The oil and gas (O&G) industry has never faced a more challenging business environment than it does today. As COVID-19 shakes fossil fuel demand and accelerates the transition to alternative forms of energy, many O&G companies have endured their most unprofitable year in decades. Gasoline demand has dropped significantly in recent months as a result of restrictions on movement and as more people work from home and rely more heavily on e-commerce. Demand in Q2 and Q3 of 2020 in OECD countries was 19% lower than in the corresponding quarters of 2019 for gasoline, and 11% lower for diesel, where a surge in logistical activities linked to e-commerce partially sustained demand. As demand has fallen, so has foot traffic in service station convenience stores (C-stores) in most markets.

One thing is certain: the competitive landscape for service stations is changing even more rapidly than industry observers had previously expected, and the risk for players that don’t adopt innovative business models is even greater now than it was when we discussed the situation in our previous report “ Is There a Future for Service Stations? ”

Counterintuitively, that’s why this is a critical time for O&G companies to invest even more in fuel retail. By exploiting nonfuel value pools, bolstering the transition to different forms of energy, and pursuing new avenues of growth, fuel retailers can help themselves diversify away from hydrocarbons and offset the volatility and possible decline of their traditional businesses. Fuel retail will be a key growth vector for oil companies in the coming years, complementing their other diversification and sustainability efforts.

The return on capital employed by oil companies that have invested substantially in fuel retail exceeds 20%.

The benefits to players that have moved early in these areas confirm the value available in fuel retail, even during a pandemic. International oil companies with a large fuel retail footprint have recorded very good financial results in recent quarters in their marketing divisions, thanks to increasing their margins during a period of declining oil prices, and to successfully repositioning their C-store concept as a safer neighborhood shopping option (often complementing online purchases), thereby increasing nonfuel revenues. Overall, the return on capital employed by oil companies that have invested substantially in fuel retail exceeds 20%.

Benefits of Investing in Fuel Retail

Players that invest in the future of fuel retail will be able to reap the benefits along four key dimensions.

Tap into new B2C and B2B value pools. Fuel retail is the only O&G business that has direct access to end customers—both B2C and B2B—and therefore is the only O&G business with an enormous amount of customer data. In times when oil demand is uncertain, companies can use this data to identify adjacent spaces to generate more value for customers and provide new revenue streams.

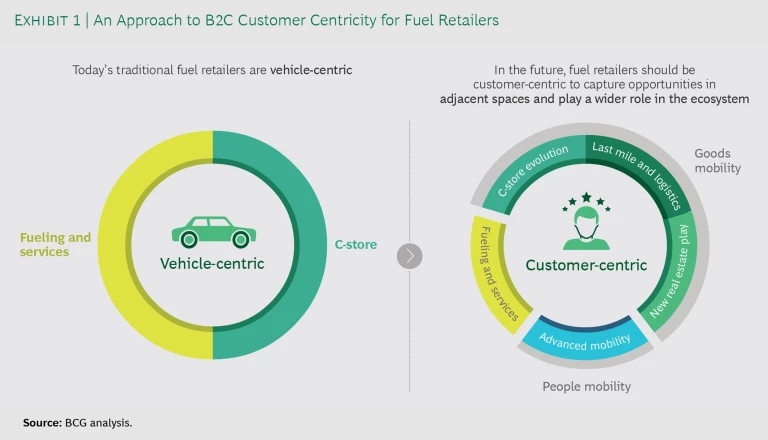

Fuel retailers have increasingly focused on building out their nonfuel offerings, using daily touch points to address B2C and B2B customer needs. Digital solutions enable retailers to further monetize these millions of daily touch points, transforming fuel retail from a vehicle-centric model to a customer-centric model and expanding their accessible value pools. (See Exhibit 1.)

In addition, fuel retailers can use their sites to pursue strategic real estate plays. For example, they can exploit these sites as logistic hubs for last-mile delivery, leveraging the proximity of their network to B2C customers—both for their C-stores and in partnership with e-commerce platforms—to grow their offering of instant deliveries, which are possible only through a well-distributed network of micro-hubs. For B2B customers, fuel retailers can leverage data accumulated from years of serving commercial fleets to offer insights into utilization and maintenance, offering new added-value services and cross-selling other products (their own, such as lubricants, or from third parties).

Expanding into new value pools will increase the nonfuel component of retailers’ income and reduce the volatility typical of the O&G business.

Expanding into new value pools will significantly increase the nonfuel component of retailers’ income and reduce the volatility that is typical of the O&G business, allowing companies to diversify away from hydrocarbons.

Bolster energy transition efforts. Companies should take this opportunity to invest in the alternative fuel ecosystem shaped by electric vehicles (EVs), shared mobility, and other emerging green transportation solutions. Fuel retailers can leverage their network presence and their direct knowledge of customers to win in these new mobility value pools. Besides the obvious value of diversification, investing in alternative fuels supports the company’s broader energy transition efforts, which accelerated during the pandemic.

Fuel retailers can provide a range of new green offerings—from EV charging to hydrogen and biofuels—in line with their pledge to support decarbonization. Companies that invest in energy transition upstream, such as hydrogen production or biofuels, can place their output in their retail outlets. Energy transition can also help companies expand beyond the service stations. For example, players such as BP and Total are planning to build many new EV charging points, which will eventually greatly outnumber their fuel retail sites.

Support placement of refined products and trading activities. The International Energy Agency warns that, by 2030, some 14% of today's refining capacity in advanced economies will be at risk of lower utilization or closure. At a time when demand for refined products is increasingly challenged, oil companies may find it important to have their service stations create an internal demand for diesel and gasoline. In addition, selling nonfuel items and other services will add value to the volumes of refined products sold through the fuel retail network. For companies with a strong trading arm, these “shorts” of refined products from the fuel retailers can be very valuable in trades, complementing their long positions from refineries and providing great opportunities for arbitrage in terms of quality, time, or geography.

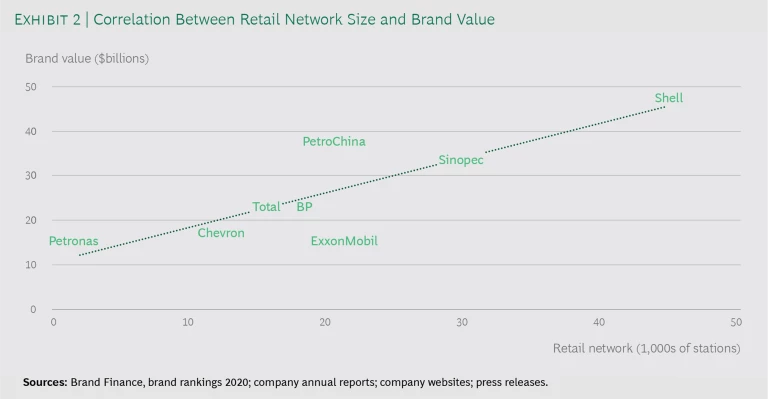

Boost brand and enterprise value. Fuel retail is a brand builder for oil companies. It reinforces brand and has marketing synergies with other business lines such as lubricants. Our analysis finds a direct correlation between the global size of a company’s retail network, as measured by the number of service stations, and brand value, as determined by independent agencies. (See Exhibit 2.)

Oil companies are considering repositioning their brand as broader energy companies that have global net-zero emissions aspirations. In this context, an extensive retail network can provide the visibility and brand equity to communicate new brand attributes quickly and effectively. This repositioning, in combination with a redesign of the product portfolio, may help attract business partners, investors, and talent. It may also help improve employee satisfaction and retention.

How to Win

Investing in fuel retail can be an attractive opportunity, but it’s not for the faint of heart because it requires transforming the business model and developing capabilities that most fuel retailers have not yet mastered.

To succeed, fuel retailers must transform their business model’s offering, asset portfolio and network, and organization and capabilities.

Today, the traditional business model for service stations is at risk because of lower transportation fuel demand and because of substitution risk from alternative fuels and alternative mobility models. In order to succeed, fuel retailers must transform their business model in three dimensions:

- Offering. Leveraging their deep customer understanding, companies need to reposition themselves as mobility, logistics, and even real estate companies that offer a broader range of products and services, exploiting their data and network locations as sources of competitive advantage. They also need to play a key role in alternative fuels (EVs, hydrogen, and biofuels), even outside the service station. Leading companies have already begun to do this.

- Asset Portfolio and Network. Players must reassess their service station networks in light of anticipated future mobility trends. Doing so will enable them to buy and sell assets proactively, purchasing today the sites that will become mobility hubs tomorrow and divesting the sites that are high performing today but may become marginal tomorrow (for example, fuel-only urban sites that EVs will challenge). Companies can also reassess and optimize their mix of company- and dealer-owned stations, using the same logic.

- Organization and Capabilities. Fuel retailers should start preparing the organization to cope with the new challenges—from holistically managing data among loyalty programs and different payment systems and lines of business to building new capabilities in digital and alternative fuels. Five or ten years from now, the organization of fuel retailers will look significantly different from the way it looks today, and building capabilities in new areas can take time, so companies should start to hire talent and review their key processes today.

In the years to come, fuel retail will be less focused on gasoline and diesel, and more focused on a holistic mobility play, alternative fuels, and a much broader nonfuel offering. Fuel retailers that successfully make this transformation will reap the benefits of securing new nonfuel value pools, accelerating their energy transition efforts, strengthening their brand, and securing a profitable channel for their remaining refined products.