Many companies struggle with post-merger integration (PMI). But with the right mindset, organizations can take advantage of PMI to achieve broader transformation—what we call full-potential PMI. Instead of merely hitting cost-reduction targets, full-potential PMI encompasses aspects that are part of the traditional integration process—as well as many that lie outside of it—to create value while still ensuring business continuity.

Full-potential PMI applies to deals intended to reduce costs (as in traditional industries with incumbent players) as well as those designed to unlock growth (as in faster-growing industries, such as technology, medical technology, and biopharma). In both cases, the approach not only leads to better outcomes in terms of cost synergies, but it also fully optimizes a company across the entire enterprise and positions it for long-term growth. According to proprietary research from the BCG Henderson Institute, companies that successfully combined PMI with transformation outperformed the competition by 11 percentage points of total shareholder return each year from 2005 to 2018.

The coming postpandemic period will likely see an uptick in deals as companies use transactions to improve their performance and mitigate risks. By implementing these deals the right way, using full-potential PMI, management teams can ensure that they’re emerging not only with the right cost structure but also with an organization poised to win for years to come.

The Limitations of “Good Enough” PMI

The integration phase is where deals often fall short. Even the most intuitive transactions—the ones that look great on paper—often miss their targets by failing to effectively combine the companies involved. To avoid this outcome, organizations launch a PMI that is just good enough—focusing on structured initiatives to achieve cost synergies, retain key talent, and ensure smooth operations for the new entity on day one after the deal closes. This approach is necessary but insufficient, and it’s also ultimately self-limiting: the company aspires to nothing greater than avoiding mistakes.

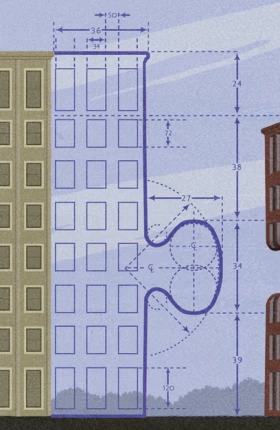

Full-potential PMI ensures that a deal not only hits all of its objectives but also capitalizes on the combined opportunity of both organizations in a more transformative way.

When done right, however, full-potential PMI ensures that a deal not only hits all of the objectives that justified the deal in the first place but capitalizes on the full combined opportunity of both organizations in a more transformative way. Notably, it calls for unlocking growth, efficiency, capability, and strategic value by encompassing measures not purely linked to the deal. Transformation initiatives that go beyond merger synergies are crucial to position the new company for outsize performance.

Conventional wisdom suggests that good-enough PMI encompasses all the change and focus that a newly combined entity can manage. We disagree. Full-potential PMI is tougher, but the core elements of success are similar for both PMI and transformations—and the advantages to pursuing both simultaneously, rather than as two separate programs, are clear. Companies emerge with a well-defined path to competitive advantage, along with the right cost structure, organizational structure, and strategy to succeed.

Three Key Levers of Success

On the basis of our work with clients, we believe that full-potential PMI requires management teams to take three key actions.

Focus on growth as well as cost, emphasizing both short-term and longer-term sources of value. Historically, companies closing a deal have given lip service to the growth component. They talk about growth as a justification for the deal but then focus almost exclusively on short-term measures to capture synergies and reduce costs. Full-potential PMI calls for a more balanced approach. Short-term initiatives to reduce costs are certainly critical—and full-potential PMI can help companies not only hit but exceed their targets in that area. But companies also need to think about transformation initiatives, both immediately and in the medium term, to grow revenue and operate the business in new ways. Driving both growth and efficiency, in parallel, is essential.

Notably, companies need to achieve the same level of specificity and detail in their plans for growth through a full-potential PMI as they do in their plans to reduce costs. What’s more, many growth initiatives may lie outside of the integration process and require an investment. Digital is a good example: in order to rethink processes and engage with customers and suppliers in new ways, companies are investing in new technologies across all business units and functions. That can have a transformative effect on operational and financial performance. But companies shouldn’t wait until after a deal has closed to start thinking about it. Planning for growth before the close is critical to increase the value-creation potential of the deal. Early planning also enables growth initiatives to be launched as soon as possible and in the right sequence to maintain business continuity.

In our experience, successful transformations depend on short-term initiatives to fund the journey and drive complex initiatives in order to win in the medium and long terms. In the portfolio for a full-potential PMI, revenue and cost initiatives are balanced with both immediate value drivers and medium-term transformative initiatives. Many of these may not have much to do with merger synergies, but they are crucial to build a long-term competitive advantage.

Integrate cultures as well as companies. Companies must consider cultural alignment in the PMI process, and they should capitalize on the natural inflection point that it creates to do so. In a sense, deals give management a window of opportunity to reset and reorient the new organization around a new, unified purpose and narrative to ensure that the company emerges with a reengaged workforce—provided that leadership thinks about this process systematically and proactively.

Management teams will need to consider how the two organizations will mesh and how to create a high-performance culture. They will need to weigh such considerations as whether the two companies are global or have workforces concentrated in a particular country (in which case organizational cultures can be more ingrained and specific). Management will also need to consider whether the companies involved in the deal have long legacies of operations or are in vastly different industries.

And if the two companies involved in a deal have different cultures, management will need to focus even more deliberately on integrating them. The scope of the cultural integration will vary by deal. Combining two US-based analytics startups, for example, may not involve significant cultural differences. But combining a US-based analytics startup with a German auto-parts manufacturer that has been in business since the automobile was invented will require more specific interventions.

Invest sufficient resources. Transformations and merger integrations both demand focus, discipline, and dedicated resources. Though combining them through a full-potential PMI approach requires no less, the return on investment is massive, given the potential value at stake. Companies need to allocate sufficient resources, such as full-time internal project managers, leadership time and attention, and external resources in critical areas. Trying to skimp on full-potential PMI represents false savings at best. (We’re consistently surprised when companies seek to generate hundreds of millions, or billions, of dollars in value through a deal but balk at designating a full-time project manager to oversee the process.)

The return on investment for a full-potential PMI is massive, given the potential value at stake.

The practical reality of full-potential PMI is a large volume of workstreams and initiatives that collectively result in outsize success. The only way to execute across so many projects and programs with speed and a high degree of financial accountability is to establish a strong integration office with the requisite processes, structure, and authority. Leadership teams need to set a bold ambition, prioritize the short-term and long-term measures that will generate the biggest value, and ensure that the business continues to operate throughout the process.

Applications Across a Wide Array of Starting Points

It may seem as though full-potential PMI applies only to distressed companies in need of a turnaround, but that is not true. From our engagements working with companies, we have seen this approach succeed for companies across the full spectrum of starting points:

- Distressed companies in need of a full turnaround

- Stressed companies facing competitive pressure and struggling to cut costs or grow organically

- Healthy companies seeking to proactively reduce costs and reposition the business for growth

- Leading players looking to reinforce their advantage and implement a next-generation strategy or digital business model

The common theme among them is a willingness to create a bold vision and take dramatic action in order to drive a step change in performance.

Integrating a deal can be challenging, and when companies overlay that process with a transformation, they are combining two of the most challenging episodes in a business’s lifespan. Yet this approach can also deliver similarly transformational gains in performance. Moreover, given that many companies are embracing always-on transformation—rather than discrete programs with clear end points—to drive their businesses, companies essentially must adopt a full-potential approach to PMI.

By balancing short-term execution with long-term value-creation, aligning corporate cultures, and investing sufficient resources, companies can ensure that they are leveraging the full range of options and capturing the maximum possible benefits from the integration and transformation initiatives.