M&A will play a vital role in helping US health care payers adapt to the transformed postpandemic industry landscape—but there’s no guarantee that all payers will make the most of their deals. To better serve their members, leading payers are using M&A to expand beyond their core business, acquire new capabilities, and boost efficiency. While M&A advances the strategic agenda, a successful post-merger integration (PMI) unlocks the deal value by ensuring that the acquired assets reach their full potential .

Leading payers are using M&A to expand beyond their core business, acquire new capabilities, and boost efficiency.

Maximizing value from acquisitions isn’t easy, however. Given today’s strategic objectives and high company valuations, it’s no longer sufficient to achieve basic cost synergies while ensuring business continuity. To succeed, payers must create “fit for purpose” integration programs that transform the combined entity to realize additional sources of value—including accelerated growth, digital transformation, new ways of working, and enhanced customer experience.

To gain insights into the challenges and opportunities, BCG analyzed M&A activity since 2015 by the largest payer groups in the US. The findings offer a window into the diversity of deal rationales and provide a basis for designing PMI agendas tailored to achieving distinctive objectives for value creation.

ASSESSING THE PAYER M&A LANDSCAPE

The ongoing evolution and consolidation of the health care sector have fueled payer M&A. As in many industries, the rapid adoption of digital technology means companies need to quickly develop or acquire new capabilities. Other factors driving M&A are specific to health care, including:

- The accelerated adoption of value-based care and risk-based arrangements

- A growing preference among providers and patients to shift the site of care to lower-acuity settings, such as the patient’s home

- Drastic shifts in the profit pools of payers and providers, which have amplified the disadvantages of smaller businesses relative to larger, more diversified ones

M&A activity by payers has been supported by abundantly available investment capital. An additional tailwind is the participation of sophisticated private equity firms that have acquired and consolidated service companies with the intention of divesting the assets to industry participants (such as payers) or taking them public.

At the same time, payers are encountering headwinds in pursuing M&A. Regulatory approval is not a certainty, so payers need to focus deal rationales on the member experience and affordability, not solely scale. Moreover, rising valuations have made it imperative to identify a wider variety of synergies. Last but not least, after a period of frenzied deal making and mega mergers, options for M&A in the industry have diminished.

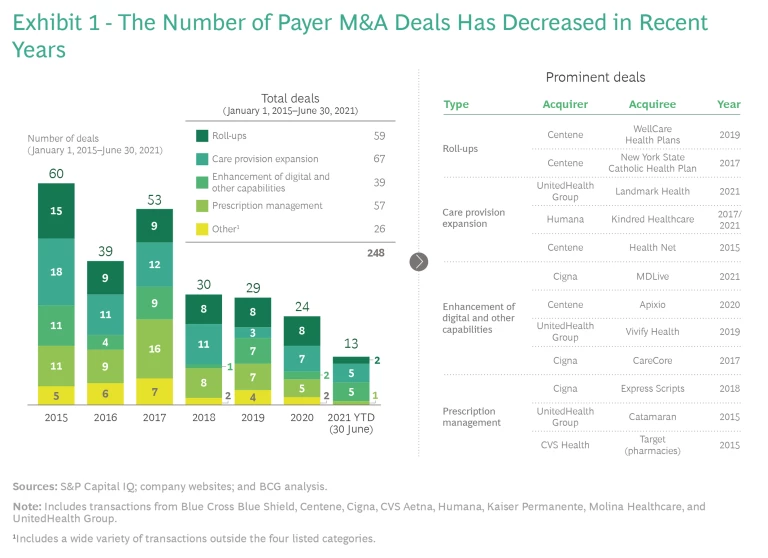

In the face of these challenges, payers appear to be taking a more cautious approach to acquisitions. Indeed, the number of payer deals has decreased every year since 2017. (See Exhibit 1.)

Against this backdrop, the M&A strategies deployed by the largest US payer groups have varied significantly. Horizontal deals to consolidate payers have accounted for a large, but now shrinking, share of transactions. Vertical deals—to acquire care delivery organizations, digital and adjacent capabilities, and pharmacies or pharmacy-benefits management capabilities—make up an increasing share. Additionally, payers engage in a wide variety of transactions outside these main categories.

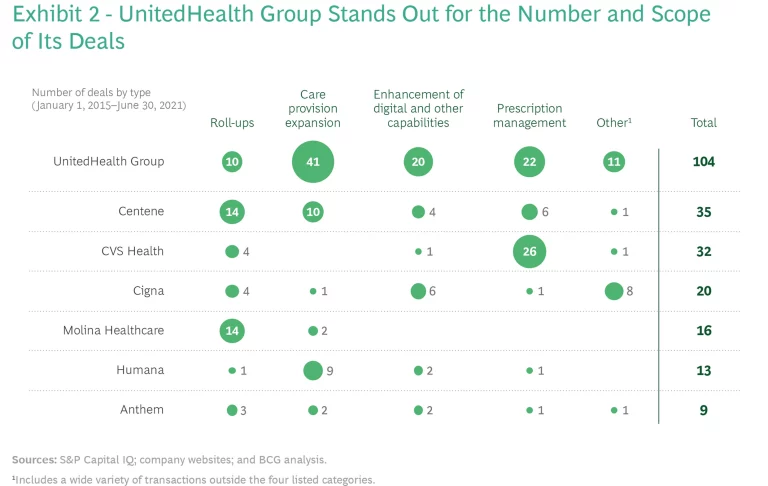

While many payers have taken a passive or selective approach, a small number of national payers have been M&A powerhouses. UnitedHealth Group stands out for the number and broad scope of its deals. It has acquired almost as many assets (by the number of transactions) as the other national payers included in this study combined and, unlike competitors, has pursued many deals outside its core business. (See Exhibit 2.)

FOUR ARCHETYPES OF PAYER M&A STRATEGIES

In examining recent transactions, we see four main archetypes that highlight the different strategies of major players.

Rolling Up Plans to Increase Scale and Enhance Care. These small and midsize horizontal deals increase absolute or regional scale. They enable the acquirer to spread fixed costs over a larger asset base—thereby enhancing cost competitiveness or freeing up resources to invest in growth (in digital infrastructure or the member experience, for example). These deals also serve as gateways to rapidly expand access in new markets or boost member density in existing markets.

During the past few years, more than 50 health plans have been acquired in roll-up deals. Payers focused on Medicaid (Centene, Molina Healthcare, and UnitedHealth Group) have been particularly active. Centene alone has completed 14 roll-ups over the past six years, including the acquisition of WellCare Health Plans in 2019 and New York State Catholic Health Plan in 2017.

Expanding into Care Provision. These vertical acquisitions aim to improve the quality and total cost of care through a more integrated care delivery model. The combined organization aligns incentives across the care continuum—including primary care, urgent care, and other home and community care settings. Payers have shown great interest in integrating care delivery, and we expect this trend to continue. Interest is especially high among payers with a strong Medicare Advantage presence, given the significant cost of care and the lower churn among plan members. UnitedHealth Group has been the most aggressive dealmaker in this archetype: it has completed almost 40 transactions focused on care delivery. Humana has also been active, acquiring organizations such as Kindred Healthcare.

Enhancing Digital and Other Scalable Capabilities. Payers are acquiring digital infrastructure or know-how that they traditionally have been unable to develop effectively in-house. Companies buy these infrastructure assets to propel themselves, or leapfrog, into the next generation of capabilities. These competencies include tools to provide remote care (telemedicine or remote patient monitoring) or improve medical-cost management (for example, utilization-management and preauthorization algorithms, advanced analytics, and health care data).

Cigna, UnitedHealth Group, and Centene have been the most active acquirers of digital and capability platforms. Examples include Cigna’s purchase of MDLive (a provider of online and on-demand health care delivery services and software), UnitedHealth Group’s acquisition of Vivify Health (a company that offers a remote patient-monitoring platform), and Centene’s deal to buy Apixio (a data science firm that provides a cognitive-computing platform).

Taking Control of Prescriptions. Some payers have acquired pharmacy-benefits management capabilities or pharmacies to gain better control of drug spending and provide members with integrated offers. Over the past few years, more than 50 payer deals have been made in the pharmacy space. The desire to gain scale here goes hand in hand with acquiring other segments of the care value chain.

CVS Health has been particularly active as it seeks to strengthen its leadership in the retail pharmacy space, its core business. But other payers have also ventured into scripts. Among the largest payer acquisitions in the past decade were UnitedHealth Group’s acquisition of Catamaran and Cigna’s purchase of Express Scripts.

TAILORING INTEGRATION TO THE ARCHETYPES

A company needs a fit-for-purpose PMI approach to unlock the value of these acquisition archetypes. Each payer’s positioning is unique, and executives must tailor their M&A and

PMI strategies

accordingly. In all cases, however, company leaders should consider a few major actions when developing a fit-for-purpose integration plan for each archetype:

- Integrate roll-ups rapidly and seamlessly to manage costs while avoiding disruption. A successful roll-up requires swiftly integrating the new asset, minimizing operational disruptions, and eliminating duplication to maximize synergies. It is essential to quickly evaluate which operations provide differentiation and which functions can be shared and scaled for efficiency.

- Use a balanced approach to integrate care delivery assets and retain talent. Many care delivery assets are complex entities where clinicians have typically enjoyed considerable latitude in deciding how to work. Some providers will likely leave an organization after a merger if the acquiring company uses a heavy-handed approach to standardize the operating model. To avoid losing talent, acquirers need to strike a balance between permitting autonomy and driving efficiency. Early on, it is critical to set expectations for the future operating model. Determining how the acquired entity will fit into the buyer’s organization includes clarifying what is left as standalone, what is aligned to ensure collaboration, and what is fully integrated. This determination should take into consideration how the acquisition affects relationships with customers and other payers. (See “Care Delivery Acquisitions Affect Business Relationships.”)

Care Delivery Acquisitions Affect Business Relationships

Because care delivery companies tend to be led by clinicians, communication and change management are especially important. Buyers should ensure that the integration will maintain, or even strengthen, the “patient first” mentality and entrepreneurial culture that have promoted success. Thoughtfully transitioning people to a larger organization requires careful planning. This includes retaining specific elements of the acquiree’s culture, such as agile decision making, so that employees can maintain their pace of work.

- Align with the acquiree on how to quickly scale capabilities. We often see that the buyer’s growth ambition outstrips the acquired company’s ability to rapidly scale and deploy its capabilities in the merged organization. Developing an aligned plan for how capabilities will be integrated is critical, as is providing the expertise and resources to make it happen.

- Develop the right operating model to bundle pharmacy services with core operations. Acquirers create value from pharmacy deals by gaining access to data on drug spending and claims, as well as the ability to offer a better experience to members through bundled services and ease of access. Success requires developing the right operating model and ensuring cultural alignment so that the acquired adjacent services mesh with the payer’s core operations.

In addition to these specific success factors, a rigorous approach to PMI planning goes a long way in improving value creation. This includes setting up a strong central integration-management office (IMO) with a clear mandate to focus on value capture. The IMO establishes baselines and assesses synergies, assigns responsibility for achieving them, and tracks their realization across teams. In addition, the office manages all related organizational and people processes, including communication and change-management planning.

It’s also important to bear in mind that merging companies are generally prohibited from sharing sensitive or competitive internal information before the closing. We have found that “clean teams” composed of third-party personnel are an effective way to manage such information and accelerate the process. These teams can, for example, analyze and plan procurement opportunities, as well as evaluate technology and digital opportunities. Even though clean teams must not share their full analyses with management until the deal closes, their efforts lay the groundwork for an early start on capturing synergies.

SIX IMPERATIVES FOR A SUCCESSFUL PMI

In BCG’s experience, regardless of the acquisition archetype, an acquirer must be clear about the strategic intent while thoughtfully planning and executing the integration. Focusing on these priorities can guide the effort:

1. Be clear about the vision. Provide clarity to all stakeholders about the intended results of the acquisition as well as how people will be affected by reassignments and other changes in the merged organization.

2. Tailor a rigorous approach. For any deal size or type, tailor your approach, stick to PMI best practices, and ensure that employees buy into the vision.

3. Define the operating model. Determine how the acquired organization will fit into the buyer—what aspects will be standalone, aligned, or integrated. Clearly defining the combined entity’s operating model before the closing helps minimize friction and ensures that the pieces fit together effectively and quickly after the closing.

4. Give priority to managing people. It’s critical to take the proper approach to retention and communicate proactively to hold onto key talent. Aligning cultures, implementing change management , and understanding the employee journey are critical to promote the long-term strategic value of acquired assets.

5. Manage cultural differences. A well-designed cultural integration takes into account the differences and similarities of the two organizations and provides a positive employee experience during the merger.

6. Align early on performance priorities. Set clear targets for improvement and establish the right metrics for measuring performance and progress.

Payers have a number of strong strategic rationales for pursuing M&A. But realizing the full potential value of an acquisition is not guaranteed. Planning a fit-for-purpose PMI should begin well before the closing, with an emphasis on addressing each deal’s distinctive opportunities and challenges. Tactical moves, such as setting up an empowered IMO and using clean teams, help promote a smooth integration process. Payers that follow the imperatives for success will be well positioned to achieve their strategic goals.