The dizzying growth in e-commerce has wreaked havoc on CPG supply chains. Here’s how companies can tackle channel proliferation and meet customers’ rising expectations.

E-commerce grew an astounding 35% during the COVID-19 pandemic, and that growth shows no signs of slowing. In the six months ending January 31, 2021, online sales of home goods surpassed physical sales for the first time. Apparel and electronics also saw step-change increases, and laggard categories like pet care, household care, and groceries reached online penetration of 10% or more—a tipping point in e-commerce growth.

Yet many of the largest brands have been unprepared for the rapid shift to digital sales . Makers of consumer packaged goods are now scrambling to supply the proliferation of channels, as retailer and consumer expectations regarding product choice, availability, and delivery times have escalated. All of this is taking place against a backdrop of demand volatility, inflation, and labor shortages.

As CPGs begin to capitalize on this unprecedented acceleration in growth, many are confronting the sobering reality of their supply chain limitations—limitations that have quickly become a barrier to profitable growth. More than a logistical problem, these constraints highlight the competitive significance that supply chain management has taken on in the digital era.

Below, we explore the challenges that CPGs face in the rapidly evolving e-commerce landscape, offering four critical supply chain strategies to meet those challenges and thrive in a volatile environment.

The Big Squeeze

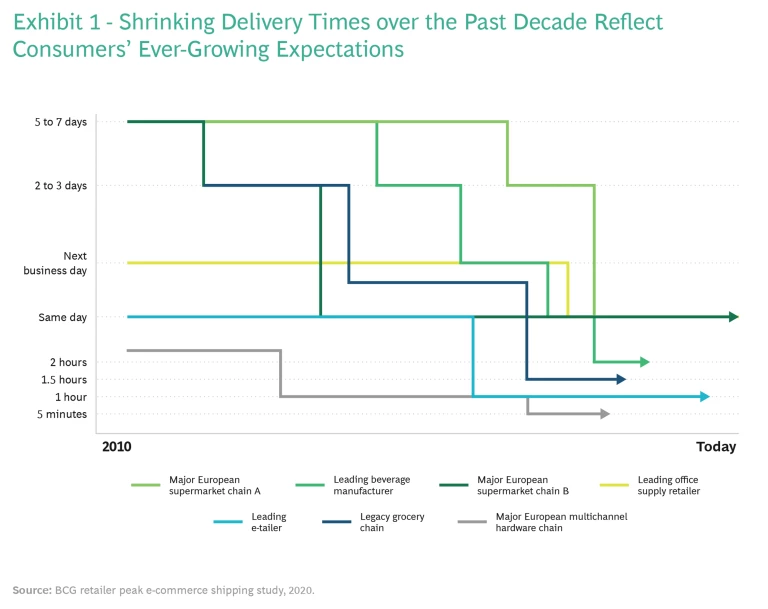

The expectation that consumers will receive their products faster no matter how and where they get them has risen dramatically over the past decade. (See Exhibit 1.) Long before COVID, CPGs were already facing a triple whammy of increasing costs, fatter inventories, and declining service levels, according to a BCG study . Those trends prompted companies to double down on cost efficiencies. Indeed, it was the push for scale and efficiency rather than differentiated assets and flows that fueled distribution and network consolidation in recent years. Then, when COVID triggered the explosion in e-commerce growth, CPGs were structurally unprepared to serve the proliferation of distribution points that arose, especially at the speed and scale that retailers and consumers demanded.

As major brick-and-mortar retailers jump into the fray and try to fend off Amazon, they are imposing increasingly complex requirements on CPGs, which are feeling the pressure in several ways:

- Demand volatility is increasing. In today’s omnichannel world, demand is far less predictable than it was in the past. According to a supply chain benchmarking study conducted by BCG and the Grocery Manufacturers Association, weekly demand volatility rose dramatically—by around 70% from 2013 to 2019—even before COVID-19 struck. And from 2019 to 2020, volatility increased another 50% among BCG's clients. Meanwhile, retailers are holding less inventory for shorter periods.

- Omnichannel retail has become the default. As more retailers expand their channels—online, pickup at the store, shipping from the store, drop shipping from the manufacturer, or shipping from an intermediate storage facility—inventory and delivery costs are escalating. Consumers have more options in terms of promotions, pricing, and fulfillment, which only add to supply chain complexity.

- Lead times are shrinking. The standard biweekly or monthly retail replenishment cycle has been supplanted by a weekly cycle. Before long, that cycle could shrink even further for certain products. Meanwhile, the traditional four- to seven-day lead time for an order from a retailer (which must now also flow to the retailer's e-commerce fulfillment center) has in many cases been compressed to two days, along with a narrower window for drop-off times during the day. The additional costs that CPGs incur as a result cannot be passed on to the consumer.

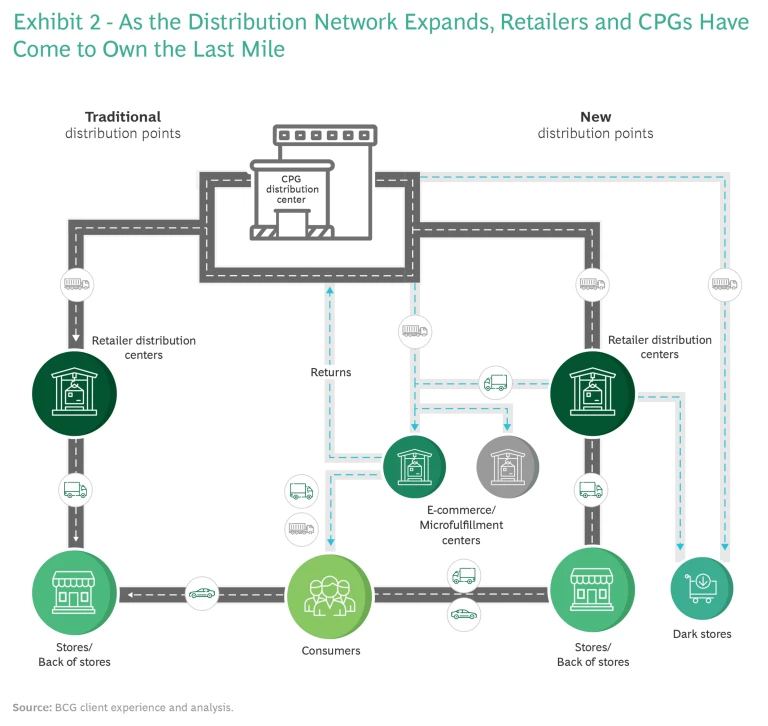

- The number of “flows” in the distribution network has multiplied. For decades, CPGs designed their retail supply chains for full trucks and full pallets. Goods left their distribution centers, destined first for the retailer’s distribution center and then for retail stores. Today, the last mile is the responsibility of the retailer, the peer-to-peer delivery startup, or even the CPG. Thus, in a relatively short period, companies have gone from a few deliveries per week to a handful of retailer distribution centers to almost daily deliveries to hundreds of fulfillment centers and dark stores. (See Exhibit 2.)

- Repercussions for stockouts are mounting. Out-of-stock events have always cost CPGs in lost sales and penalties, but online stockouts come with more risks. Conversion rate data indicate that shoppers routinely abandon their shopping carts when informed that a product is unavailable. This suggests that substitutions presented to them online are far less palatable than those they might make at the store themselves. Worse still, stockouts pose a long-term risk: retailers’ algorithms push out-of-stock items further back on results pages. Studies show that most shoppers rarely search beyond the second or third page, so consistently underdelivering an item effectively banishes it from sight, resulting in loss of market share that could well be unrecoverable.

While many major online retailers and category-specific entities (such as Wayfair and Chewy.com) venture into other channels, CPGs are likewise aggressively pursuing online growth beyond omnichannel retailers, including marketplaces such as Amazon (as both first-party and third-party purveyors) and their own direct-to-consumer channels.

Two Strategic Imperatives

Is it possible to compete in all channels without sacrificing market share or profitability—and if not, how do you prioritize? Should you aim to score A+ on some and B+ or even B- on others? Or shoot for a B on all? How to decide appropriate delivery speed times—knowing that, with algorithms monitoring stockouts and dictating page placement, “slow” could be too late?

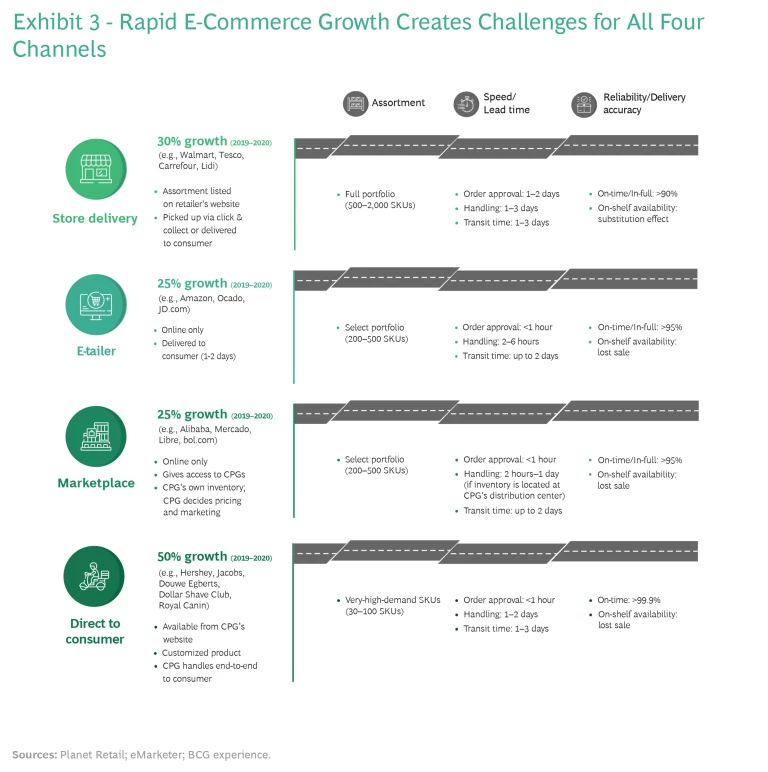

Even with the advent of new tools and technologies, most CPG supply chains still fall short because they were wired for brick and mortar, not for the labyrinthine complexities of omnichannel e-commerce. Rather than follow a monolithic approach, a CPG’s e-commerce supply chain needs to be segmented into several distinct supply chains. CPGs must balance assortment tradeoffs, lead times (for order fulfillment and transit), and their delivery capabilities against the need to maintain market presence. (See Exhibit 3.)

Get the Product Mix Right

For its omnichannel retail customers, a CPG must provide its full portfolio of products, whereas e-tailer and marketplace customers will require only a portion of that portfolio. For its own direct-to-consumer (DTC) channel, a CPG will need to supply a relative handful of high-demand products. (DTC will, of course, be most relevant for high-volume consumables—a broad assortment that meets consumers’ “basket” needs—as well as for high-value specialty items and CPGs that operate a direct-store-delivery model.) The variations in other requirements across channels, particularly speed, are similarly considerable. The end result is a dizzying array of requirements.

A commodity item, which requires you to compete on speed and volume, will call for one approach. For a strong brand, in contrast, the channel options will include the big omnichannel retailers (possibly a major category-specific e-tailer), a marketplace like Amazon, or your own DTC channel. If your company values loyalty, engagement, and differentiated products, DTC may be the more valuable channel. (See “Why Not to Overlook DTC.”)

Why Not to Overlook DTC

Consumers often prefer to deal directly with brands: they can get a more customized product through a more personal shopping experience. By forging relationships with consumers, brands can gather insights that are unavailable to them via their retailer relationships. By eliminating the middleman, brands can increase margins while offering competitive prices (even on heavy items, when next-day or second-day delivery isn’t important). Building critical mass with customers on any given product ensures at least one channel with more stable demand levels. Finally, DTC offers a hedge against retailer disruption.

But DTC has its challenges. Key among them are the need for fulfillment centers before the last mile that can process individual orders and a seamless order management and customer care experience. Replenishment sizes must be kept small so that inventory at the fulfillment center stays low, but that requires more picking and repacking. More generally, the fast-changing environment puts added pressure on teams and processes. And forecasting and inventory-planning systems need to be robust enough to cope with volatility and complexity. Despite these challenges, CPGs that are category leaders should adopt a systematic approach to defining (and reevaluating) their DTC strategy over the coming years.

Dominate the Digital Shelf

Apart from the strictly dollars-and-cents considerations, CPGs have a strategic obligation to make their products available in multiple channels, even when the business case for doing so is weak. This not only serves to keep competitors at bay but also signals to consumers that the brand is alive and well. For young consumers—the big spenders of the future—appearing on the various digital shelves is essential, since absence from those platforms can wipe a brand off their radar.

Four Critical Design Moves

The complexity of the e-commerce supply chain can be mind-boggling. But it can be managed with the right design and systems and with relationships, internal and external, that support visibility and flexibility. We’ve distilled four design moves that are helping leading CPGs rein in complexity.

1. Align the Commercial and Supply Chain Functions

Companies have traditionally focused on the demand side, expecting the supply chain to dutifully keep up. But that legacy relationship no longer serves CPGs well. Managing today’s complex requirements calls for a more interactive, integrated relationship between the commercial and the supply chain functions. In both short- and long-term network and capacity planning, information flows, assumptions, and projections must be transparent and each side’s needs and resources clearly and regularly communicated.

Companies need to link demand-side assumptions to supply-side requirements (and vice versa) for each channel they serve. Given the constant fluctuations in demand and requirements across multiple channels, this cannot be a one-and-done effort. Teams should revisit their assumptions every three to six months to incorporate market feedback.

As a first step, the commercial side needs to articulate its strategic aims and choices—that is, its omnichannel customer promise and growth aspirations—to the supply chain side. Commercial then needs to incorporate those choices into the retail customer promise by channel, product category, and region. In turn, the supply chain side must clarify its capabilities and requirements to the commercial side.

Even with the advent of new tools and technologies, most CPG supply chains still fall short because they were wired for brick and mortar, not for the labyrinthine complexities of omnichannel e-commerce.

Once these requirements are defined, CPGs need to translate the customer promise into strategic supply chain requirements that will govern future fulfillment choices. The supply chain side should prioritize and spell out each fulfillment choice, weighing the following factors: the inventory strategy; the changes necessitated in physical assets (such as distribution centers); the changes in processes (such as moving to an agile, three-day sales and operations execution planning cycle); and the digital and organizational capability gaps that must be filled. Then the supply chain can weigh in on the feasibility and the total cost economics of the various fulfillment choices—and iterate with commercial on the strategic requirements until they are aligned. We think of this approach as “sales and operational dynamics.”

This give-and-take allows CPGs to examine the next 12 months’ volume flows through their key omnichannel retailers, marketplace customers, and DTC channel, and to extrapolate those flows over the next two or three years. They can plug in their unique service-level requirements (such as order-to-delivery speed, SKU assortment, and returns) to calculate supply chain cost-and-profit economics, and then feed that data back into the demand side to further inform and refine the customer promise. Both sides can evaluate underlying assumptions—and see, for instance, whether it makes sense to add consumer sentiment analysis to the mix. This will be particularly important as regions and economies emerge from the pandemic.

2. Understand the Business Case Economics Across Fulfillment Choices

Next, CPGs need to develop a rigorous, holistic model to map supply chain strategy scenarios to concrete business outcomes on an ongoing basis. This will help them analyze such questions as: How will fulfillment design choices affect year-over-year case or unit-cost fulfillment trends? How will they affect working capital and capex investment needs? What are the tradeoffs between cost and customer promise within and across the channels? As costs rise, how are consumers and customers adjusting their buying choices? CPGs need to formulate a way to link supply chain business case outcomes to the annual financial business-planning process. Such a linkage will allow a P&L-level view, which, in turn, can inform, align, and validate the overall fulfillment strategy.

The complexity of the e-commerce supply chain can be managed with the right design and systems and with relationships, internal and external, that support visibility and flexibility.

CPGs need to factor in external developments that would affect these economics. These include automation that accelerates picking or transportation, technologies that improve forecasting, shifts in consumer preferences, and new (or disruptive) sources of competition.

With greater alignment between the commercial and supply chain functions and greater clarity on the business case economics, CPGs will be better equipped to assess the tradeoffs among customer promise, offering, and retailer requirements and cost implications.

3. Reconfigure Your Distribution Design

CPS must ask themselves: How much capacity do we need (in throughput and space), and how distributed is our network? Is our physical network configured in a way that can support future capacity growth while supporting each channel’s distinct pick-and-pack and flow path requirements? Meeting a one- or two-day lead time for replenishment at a retailer's upstream consolidation mixing center requires an entirely different kind of setup than the one needed for building mixed totes to replenish a customer's dark stores or for delivering directly to the retailer’s e-commerce fulfillment centers. So to design a robust, flexible network, CPGs need to understand how their key retailer customers are transforming their fulfillment models. Talking to your top ten customers is thus an important first step.

Having the capacity to store and pick products for shipment means determining how much space you will need next month, next year, and two years from now. That means answering these questions:

- How many distribution centers will we need?

- Where should they be located, and how close should they be to the consumer? Obviously, the answer to this question must be linked to your commercial strategy. Megawarehouses (supplemented with dark stores) make sense in Europe, given the continent’s many megacities, but not necessarily in countries with more dispersed populations. Given the trend toward shorter lead times, a multimillion-dollar investment could backfire in two years’ time.

- What assortment should we store at each distribution center? (How do we determine high- versus low-velocity distribution centers?)

- How should we manage the replenishment strategy: push or pull?

- What automation choices should we make? These decisions must be linked to expected volumes, as it takes considerable volume to justify the considerable investment. (For grocery—in particular, fresh products—these tradeoffs can be more difficult.)

CPGs need to think long term about asset types and their requirements: How close to the consumer must they be? How flexible? How many orders can they handle? The flow of goods is another question: How many touchpoints should it take to get product from factory to consumer? Despite today’s proliferation of touchpoints, it’s possible that in the future there will be only two or three touchpoints between factory and consumer for certain high-velocity products.

4. Build No-Regrets Capabilities

Developments since COVID struck have unfolded so quickly that companies have hardly had the chance to gain any historical perspective. Still, it’s important to not wait too long to shore up supply chain strengths. If your biggest customer rolls out a new program and your competitors are already onboard, don’t assume the retailer will give you time to catch up. Still, it’s inadvisable to move precipitously, without sufficient analysis and evaluation. Course corrections can be costly, as some high-profile brands have learned the hard way.

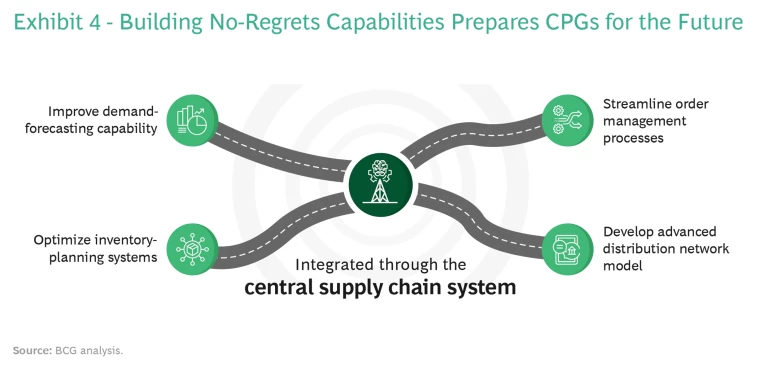

Beyond improving transportation management and scheduling and forging strong relationships with partners, forward-looking companies from across CPG sectors (and with different channel mixes) are pursuing four no-regrets moves, integrated through the central supply chain system. (See Exhibit 4.)

Improving demand-forecasting capability. Many companies are implementing automated systems that capture and leverage multiple demand signals. Leaders are increasingly able to combine macro trend data (such as high-frequency credit card transaction data) with trade data (such as inventory depletion, promotion, and omnichannel shelf sales) to drive improved store- and SKU-level forecasting on a weekly basis. This enables them to deploy products more efficiently—improving weekly availability (and visibility) at the omnichannel retailer’s shelf to boost omnichannel sales and enhance the end consumer’s experience. Predictive ordering, used by Amazon and Uber Eats, among others, will become increasingly common; with robust, geographically specific data in hand, companies can proceed to load the truck without waiting for the actual order to come in.

Optimizing inventory-planning systems. The complexity of serving many retail customers with their many requirements calls for strong inventory-planning capabilities: the ability to analyze forecasting inputs and optimize inventory levels across a distributed, multilevel network—and update the results in real time. Such a capability allows CPGs to seize sudden opportunities, such as a retailer's AI-based prediction of an imminent spike in demand that could result in a double-digit sales increase for a given product. These sorts of spikes were not uncommon during the pandemic, and CPGs that were unequipped to flex lost out.

More robust systems provide the transparency in decision making that allows CPGs to analyze the strategic overrides they’ve made, such as overstocking everything in a given region if they lean toward being customer-centric.

Streamlining order management. In addition to having systems connected with retailers to continuously provide and receive demand and inventory information, CPGs can boost order management efficiency through analytics. Analytics can do a lot. They improve the approach to replenishment (segmenting by customer as well as by product). They also help companies make more informed decisions—for example, in weighing the tradeoffs between speed and efficiency (truckload size) in getting at-risk products (such as those out of stock on the store shelf) to the customer.

Developing an advanced distribution network model. A multi-echelon model (such as having centralized warehouses as a fallback to support spoke warehouses closer to the end customer) helps CPGs get the most out of their end-to-end spending. It also allows them to regularly evaluate and fine-tune network performance based on different demand and lead time scenarios.

No company can go wrong building critical capabilities and enablers—in particular, digital and automation capabilities. The smartest approach is to first pilot such efforts, so you can learn before scaling them.

The COVID-19 pandemic sparked a meteoric shift to online shopping, which is creating unprecedented opportunities for CPGs to build market share and grow. To seize these opportunities, they need to remove the bottlenecks created by their legacy supply chain systems and processes. Their first order of business must be to better integrate the commercial and supply chain sides. Focusing on demand without factoring in the many variables and complex dynamics of multichannel retail is an invitation to performance woes that can ultimately put the brand at risk. The most ambitious marketing strategy will backfire if it is developed independently of supply chain capacity planning and distribution capabilities. Get supply chain right, and it will become a powerful revenue enabler.