Powerful new models are in the works, but effective implementation depends on building the right capabilities and enablers.

The opportunity to fundamentally realign how you engage with customers does not come around often. Digital technologies opened the door in many sectors, including pharma, and the pandemic pushed it wide. Developments were further accelerated by the combination of changing expectations of physicians and patients, technology advances, and regulatory shifts in such areas as telehealth and online prescription sales.

BCG's latest survey of health care professionals on the impact of COVID-19 showed clearly how profound the changes have been in the ways that doctors engage with patients and pharmaceutical companies as the post-pandemic reality takes shape. A sustained shift toward greater use of virtual channels and a strong desire for more medical and scientific information stand out. Companies that adopt a new model, increasing personalization in their outreach, enjoy substantially higher satisfaction ratings from physicians.

Many leading pharma companies are seizing the opportunity to use new modes of engagement to deliver better outcomes for patients and greater overall value in health care, while in the process improving interactions with their physician customers, deepening those relationships, and driving business performance. Some are already seeing the value of the more personalized model, but only a few have been successful in effectively scaling it across treatment areas and markets. Getting it right is not easy.

A Next-Generation Customer Engagement Model

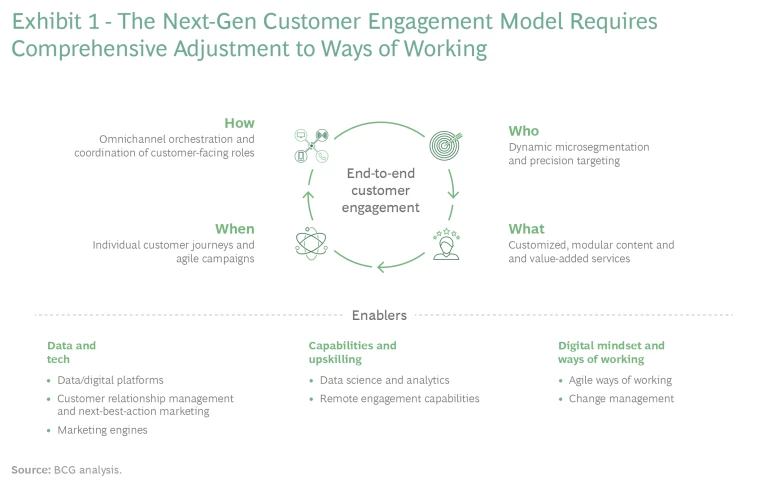

The new model leverages digital technologies, data, and analytics to augment companies' existing strengths and experience and their established relationships with physicians. (See Exhibit 1.) Companies can provide the desired information, build satisfaction, and, ultimately, increase adoption by customizing engagement down to the level of the individual physician. The goal is to personalize content, channel, and time of delivery without increasing complexity. To get there, companies should take a stepped approach, focusing on the highest-value areas first and building an effective cross-functional operating model during implementation.

Whom to Engage. Under this next-gen model, pharma companies can gain real-time and predictive insight into the needs and preferences of physicians. They can base their outreach on dynamic microsegmentation and precision targeting informed by knowledge of each physician’s characteristics and behaviors, areas of interest, and preferred channels and timing for communications. This information can be generated from a statistical analysis of engagement data, both face-to-face and virtual, as well as from digital-marketing data. Other factors influencing treatment decisions, such as peer-to-peer networks and patient profiles, can be assessed by analyzing historical prescription patterns and digital-marketing and social media data.

What to Say. Pharma companies can deliver, via patient engagement platforms or services, customized, modular communications that provide doctors with medical information and offers of assistance. Historically, pharma companies have run one to three campaigns annually. When combined with accelerated and more agile internal processes and ways of working, the next-gen model enables substantial acceleration: 10 to 12 dynamic and personalized campaigns per year are now possible. Modular content is optimized for the preferences and behaviors of individual health care providers through A/B testing and a constant feedback loop of content engagement. Companies can also provide value-added offers, such as support for physicians' efforts to digitize their own engagements with patients.

When to Engage. The next-gen model enables tailored engagement based on data-driven insights into when various types of commercial interaction are most appreciated by and effective with individual physicians—for example, the time of day or day of the week that they prefer to read their emails, speak with pharma reps, or attend speaker programs. Pharma companies can initiate engagement when a doctor starts investigating a treatment through other digital channels or alters the treatment of a particular condition. Interaction builds on dynamic trigger points, such as the opening of an email, and each interaction becomes part of a smooth engagement journey.

How to Engage. Real-time adjustment and (re)allocation of budget and resources to the most effective channels are now possible, as is achieving a fact-based understanding of how various channels interact, how best to sequence touchpoints among channels, and how to deliver the most satisfactory experience to the doctor.

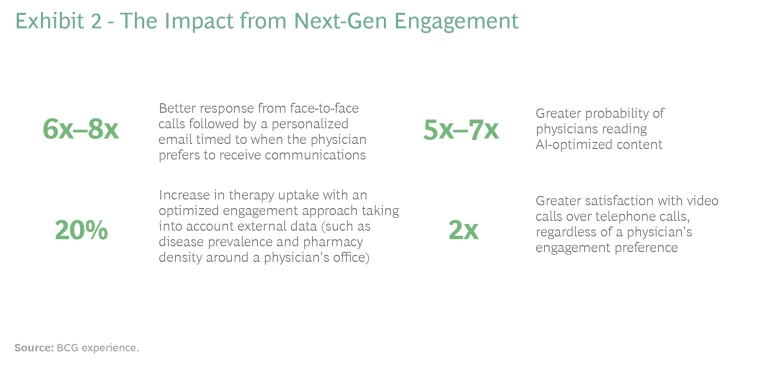

Getting It Right. While application of the model depends on factors specific to each market and treatment area, pharma companies that get personalized outreach right see significant benefits, such as more effective use of drugs, closer partnerships with doctors, and improved patient outcomes. (See Exhibit 2.) Getting it right, though, is no easy matter, and many companies have learned costly lessons from their early efforts. The key, in our experience, is to recognize that building the model requires putting the necessary enablers in place, which takes time. It’s essential not only to capture the value of data and analytics but also to instill an approach that is simple and practical enough to scale across the numerous customer engagement resources of pharma companies.

The Enablers of Next-Gen Customer Engagement

The next-generation customer engagement model employs specific technological and human enablers. The tech tools are important, of course, but the right capabilities, skills, and ways of working may be even more so.

Data and Tech. The exponential proliferation of digital channels, apps, wearables, and other generators of customer-specific, health-related data mandates that companies acquire or build a robust data and digital platform capable of ingesting structured and unstructured data from multiple sources. The automated ability to collect, manage, and protect data is essential to such capabilities as gaining a full view of the customer, managing personalized engagements, orchestrating interactions by channel, and achieving improved commercial insights.

Analytics engines and solutions use data from across the patient and physician value chain to provide the dynamic microsegmentation, precision targeting, and provider network analyses that form the basis of next-gen engagement. Specific solutions include:

- Machine-learning capabilities that can analyze the interests, needs, and preferences of health care professionals to steer engagement

- Machine-learning-based next-best-action decision platforms to help identify optimal engagement plans for individual customers

- Marketing engines that provide automation and the use of advanced analytics for insight-driven decision making

These sophisticated programs can help companies deliver personalized communications, automatic and dynamic call planning, and field force optimization, among other capabilities, but they must be combined with human skills and ways of working that bring speed and agility to internal processes.

Capabilities, Skills, and Ways of Working. Companies will need a very different set of skills for next-gen ways of working. The new model requires the deployment of multiskilled, typically cross-functional, customer-facing teams that can work effectively together with a focus on value. Perfecting the targeting and content capabilities that make remote outreach work requires experimentation and iterative ways of working. Continuous improvement means that frequent feedback and testing and learning take place in short delivery cycles. Engaging physicians in remote ways, such as by phone or video, requires training and new engagement metrics.

Companies can provide the desired information, build satisfaction, and, ultimately, increase adoption by customizing engagement down to the level of the individual physician.

Ultimately, the next-gen model requires the right people operating together with the right behaviors—and resisting the natural inclination to retreat to functional homes or silos, which is an all too frequent reaction. Teams will comprise business and technical personnel and include new roles, such as data scientists, data engineers, and software engineers, that many organizations will likely need to source (rapidly) from the open market. Instilling the right behaviors starts with leaders, who will have to immerse themselves in the new ways of working, change how they interact with team members (the average leader spends much more time asking questions than providing answers, for example), and engage in “value steering”—seeking to continuously improve by collecting and acting on the right data, as opposed to simply reviewing updates. As more teams adopt the new ways of working, leadership’s job becomes more about prioritizing work (aligning it with purpose) and instilling into teams the concept of alignment and autonomy. Alignment around a common purpose and goals unlocks the autonomy and ability of teams to act on their own, spurring both ownership and creativity and enabling team members to make quick decisions and move fast.

Some companies may decide to support the transformation with an accelerator or a center of excellence that provides coaching, training in common methods and tools, and upskilling for employees who need to learn new skills or ways of working. The center of excellence can also kick-start or champion the recruiting engine for new skills and help develop the right metrics and supporting communications.

Practicality and Simplicity Are Key

Pharma companies will use more sophisticated analytical methods to personalize the customer journey and provide richer content to physicians. At the same though, the model must be practical and simple enough to be used by customer engagement teams. Some pharma companies have struggled with microsegmentations that are overly complex, which leads to several problems. Field teams do not use the new tools, companies are unable to measure the impact of overly sophisticated engagement journeys, and overengineered processes weaken the impact of cross-functional teams. Companies should focus on the areas that create measurable impact. They should embed new insights into the existing day-to-day operations of their teams and integrate impact measurement and learning cycles into existing ways of working. They should avoid imposing any unnecessary burdens on their customer-facing and marketing teams.

The Pharma Transformation Journey

Many pharma companies have already started to move their engagement models toward personalization of content, channel, and time of delivery, and their pilot efforts are showing great results. But really improving their interactions with physicians and deepening those relationships require taking pilots to the next level by scaling a new operating model across the organization. This can be a big challenge. Next-gen customer engagement requires an end-to-end transformation. Buy-in from senior stakeholders, active participation and support from all parts of the organization, and sufficient investment are critical. In our experience, companies should expect a two- to three-year journey that requires a structured, step-by-step approach to get it right.

The journey starts with setting the ambition and strategy that define the envisioned engagement and operating model, including the setup of a data and digital platform to collect and manage customer data and serve as the engagement engine. This exercise should not become a time-consuming or progress-preventing hurdle. Once the basic vision and tools are in place, companies can take a step-by-step approach to implementing such new capabilities as dynamic targeting and automated outreach decision making based on data-informed determinations of the next best action.

Companies will likely take most of the first year to adapt and adjust the data and analytics setup for various functions, such as inside sales and omnichannel management, and to pilot the new ways of working. Most companies will need to put targeted effort into selling the sales force on the next-gen model through measures designed to implement change management , overcome resistance, and develop digitally based, next-generation selling capabilities. The second year is typically devoted to building out advanced customized content and offers, individual customer journeys, and fully agile ways of working .

Getting Started

From our experience, this new way of engaging with customers is a heavy lift and involves substantial behavioral change among the field force, marketing, senior management, and other key stakeholders. One successful approach that many of our clients have followed is to think big, start small, and scale quickly.

The new model requires the deployment of multiskilled, typically cross-functional, customer-facing teams that can work effectively together with a focus on value.

Starting small with a clear focus on value helps with change management, and putting some early wins on the scoreboard helps build support. By focusing a few teams on delivering real value, the approach can work for organizations that have already embarked on a transformation journey but have hit internal resistance. Ideally, the organizational and technology changes are tackled in tandem, since both technology and the way humans interact with it are at the heart of the new model.

Here are five steps that pharma companies can take to jump-start the shift to a next-gen engagement model:

- Determine the data and analytics capability you’ll need. Don’t be held back by an imperfect data and system landscape. Take the time necessary to scope and build a sophisticated data set, including external data, and to identify other essential pieces of the data and tech capability (such as the data and digital platform and the marketing engine).

- Identify and showcase the impact of the first pilots to put momentum from real results behind the transformation.

- Break down silos between functions, such as marketing, sales, and data and analytics; involve legal and compliance in cross-functional teams from the very beginning. Don’t fall into the trap of needing to set up the perfect organization and acquire all relevant talent; recognize that change will come gradually.

- Determine the right balance between locally and centrally coordinated execution of multichannel engagement activities. From the beginning, put local market teams in the driver seat, ideally from sales, marketing, and business intelligence. (Bringing these functions closer together can itself unlock value.)

- Understand and communicate regularly that the transformation is a marathon for both local affiliates and the organization as a whole. Stay focused on constantly managing progress and impact to be ready to seize the value and course correct where necessary.

The changes taking place in the health care sector represent a rare opportunity for pharma companies to radically rethink how they engage with customers. In our experience, companies that embrace the next-gen engagement model and put in place the required technology and human enablers have seen improvement in two areas. The first is physicians’ conviction that the information they receive helps them provide the best possible treatment to patients. The other is significant commercial acceleration. We are already seeing how enhanced engagement brings benefits for customers, patients, and pharma brands. Early movers will establish lasting sources of advantage over latecomers.