely, offering always-on support and sending updates in real-time.

Integrated e-payment processes are the link between shoppers and financial institutions. Best-in-class payment platforms offer seamless one-click purchasing for repeat visitors based on previously saved information, or leverage wallet applications with pre-paid capabilities. E-commerce transaction security is a major consumer concern, so e-payment should address this issue convincingly, protecting against both external cyberattacks as well as internal fraudulent activities. Effective anti-fraud systems use information from past customer purchases to identify suspicious or outright fraudulent online purchases and flag them accordingly.

E-commerce: Already a Driving Force in Retail

Global e-commerce revenues were expected to grow 15% annually in 2020, but with the pandemic’s boost, they shot up 25%.

Traditional brick-and-mortar retailers have gone online as well, often experimenting with omnichannel hybrid formats to tie online functionality to their offline presence. A store may post QR codes near merchandise so that customers who don’t find their shirt size on the rack, for example, can scan a code on their phone to be redirected to the retailer’s website, where they can order what they want and have it delivered from another store. For customers with lower levels of trust in e-commerce, such omnichannel hybrids can ease doubts and overcome hurdles to adoption.

Indeed, traditional retailers have suffered significant blows from the e-commerce boom in recent years and its acceleration during the pandemic. To survive in the new post-COVID e-commerce climate, they have had to adapt in other ways to appeal to younger, more online-savvy customers. Millennials and upcoming Generation Z consumers are more influenced by products mentioned in social media than by physically seeing them in stores. They have a stronger preference for the speedy delivery and higher price sensitivity.

Saudi Arabia: A Market with Both a Huge Potential and Some Challenges

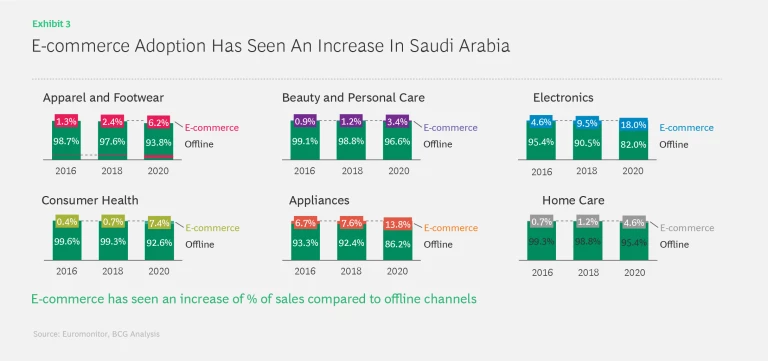

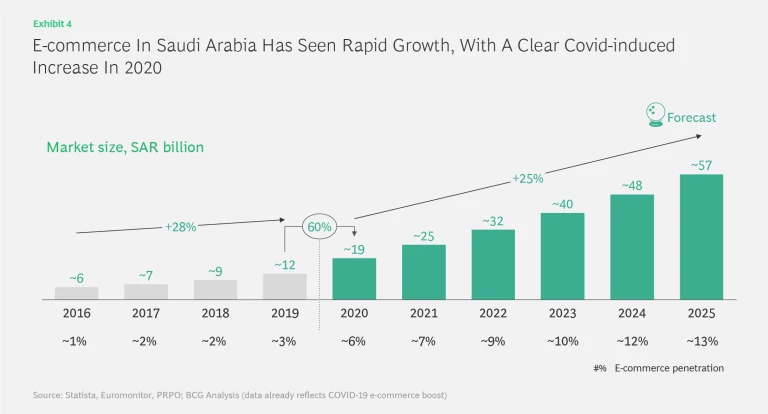

E-commerce in KSA has grown rapidly as the Kingdom steadily realizes Vision 2030, a comprehensive plan aimed at transitioning the Kingdom to a knowledge-based economy. Online sales have increased almost 60% on average annually across all categories, with the strongest position of e-commerce in the media products, and apparel and footwear, segments (see exhibit 3). At this point, e-commerce growth outpaces traditional retail and shows no signs of abating (see exhibit 4).

Yet, despite exceptional growth, Saudi Arabia’s e-commerce is still in a nascent phase. In 2020, it accounted for just 6%

KSA retailers that recognize the potential and the gaps in e-commerce have two main opportunities to establish an online presence: by building the business themselves or partnering with a marketplace platform. Establishing a strong, local e-commerce presence with in-country product stock, efficient last-mile logistics, cheaper and faster delivery, and product returns could help them quickly take market share from global players. This would make it especially difficult for mid-size international and global players without a local physical presence to compete, creating a huge opportunity for local and regional players.

A favorable environment: plenty of support for e-commerce already in place

Factors involving Saudi Arabia’s telecommunications, internet, legislation, and financial services all support e-commerce’s advancement. Saudi consumers’ shift from using desktops to smartphones as their preferred device for shopping online is an important consideration. KSA boasts one of the highest smartphone penetration rates (97%

Another aspect of technology works in KSA’s favor, too. Mobile broadband internet subscriptions are exceptionally high in Saudi Arabia – higher than the majority of advanced markets. KSA ranks 10th in the world for the fastest internet speed as well.

Lastly, KSA has a relatively high share (72%) of the over 15-year-old population with a bank account, which enables future e-commerce growth.

The government is supporting commerce law,

And Saudi Arabia’s population exhibits an inherent readiness for e-commerce. Young people aged 18-34 comprise the largest segment of the population (43%

Another trend that showcases Saudi consumers’ willingness to engage in e-commerce involves the informal sales conducted by fashion designers and other small businesses directly over social media. When consumers view a desired piece of apparel on Instagram, for example, they can ask whether the item is on sale. If it is, they are given details on how to transfer money to a bank account as payment. Then the item is sent to the customer. While such informal sales are not condoned by the government because they present a risk for the consumer, they suggest that Saudi shoppers are very much ready to tap into the online market.

The Saudi market, with its tech-savvy customers and strong demand for e-commerce offerings, indicates that the main driver of growth will be the development of a high-quality supply side.

Challenges remain

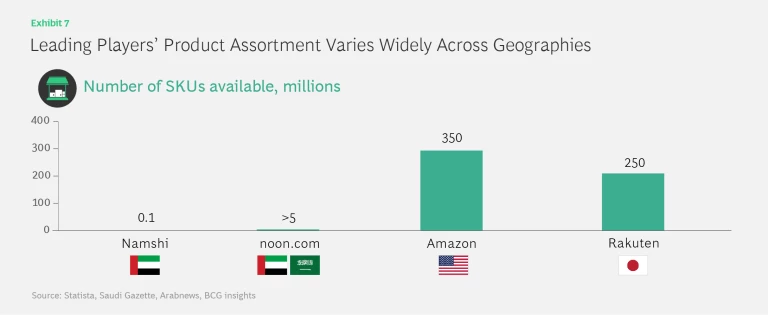

Despite the expansion, Saudi and GCC e-commerce players still face several challenges. One of the biggest is their product assortments’ limited size. Regional champion Noon.com offers over 5 million SKUs, and Namshi, a market leader in apparel across the GCC, has ~100,000 SKUs. In comparison, Amazon in the United States has 350 million and Japanese market leader Rakuten has 250 million (see exhibit 7).

In terms of delivery speed and options, regional GCC e-commerce players are also rather limited. Within KSA, just a small set of online retailers in major cities offers same-day delivery, which is a standard in advanced markets elsewhere in the world. Hyperlocal e-commerce platforms also offer delivery options of one hour or less in key metropolitan areas, including Turkish start-up Getir, which delivers groceries in under 10 minutes in Istanbul and London,

Moreover, the current lack of infrastructure to support new Saudi players is a critical limiting factor for developing innovative solutions that could address the above challenges.

E-commerce is a Key Growth Vector for Retail in KSA and the Middle East

At this point, establishing a competitive e-commerce offering requires a lower initial investment and promises faster time to market than a traditional network of brick-and-mortar stores. Prior to the pandemic, higher rents were already limiting fast retail expansion, and with the impact of pandemic restrictions for the domestic population and a halt to international tourism, expansion of a physical retail network is even more complex.

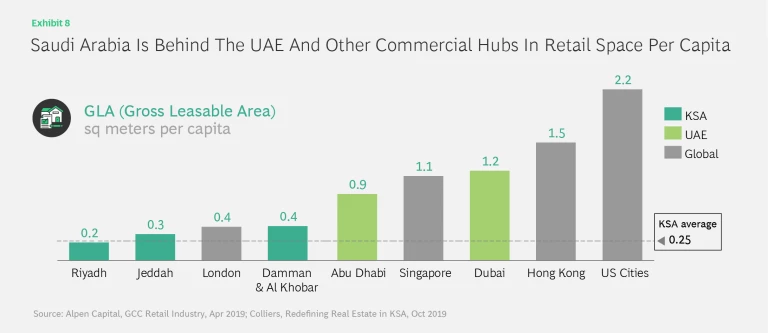

When it comes to available retail space per capita, the traditional brick-and-mortar offering in Saudi Arabia scores generally lower or average compared to regional and global players, despite recent growth (see exhibit 8). Traditional retailers are expanding in the coming years, with the six largest projects expected to add more than 1.1 million square meters of retail space by 2023.

However, given the pace of e-commerce, KSA may not ultimately need to develop as much retail area per capita as other countries shown in exhibit 9. In the end, this may benefit the Saudi retail sector because it will avoid the problems posed by excess retail space, an issue now plaguing many Western economies as their mature retail sectors readjust to e-commerce and the post-COVID world.

Interestingly, domestic e-commerce can significantly influence spending abroad, whether during shopping trips or online through foreign e-commerce platforms. Pre-COVID, Saudis spent USD 26 billion abroad per year on tourism including retail,

The average spend per e-commerce user in KSA increased more than 50% during the past three years and is driving improvements in service quality and offering breadth, providing more reasons to shop locally.

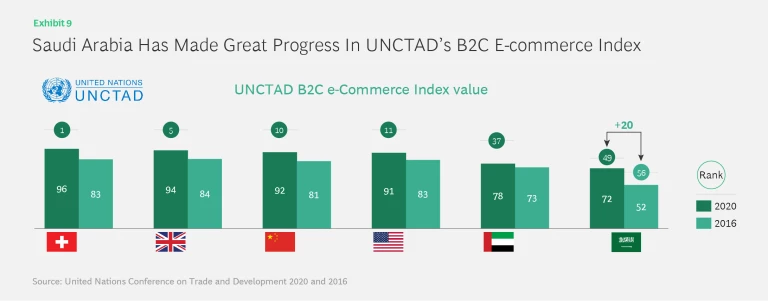

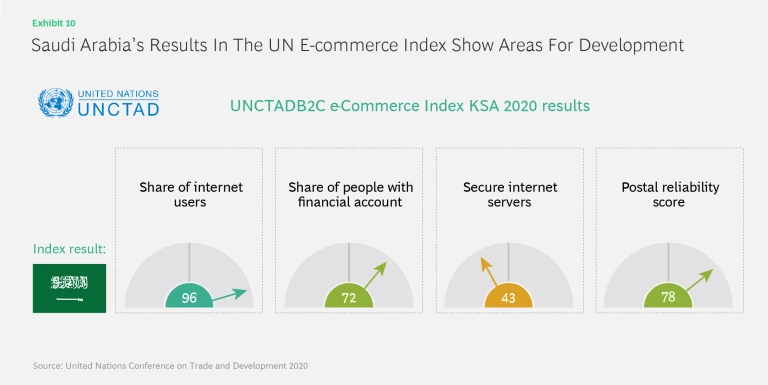

Regarding the e-commerce environment and infrastructure, KSA has made great progress, according to the 2020 UNCTAD (United Nations Conference on Trade and Development) Business-to-Consumer E-commerce Index, which ranked 152 countries on their readiness to engage in online commerce. Countries were scored on access to secure internet servers, reliability of postal services and infrastructure, and the portion of their population that uses the internet and has an account with a financial institution or a provider of mobile money services (see exhibit 9).

On the other hand, the index also indicated where KSA can develop further, including the rising number of secure internet servers, and to a lesser extent, increasing the share of individuals with accounts at financial institutions, and postal reliability (see exhibit 10). While servers and postal service as infrastructure matters are already being improved, consumers’ possession of a bank account appears to be mainly a cultural issue. KSA banks already offer a wide range of services, and some are online-only, so the barriers do not seem to be due to a lack of infrastructure. A recent survey shows that the most common reasons why Saudis do not have a bank account are a lack of financial resources and relying on a family member’s account.

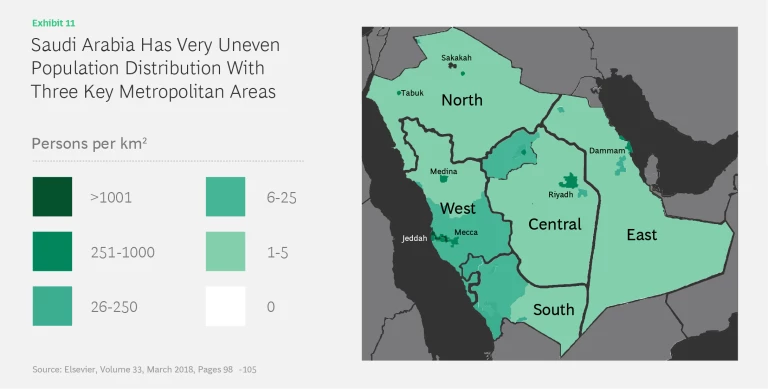

Saudi Arabia’s population distribution is another factor that gives e-commerce an advantage over conventional retail. Though 13.9 million of the Kingdom’s total population of 34.8 million people are located in the three major cities – Riyadh, Jeddah, and Mecca – the overall population density is very low, with 16 people per square kilometer (the global average is 55).

With all of this in mind, the rapid development of e-commerce, in parallel with the maturing traditional retail sector, will allow Saudi Arabia to better upscale its overall retail offering and do it in a shorter timeframe. Development of e-commerce and overall enhancement of digital infrastructure are key national strategic priorities included in Vision 2030. E-commerce will also help drive economic growth, with the domestic online market expected to double to USD 2 billion by 2025.

E-commerce for Economic and Social Development

The additional boost in retail spending expected from e-commerce stems mostly from two sources: making more products available to a larger segment of Saudi Arabia’s population, and capturing retail spend currently conducted abroad.

Developing e-commerce has another economic and social benefit: the skills and technologies it requires are equally suited to support other industries, especially logistics. The rise of last-mile delivery players and the establishment of advanced fulfillment centers to support e-commerce could also lead to the creation of a logistics hub in the region, which is another priority outlined in Vision 2030.

And then there are the jobs that the e-commerce industry will generate at a variety of skill levels, including managerial and tech-enabled positions with IT competencies. The number of low-skilled jobs in operations will likely be limited due to automation and the deployment of modern technologies.

These jobs will appeal to the Saudi workforce, especially positions in technological, creative, and entrepreneurial areas. Overall, e-commerce jobs will present viable employment for the local Saudi population. This trend is already unfolding. Amazon recently announced 3,400 new jobs in Saudi Arabia, and Saudis comprise 60% of Amazon’s permanent workforce there.

A thriving e-commerce sector supports entrepreneurial activities in several ways. E-commerce has low barriers to entry for smaller players. Niche retailers could enter with limited investment using the newly established e-commerce ecosystem. Such start-ups could rent space in an existing fulfillment center, for example, receive competitive services from high-quality last-mile logistics companies, and source technological capabilities from specialized service providers. Indeed, the Kingdom’s start-up scene, where many entrepreneurs are in e-commerce, is enjoying such momentum. It is heightened by a record-breaking flow of venture capital funding, which grew 65% in the first half of 2021, as compared to the first half of the previous year.

E-commerce also provides efficient market access for new consumer products – potentially to millions of customers – with the placement of those products on convenient platforms. Large players can be willing to collaborate with smaller businesses, as Noon.com’s approach shows. Setting up a new vendor profile on their platform can be done online and takes less than a week.

For young entrepreneurs, e-commerce is a viable and attractive option for selling their products. Small businesses usually create connections with customers based on shared values and good customer service. These can be communicated especially through conversational commerce. It enables customers to get support, ask questions, get personalized recommendations from company representatives and subsequently purchase the product within messaging applications.

Furthermore, establishing an e-commerce industry is spurring development of diverse technological service providers that are needed to come up with payment platforms, website design, and optimization software, among other solutions. Government institutions, such as mada, have provided central payment platforms that should be further developed for optimal connectivity and technological growth in the private sector.

Beyond purely economic outcomes, e-commerce can also have a significant social impact in rural areas, which are currently underserved by brick-and-mortar stores. Historically, e-commerce has a much deeper geographical reach through centralized fulfillment centers that can economically deliver products to remote areas. Indeed, major e-commerce players in KSA now deliver to all addresses in the Kingdom.

Indirectly, consumer buying power will improve as well. Increased competition online results in lower prices, price transparency, and consumers’ ability to compare their options in real-time.

It Takes a Suitable Business Environment

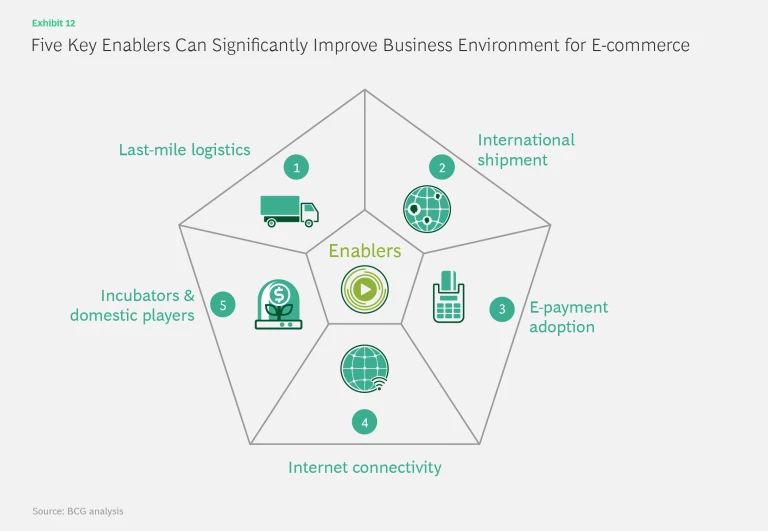

80% of Saudis say they will continue shopping online after the pandemic ends,

1. Last-mile logistics

As discussed previously, logistics is a major enabler in e-commerce. Even so, last-mile logistics is a critical pain point in Saudi Arabia. Delivery prices are high, and logistics players do not offer fast delivery options with comprehensive geographic reach. Next-day delivery is offered by key players such as Amazon or Noon.com in major cities, yet delivery takes Amazon four to six days in rural areas. Moreover, customers are not satisfied with existing courier services, due to their slow process and poor customer service.

Communication with customers about the delivery date and time – via chatbots, for example – would create the opportunity to notify them all along the delivery process and flexibly respond to their needs regarding delivery timing.

2. International shipment

Considering the overall logistics value chain, cross-border processes are at the core of e-commerce business models. Customs procedures have become more reliable and faster recently, with a target of processing shipments within 24 hours and all paperwork consolidated in one online form.

Recent changes in import taxes have affected the cross-border flow of goods.

3. E-payment adoption

The Kingdom recently made great strides in introducing new and different payment methods through the Monetary Authority’s subsidiary, mada, which enable popular technologies such as ApplePay and debit-card online payments that were not possible before. However, recent studies show that cash-on-delivery remains the most popular payment option in KSA with 25% of e-commerce transactions completed in cash in 2020.

4. Internet connectivity

Saudi Arabia’s digital infrastructure is fairly advanced, compared to other markets with stronger e-commerce industries, as we mentioned earlier. The country has shown great progress in internet connectivity and coverage in the past few years, leading the fifth-generation (5G) countries in network coverage and speed – and becoming the country with the fastest mobile internet connection as of January 2021.

5. Incubators and domestic players

KSA’s traditional retailers have generally been slower to embrace e-commerce, due mostly to order fulfillment challenges and costly operating models. Amazon presents a challenge to local and regional retailers, so KSA needs to ensure a system exists that nurtures these businesses, and at the same time incentivizes foreign ones to localize while still promoting fair competition to help domestic e-commerce develop.

Current incubators in KSA and GCC region can also help entrepreneurs pursue new projects in e-commerce and build communities for sharing knowledge and information. The annual SIDMC

Looking at the Long-term Benefits

E-commerce is the driving force of today’s retail, globally and in the GCC region, as a standalone service or as part of an omnichannel offering. With Saudi Arabia’s high digital affinity and relatively below-average brick-and-mortar retail infrastructure, it is indeed a fertile environment for the rapid proliferation of online shopping. The influence of COVID-19 allowed us a valuable look into how e-commerce can grow, and its momentum should be maintained. The right set of governmental policies can help advance infrastructure, change citizens’ habits and allow local players to flourish, turning the Kingdom’s retail sector into a digital powerhouse and regional hub, and making Saudi e-commerce a pillar of the GCC economy.

The authors are grateful to the broader team of BCG colleagues and alumni whose insights and experiences contributed to this white paper, and in particular, Huseyin Erol, Davide Camisa, Sophia Frempong, Martin Zak, Dora Mocsinka, Max-Christian Rath, Jakub Caloun, Sarah Alsalem, and Lea Uhliarova.

This BCG insight paper was prepared in collaboration with Meta, and namely:

- Suha Haddad: Director of Agencies & Ecosystem Development – MENA

- Leen Fakhreddin: Creative Agency Partner – MEA

- Anna Germanos: Head of CPG, Retail & E-commerce, MENA