By transforming their commercial operating model, biopharma companies can better engage with health care professionals and patients.

Biopharma companies

must radically rethink their commercial operating models to better serve patients, engage employees, and respond to competition. This requires looking at those models holistically and putting in place the right human and technology enablers. By razing institutional silos, accelerating cross-functional decision making, and improving agility, efficiency, and resource allocation, companies can unleash the full potential of their employees and ensure more effective competition in the marketplace.

The Need for Transformation

While biopharma companies have been making incremental changes to their commercial operating models for years, the pandemic intensified several trends that call for a more rapid and fundamental transformation. Customers are demanding more personalized and real-time responses to their needs. The use of digital channels is growing. More stakeholders (such as patients and payers) are getting involved in decision making. Budgetary pressures on health care systems are building. And new technology startups in the health sector have become more aggressive.

At the same time, biopharma companies must manage the growing complexity of their portfolios. These include more medicines for highly stratified patient populations, new modalities with unique go-to-market models, and increasing use of personalized treatments and combination therapies.

In this environment, every biopharma company needs a strategy specific to its portfolio and focused on being more responsive to (and even anticipating) customer needs, better serving health care providers and patients, and engaging with the broader health care system. This strategy will, in turn, depend on transforming the human and technology enablers of the commercial operating model.

The New Model Enables Four Compelling Use Cases

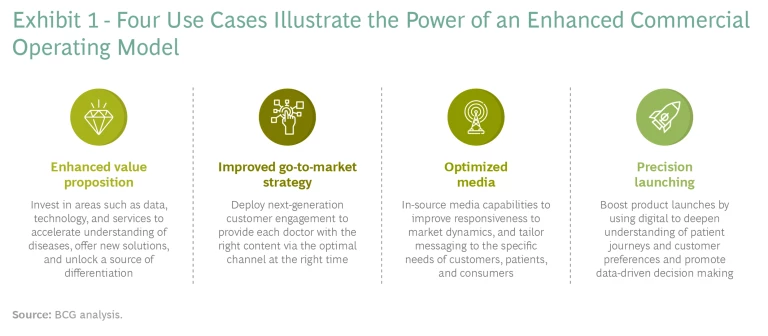

Every biopharma company’s priorities are unique. But we have observed a number of compelling use cases that illustrate the power of an enhanced operating model and the possibilities that many biopharma companies might tap into. (See Exhibit 1.)

An Enhanced Value Proposition

In recent years, many companies have invested heavily in data, technology, and services to accelerate their understanding of diseases and their delivery of new solutions. Roche's acquisition of Foundation Medicine and Flatiron Health is an example of this trend. According to the company's website, Roche uses cloud-based workflows that integrate aggregated data into a single, holistic patient dashboard, enabling tumor boards to personalize treatment choices. The company also develops software for wearable medical devices and other digital biomarkers, which provide valuable data and improve outcomes for patients with such conditions as multiple sclerosis, autism spectrum disorder, Huntington's disease, and Parkinson's disease. Finally, Roche uses digital tools to provide more sophisticated disease management services.

An Improved Go-to-Market Strategy

Some companies are adopting a next-generation customer engagement model as part of their go-to-market strategy. The goal is to provide doctors with the content they want via their preferred channel at the specific time they want to see it—and to do so without increasing complexity for the company’s customer engagement teams. The model leverages digital technologies, data, and analytics to augment pharma companies’ existing strengths and experience and their established relationships with physicians. The model's power lies in doing more than simply boosting commercial effectiveness. It also enables a closer partnership between the company and doctors and delivers better results for patients at lower cost, thus contributing to a more sustainable health care system.

Optimized Media

Some companies have made the strategic decision to in-source their media capabilities in order to improve their responsiveness to market dynamics and tailor their messaging to the specific needs of customers, patients, and consumers. This approach has required them to assess and identify their needs with respect to marketing data and technology, in-house talent, and ways of working across brand teams, centralized marketing, and the technology function.

Precision Launching

Leading biopharma companies have recently demonstrated the effectiveness of digital launches . Going forward, we believe that weaving digital tools and analytics into every aspect of a product launch will be a prerequisite to engaging with customers and a major source of competitive differentiation. Winning companies will use digital tools and channels to deepen their understanding of patient journeys and customer preferences, promote data-driven decision making, and provide personalized experiences to health care providers and patients.

Turning Potential Use Cases into Reality

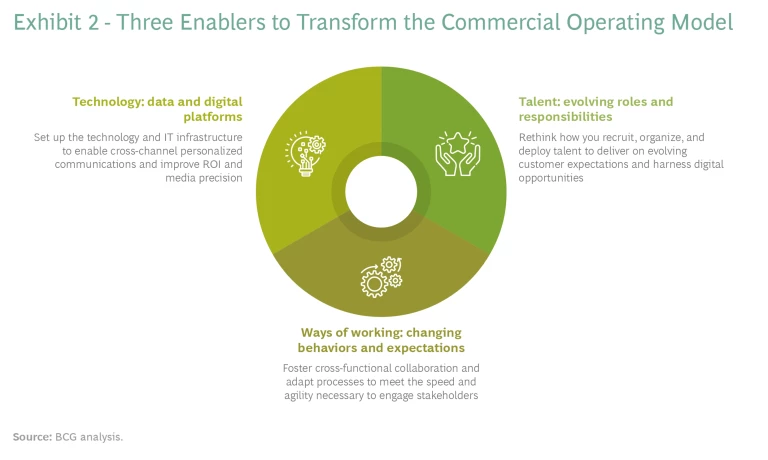

To drive their transformations and make these potential use cases a reality, companies must develop their technology, talent, and ways of working. On the technology side, this requires establishing a strategic technology function that utilizes various digital platforms to integrate data sources for advanced analytics, generate actionable insights, and deploy commercial resources. On the human side, it requires bringing some roles in-house—and possibly expanding their responsibilities—as well as implementing more agile ways of working that improve cross-functional collaboration and speed to market. (See Exhibit 2.)

Technology: Enabling Change Through Data and Digital Platforms

Three critical categories of supporting technology and IT infrastructure are needed to personalize messages and actions, improve the ROI and precision of media and other commercial activities (such as launches), and enhance the value proposition beyond the drug or treatment itself:

- A data lake that integrates multiple data sources (including sales, customer relationship management, digital marketing, real-world evidence, and competitor benchmarks) for more bespoke analytic tasks, such as highly specific omnichannel analysis and deployment, precision targeting, and health care provider network analysis.

- A customer relationship management system to plan, record, and measure interactions with customers and patients. In the case of provider interactions, nearly all companies are good at recording virtual and in-person visits, but they are less consistent in capturing interactions through other channels (such as email, e-detailing, and webinars). Advanced analytics needs data from all channels to run activities such as omnichannel orchestration, microsegmentation, and next best action, as well as to drive personalization at scale (across multiple markets, businesses, franchises, and brands). To improve patient interactions, companies can better utilize email and text messaging—with patients who have opted in to such communications—to share information on adherence, co-pay assistance programs, and disease status.

- A data management solution, such as a digital marketing platform or a customer data platform, to design, plan, execute, and track digital-marketing activities. To get the most out of their marketing efforts, biopharma companies must connect their data management solution to external data sources (including third parties offering digital-marketing services such as webinars and third-party mailings) as well as to internal data sources (including first-party relationship data and sales).

Talent: Evolving Roles and New Responsibilities

But technology alone is not enough to transform the commercial operating model. It’s also critical to get the right talent and ways of working in place to take advantage of the advancements in data and technology . Biopharma companies therefore need to rethink how they recruit, organize, and deploy talent, as well as how their technology and commercial functions collaborate.

Every biopharma company needs a strategy specific to its portfolio and focused on being more responsive to (and even anticipating) customer needs, better serving health care providers and patients, and engaging with the broader health care system.

In some cases, this means revising current roles and creating new ones. For example, physicians are increasingly interested in engaging with biopharma representatives who act as “advisors” on specific disease areas and have knowledge beyond the products they promote. The reality today is that pharma companies have less access to physicians and fewer face-to-face interactions, so it's critical that every one of their engagements with customers be useful and on point.

MSLs and Sales Reps. This necessity is leading some pharma companies to elevate the role of their medical scientific liaisons (MSLs), making them the customer’s primary point of contact for specific therapeutic areas—always, of course, being careful to remain in compliance. For example, a company might use MSLs when disease awareness and medical education are the primary goals, rather than boosting the brand’s visibility among competitors.

In other therapeutic areas, pharma companies are rethinking the role of sales representatives, increasing the scope of their responsibilities and promoting an entrepreneurial mindset when engaging with physicians and other providers and stakeholders.

As the roles of sales reps and MSLs evolve, so too will the role of first-line managers, who will spend more time coaching on new behaviors and ways of working. Over time, however, as sales reps and MSLs become more empowered and autonomous, the need for these managers may decline.

Field and Office-Based Roles. Meanwhile, digital channels and data and analytics make it possible to eliminate the traditional wall between customer-focused field roles and noncustomer-facing office-based roles. Ultimately, this can create a stronger, more seamless omnichannel experience. Some of our clients have already deployed inside sales teams that interact remotely with customers. Others are combining the sales and marketing roles, typically in countries and therapeutic areas where fully dedicated sales reps and product managers are not warranted. In mature therapeutic areas that lack fully dedicated MSLs, companies are employing office-based medical managers or advisors to serve as resources for physicians.

During the COVID-19 pandemic, physicians have come to appreciate how efficient and effective virtual engagement with pharma companies can be. According to a recent BCG survey , three-quarters of them prefer to maintain or increase the number of virtual (as opposed to face-to-face) engagements with reps. While doctors still count on personal visits from sales reps and MSLs, particularly during a product launch, they also want pharma companies to adapt to changing times.

Sourcing and Talent Acquisition. Biopharma companies are also rethinking their sourcing strategies and bringing roles in-house. For example, a top biopharma company is in-sourcing digital media expertise to optimize patient and consumer engagement. Roles include campaign specialists with expertise in search, social and display advertising, and media buying. Others have brought data science and data engineering resources in-house for better customer targeting and next best actions, as well as capabilities to measure campaign effectiveness.

With in-sourcing come new talent acquisition challenges. Biopharma is one of many industries competing for analytics and digital expertise. In response, some of our clients are bringing in specialist recruiters, participating in recruitment activities such as campus hackathons, interviewing and making offers more rapidly, and benchmarking compensation against technology (rather than pharma) companies. To compete on the open market and attract talent, biopharma companies also need to revise their compensation models, titles, and location requirements.

Ways of Working: Changing Behaviors and Expectations

While some companies have implemented the latest technology and hired new digital talent, many still struggle to make the new model work. One common stumbling block is adopting new ways of working. We consistently hear from our clients that the most difficult part of establishing a new commercial model is breaking down historical silos and adapting processes to achieve the speed and agility necessary to engage stakeholders. These challenges have frustrated brand marketers, commercial operations specialists, and technologists.

Companies need to rethink how they recruit, organize, and deploy talent, as well as how their technology and commercial functions collaborate.

But change and progress are possible. For one of our clients, embracing agile principles to break down institutional silos has made it easier for the functions involved in the go-to-market strategy to collaborate on such challenges as intensified competition, barriers to patients’ access to medicines, and rapid change. Better aligned on objectives and able to work cross-functionally, these teams can now design and launch commercial campaigns three times faster than before; they can also test commercial proposals and tactics more rapidly, gathering customers' feedback and refining solutions to meet their expectations.

Cross-functional collaboration and agility starts at the top at this company. The executive committee meets each week to align on common objectives, set and schedule priorities, and allocate resources to accomplish them. For example:

- The annual strategic and tactical plan for each product has been streamlined. A succinct 20-page document has replaced 100-page reports that formerly required endless internal meetings to discuss.

- The budget planning process has gone from a lengthy and burdensome effort that involved updating forecasts and significant uncertainty to an ongoing, less time-consuming process that focuses on the most relevant budget issues and immediate resource allocation decisions.

- Employees have more direct responsibility for maintaining compliance than in the past. The internal compliance “cop,” who previously ensured that employees were following the rules—and in the process created significant approval bottlenecks—is now more like a coach, helping them understand the most appropriate way to operate.

Also worth noting is that these agile ways of working are increasingly the way that partners and other stakeholders want to interact with biopharma companies. In fact, health care professionals and patients have come to expect the kind of support, responsiveness, and tailored solutions that only agile ways of working can deliver.

To win in the 2020s, biopharma companies need to engage differently with patients, potential patients, and physicians, offering them a better value proposition, and they need to face competitors in a faster, more nimble way. That means changing the operating model, which will only happen with strong leadership. Leaders must begin making the hard decisions required to invest in new technologies, upskill the workforce, and transform their go-to-market strategies. Moreover, they must champion a more agile and collaborative way of working that better engages employees. Putting the right human and technology enablers in place to accomplish such sweeping change will, without question, take significant resources. But those that commit to this effort stand to make significant gains in market share and the bottom line.