Although the oil and gas industry has made significant progress toward greater diversity, much remains to be done to gain the performance and productivity benefits that a diverse workforce provides.

A collaboration between the World Petroleum Council and Boston Consulting Group

Introduction

Since 2017, when the World Petroleum Council (WPC) and BCG first examined attitudes about gender balance in oil and gas, the industry has experienced significant disruption. In addition to the severe effects of the COVID-19 pandemic, the global energy transition and the continued growth of digitization have accelerated both the need for and the pace of change.

The percentage of women working in the oil and gas industry remains unchanged at 22%, the same level reported in 2017. The pandemic and associated oil price shock likely impacted progress, which underscored the need for continued focus, commitment, and action to improve diversity and inclusion (D&I) . There are glimmers of hope: the number of D&I policies and programs introduced by companies is up by about 50% since 2017, indicating that even though outcomes stalled, the commitment to act and lay foundations for future progress strengthened throughout the period.

Challenges Persist in the Sector

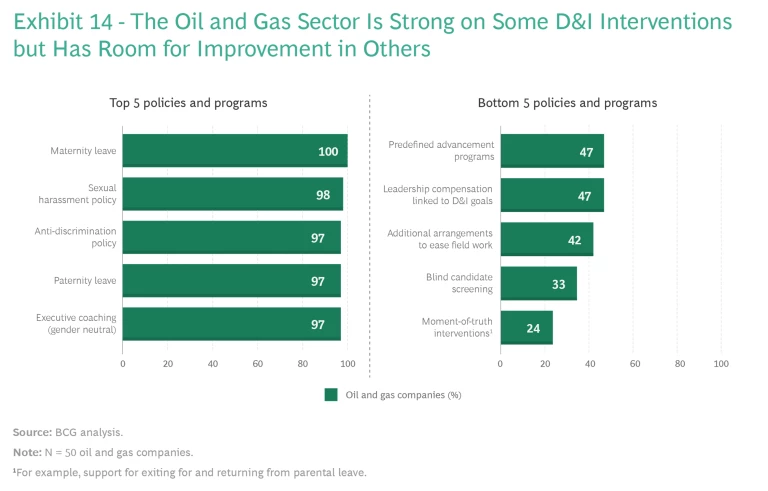

More must be done to achieve gender parity and improve diversity. Significant gaps in policies and programs remain. Less than half of companies link leadership compensation to D&I goals. And only one-third have procedures to ensure “blind” screening of candidates to remove unconscious recruiter biases.

Companies must take urgent action to boost diversity among their employees and make diversity a strategic priority if they are to thrive in a data-driven, low-carbon world. This new world will require innovation, and innovation requires diversity; BCG has found that companies with greater diversity outperform others on both innovation and

While other sectors have realized the importance of purpose-led work, better work-life balance, and equity, many oil and gas companies have only recently begun to commit to this journey in earnest. Our research shows that although the importance of race is increasing in the oil and gas sector’s D&I conversation (based on industry press coverage), gender remains the primary topic.

So far, oil and gas companies have undertaken fairly simple and straightforward D&I initiatives and have met local regulatory and legal requirements. Further progress will require business leaders and managers to take harder steps—questioning unconscious bias far more and making deliberate decisions to boost diversity and inclusion in their hiring choices, policies, and support throughout employees’ career life cycle. Such an effort calls for a more intentional and proactive approach, led from the top, that embeds D&I values in all key business processes, especially HR-related ones. According to our findings, five challenges require especially urgent attention:

- Underrepresentation of Women in Entry-Level Jobs. While 44% of male and female STEM graduates and young professionals worldwide indicate an interest in working in the oil and gas industry, women occupy only about one-quarter of the industry’s entry-level

positions.2 2 ADNOC: Oil & Gas 4.0: Workforce of the Future, 2019. This results in a slimmer pipeline for women to be promoted from within. - Lack of Women’s Representation in Technical and Operations Roles and Expatriate Positions. Women continue to be underrepresented in these areas—both of which are critical to improving a person’s promotion prospects—despite the willingness of nearly two out of three women in our employee survey to accept international assignments and alter their career plans.

- Low Uptake of Existing D&I Policies. About half of the male and female employees we surveyed said they don’t use their company’s D&I policies and programs. While some employees said that doing so was “too much effort,” others said that they felt unsupported unless their supervisor was also from a diverse group.

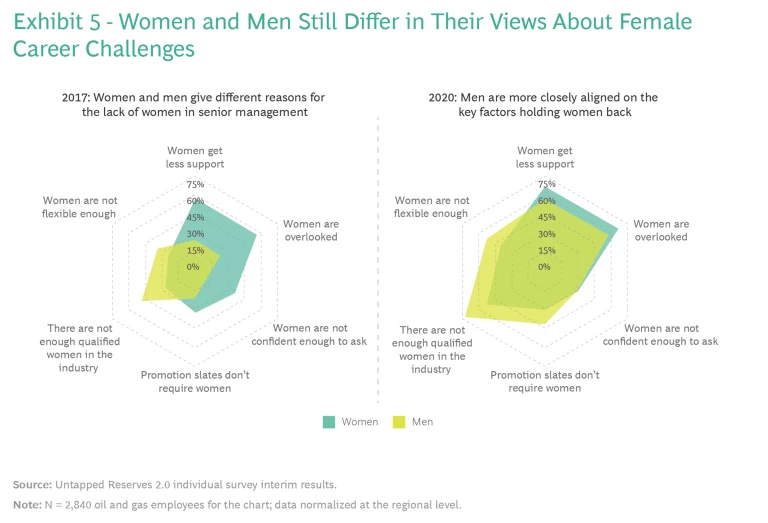

- Persistent Unconscious Biases Around Gender-Related Challenges. Although they are more aligned now than they were in 2017, women and men still differ in their views about female career challenges, with a significant perception gap remaining in several areas. Men hold over four-fifths of decision-making senior and executive-level positions, increasing the risk that a lack of understanding of the actual barriers faced may negatively impact women’s prospects for advancement.

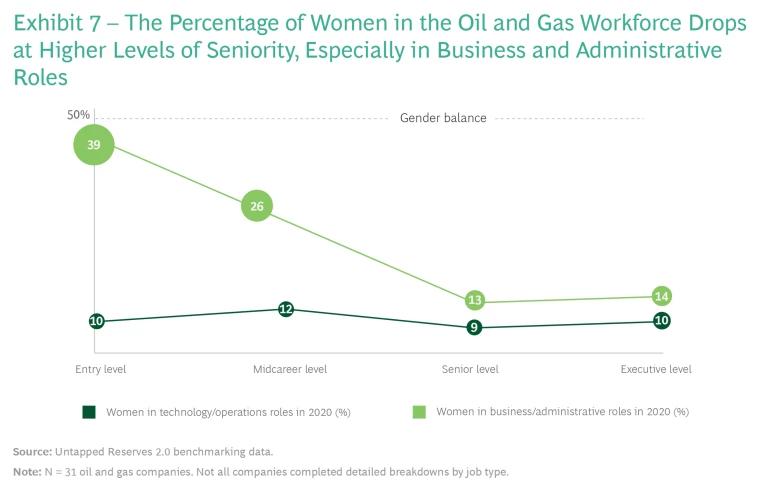

- Low Female Representation in Senior Roles. The proportion of women in senior-level decision-making positions is half that of women in midlevel positions, particularly in business and administration roles (where the numbers dropped from 26% in 2017 to 13% in 2020). This pattern holds true across regions and is consistent with our 2017 findings.

Signs of Progress Emerging

There are some positive signs that companies have taken action since 2017 to support diversity:

- About 67% of the companies we surveyed in 2020 have a dedicated D&I team, typically within HR, compared to 39% in 2017; and 74% of companies track relevant D&I key performance indicators (KPIs), versus 40% in 2017.

- The CEOs of 77% of companies have publicly pledged to meet D&I targets—up from 38% in 2017.

- About 70% of the employees we surveyed in 2020 believe that the industry has improved the way it addresses D&I since 2017.

The industry’s more active approach has yielded positive results in important areas. While women’s overall representation in the industry has remained flat, the share of women in global companies (those with operations in multiple countries) has risen slightly from 24% to 25%, and the proportion of women at global companies entering the industry as university graduates has also increased slightly, from 26% to 28%. In addition, the number of D&I policies and programs implemented by companies (across all types of interventions) has increased, on average, by about 50%—a significant and very positive shift since 2017.

Notably, all of the companies that we surveyed in 2020 offer maternity leave, and more than 95% of them support equal pay, offer paternity leave, and have sexual harassment policies in place (versus 90% of companies offering maternity leave, 67% of companies supporting equal pay, and 56% of companies providing paternity leave in 2017). Now that these critical table stakes (which are often mandated by governments) are widely in place, companies are starting to explore more advanced policies and programs, including childcare support and making diversity a key component of leadership remuneration.

A Structured Approach to Accelerating Progress

The business case is clear. By creating a more diverse and inclusive culture, oil and gas companies can benefit from greater depth and breadth of perspective and can boost business performance. According to Catalyst, a nonprofit organization, companies with more women on their board of directors outperformed those with the least on three financial measures: return on equity (53% higher), return on sales (42% higher), and return on invested capital (66% higher). Another study shows that companies with top-quartile performance on ethnic and racial diversity enjoyed 35% higher financial returns, and those with top-quartile gender diversity were 15% more likely to have returns above industry

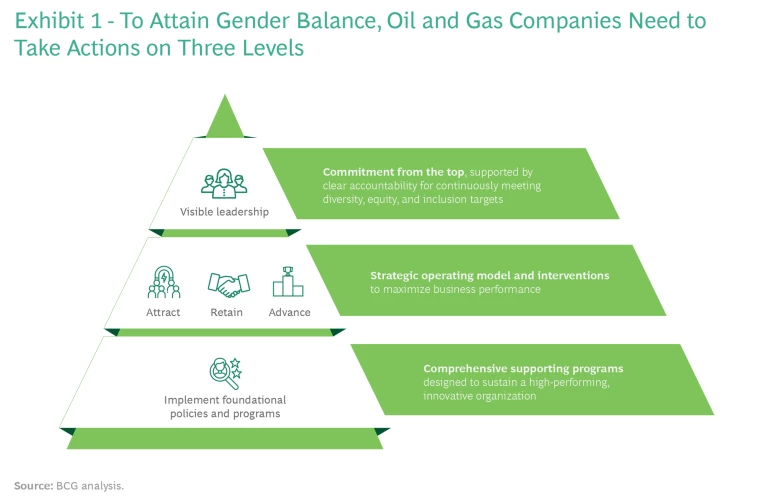

In the course of our research, we’ve identified three essential elements that together form a framework for a successful D&I strategy. (See Exhibit 1.)

They are as follows:

- Foundational D&I Policies and Programs. Companies need to ensure that strong policies and programs are in place so that they can track progress and maximize business performance. For example, they must introduce procedures to ensure that managers are held accountable for achieving D&I goals and to embed D&I values in decision making, in addition to providing basic (and often regulatory) requirements such as maternity/paternity leave, equal pay, and anti-discrimination policies.

- Strategic Operating Model and Targeted Interventions. Companies must create a strategic operating model that enables them to attract a more diverse talent pool, retain diverse staff throughout the employee journey, and ensure that diverse individuals advance into senior-level jobs. For example, companies need to ensure that their policies and processes are impartial and gender neutral, and take a transparent, merit-based approach to assessment.

- Clear, Sustained Commitment from Senior Leadership. Strong, visible commitment from senior leadership, supported by clear accountability, is a key factor in determining whether male employees consider diversity, equity, and inclusion important. This includes having clear targets and aspirations to signal that D&I is a strategic priority for the organization and to foster accountability within leadership for driving D&I outcomes.

Our research and industry engagement indicate that the following six ways of addressing these ongoing challenges are likely to have the most impact across all career levels:

- Reinforce leadership commitment through visible and sustained support.

- Track baseline metrics and set clear goals and targets.

- Ensure that there is no bias in promotion pathways.

- Empower employee resource groups to improve program and policy effectiveness.

- Link D&I outcomes to capabilities around innovation and adaptation.

- Actively create an inclusive environment.

The first two approaches are especially relevant for the “leadership” level in our framework, while the final four relate to the “operating model” level of the framework.

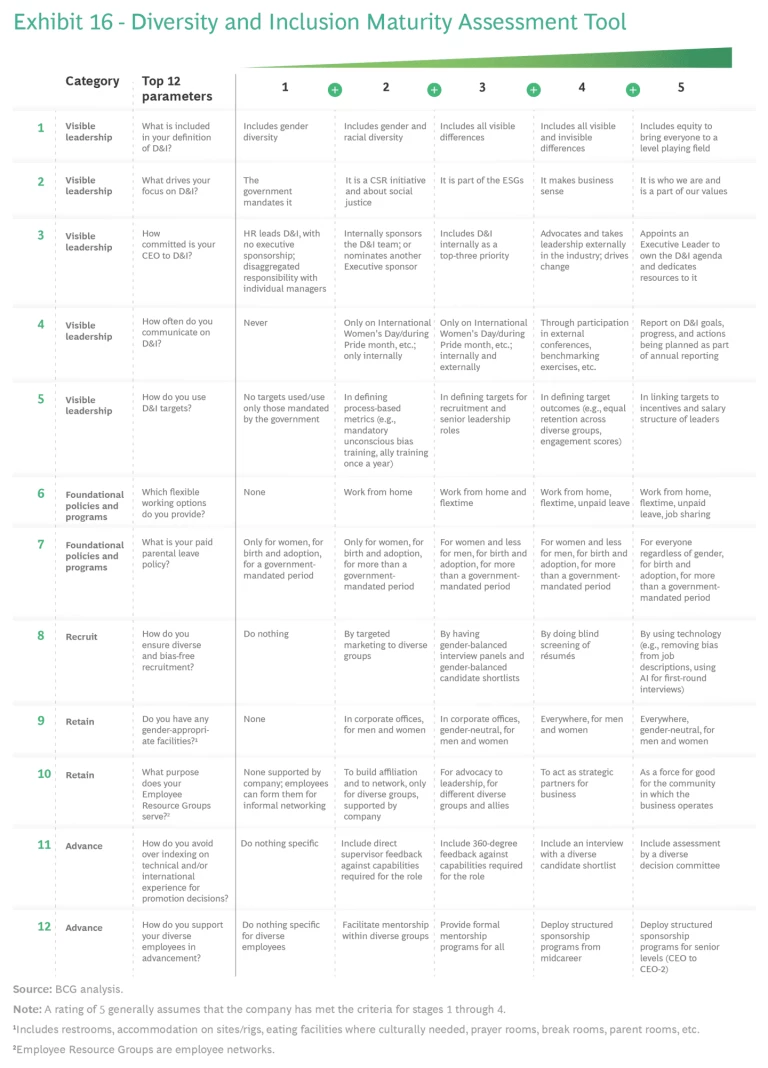

To support companies in identifying the actions they need to take to drive an increase in diversity outcomes, BCG and the WPC have developed the Diversity and Inclusion Maturity Assessment tool, which rates companies across 12 parameters and gives a score ranging from one to five for each one. The parameters cover factors ranging from CEO commitment to flexible working, and they fit into the five categories contained in the framework above. Using this tool, companies can develop momentum and create more targeted policies and programs to move the needle on D&I. (See “

Our Tool for Assessing (and Advancing) D&I Maturity

.”)

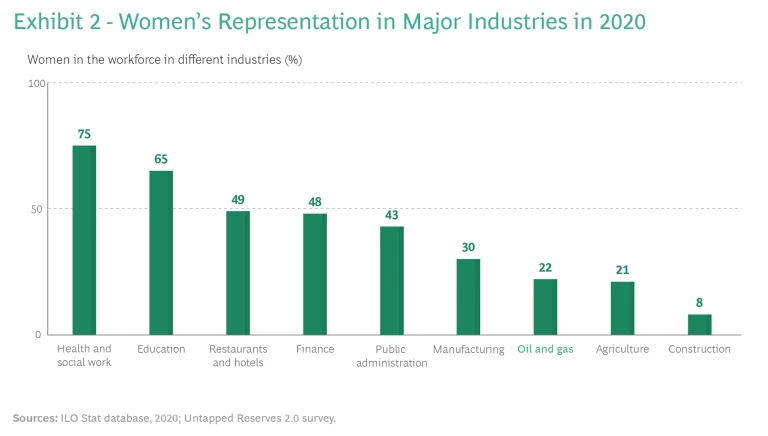

The Oil and Gas Industry Today

Headline progress on women’s representation in the oil and gas industry has stalled at 22% since 2017. In addition, the oil and gas industry continues to underperform other sectors, ranking in the bottom third for gender parity among nine sectors. (See Exhibit 2.) Within the industry, however, we noted some pockets of improvement at the regional level.

Pockets of Regional Improvement

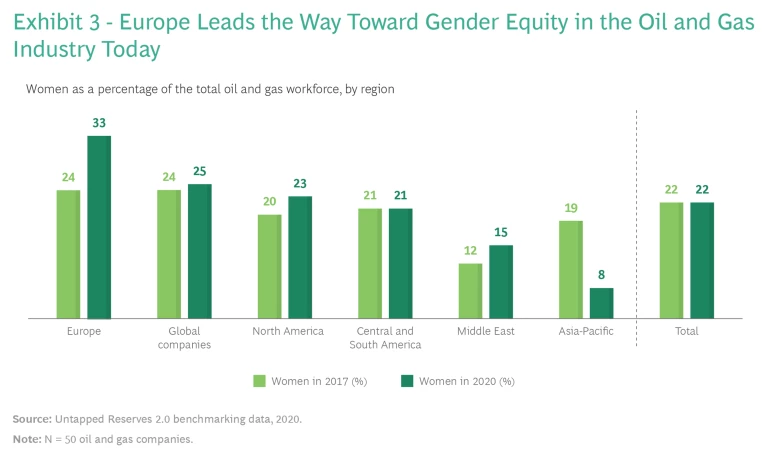

Europe has seen the greatest improvement in gender equity since 2017. Women’s representation has risen from 24% to 33%, helped by increased interventions from governments in Germany, the Netherlands, and other countries. (See Exhibit 3.) For example, in Germany, under the Wage Transparency Act, employees can ask their employer to disclose how their pay compares with male or female colleagues, so the act enables workers to discover the average salary of employees of the opposite gender who perform an equivalent job. In most other regions, women’s representation either improved slightly or remained the same. The only region to see a decline in women’s representation is Asia-Pacific.

How Global Companies Performed

Approximately 40% of companies in this year’s company survey are multinationals that operate in multiple countries. Companies in this global category in 2020 include the industry’s biggest players and are broadly comparable with those in 2017. Global companies tend to set more D&I goals and policies and to be more active in pursuing these objectives than regional companies. Among global companies, women’s representation increased only very slightly, from 24% to 25%.

The overall decline in representation as women progress from midcareer positions to more senior roles exceeds 50%—a figure consistent with what we observed in 2017.

The data also reveals several other significant developments among global companies, the first two related to the “attract” component in the framework operating model and the third related to the “retain” and “advance” components:

- The proportion of women entering the industry as university graduates has improved but is still less than one-third of the total graduate intake. Companies are using policies and programs such as targeted marketing campaigns and partnerships with universities to recruit female graduates, but attracting sufficient talent in general remains an issue.

- Women are underrepresented in entry-level technical jobs that do not require a degree, despite being overqualified. As in the past, women are underrepresented in entry-level technical positions that don’t require a degree—and women who do secure these roles are more likely to have a degree than their male colleagues (57% of women versus about 40% of men). As a result, the relatively few women selected for these jobs tend to be overqualified. At the same time, these roles are valuable ones for successful female candidates because they provide on-the-job apprenticeships and training that enable women to progress in technical areas later in their careers. This area clearly warrants further attention from global companies.

- The decline in women’s representation between middle-level and senior-level positions is as pronounced as it was in 2017 and is consistent across all regions. While some companies have started to take action, not enough are introducing programs to address the decline at senior levels. Our research shows that 50% of women feel that sponsorship is an important pathway to promotion and senior-level advancement. Companies interested in supporting increased senior diversity should focus on sponsorship and mentorship programs, and should link executive compensation to meeting D&I targets.

Key Findings from Our Employee Survey

In general, men and women continue to express different views about their company’s efforts to tackle gender imbalances, although the gap is narrowing. Our research identified the following developments:

- Men were more optimistic than women about the D&I progress their company had made since 2017. Overall, 75% of men and 66% of women said that there had been “some” or “significant” improvement. In addition, twice as many men as women said that their organization’s current promotion criteria were fair, whereas twice as many women as men said that companies needed to put more effort into promoting women.

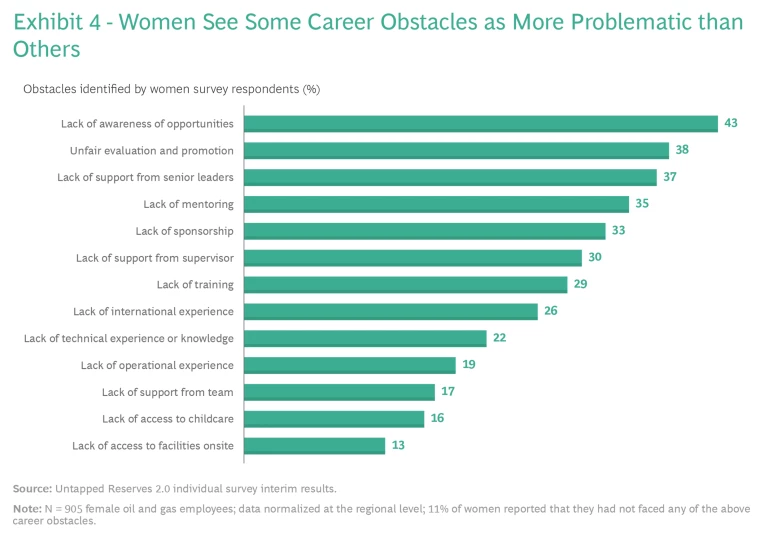

- Sponsorship and mentorship career obstacles are unique to women. Some obstacles to career advancement, such as unfair evaluations and an absence of international experience, were problematic for both men and women. Others, however, including a lack of mentoring and sponsorship and a lack of supervisor support, posed particular problems for women. (See Exhibit 4.)

- Women use their company’s attraction and retention policies less than men do. Women were less likely than men to say that they have used their company’s retention policies (23% versus 30%) or advancement policies (34% versus 38%). Examples of such policies include mentorship, education assistance, technical training, and predefined advancement programs. This may indicate an underlying issue with how the policies are designed—or with how they are presented and accessed within organizations—that renders them ill suited to diverse employees.

- The D&I policies and programs most used by men and women differ. Women were most likely to favor mentorship (54%), employee resource groups (54%), and balanced promotion slates (53%). Indeed, women were twice as likely as men to think that employee resource groups are helpful. By contrast, men favored technical training to maintain skills (54%), visible role models (44%), and access to career progression opportunities (44%). Women also valued technical training (45%), visible role models (46%), and access to career progression opportunities (50%), and they generally rated the value of D&I programs overall more highly than their male colleagues did. Women value unconscious bias training more than men do. Significantly, 20% of female respondents, but only 8% of male respondents, thought that unconscious bias training was helpful. Since more companies are introducing unconscious bias programs, according to the findings from our company benchmarking, the data suggests there may be a lag between delivery and uptake among target audiences.

- Women and men are more aligned in their views about female career challenges in 2020 than they were in 2017. More men in 2020 agreed that women get less support and are overlooked for promotion. (See Exhibit 5.) However, since men continue to hold the majority of decision-making roles in the industry, the remaining gap between men’s and women’s views on these points is likely to continue to negatively impact women’s career prospects until a more transparent conversation about the barriers faced in the advancement of diverse candidates occurs.

Career Progression Trends for Women in Technical and Business Roles

Among all companies, our research uncovered two major findings about gender balance in different job types:

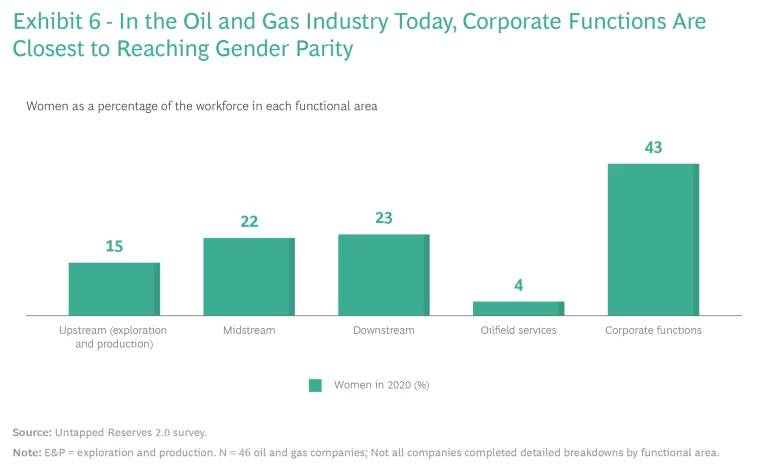

- The proportion of women working in business and administration (such as sales, business development, and finance) falls by more than 50% from entry-level roles to senior-level roles. This is consistent with our findings in 2017. The reason for the decline may be that skills developed in these areas are more readily transferable to jobs outside the oil and gas industry. Consequently, if their existing employer’s culture or level of inclusion is not positive for them, these employees can move to another company, or even another sector, that may be more inclusive. At the same time, because corporate functions consist largely of business and administration roles—an area where women are still better represented—it comes closer to achieving gender parity than any other functional area in the industry, particularly for early career steps. (See Exhibit 6.)

- The proportion of women in technical and operations roles—equipment handling, maintenance, and other field service disciplines—remained relatively stable across career steps, most likely because the relevant qualifications, skills, and experience are less transferable outside of the oil and gas industry. Women’s representation within this group remains very low, as women account for less than one in eight technical and operations employees at all career levels. (See Exhibit 7.)

Experience in technical roles tends to be a prerequisite for senior leadership positions with profit-and-loss responsibility. Both male and female employees in our survey believed that technical aptitude was essential for promotion to a senior level: 71% said that technical expertise was the main criterion for senior-level advancement, and 60% said that being an engineer or having a similar technical education was the primary factor. Without rapid action to improve intake—of early-career hires but also of lateral hires into midcareer roles—and to retain women in these technical roles, it will become even harder to progress toward gender parity in oil and gas leadership in the years to come.

Some leading players are revisiting their job requirements for middle management technical positions. For example, they are taking the view that a diverse individual with an accounting or commercial background and strong leadership and strategic skills may be able to leverage the technical expertise within their team more effectively, allowing that individual to succeed in what was previously seen as an exclusively technical role.

Major Developments Affecting the Industry

Three major developments impacted oil and gas companies in recent years and created major shifts in the way the industry functions: the energy transition, post-COVID-19 flexible working policies, and an expanding definition of diversity that extends beyond women to create a more inclusive environment for all types of people. Progress on all three fronts is critical if companies are to attract and retain talent, especially as more people make career choices based on their values. Another BCG study found that 57% of respondents to a global survey—and 90% of respondents from underrepresented (diverse) groups—would consider leaving their current job for one at a more inclusive organization if their company didn’t meet baseline D&I criteria. The research estimated the cost of replacing those employees at more than $25 billion a

The Energy Transition

The energy transition has accelerated since our 2017 survey, impacting oil and gas players worldwide. Several oil and gas companies have responded by expanding into new, greener areas—including renewables, sustainable fuels, and electric vehicle charging networks—and many leading players are rebranding or setting net-zero goals.

Responding to the challenges of the energy transition will require innovation in what has historically been a quite conservative sector. Companies with above-average diversity on their management teams reported innovation revenue that was 19 percentage points higher than that of companies with below-average leadership

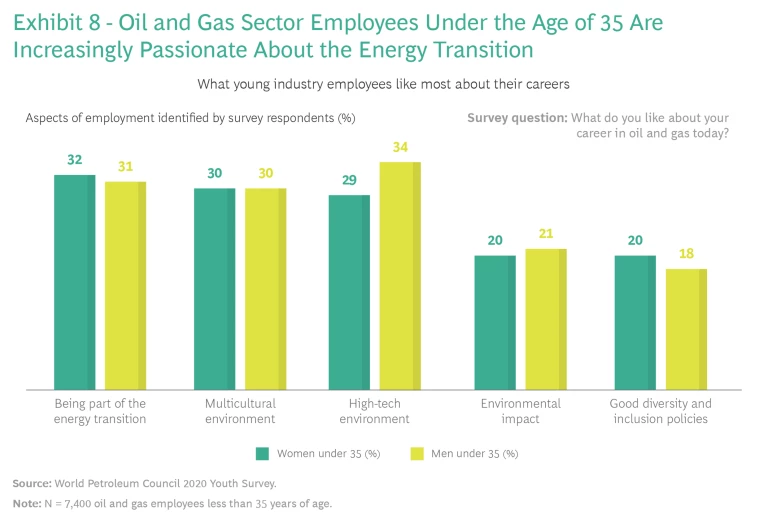

Companies that actively and visibly take action to create clean energy businesses can attract a more diverse talent pool. According to the World Petroleum Council 2020 Youth Survey, about one-third of respondents viewed the energy transition as one of the things they like most about their careers. (See Exhibit 8.) Emphasizing a company’s efforts to advance the energy transition will increasingly become a prerequisite for success in recruiting diverse talent.

Changes Due to COVID-19

In oil and gas, as in other sectors, COVID-19 has been an incredibly disruptive force since it emerged. Companies took many different approaches to D&I issues in the midst of the pandemic, but several leading companies recognized the need to maintain or accelerate their D&I policies and programs:

- During its 2020 restructuring program, Shell recognized the risk and cost of regressing on diversity, so it proactively protected its D&I progress by incorporating diversity-based KPIs into the program. By ensuring accountability through access to data for decision makers, these indicators helped the company increase the proportion of women in leadership positions by more than 4 percentage points. (See “ Case Study: Shell .”)

- Argentina’s state-owned oil company, YPF, recognized that there was an unequal division of responsibilities for household work when employees went into lockdown. In response, it started a campaign urging men in the organization to “share the load” of care duties at home to support equity outcomes. (See “Case Study: YPF.”)

Case Study: YPF

D&I Outcomes

YPF uses employee surveys covering diversity- and gender-related topics to develop and prioritize D&I actions for different groups within the company. This approach enables YPF to maintain momentum in key D&I areas and to gauge the success of individual initiatives, helping ensure their effectiveness.

To boost transparency around its D&I efforts, YPF publishes several reports. In 2017, the company began including a section specifically about D&I in its annual report. The following year, it included a diversity report as part of its broader sustainability report. Managers communicate progress on gender- and diversity-related KPIs every six months to the company’s executive committee and annually to the board of directors. In addition, the company publishes details about its D&I initiatives and wins internally and externally.

Unique D&I Interventions

In July 2020, YPF conducted an employee survey to understand how COVID-19 was impacting gender roles and the use of time by men and women during the pandemic. Approximately 1,700 employees—about 60% men and 40% women—responded, with only a very small number opting to answer anonymously. The survey revealed that the pandemic had reinforced traditional, stereotypical gender roles. For example, men spent less time than women caring for children and more time doing paid work. Women did the bulk of cleaning and care activities, spent less time doing paid work, and had less sleep than men. “Our goal with the time-use survey was to sensitize our employees—to initiate the dialogue,” said Poli Argento, YPF’s diversity lead.

The results led YPF to make promoting co-responsibility a key element of the company’s D&I approach. It concluded that diversity and gender equity considerations should be incorporated into decisions within the company about assigning roles and tasks and fixing objectives. In addition, the company set out to promote more equitable career development programs for men and women employees, increase respect for other groups within the organization, create more flexible working arrangements, encourage greater sharing of domestic duties at home, and raise awareness of D&I challenges.

After the survey, YPF ran a campaign promoting greater co-responsibility within the company via its internal social media channels. It encouraged employees to share domestic tasks, by asking them questions such as “Did you help your kids with their homework?” and “Did you wash the dishes?” The campaign had more than 17,000 views and over 400 reactions, and it generated conversations between social media users.

“As companies, it is difficult for us to get into the private spaces of our employees. But it is hard to achieve equity if we do not have visibility about the realities experienced in each household,” explained Argento. “To break stereotypes, we must take more steps forward.” At the same time, the company wanted to endorse a different perspective. “It is okay for a man to say, ‘Today I am going to pick up the children at school and I cannot go to this meeting,’” she said.

Supported by the survey findings and its refreshed D&I agenda, YPF launched external communication campaigns, podcasts, and virtual meetings with its business partners to advance improvement in key D&I areas. In company-wide open talks (the first about diversity during COVID-19), employees from diverse groups reflected on how to improve inclusion and gender equality. In another talk, senior leaders from the company shared their own experiences with tackling co-responsibility at home and managing gender integration in their teams.

Challenges and Opportunities

The company has found that a more inclusive approach not only improves employees’ experience of work, but also helps YPF achieve its goals. However, challenges related to changing attitudes that reflect gender-based stereotypes remain. Many male field workers still believe that women should be treated differently with regard to issues of safety or physical strength. “One female field worker put it like this: ‘When a man and a woman lift something, the assumption is that the man is helping her. But when two men lift something, it’s considered teamwork,’” Argento said. Reeducating workers starts with better understanding the needs of others and not making assumptions, she noted.

Overall, female employment was more impacted by the pandemic than male employment. According to a BCG survey across all industry sectors, women, on average spend 15 more hours on domestic labor each week than men

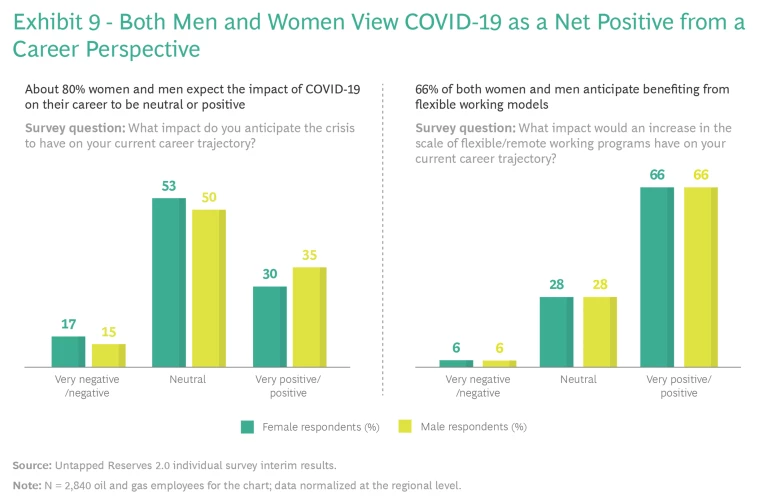

However, women who remain in the oil and gas sector seem to feel the impact of COVID-19 on their career only slightly more negatively than male colleagues do. (See Exhibit 9.) Both men and women see flexible work models as a positive development over the past two years. In our employee survey, about 65% of male and female respondents said that they expect to benefit from the new models that have been introduced or expanded as a result of the pandemic.

Our survey also found that company leaders emphatically believe that the changes in working practices are here to stay. “Our plan is to continue with the option of home working—to some degree—once things go back to the new normal” was a common refrain across conversations in all corners of the globe. But while 84% of oil and gas companies provide some form of flexible working, other options are less widely available: 76% of companies in the sector provide unpaid leave, and just 41% allow job sharing. Introducing programs to formalize these new workplace approaches will be important in boosting employee retention and attracting the next generation of diverse talent to the industry.

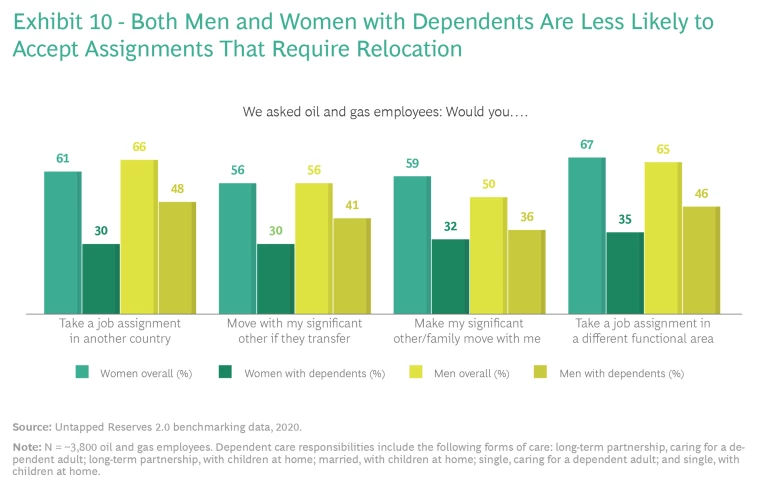

Our employee survey indicates that caring for a dependent person affects women’s job choices more than men’s, but such responsibilities have a noticeable impact regardless of gender: 30% of women with dependents and 48% of men with dependents would be willing to take on an international assignment, versus 61% and 66% respectively for individuals without dependents. (See Exhibit 10.) The best approach for companies to take is to avoid making assumptions about personal circumstances, and instead to ask and offer opportunities equitably. Although both men and women with dependents may decide to decline assignments that entail relocation, a substantial number of those with dependents (30% of female respondents and 48% of male respondents in our survey) indicated that they would say yes. The bottom line is not to assume what the answer will be, but instead to ask each individual directly.

Expanding the Definition of Diversity and Inclusion

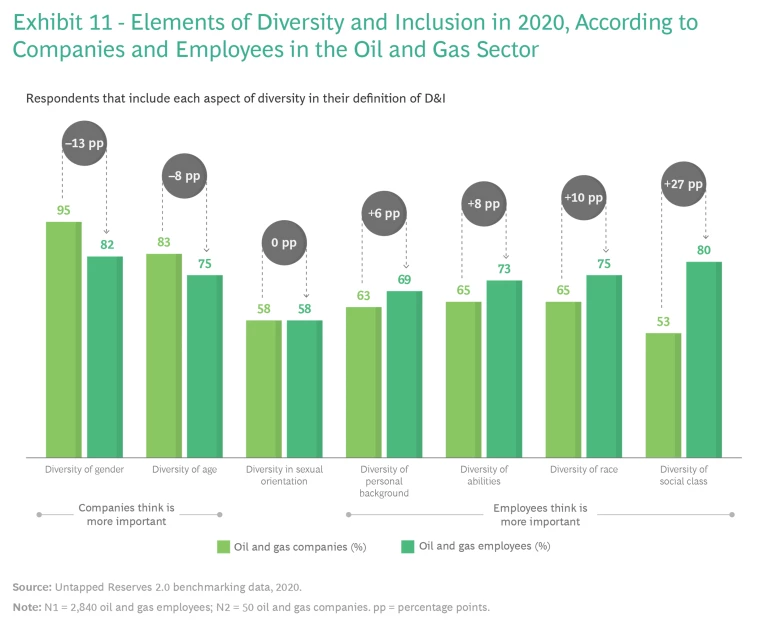

The oil and gas industry needs to take action on all fronts to embrace diversity in its broadest sense, foster greater inclusion, and build equity. Today, we see a disconnect between companies and their employees about what constitutes diversity and inclusion. Many employees expect a broader dialogue than companies currently provide, particularly on race, abilities, and socioeconomic diversity. (See Exhibit 11.)

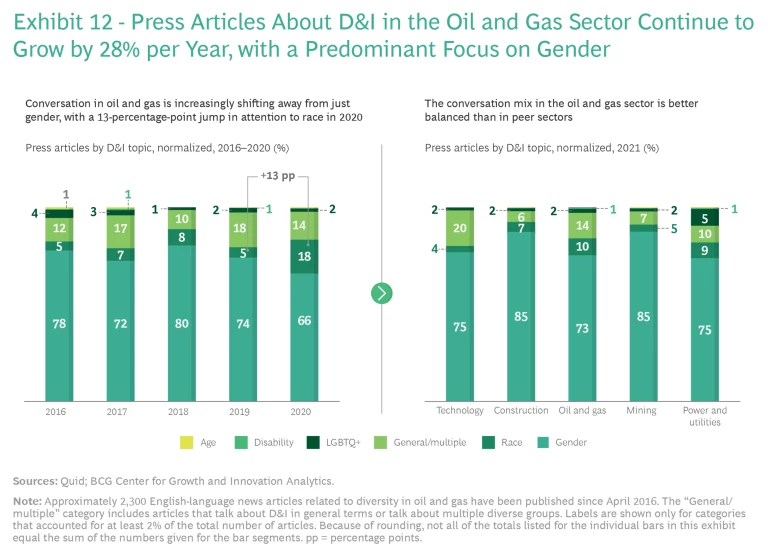

In recent years, companies’ conversations about D&I have become more frequent and have slowly expanded to encompass other forms of diversity such as race and ability. The share of press coverage focusing on race in the oil and gas industry increased by 13 percentage points from 2019 to 2020 (on a normalized basis), particularly in light of the Black Lives Matter movement in the US, although gender is still the primary D&I topic. (See Exhibit 12.) Compared with the D&I discussion in sectors such as mining, construction, and even technology, the conversation at oil and gas companies is relatively balanced, although there, too, gender remains the dominant topic.

For example, bp has broadened its D&I agenda to reflect the importance of equity and is prioritizing actions related to people of color. (See “Case Study: bp.”) This effort has included rolling out policies and programs that actively promote its intention in its two biggest markets—the US and the UK—and incorporating diversity, equity, and inclusion as a core part of its strategic framework.

Case Study: bp

D&I Outcomes

bp has recently made progress in the areas of gender and ethnic minority representation. The company’s board and leadership team are more diverse than ever, and bp is targeting gender parity in its top 120 leadership positions by 2025. Women account for 40% of bp’s senior management, up from 30% prior to its Reinvent restructuring program in 2020. At the executive level and below (excluding frontline jobs), women make up 35% of employees.

Following the racial justice movement in 2020, bp broadened its D&I agenda to reflect the importance of equity. “We wanted to increase our focus on underrepresented ethnic minorities. We acknowledge that not everyone starts from the same place, and that raises interesting questions for meritocracy,” explained Kerry Dryburgh, the company’s executive vice president for people and culture.

As part of its new diversity, equity, and inclusion (DE&I) approach, bp created clear intentions for addressing the underrepresentation of ethnic minorities. “We are being as deliberate about ethnicity as we have been about gender,” said Dryburgh. “Our Global Frameworks for Action emphasize the principles of transparency, accountability, and talent, and our progress will be reported in our annual DE&I report.”

In 2020, bp appointed Mark Crawford as its first senior vice president for DE&I. Crawford has launched new Frameworks for Action in the US and the UK aimed at improving racial equity and diversity.

Unique D&I Interventions

For bp, diversity, equity, and inclusion are essential to transforming the business. The company aims to achieve net-zero emissions by using diverse teams that can fuel creativity with divergent thinking. “The only way to work differently and think differently is to bring a diverse group together. And to face our future business challenges, we need to do things differently,” explained Dryburgh.

The company is rolling out a number of DE&I initiatives in the US and the UK before extending them to other regions:

- More Diverse Recruiting Panels. bp has diversified the composition of its job interview panels to boost diversity, and it is encouraging its supply chain to do the same.

- Increased Spending with Diverse Suppliers. bp plans to increase its spending with diverse suppliers to $1 billion by 2025. Starting in 2020, when it launched a new supplier growth initiative, the company has been matching suppliers from businesses that have certified minority, woman, LGBT+, veteran, or disability ownership with its internal supply chains through sustainable processes, systems, and partnerships in the US and the UK.

- Outreach to Underrepresented Groups. In the US, bp is bolstering minority internship programs and partnering with historically Black colleges and universities. In the UK, it is working with the Royal Academy of Engineering to increase the number of girls and women studying STEM subjects.

- Racial Equity in Representation. In the US, bp intends to double its representation of African Americans in company leadership positions by 2023.

- Mentorship and Sponsorship. The company aims to build equity through tailored programs, diverse mentoring circles, and business improvement workshops that enable individual employees to build the skills they need to progress.

- Closing the Ethnicity Pay Gap. bp plans to externally report on its UK ethnicity pay gap annually, starting no later than early 2022, using data from the most recent completed year. The company intends to publish this data regardless of any UK government requirement to do so.

- Parental Care. In the US, bp provides 8 weeks of paid parental leave, which can be extended to 12 to 26 weeks of unpaid, job-protected leave. bp offices include “mothers’ rooms” for women who are breastfeeding.

- Hiring Inclusively. Starting in 2021, the company will operate a refreshed recruitment process. Where appropriate, the updated process will use demographic and social data on available talent pools to widen the search for potential talent.

Challenges and Opportunities

“A just transition is more likely to succeed if it’s fair and equitable. It’s not our energy transition; rather, it belongs to the communities in which we operate,” said Dryburgh. She noted that as bp develops renewable energy in areas such as hydrogen and offshore wind, the company must ensure that it is giving opportunities to communities and individuals that need it. bp has a real opportunity to support social mobility and gender and racial equality through job creation and job protection in hard-to-abate industries.

The shift that bp has made to date in how it approaches DE&I has been enabled partly by the company’s transformation program and partly by paying attention to evolving employee and social expectations. The company’s sustainability framework explicitly connects its sustainability actions to a broader set of societal goals, including getting to net zero, improving people’s lives, and caring for the planet. Dryburgh’s advice is clear: “Keep walking in a straight line, keep explaining, but do not apologize for it.”

Driving Further Progress in the Industry

In recent years, the oil and gas industry has taken important steps forward in the area of D&I, including establishing foundational table stakes such as equal pay and maternity leave. But companies also made progress in more advanced areas such as unconscious bias and dedicated resourcing for D&I teams. Nevertheless, companies must go further and drive real change in their D&I performance by continuing to mature programs and policies that are harder to implement but more impactful, such as sponsorship, mentorship, greater leadership accountability for D&I outcomes, and creating a more inclusive working environment across a definition of diversity that extends beyond just gender diversity.

The Industry Has Laid the Foundation for Change

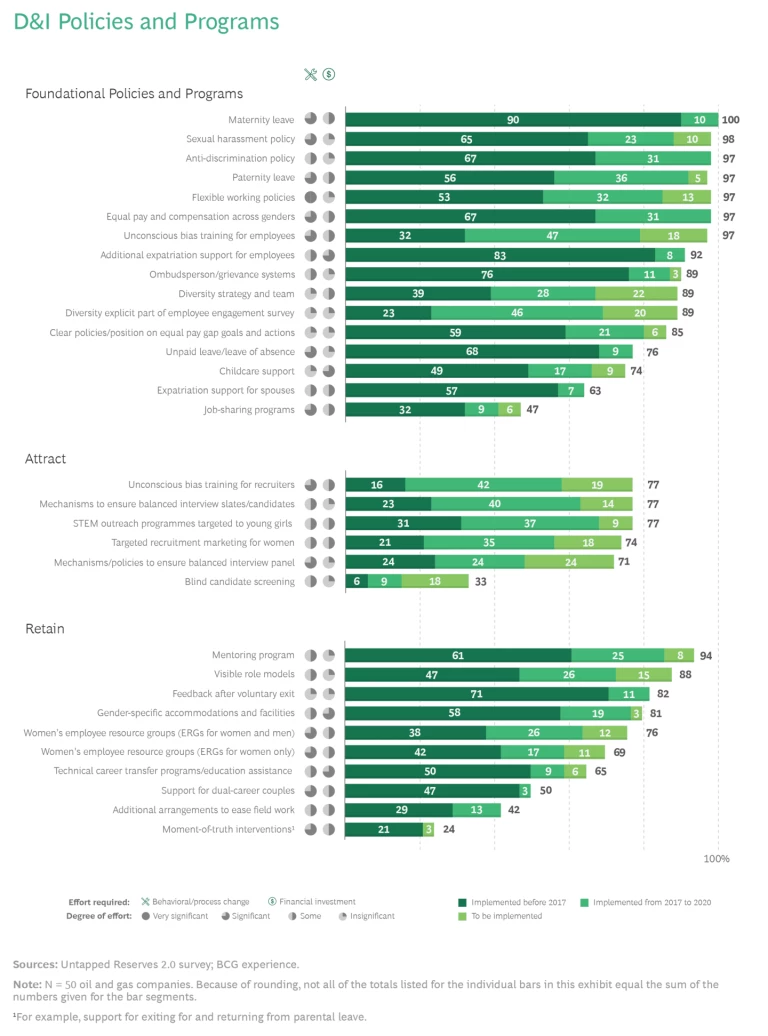

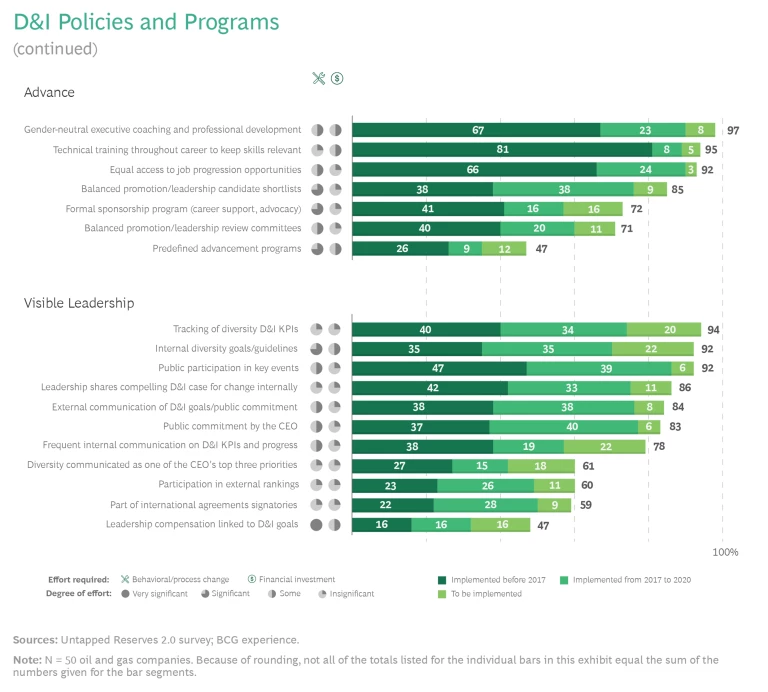

Since our 2017 survey, oil and gas companies have become far more active in introducing D&I policies and programs. They have made significant progress in areas including retention, recruitment, and leadership. (See the Appendix .)

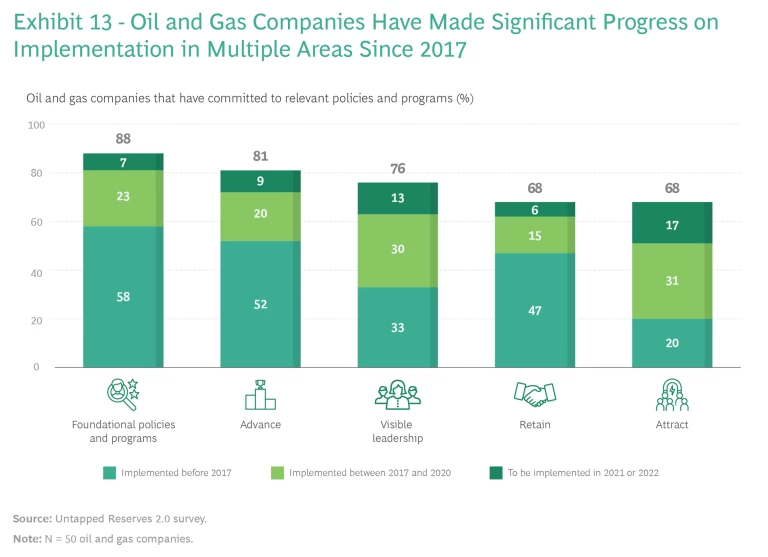

For example, only 20% of companies had D&I policies and programs for recruitment (the “attract” component in our pyramid framework) prior to 2017, but another 31% implemented policies and programs (such as outreach programs and unconscious bias training for recruiters) from 2017 to 2020. And a further 17% have committed to introduce such initiatives in the near future. (See Exhibit 13.)

At the level of individual policies and programs, companies have made important progress in offering maternity and paternity leave and introducing policies that tackle sexual harassment and discrimination—areas that are likely to be subject to government mandates. (See Exhibit 14.) However, company performance in the sector is lagging in some areas where government regulations do not apply. Less than half of oil and gas companies link leadership compensation to the achievement of D&I goals. And only one-third have procedures in place to ensure so-called “blind” screening of candidates to remove recruiters’ unconscious biases.

No cookie-cutter approach to diversity and inclusion works across all organizations, but we have found that the following actions have the most significant impact among companies that seek to improve their D&I performance:

- Reinforce leadership commitment through visible and sustained support.

- Track baseline metrics and set clear goals and targets.

- Ensure that there is no bias in promotion pathways.

- Empower employee resource groups to improve program and policy effectiveness.

- Link D&I outcomes to capabilities around innovation and adaptation.

- Actively create an inclusive environment.

We illustrate each of these action areas with a case study in which a company is making meaningful progress in that area. We highlight their stories to show what advanced D&I maturity can look like and to provide inspiration for other companies that would like to progress on these critical dimensions.

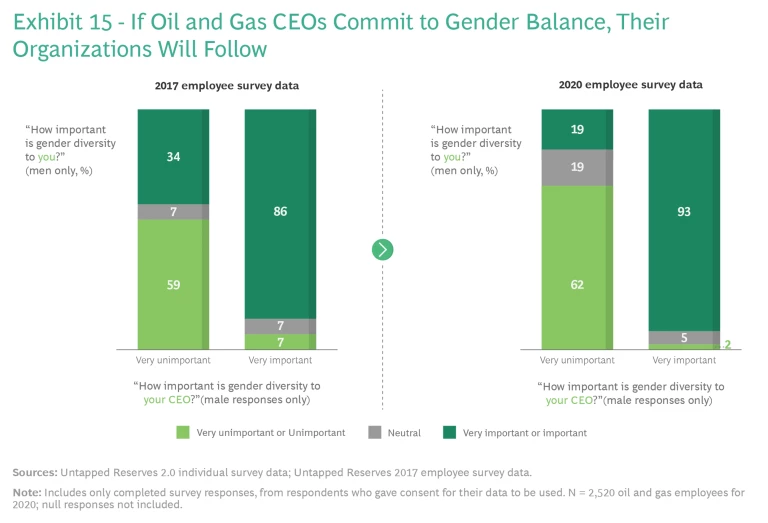

Reinforce Leadership Commitment Through Visible and Sustained Support

Strong and visible CEO and executive team commitment to D&I is a prerequisite for change. This is especially true among male employees. A key finding that emerged from our 2017 survey was that if the CEO considered gender balance important, most male employees in the company would, too. The relationship between these factors was even stronger in 2020. In our 2020 survey, 93% of male respondents whose CEO considered the topic very important said that gender diversity was either important or very important to them as well, up from 86% in 2017. (See Exhibit 15.) To provide effective leadership in this area, leaders must consistently and frequently reinforce the strategic importance of D&I, through their actions and their words.

Senior leaders who understand and can articulate the benefits of D&I help set the tone for the whole organization. They can use their leadership position with various business functions to leverage learning and celebrate success stories from different parts of the organization. Senior leaders must be clearly accountable, with performance evaluations and compensation linked to meeting D&I goals. Organizational KPIs should include targets for gender equity in senior management ranks, too. Salym Petroleum offers a strong regional example of a company whose CEO is moving the needle on D&I. (See “Case Study: Salym Petroleum.”)

Case Study: Salym Petroleum

D&I Outcomes

Through its outreach programs, Salym Petroleum tries to create a more balanced picture of the energy sector among its own staff, partners, and stakeholders; among students; and in local communities. It seeks to overturn outdated perceptions of industry employees and define a new vision for the “oil field heroes” who work in physically challenging, hazardous environments. It also aims to encourage people to view the sector as a high-tech, forward-looking one, with a wide range of opportunities. The company has created a platform of collaboration and open dialogue to engage better with schools and universities, and it organizes regular events to promote greater awareness of career opportunities in STEM subjects, particularly among women.

At present, most women employed by the company have administrative jobs. Women account for 12% to 15% of its technical staff who use engineering and subsurface skills, and 20% of field positions. On its board and senior management team, women make up one-fifth of the total, although the remuneration committee is evenly split. About 35% of midlevel managers are female. Overall, the workforce—both male and female—is almost exclusively Russian, with just a handful of expatriates. “We believe we should represent the community and population where we are operating,” said Collins.

During the COVID-19 pandemic, Salym Petroleum altered its working practices to give employees greater choice and improve the retention of women staff. It provides fully paid leave during pregnancy and a maternity leave, along with medical insurance covering pregnancy and delivery. Longer maternity and paternity leave (up to three years) is available, as is the option of remote working. The company continues to invest in accommodation facilities, as an enabler of increased diversity.

The company is pursuing further initiatives to cement diversity and inclusion as key priorities. D&I champions work with the communications team to promote these values through regular engagements with employees, input from external experts, and external events arranged by the company. Salym Petroleum’s website includes a special D&I section. Annual performance appraisals measure how well employees are meeting the company’s code of conduct, and regular surveys assess workers’ attitudes to identify any areas that may need improvement. As part of its outreach efforts, the company invests in inclusion-focused training programs at local universities.

Unique D&I Interventions

A code of conduct governs the behavior of the joint venture’s employees. In recent years, Salym Petroleum set up a working group to increase the online visibility of the company’s D&I values and to test new and existing programs against its D&I objectives. One such program is the Good Neighbors Program—a community engagement initiative that, among other things, aims to develop small and medium-size enterprises. The Good Neighbors Program is closely linked to the company’s core business activities—safety, environment, indigenous people, education, health care, and small and medium-size enterprise development—as well as to its corporate values. The Good Neighbors Program contains strong messages about D&I, ethics and compliance, bribery and corruption, gender, equality, and inclusion.

Challenges and Opportunities

Salym Petroleum continues to adapt to changing work patterns and ways of work. Recent topics tackled by the employee-run welfare committee include plans to train staff to behave with inclusion during online meetings and when working remotely. However, the company finds that it can be hard to monitor how employees act when they use these new approaches, to ensure that they are abiding by and receiving feedback on its code of conduct. “Inclusion goes beyond diversity; it is about how people feel. Do our team members feel valued, listened to, and included in the workplace? We need to continually work on it, as this is a dynamic process, a challenging one, but one more than worth the effort,” said Collins.

Track Baseline Metrics and Set Clear Goals and Targets

Companies that want to become more diverse and inclusive organizations must monitor data across the business. By analyzing information about recruitment, retention, and advancement trends, they can spot gaps, set aspirational goals and clear targets, and identify and implement effective policies and programs. Companies should take into account both qualitative and quantitative data. For example, they should conduct interviews and run focus groups of employees from diverse groups, to assess their needs, to call out success stories, and to adapt policies and programs to better address the actual needs of a diverse workforce.

When assessing their current approach, leaders should ask themselves several questions:

- Do we make metrics available to managers who are responsible for hiring, promotion, and retention in different functions?

- Have we included equity in our D&I metrics and do we have systems in place to capture feedback on progress toward all of our diversity goals?

- Do our current hiring, development, and promotion processes anticipate and actively advance, sponsor, and retain diverse talent?

ADNOC provides a strong example of a company that has made tracking metrics and setting targets a cornerstone of its D&I strategy. (See “Case Study: ADNOC.”)

Case Study: ADNOC

D&I Outcomes

ADNOC introduced gender diversity pledges in 2016—with a target date of 2020—following the arrival of its new CEO, Dr Sultan Ahmed Al Jaber. “Changes do not happen until there is commitment from the top,” said Deborah Titcombe, the company’s senior vice president for people development. “The emphasis on gender balance came into focus when Dr Sultan joined.”

Today, the company has exceeded all its pledges. ADNOC currently has three female CEOs across its group of operating companies (versus a target of one female CEO), 18% of senior managers are women (versus a target of 15%), and 30% of new Emirati joiners are women (a one-third increase since 2017).

ADNOC has increased its number of female engineers by 90% to around 1,000, and close to 800 women work at its oil and gas fields, a rise of 21% since 2017. In addition, women hold 23 board positions across ADNOC’s subsidiaries, a fourfold increase since 2017.

Unique D&I Interventions

Following the success of its earlier pledges, ADNOC has made new ones that aim to accelerate progress toward gender balance within the organization:

- By 2022, appoint at least one female representative on every company board of directors where ADNOC is the majority owner.

- By 2030, achieve 30% female representation in technical roles.

- Gender-Focused Initiatives. Gender balance committees at the group level, and within joint ventures and subsidiaries, ensure that senior management allocates sufficient resources to meet the company’s pledges. They also provide a forum for discussing gender-related issues. ADNOC aims to achieve an equitable gender balance in leadership programs, including ADNOC’s popular Future Leaders program. Today, women make up 30% of the intake, but that number is expected to rise. The company also seeks to boost female participation in its first-ever joint executive program with Harvard University.

- Local Initiatives. ADNOC was the first funder of Pathway20, a UAE-based initiative to increase female board representation at locally listed companies to 20%. It provides a pathway for women to gain experience and support during their first board appointment. ADNOC sends two senior-level women, with at least 15 years of managerial experience, to the program each year.

- Youth Development Program and Youth Council. About 4,000 recent joiners, on both graduate and nongraduate career paths, participate in this program, which is designed to ease their integration into the organization. About 21% of recent joiners on the graduate path are women. The company’s youth council membership is 50% male and 50% female, and the council meets with ADNOC’s executive leadership team at least once a year.

- Encouraging Greater Female Participation in Non-administrative Roles. To attract more women to technical and operational roles early in their career, the company ensures that operational sites have separate gender-based facilities. It also runs communication campaigns and sponsored events that highlight opportunities for women in technical and operational roles, and it offers internships for female candidates through partnerships with the UAE’s four biggest universities.

Challenges and Opportunities

ADNOC faces competition for talented women from other high-growth sectors in the UAE. Social attitudes about the role of women in oil and gas also pose obstacles to change. Through outreach programs with schools and universities, ADNOC promotes greater awareness of STEM subjects and STEM-related job opportunities in the energy sector. The company’s head of human resources sits on several university boards and helps those organizations focus on the skills of the future. ADNOC partners with universities on technology programs in data science and hydrogen, and it tries to ensure that these programs have a good gender balance. To mitigate the risk of recruiting or promoting people before they are ready, the company links advancement criteria to capability building in its leadership programs.

Ensure That There Is No Bias in Promotion Pathways

Oil and gas companies can take several steps to promote D&I in advancement policies and processes. To minimize unconscious bias, they can adopt “blind” recruitment processes (which remove the candidate’s name and any other identifying factors from applications), have multiple diverse candidates on each slate, actively shape “stretch” roles for diverse candidates to support development pathways, and use more diverse interview panels. Mandatory training can help managers realize the potential operational and financial benefits of greater diversity as a source of competitive advantage. And openly recommitting to diversity and reframing outreach programs to make them more gender-neutral and inclusive of diverse backgrounds can increase companies’ attractiveness to potential hires.

To eradicate bias and boost inclusivity, leaders should ask themselves the following questions:

- Is unconscious bias training built into our core curriculum?

- Are our decision makers (recruiters, managers, and senior leaders) trained to actively create inclusive team environments?

- Have we publicly communicated our zero-tolerance policies regarding harassment and discrimination?

- Do we understand where our formal and informal processes fall short today?

One company tackling those challenges head-on is Kuwait Petroleum Corporation (KPC). (See “Case Study: KPC.”) For KPC, filling senior roles is about more than just confirming that candidates have a technical background; it is also about ensuring that they have the leadership skills necessary to build consensus, make tough decisions after considering multiple perspectives and sometimes contradictory information, and listen to team members and stakeholders. This makes for a more merit-based and inclusive approach to promotions. It also creates a pathway to senior positions for employees with technical and operations backgrounds as well as for those in business and administration roles, increasing the diversity of experience in the organization’s leadership.

Case Study: Kuwait Petroleum Corporation

D&I Outcomes

Through its gender-neutral approach, KPC has achieved significant representation of women in the workforce and in the recruitment of female graduates. Overall, female graduates make up 30% of the company’s total graduate workforce, thanks to a strong pipeline of female STEM graduates. Over the past five years, women have accounted for 39% of KPC’s graduate intake, on average. The progress of female graduates within the organization from entry-level to midcareer positions has also improved.

Because of its gender-neutral and unbiased approach, the Kuwaiti oil sector, through KPC, has played a leading role in the region in hiring women for technical and onsite positions since the 1970s, and in promoting women to the level of CEO or managing director since the early 1990s. Kuwait was also ahead of other countries in the region in having female refinery managers.

Unique D&I Interventions

KPC’s positive gender outcomes result from its meritocratic culture and from attracting a more diverse talent pipeline.

The KPC promotion process is highly transparent and meritocratic, which helps prevent biases that can inhibit diversity. First, the HR department ranks individuals on the basis of objective criteria, such as length of service and relevant qualifications, to produce a list of the top ten candidates. Then, a panel of managers from across the business interviews these candidates. The panel members, who are not aware of how each candidate ranked in the HR evaluation, award their own scores based on the candidates’ interview performance and on criteria such as leadership skills. Using scorecards in this way boosts transparency and enables KPC to select candidates on the basis of their ability, and using interview panels eliminates potential bias from individual line managers. The process also encourages a balance of perspectives, introduces opportunities to challenge assumptions, and links strongly to objective criteria (with the support of HR). All of these factors come together to create greater opportunities for diverse individuals to succeed in roles on their own merits, without fear of bias.

In addition to the organization’s merit-based promotion procedures, KPC’s value proposition as an employer with a strong regional brand has helped it attract more female graduates. It offers top-quartile remuneration, extensive development programs and training, job security, and exposure to a global sector. KPC also provides between 42 and 45 days of annual leave, depending on career grade (more than required by law), and four months of maternity leave with an option to work reduced hours for two years. The high visibility of women in senior positions means that these individuals act as role models for young female employees lower down in the organization. These factors, coupled with transparent recruitment campaigns, have helped KPC achieve one of the strongest intakes of female STEM graduates in the region.

Challenges and Opportunities

There is still work to be done to address gender imbalances across the business. The organization believes that continuing to build a strong and diverse recruitment pipeline, supported by merit-based advancement procedures, should help significantly increase women’s representation within the organization over the coming years.

Empower Employee Resource Groups to Improve Program and Policy Effectiveness

Employee resource groups are a common feature of business organizations today. These voluntary, employee-led groups typically provide support for individuals who share an affinity related to gender, ethnicity, religion, or lifestyle. They can aid in personal or career development, facilitate discussions within the organization, and act as safe spaces. In their more mature form, such groups can help companies achieve their strategic business goals, by acting as advocates for their employers, building bridges with local communities, and participating in shaping in-house D&I policies and programs.

Aera Energy is an example of a company that is leveraging employee resource groups to great effect. (See “Case Study: Aera Energy.”)

Case Study: Aera Energy

D&I Outcomes

As an indication of its commitment to diversity and inclusion, Aera uses the term “inclusion and diversity” (I&D) to describe its policies and programs—acknowledging that, without inclusion, the benefits of diversity cannot be realized. The company has transformed its I&D strategy to make “embracing inclusion” a fundamental organizational value—one that is reflected in the company culture and its decision-making processes and does not depend on any single executive to drive it forward. “Inclusion and diversity need to be as critical as safety is in our industry. It cannot be a senior leader’s pet project,” said former CEO Christina Sistrunk. “We don’t run safety based on the passion of individual leaders, and the same should hold true for I&D.”

By adopting this approach, Aera has achieved significant positive I&D outcomes that are uncommon in the industry. From 2015 to 2020, it had a female CEO. The core executive leadership team is split about evenly between men and women (with women slightly ahead) and is racially and ethnically diverse, a reflection of the communities in which Aera operates. In the broader workforce, minority representation has increased year-on-year for more than a decade. And voluntary employee resource groups (ERGs) bring together employees with shared common affinities, providing support for employees and helping Aera achieve its business goals.

Unique D&I Interventions

Aera has found that three levers have made the greatest impact on its I&D ambitions:

- Leadership Commitment. Aera sets clear expectations that the company’s leaders will prioritize inclusion. As part of communicating the business case for why I&D is critical for Aera’s success, leaders craft and share personal stories about the power of inclusion. The company also incorporates inclusion as a requirement within its leadership competencies. The performance review process and employee engagement metrics help the company gauge how leaders accomplished their goals. “If you are not inclusive, your engagement scores will be low, and it can be career limiting,” explained Brent Illot, a vice president of operations.

- Talent Management. In 2017, employee feedback indicated that Aera’s I&D strategy was unclear to many workers. Some felt that progress was insufficient, while others considered I&D peripheral or a distraction from Aera’s commercial success. In response, the company committed to refreshing its I&D strategy to convey clear goals related to leadership, culture, talent, and community. The company also provided a more robust framework for Aera’s ERG program, treating employee involvement in ERGs as an opportunity to develop valuable business skills and recognizing such participation in performance evaluations. “The role gave me opportunities to improve and hone my leadership skills,” said Linda Mohammad, a production engineer and former lead chair of both the Aera Asian ERG and the Aera Black Employee Network. “It comes with no authority, so you have to lead through influence.”

- Empowered Employee Resource Groups. The company’s ERGs provide a safe space for individuals “to have conversations important to them and to challenge norms,” said Erin Larner, a senior manager. The groups align their annual business plans so they support Aera’s strategic imperatives, helping tackle business challenges such as maintaining a strong social license to operate. About 60% of company employees are members of at least one ERG. Being a member—and later a leader—of the Aera Black Employee Network helped Ashley Davis feel at home when she relocated to the company’s head office in Bakersfield, California. “I would not have been willing to move across the country for my job if not for ABEN,” said Davis, an engineering supervisor who joined Aera four years ago and identifies as Black.

Challenges and Opportunities

Aera has made considerable progress on its I&D journey, but some opportunities remain. Representation of women is one such opportunity: current female representation across the company is 23.5%, although the figure is 40% in the youngest age bracket (20- to 29-year-olds). Another key opportunity involves broader participation in ERGs. In the past, most ERG events took place at Aera’s headquarters, which limited the opportunity of field workers to participate, due to the time required for travel. ERGs began offering more virtual options in recent years—a shift that the COVID-19 pandemic accelerated dramatically. The virtual options have increased the involvement of field staff in the ERGs, and team leaders’ encouragement of their teams to participate has boosted traction more broadly. Aera recognizes that I&D is not yet as fully embedded in the company’s DNA as safety, but it has moved significantly closer to that objective.

Link D&I Outcomes to Capabilities Around Innovation and Adaptation

Many companies think of D&I as a compliance issue; others believe that taking action on D&I is simply the right thing to do. But companies are starting to understand how it can have a more fundamental impact and improve their ability to innovate and adapt in a rapidly changing world. This ability will be increasingly important as companies embrace digital technologies and transform their businesses in response to the energy transition. Viewing D&I as a strategic business imperative rather than just as a social impact objective will enable companies to take a more customer-centric approach, increase shareholder value, and gain competitive advantage.

To leverage D&I as a strategic business driver, leaders should ask themselves these questions:

- Have we identified diversity, equity, and inclusion in our business as a strategic priority, and have we adjusted our strategies and operating models to reflect these values?

- Do we have sufficient insights about minority populations in our customer base, and have we translated these into products, services, and pricing to equitably serve them?

- Have we identified any company policies with unintended externalities that may limit equity or inclusion in our products or service offering?

Shell is a leading example of a company that has taken this business-driven approach to D&I. (See “Case Study: Shell.”)

Case Study: Shell

In recent years, the company’s DE&I agenda has focused on improvement in four areas: gender, race and ethnicity, LGBT+, and enablement and disability inclusion. Shell believes these are the areas where leveling the playing field and removing barriers can make the biggest impact. As part of its wider commitment to creating a more caring and inclusive workplace, the company is also taking steps to destigmatize mental illness and offering flexible working arrangements to its employees.

In 2018, the company appointed Singapore-based Lyn Lee as its chief diversity and inclusion officer. In Lee’s view, diversity—and the multiple different voices it brings—can strengthen business performance, particularly as the company accelerates the transition of its business to net-zero emissions, in step with society. “We’re working hard to become one of the most diverse and inclusive organizations in the world, a place where everyone feels valued and respected. Ensuring we all feel a sense of belonging and can bring our best self to work is both the right thing to do and something that delivers business performance,” said Lee.

D&I Outcomes

Shell implemented a major restructuring program in 2020 to build a simpler, more cost-effective organization in order to deliver on its ambition to be a net-zero emissions energy business. To mitigate the risk of moving backward on its D&I commitments, the company incorporated diversity KPIs into the program. On the topic of gender diversity, for example, Shell has driven an increase of +4.3% in women among Shell’s top 150 leaders. This is helping Shell progress toward reaching its target of 30% representation of women among the company’s top 1,400 leaders by the end of 2021.

Unique D&I Interventions

Having a more representative workforce strengthens local support for Shell in the communities where it operates and can help the company tailor its products to local needs. For example, the Shell China commercial team generated significant customer traction by launching a marketing campaign for a new lubricant based on the color of jade, which locally symbolizes prosperity, success, and good luck. The campaign, led by Chinese members of the team, delivered ten times the expected returns in the first two hours, becoming the most successful such effort to date.

Continuing the theme of building the best teams, Shell consciously guards against biases in hiring and promotion decisions. For example, managers are encouraged to challenge candidate shortlists that don’t provide sufficient gender and ethnic balance. Shell also monitors employee engagement, inclusion levels, and psychological safety in its annual people survey. This helps the company understand progress and identify where it needs to provide additional support. Carlos Maurer, executive vice president of the sectors and decarbonization business, said “We have balanced intakes at entry level of very good talent. There is no reason for them to not make it to the top. We take calculated risks on everybody, but our biases can put risk on some people more than others, and leadership can change that. So, if I’m told there is nobody to achieve balance, I ask the person to look again.”

Challenges and Opportunities

The company recognizes that DE&I will become increasingly important as the industry evolves with the energy transition. By encouraging a culture of “failing fast” and a “learner mindset,” Shell believes that its leaders will be better prepared for these developments and more welcoming to younger, tech-savvy employees. But challenges remain. As Lee Hodder, vice president of upstream in Shell’s digital transformation division, observed, “It can still be difficult for a reservoir engineer with 30 years’ experience to be open to learning about AI and its applications from someone fresh out of university.” But Shell hopes that by having the right processes in place to drive inclusion, and leaders that model the right behaviors, it can break down these barriers and reach its goal of becoming one of the most diverse and inclusive organizations in the world.

Actively Create an Inclusive Environment

In an inclusive environment, diverse employees feel comfortable about bringing their whole selves to work and expressing unique viewpoints. Such diverse perspectives are important so that oil and gas companies can start to solve the complex challenges that lie ahead. However, creating an inclusive environment is about cultural change within the organization and is not something that diverse groups can do for themselves. The cultural shift is achieved when everyone in the organization understands and values the benefits of diversity and the workplace becomes a place where diverse teams can thrive. Middle managers can foster positive change by selecting high-potential employees as D&I ambassadors.

In building a more inclusive culture, leaders should ask themselves these questions:

- Are our strategic decision-making bodies diverse and inclusive, and do they empower minority members to voice opinions and influence decisions?

- Are senior leaders actively engaged in sponsoring diverse individuals?

Chevron is a leading example of a company that is taking action on these fronts. (See “Case Study: Chevron.”)

Case Study: Chevron

To achieve the company’s D&I ambitions, Lee Jourdan, Chevron’s chief diversity officer from 2018 to early 2021, aimed to initiate authentic, highly personal dialogue across the company’s operations worldwide. “What we are doing, we are doing for everyone, but we must be intentional about it,” he said.

D&I Outcomes

For years, Chevron has leaned into D&I and found that there was a business case for increasing it from the bottom up. Widening the talent pool for frontline management by purposefully including individuals from different backgrounds and with unique perspectives not only inspires creative solutions, but also builds trustworthiness and agility—all of which directly impact performance. Chevron, the American Petroleum Institute (API), and other API members started looking at ways to decrease resistance to change in D&I, making the industry more attractive to new hires by removing unnecessary barriers for entry, such as college degrees that were unnecessary for certain roles.

Chevron and the Catalyst organization created a small group-learning program called Men Advocating Real Change (MARC) for employees to better understand headwinds that women face, especially in the workplace. Some participants in the program explored gender equity issues that were highlighted in media, especially the daily news. “The news is a major driver for D&I, and it can make it easier for the predominant set—that is, white men—to understand what women are going through,” Jourdan explained. The company encouraged these single-gender groups in multiple countries to discuss D&I issues arising from local media coverage. By discussing the ways in which media represent different genders and drive attitudes, participants gained greater insights into the experience of other groups. After a few months, participants were organized into mixed gender groups and encouraged to discuss gender issues that they observed. When the program concluded, participants reflected on their experience. Men who had participated were two-and-a-half times more likely to speak up when they observed non-inclusive behavior. And women who had participated were three times more likely to speak up.

Unique D&I Interventions

Recognizing gaps in representation between women of color and Caucasian women, the company disaggregated its race/ethnicity data by gender. It also leveraged the Equal Employment Opportunity Component 1 report (EEO-1), published annually as mandated by the U.S. Equal Opportunity Act to track gender and ethnicity gaps, for internal and external accountability. Following its discovery of the gaps in representation, Chevron began to identify unconscious bias in the organization. The company recently piloted two formal sponsorship programs within the company to expand advocacy opportunities for employees in its finance function and its downstream and chemicals business.

Chevron also revamped its future leader programs and developed a small-group program similar to MARC. The new program, Elevate, expands the discussion beyond gender to include other dimensions of diversity, such as age, ethnicity, military veterans, and disabilities. These programs were “not about forcing the numbers but rather having the right conversations—such as what are the headwinds versus the tailwinds—to grow in the right direction,” said Jourdan.

Challenges and Opportunities

Chevron recognizes that there are further opportunities to expand representation in its global workforce. In response, its approach has been to better understand cultural factors within each of its 14 business functions. The company has started to track D&I-related metrics for each function (including employee attrition and turnover) to help it set more effective goals.

Our Tool for Assessing (and Advancing) D&I Maturity

Before oil and gas companies can create effective D&I strategies, policies, and programs, they need to understand the extent of D&I progress in their businesses and identify areas of weakness. To help them do that, we have created a Diversity and Inclusion Maturity Assessment tool, based on best practices from leading D&I policies and programs across industries. (See Exhibit 16.)

The Diversity and Inclusion Maturity Assessment tool consists of a checklist of 12 parameters across five categories, ranging from leadership to career advancement. Each parameter is defined along a five-step scale, where step 1 represents the bare minimum/table stakes action and step 5 represents the current view of a progressive, forward-leaning action (noting that this space and what is considered progressive will continue to evolve). The steps are typically sequential and additive, and they reflect increasing maturity of D&I approaches when read from left to right. Using this tool, companies can create a baseline for themselves today and identify blind spots and areas for further focused efforts and priorities.

We encourage companies to use the tool to plot their starting point on the basis of current programs, and then set aspirations for the progress they would like to make over the next one, three, and five years. The tool can also facilitate discussions with management and boards about what realizing the full potential of diversity and inclusion looks like if they want to be best in class for attracting and retaining diverse talent—conversations that lead to action.

We look forward to engaging with companies around this tool in the future and actively tracking developments as companies progress over time, through future editions of Untapped Reserves.

Conclusion

Even though they have made important advances in policies and programs, oil and gas companies’ progress with D&I outcomes has stalled, and women’s representation remains unchanged from what it was in our previous survey in 2017. If the industry is to secure and retain the talent needed to respond to the energy transition and other industry changes and challenges, it must maintain a clear focus on improving diversity and inclusion. Companies can do this by focusing on the six priorities for action that we outlined in Chapter 4, and by using our Diversity and Inclusion Maturity Assessment tool to determine their starting point and drive real change across their organizations.

It is especially important for companies to consider interventions that address the challenges that arise at different stages in an individual’s career journey:

- Attract. Ensuring that recruitment messages align with company strategy on the energy transition and diversity is vital in attracting next-generation employees who are deciding where to apply on the basis of whether companies share their values on the climate or diversity. Once the new recruits have joined a company, employee resource groups and networks can help women develop a greater sense of belonging during the first few years of their careers.

- Retain. At the midcareer point, flexible working arrangements, moment-of-truth interventions (for example, when an employee is departing for or returning from parental leave or has an offer of alternative employment outside the company), and formal mentoring and sponsorship programs can support women juggling work with increased family demands and help them progress to more senior roles. These programs, along with more structured family support, are also critical to retaining women as they advance to more senior career levels.

- Advance. Making progress on advancement requires developing a concerted set of programs around sponsorship and mentorship, establishing predefined leadership pathways, and maintaining a commitment to bias-free talent management and selection, including balanced candidate slates and selection panels. Advancement must also be equitable and provide transparency on equal pay.

Companies have made significant progress since 2017 in implementing many of the easier policies and programs that are now in place. Given the lag between implementation and impact, we expect to see further positive effects and improvements in the next survey.

Moving the dial further on D&I will be harder, however. At the leadership level, it will require a more strategic commitment and a degree of personal accountability. Throughout this report, we have highlighted examples of what “best in class” looks like and explored a progressive view of maturity to help companies continue to push for better D&I outcomes.

As we noted earlier, BCG and the WPC intend to publish an updated Untapped Reserves report every three years, in conjunction with the triennial World Petroleum Congress, as we continue to promote greater diversity, equity, and inclusion in the industry—values that are essential to delivering improved business results and driving positive employee experiences. The message is clear: Now, more than ever, oil and gas companies must make diversity a strategic priority for their organization.

Methodology

The workforce data that we analyzed for this report came from oil and gas companies that span a broad range of company types and geographies. (See Exhibit 17.) Although the data set in 2020 is not identical to the one we used in 2017, both data sets are representative of the global industry. In addition, because we received more responses to our employee survey from some countries than from others, we weighted all countries equally so that we could make consistent comparisons and draw meaningful conclusions between regions and globally. In 2020, we conducted research on 50 companies with collective revenues of $2 trillion. In addition, we surveyed more than 2,800 industry employees across 60 countries and interviewed more than 50 senior executives and other industry professionals.

Full Data on Company Policies and Programs

In the following charts, we have analyzed performance data from 50 companies across the five categories of D&I policies and programs shown in the framework. The five categories are foundational policies and programs, recruitment (denoted as “attract” in the framework), retention (“retain“), advancement (“advance”), and visible leadership.

Each chart shows the percentage of companies that implemented a given policy or program prior to 2017, did so between 2017 and 2020, or have committed to implementation in the future.