For companies, especially those in consumer-facing sectors, end-to-end supply chain emissions are much higher than the direct emissions from their own operations. By implementing a net-zero supply chain, companies can amplify their climate impact , enable emission reductions in hard-to-abate sectors, and accelerate climate action in countries where it would otherwise not be high on the agenda.

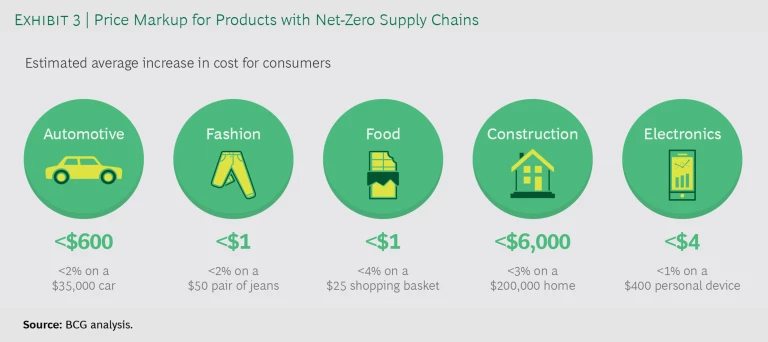

In most supply chains, the costs of getting to net zero (the state in which as much carbon is absorbed as is released into the atmosphere) are surprisingly low. Even full decarbonization would result in end consumer price increases of only 1% to 4% in the medium term—less than $1 on a $40 pair of jeans.

The Economic Case for Reducing Supply Chain Emissions

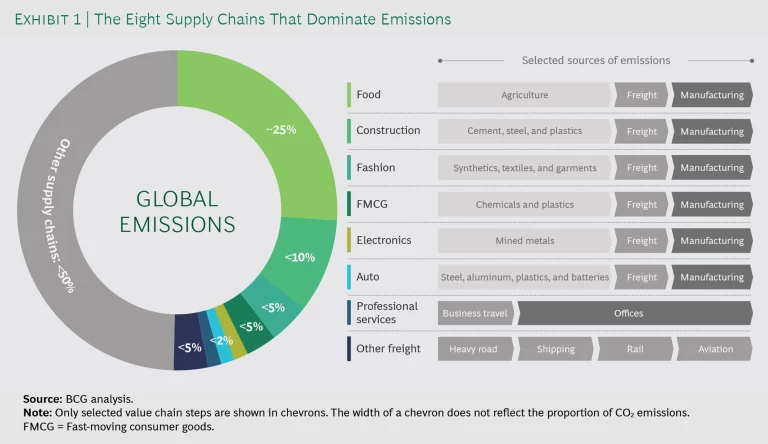

The global supply chain carbon footprint is substantial. Eight global supply chains account for more than 50% of annual greenhouse gas emissions. Only a small proportion of these emissions are produced during final manufacturing. Most are embedded in the supply chain—in base materials, agriculture, and the freight transport needed to move goods around the world. (See Exhibit 1.)

For producers of many of these materials, as well as for freight transport players, ambitious decarbonization is extremely challenging. Many supply chain emission reduction measures are comparatively expensive. Partners often operate in markets that are commoditized, with slim margins and limited opportunities for differentiation. Across a whole value chain, however, emissions may be addressed more affordably. In most supply chains, there is the potential for substantially more efficiency and for much greater reuse of materials. (See Exhibit 2.) In addition, a large share of emissions comes from traditional power, which can be replaced relatively cheaply with renewables.

As a result of this—and the fact that emission-intensive base materials account for only a small share of end consumer prices—decarbonization is much less expensive for companies at the end of any given value chain. In fact, in all the value chains we have analyzed, full decarbonization would lead to an increase of no more than 4% in end consumer prices.

How can this be? As an example, consider the steel that goes into a midsize family car with a $35,000 sticker price. Producing steel is one of the most emissions-intensive activities in the supply chain. Producing zero-carbon steel can increase the steel makers’ costs significantly—by as much as 50% in some cases. But since steel accounts for only roughly $1,000 of total car costs, the markup on this final product will be much, much lower. In fact, the same car made with exclusively zero-carbon materials would cost only about $600 more—or roughly a difference of 2%. Considering that getting there will take even the most ambitious companies many years, the immediate economics look much less scary. (See Exhibit 3.)

Why Little Progress Has Been Made to Mitigate the Global Supply Chain Carbon Footprint

So why is decarbonization—which is key to mitigating the aggregate supply chain carbon footprint—not already commonplace? The answer is that it is challenging.

For one thing, most companies do not understand the extent or the nature of the problem. While a manufacturer can calculate the greenhouse gas emissions from its own operations with a relatively high degree of confidence, getting a view on scope 3 emissions is complex. The challenges are especially daunting for companies with tens of thousands of individual products and significant turnover in the supplier base. Some even struggle to understand who their suppliers are in the first place. It does not help that data-sharing on product emission footprints is still in its infancy.

Subscribe to our Social Impact E-Alert.

Even when companies have a decent amount of transparency, addressing emissions is far from trivial. Supply chain emissions can be distributed across hundreds of individual tier n suppliers (including suppliers and suppliers of suppliers) in many countries around the globe. They are not static. And prompting action can be challenging. It requires a deeper understanding of abatement economics in upstream sectors, more intensive engagement with suppliers, greater education, joint projects, and, in some cases, the willingness to commit to long-term partnerships. Not many procurement organizations are set up to do these things.

Overcoming Barriers to Reduce Supply Chain Emissions

Fortunately, many of the obstacles can be overcome. Nine initiatives can enable companies to tackle their supply chain emissions successfully.

Build a value chain emissions baseline and exchange data with suppliers. Establishing a comprehensive emissions baseline is a crucial first step in a supply chain carbon footprint reduction strategy. Starting with tier 1 suppliers and the products, components, and commodities that account for the most CO2 emissions, companies should define a baseline using emissions factor databases, paired with direct supplier data where available.

Set ambitious reduction targets on scopes 1 to 3 and publicly report progress. Once they have transparency on their supply chain emissions, companies should set a public target of 1.5°C, a net-zero target, or both, across all emissions scopes and understand what this means for their businesses. In most cases, targets are achievable at limited cost. Companies should also actively cascade targets through their supply chains.

Redesign products for sustainability. Companies should make sustainability part of design decisions, for example by increasing recyclability and using greener materials. Even existing products can be redesigned to reduce supply chain emissions.

Design the value chain and sourcing strategy for sustainability. Companies should also consider emissions in their value chain design choices, for example by rethinking their make-or-buy decisions and by limiting the need for long-range logistics. Nearshoring can reduce transport emissions and has the secondary benefit of making supply chains more resilient to shocks—increasingly important in a postpandemic world.

Integrate emissions metrics in procurement standards and track performance. Setting procurement standards for suppliers is one of the most powerful direct ways to address upstream emissions. Strong standards link practices to procurement decisions, such as mandating a specific share and quality of renewable power, required levels of process efficiency, or a required share of recycled materials. In some cases, this may require more intensive engagement—for example to educate, provide technical advice, enable longer-term asset upgrades, or encourage a commitment to continuous improvement.

Work with suppliers to address their emissions. Some upstream suppliers may lack the knowledge to reduce emissions. Providing education and technical support can be transformative. Where tier n suppliers struggle with the economics of longer-term asset upgrades, companies can help by co-investing or committing to longer-term offtakes.

Engage in sector initiatives for best-practice sharing, certification, traceability, and policy advocacy. Pushing for sector initiatives through industry bodies is another way to increase impact. Ambitious companies should put pressure on industry bodies and other organizations to establish sector-level targets for climate action. Companies can also join forces in cross-sector policy groups to change the wider policy context for decarbonization.

Scale up buying groups to amplify demand-side commitments. Joint commitments on green materials can be a powerful tool to encourage upstream investments into otherwise subscale decarbonization technologies and make green solutions more economic over time.

Introduce a low-carbon governance to align internal incentives and empower your organization. Finally, companies looking to decarbonize their supply chains need to change the way they operate internally. Procurement functions will have to adjust, as will product development, finance, strategy, and sustainability. Supply chain changes will be successful only to the extent that they are supported by clear targets, dedicated funding, and management incentives. At the same time, the number of interfaces between functions involved in climate-related topics needs to be reduced. All of this requires better governance.

A Carbon-Neutral Supply Chain on the Horizon?

Supply chain decarbonization—and, more broadly, analyzing the relationship between the supply chain and climate change—presents a giant untapped opportunity for international action. It can enable companies with relatively small direct-emissions footprints to have impact on a global scale. And it does so with a very limited impact on final product prices. In most industries, economics are not a meaningful barrier to achieving net-zero supply chain emissions.

Upstream decarbonization, however, is hard—and it takes time. It requires companies to change the way they design products, choose and engage with suppliers, and govern their own organizations. Leading companies are already addressing these challenges, making headway in the effort to reduce their supply chain carbon footprint. Others should start doing so, too.

This article is a summary of a longer report published by the World Economic Forum in collaboration with Boston Consulting Group. The full report can be downloaded here .

The authors thank Henri Humpert for his contribution to this article.