New research spotlights four ways companies can respond to the big changes taking place in the digital marketplace.

Companies Look to the Future

For European companies, deep tech is fast becoming big business. More corporations in non-technology sectors are investing in or otherwise forming partnerships and alliances with startups and smaller companies in emerging technologies built around significant R&D advances. The trend is picking up steam, and corporations that are not actively exploring such innovations as artificial intelligence (AI), advanced materials, biotechnologies, blockchain, augmented reality (AR), and virtual reality (VR) may find it hard to break in later when ecosystems have solidified around maturing and market-ready technologies. For some more-advanced deep technologies, the ecosystems are already well developed.

For this report, BCG and the corporate and investment banking firm Natixis joined forces to gain a 360° view of how corporations engage with and invest in deep tech in Europe. BCG has been writing about deep technologies with our partner, Hello Tomorrow since 2017, when we first explored the relationship between large companies and deep tech startups. In its publications, Natixis CIB Research and Natixis subsidiary Clipperton have explored such topical tech issues as the cloud in the digital transformation of European companies, the special-purpose acquisition companies craze, and digital health.

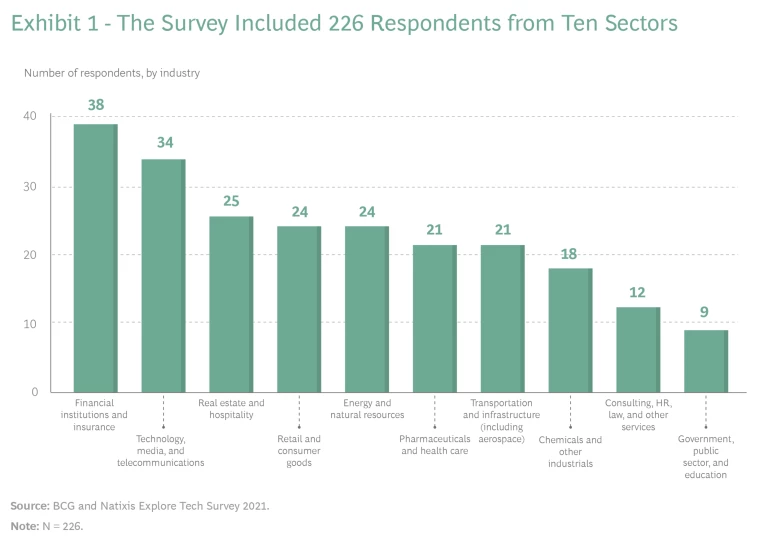

BCG and Natixis surveyed 226 respondents from 204 organizations (more than half of which are companies with annual revenues of more than €2 billion) in ten major European sectors. (See Exhibit 1 and “About the Survey.”) To augment the survey data, we conducted a series of qualitative interviews with senior executives.

About the Survey

We received 226 responses from 204 companies. There is no significant statistical difference in the percentages of respondents and companies in the survey data that we cite throughout the report.

Four conclusions stand out:

- Deep tech is a wave that large companies do not want to miss—especially in the face of crises such as COVID-19 and climate change. Both direct investment through partnerships, alliances, and M&A, for example, and indirect investment through corporate venture capital (CVC) and independent venture capital funds appear to be on the rise.

- European companies appreciate the disruptive power of deep tech. While AI may be seen as the most disruptive emerging technology today, many companies view blockchain and AR and VR as the most relevant disruptors in coming years. Assessments of the probable impact of any particular technology depend strongly on the industry and correlate with the technology’s maturity.

- Investing in emerging technologies is good, but investing in people and partnerships at the same time is even better.

- Blockchain, which came to prominence in the finance sector, is powering new asset classes, known as digital assets, that companies far removed from finance are adopting. Beyond cryptocurrencies, real asset and security tokens are growing rapidly.

Here’s our look at the approaches that large companies are taking to deep tech and their rationale and expectations for their investments.

A Powerful Wave

The BCG and Natixis Explore Tech Survey found that 90% of European companies invest in deep tech; and among these corporations, 78% have maintained or accelerated their investments in response to COVID-19. This contrasts with generally declining capital expenditures in the aftermath of the great financial crisis (down 8% overall, according to Natixis estimates).

What European Companies Want

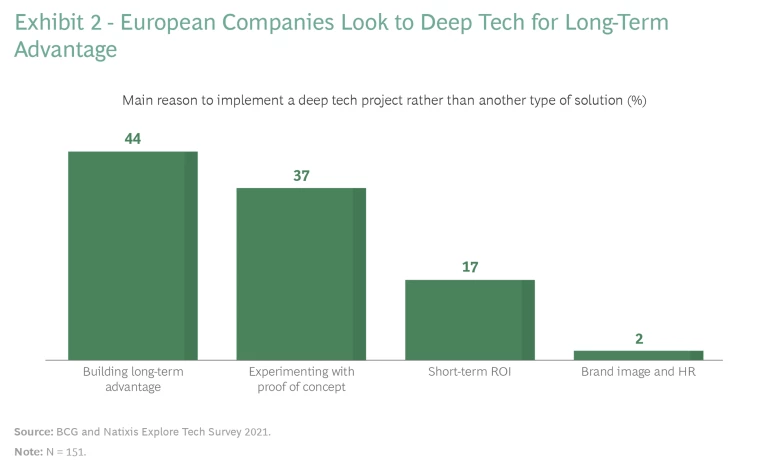

The number one goal for deep tech investments is to build long-term advantage. (See Exhibit 2.)

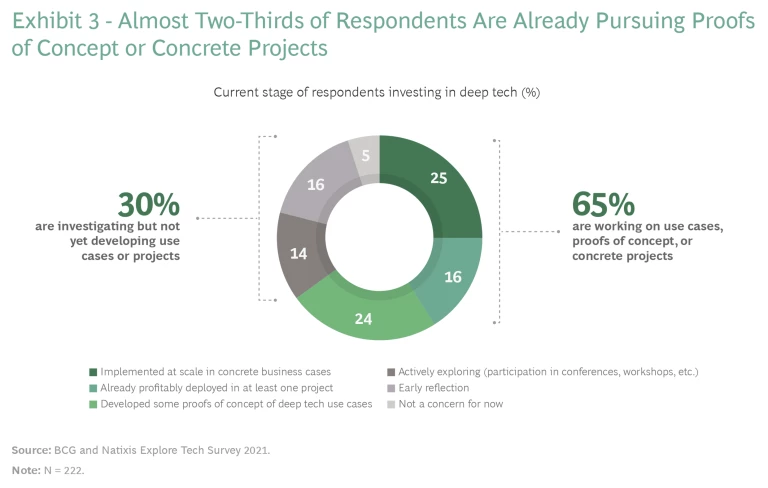

Because they are rooted in fundamental science, deep tech technologies are often transformative (think electric cars), and early movers can establish a powerful edge over the competition (as Tesla has done). Companies want to monitor trends and keep an eye on promising technologies, even if no clear business application yet exists. Others want to experiment with proofs of concept (PoCs), and a few see the potential for a near-term return. (See Exhibit 3.)

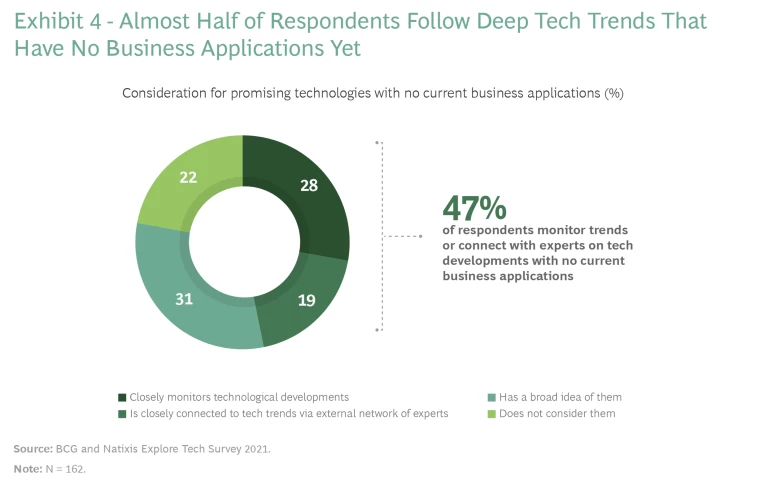

Many companies are working on use cases, PoCs, and concrete projects to assess the business feasibility of advanced technologies. Evaluating potential return on investment (ROI) is particularly important for investments that entail high capital costs or that involve sectors with high customer price sensitivity. That said, almost half of European companies are content to monitor developments that have no current business applications, either by staying in touch with experts in the technology or by putting some chips on the table and waiting for viable use cases to emerge. (See Exhibit 4.)

The COVID-19 crisis has markedly increased corporate interest in deep tech. Most notably, the success of the two mRNA-based coronavirus vaccines thrust biotechnologies into the spotlight. By pushing companies to accelerate their digital transformation and e-commerce, the pandemic has also helped pave the way for digital traceability tools, smart contracts, AR and VR, and digital assets. At the same time, the crisis made companies realize how much they depend on global supply chains for hardware elements critical to deep tech.

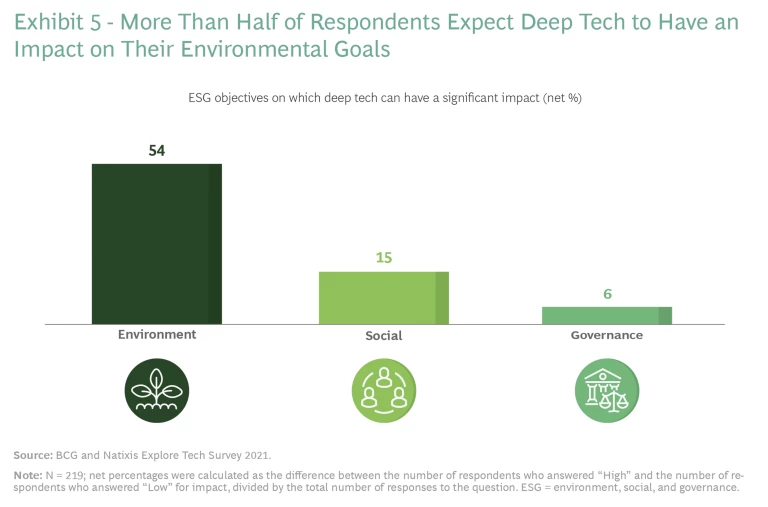

In a similar vein, the climate change crisis creates new opportunities for companies that build capabilities in deep tech. More than half (54%) of respondents view these technologies as critical to meeting climate goals, with especially strong needs in the chemicals, energy, telecom, and transportation sectors. (See Exhibit 5.) Some deep technologies can contribute to the decarbonization of corporate operations—by encouraging development of innovative, greener materials and emission-free power generation, for example. Companies can also leverage deep tech innovations to develop new products and services to help tackle environmental challenges. As one venture capitalist put it, “There is a strong momentum in Europe around greenhouse gas reduction, which decoupled the scale and the pace of funding for startups and could be part of the solution. The objective is now to identify relevant levers and technologies to decarbonize each industrial sector, rather than focusing on a specific deep technology on its own.”

An open question among large European companies is whether the EU and national COVID-19 recovery plans will support technological investments in deep tech. Today, 58% of companies in the region benefit from public funding for their deep tech projects, but often only to a limited extent. More than half reckon that public money represents less than 10% of their project funding, and 70% either do not expect their deep tech projects to benefit from the EU and national recovery plans or do not know whether they will.

Companies also worry that the government plans may not do enough to enable Europe to gain sovereignty over critical deep tech components and alleviate dependence on global supply chains. Almost half of respondents think that the EU recovery plan is too small to help Europe catch up with the US and Asia or fully recover from the crisis. In addition, respondents see the process for accessing public funding as so cumbersome that it may cause some companies not to pursue these programs.

How Companies Invest

Whatever investment channel they use—direct investment, CVC, or external funds—companies must keep in mind the practical process of moving from investment to implementation. How do they scale up PoCs? How do they involve business teams to ensure that deep tech projects respond to real needs and bring real solutions?

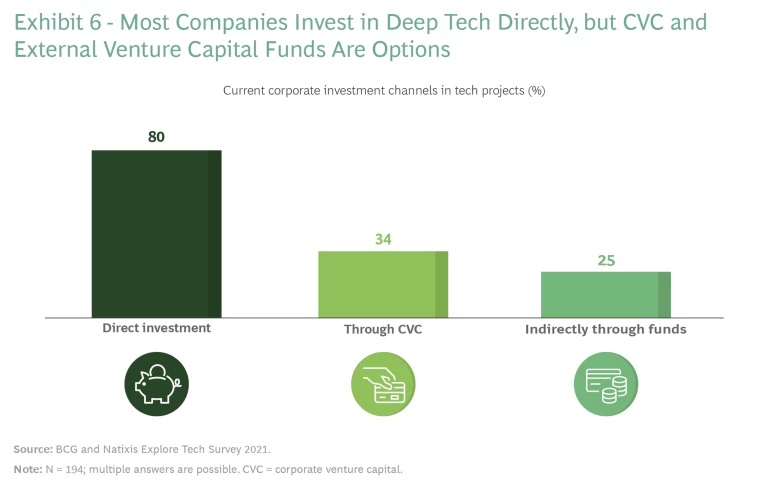

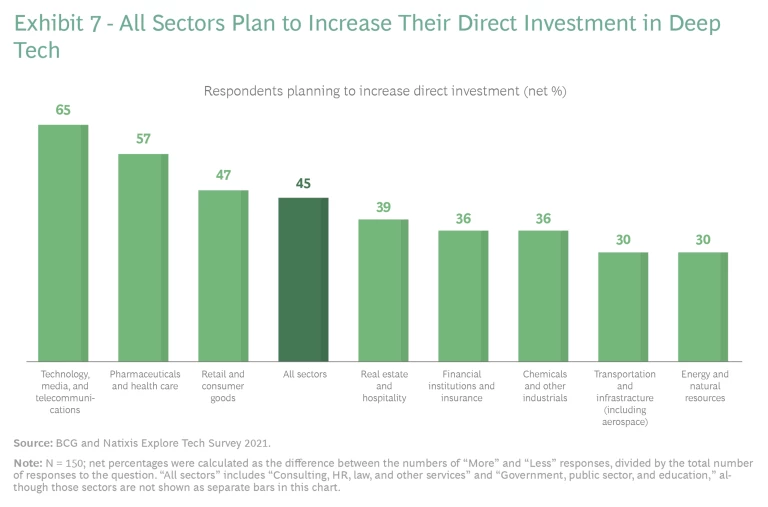

Most companies elect to invest directly in deep tech and expect to do so more in the future, particularly in technology, media, and telecommunications (TMT); pharmaceuticals and health care; and retail and consumer goods. (See Exhibits 6 and 7.)

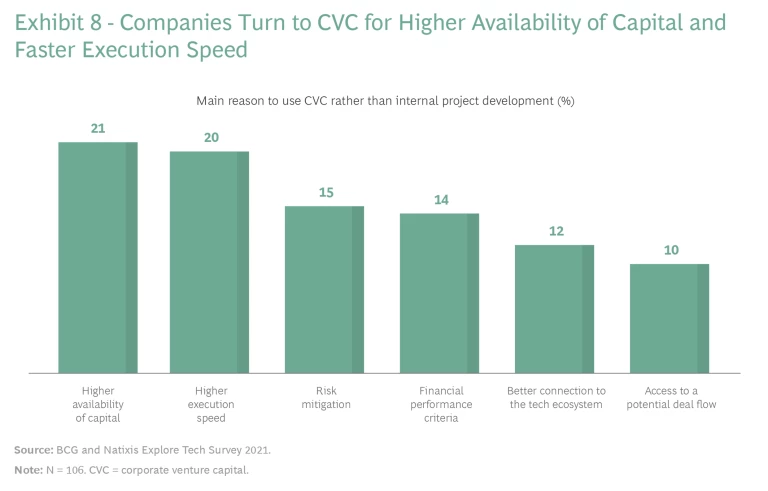

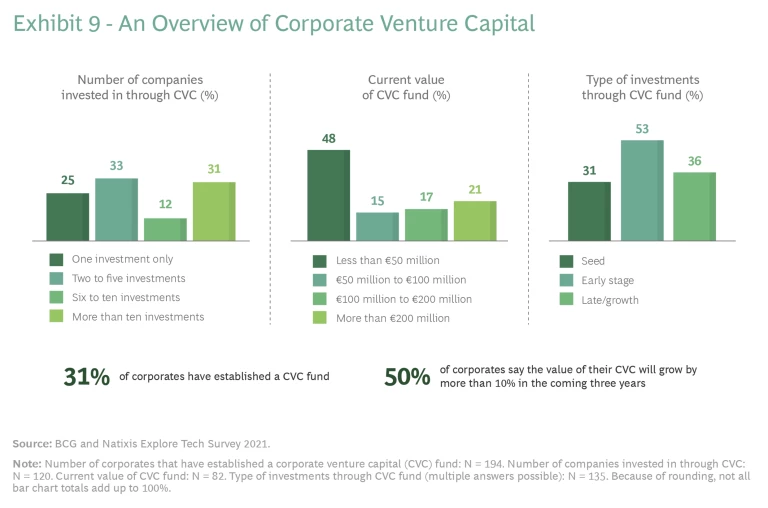

But it can be difficult to dedicate time and resources to exploring trends while dealing with the pressures of managing daily operations and near-term financial priorities. Investing through CVC or an external fund separates priorities and enables companies to advance step by step while exploring use cases and developing PoCs. Some companies turn to CVC for higher availability of capital and faster execution speed. (See Exhibit 8.) More than 30% of respondents have established a CVC fund, and half expect the value of their CVC funds to grow by more than 10% over the next three years. (See Exhibit 9.)

Some companies turn to external funds in part to gain access to better deal flow and to enable stronger connections to the ecosystem. “We have transformed our company’s CVC into an independent VC fund, where our company is one of the multiple investors, enabling full autonomy for investments,” said a partner of a venture capital fund initiated by an aerospace company. “We keep close links with the company and other LPs to play an early-warning role on the potential impact of new technologies and to identify promising startups.”

To scale up, companies must ensure that innovation is not entirely separated from operations. Many prioritize investment topics in line with their operational objectives. For instance, a large building industry company has established a fund with 22 startups to develop innovative solutions relevant to the company’s activities. Business teams must be involved to prioritize the right use cases. As the deputy director general for digital transformation, innovation, and sustainable development said, “It is crucial to have a long-term vision of how deep tech will be used to better serve client needs. This involves a continuum approach for each maturity stage, with business units investing directly in mature technologies for their operational needs while, at the group level, promising markets and technologies are explored notably through CVC by being on boards of startups or working jointly to analyze trends with external funds.”

The Disruptive Power of Deep Tech

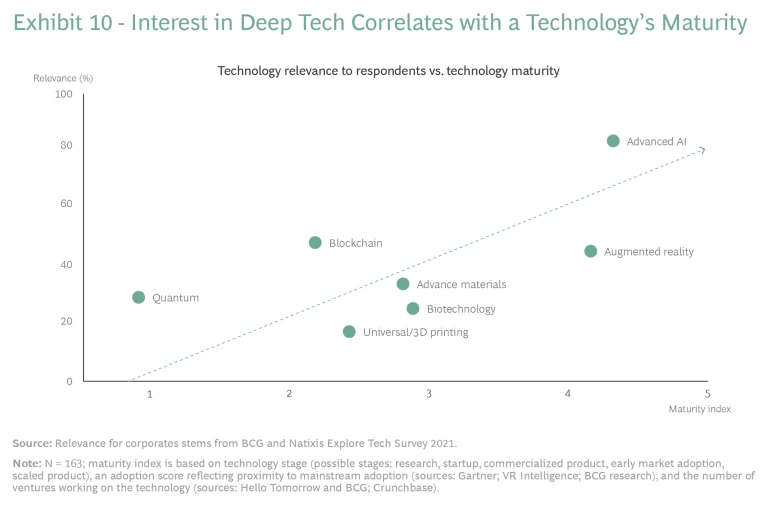

Corporate adoption correlates most strongly with technology maturity. (See Exhibit 10.) Maturity begets proven use cases, which in turn demonstrate ROI, unlocking corporate funding. Advanced AI and cognitive algorithms are the clear leaders in corporate adoption today, followed by blockchain and AR/VR technologies.

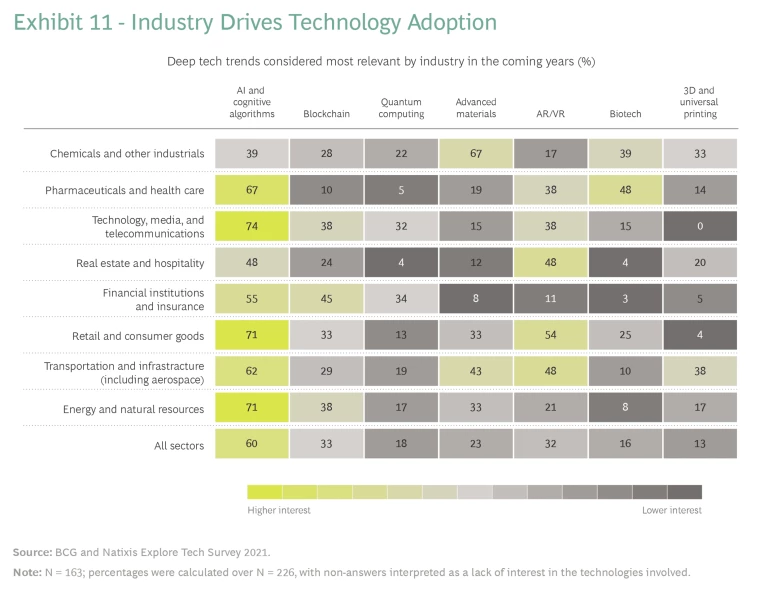

After maturity, the most significant factor driving adoption is the industry in which a company operates. (See Exhibit 11.) There, too, the existence of proven use cases is a crucial link fostering investment.

Here is a look at several standout deep technologies and their ability to disrupt different sectors.

Advanced AI and Cognitive Algorithms

Advanced AI and cognitive algorithms are clear leaders in corporate relevance now, cited by 60% of respondents. Fueling progress in AI are better learning algorithms, larger data sets, and improvements in hardware. Two-thirds of pharma and health care respondents see these technologies as highly relevant in their sector. AI contributes to better diagnoses—especially in disciplines that use medical imaging (such as radiology, ultrasound, and ophthalmology)—by detecting tumors and anomalies earlier and revealing problems that traditional equipment cannot identify. AI is increasingly being used to analyze electronic medical records and biological and imaging results. It can help set up the most effective and appropriate treatments for patients, and it can predict a disease’s evolution markers.

In this decade, AI will achieve significant advances in cognition. Cognitive algorithms replicate human thought processes to simulate the way the human brain works. Algorithms include self-learning programs that use data mining, pattern recognition, and natural language processing. Among the business-relevant applications are speech recognition, sentiment analysis, risk assessment, and fraud detection (the last being key for insurance companies, for instance).

The Benefits and Challenges of Blockchain

Cryptocurrencies grab the headlines, but the underlying blockchain technology has multiple potential applications across a wide range of industries. Respondents rank it as the second-most relevant technology today.

Blockchain enables the “digitization of trust,” making it a secure and reliable transactional tool. In a blockchain ecosystem, each block is time-stamped and chronologically ordered in such a way that its hash value depends on the hash value of the previous block—a sequential arrangement that enables traceability solutions for foods, cosmetics, cars, diamonds, and other goods. Tokenization, for instance, is making inroads in such markets as art and real estate, where it brings new sources of liquidity, greater transparency (through immutable proof of ownership), and ease of execution (through smart contract implementation). For its part, the circular economy can benefit from the deployment of waste management systems that enable complete visibility of processes for recycling hazardous or polluting materials.

Blockchain helps businesses better control and optimize their entire supply chain with all of their suppliers and the suppliers of their suppliers. This approach is being piloted in the food industry. It delivers other benefits in instances in which a central authority is not required or not trusted.

For all its promise, blockchain has drawbacks that companies are still trying to overcome. First, its fully decentralized architecture limits the volume of transactions that it can perform. For example, Bitcoin can process only 4.6 transactions a second while Visa can handle 1,700. Blockchain also requires significantly more power than centralized databases or data lakes. Bitcoin consumes 0.55% of the world’s electricity.

Now Is the Time for AR and VR

Often mistaken for one other, AR and VR are separate technologies that are revolutionizing user interfaces in different ways. AR superimposes virtual elements on the user’s real environment, via the camera in a smartphone or tablet (or sometimes via glasses), while VR relies on a helmet to immerse the user in a virtual world. Both technologies have improved considerably in recent years, thanks to improved computing power, greater storage capacities, better graphics resolution, and the impact of other technologies such as AI.

AR and VR endured false starts in the 1990s when the term was coined and again in the 2010s when Facebook acquired Oculus for $3 billion. But our survey indicates that the technology may be taking off for real this time.

The benefits of AR and VR vary by industry. In retail, the technologies improve customer experience and loyalty, increasing sales and giving users competitive advantage. Among retail and consumer goods companies, 54% see AR and VR as highly relevant. And in real estate, 48% of respondents expect VR to transform the transaction and construction experience with virtual visits to prospective residential or commercial properties from anywhere at any time.

Hurdles remain. The technologies are difficult to set up and require good connectivity. Headsets still lack practicality and autonomy, limiting their industrial usefulness in mobility or in factories, and they continue to be expensive. Technological advances, price reductions, and the deployment of 5G networks should drive greater adoption in the coming years, however.

Taking the Long View in Quantum Computing

Quantum computing attracts more interest than its current state of development might suggest. Although actual high-impact applications are probably still five to ten years away, quantum computing is likely to have a profound impact and create enormous value (ultimately between $450 billion and $850 billion for users, according to BCG estimates). Companies in finance, TMT, and chemicals are taking notice. In fact, quantum computing is one of the few deep technologies that already have a significant market for PoCs ($300 million in 2020). For instance, Volkswagen established a proof of concept with a D-Wave quantum computer to tackle the tricky problem of traffic optimization. In 2020, Airbus launched the Airbus Quantum Computing Challenge to identify quantum applications that are designed to solve complex problems such as load optimization or aircraft design.

People and Partnerships Matter

Investing in technology is good; investing at the same time in people and partnerships is even better.

Building the right mindset and skills within the company is critical to translating successful PoCs into real solutions for implementation and adoption. “Deep tech development requires the right mindset and some degree of cultural transformation, especially in companies with a strong culture of safety and risk analysis,” said the head of innovation at a railway company. “We must also find ways to reconcile the long-term horizon of the industrial deployment with shorter technological innovation cycles.”

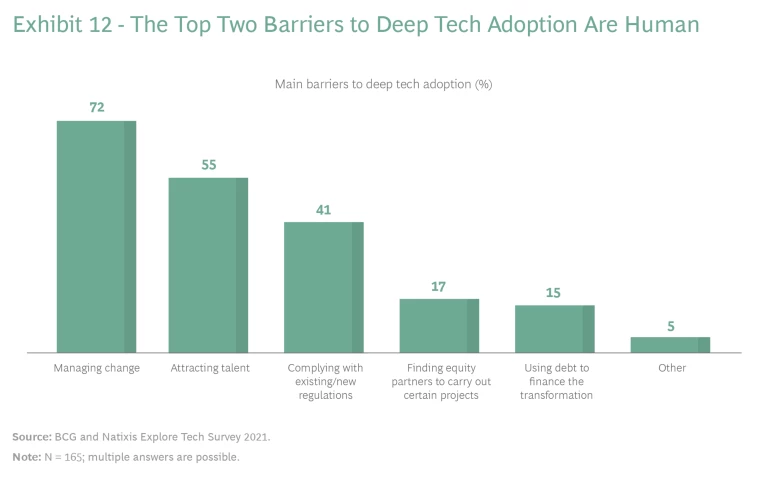

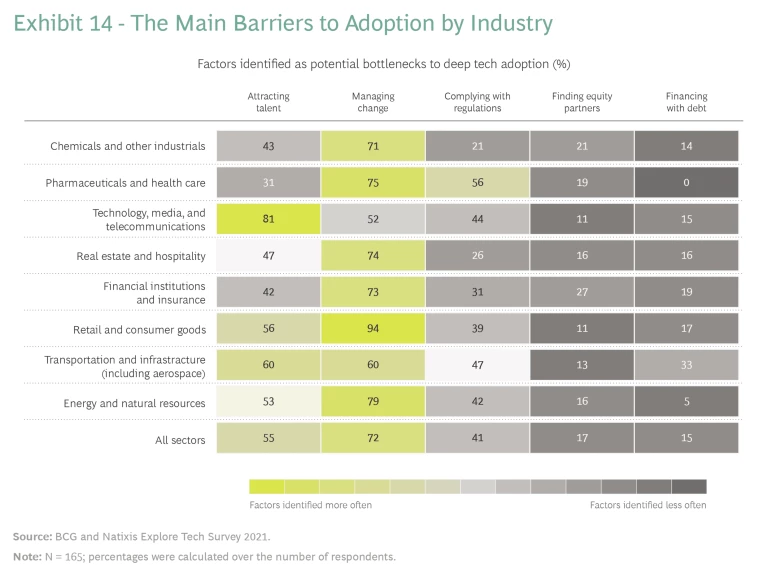

Embracing deep tech innovation requires more than just financial investment. Business teams need to be open-minded, agile, and able to embrace new technological solutions. The top two barriers to deep tech adoption are human: managing change, cited by 72% of companies, and attracting talent, cited by 55%. (See Exhibit 12.)

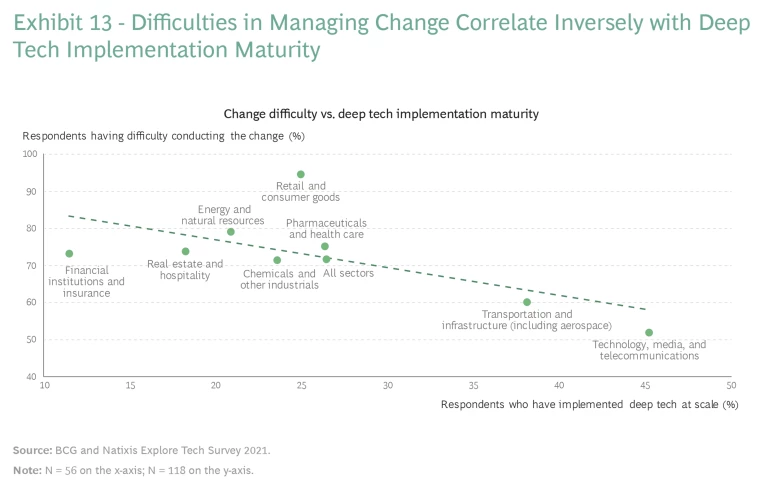

The survey results also show an inverse correlation between technology maturity and difficulty in managing change. (See Exhibit 13.) In industries in which use cases are less well established (and in which many teams are risk averse and uninterested in technology), change management is more challenging. Active commitment and mobilization of the entire executive team (not just the IT director and the innovation team) can help ensure that the company embraces new technologies.

For highly regulated industries such as pharmaceuticals and health care, in which accessing and using data can be severely restricted, complying with regulations is a major challenge. This can create hurdles for solutions such as homomorphic encryption, which permits safer collaboration between economic actors and could enable users to exploit private or sensitive data without revealing its content. (See Exhibit 14.)

Debt financing can be an issue for capital-intensive industries such as transportation and infrastructure (33% of respondents in these sectors cited this obstacle), while finding equity partners is a more significant hindrance for chemicals and financial institutions.

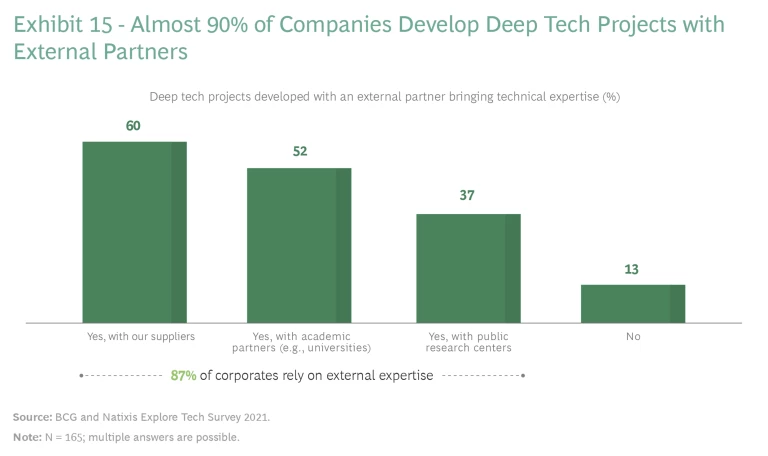

One way that many companies gain expertise is by partnering with other stakeholders. (See Exhibit 15.) For example, in health care, some hospitals, such Gustave Roussy Transfert in Paris, have created entities dedicated to technology transfer. “Partnerships are a key resource for deep tech companies in health care,” said a partner at a life sciences venture capital fund. “A large share of successful startups are spinoffs from laboratories, and they leverage a continuous flow of research expertise from their mother lab down the road of the project. Hospitals are also a key partner, to run clinical trials on specific diseases or to leverage a practitioner network and have access to scientific and medical congresses.”

Building an open innovation network can also help companies identify investment opportunities and provide a natural deal flow as they become acquainted with and integrated into the deep tech ecosystem. For instance, L’Oréal Open Innovation established partnerships with large tech organizations to improve its technology scouting. The team has launched more than 70 PoCs and accelerated 32 startups since 2018 through its partnership with Station F, a business incubator.

The Rise of Blockchain-Powered Digital Assets

A few years ago, blockchain essentially meant cryptocurrencies, starting with Bitcoin, for which it was invented. An emerging consensus divides digital assets into four groups:

- Cryptocurrencies such as Bitcoin are used for payments and exchange operations.

- Stable coins are designed to have a consistent value over time, in contrast to the high volatility seen in cryptocurrency prices. Stable coins may be fiat-backed or commodity-backed and large companies are likely to use them for hedging purposes.

- Utility tokens are tied to defined products or services and issued through ICOs or initial coin offerings. These are distinct from digital coins because they have no direct monetary value and are primarily used in blockchain ecosystem applications.

- Security tokens represent the legal ownership and promise of future cash flows. The most prominent of these are real asset tokens, which digitize real assets and convert them into tokens, enabling owners to store and trade them, including in fractions.

The fast-rising breadth and number of use cases that have developed for digital assets over recent years give rise to a couple of questions:

- How much interest do European companies have in various digital assets?

- Do companies expect digital assets to have a big impact on their industries?

Corporate Interest Extends Beyond Cryptocurrencies

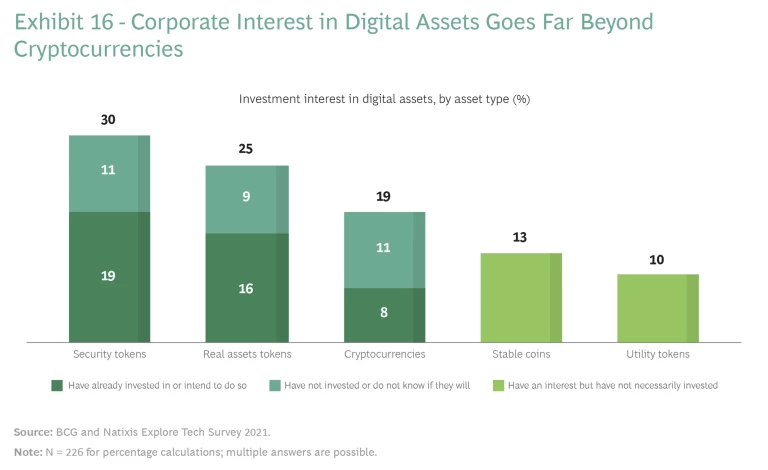

Cryptocurrencies are the most widely used digital asset. Corporate interest in Bitcoin and other cryptocurrencies has extended to many sectors. In our survey, 19% of respondents said they were interested in cryptocurrencies, and 11% said they have already invested or are considering investing in the near future. (See Exhibit 16.) In interviews, several executives confirmed that cryptocurrencies can be a useful option for diversifying investments in the context of low to negative short-term rates, despite volatility risk and regulatory concerns.

More companies are also looking into whether the use of cryptocurrencies could facilitate payments, since a growing share of their customers are willing to pay with cryptocurrencies. Using this vehicle could enable companies to gain access to new demographic customer segments. However, anti-money-laundering and know-your-customer policies are major hurdles for further use of cryptocurrencies by companies.

Central banks are looking at the topic, too. Earlier this year, the Banque de France and the Swiss National Bank experimented with their first issuance of a tokenized central bank digital currency (wholesale CBDC) for cross-border settlements with a consortium of private companies, including Natixis.

Today corporate interest in digital assets extends far beyond the cryptocurrency universe. Survey respondents have shown greater interest in security tokens and, to a lesser extent, real asset tokens than in cryptocurrencies.

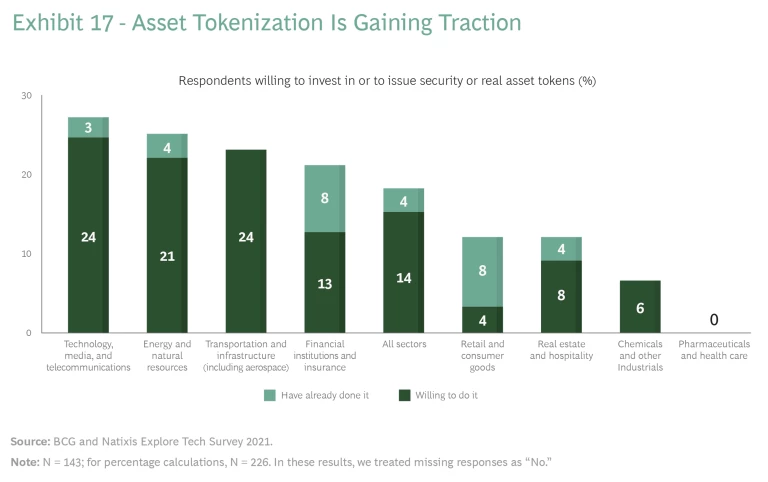

Although these financial instruments are still emerging, about 14% of respondents are considering investing in or issuing security or asset tokens in the next two years. (See Exhibit 17.) In addition to the finance sector, interest is high in energy, TMT, and transportation and infrastructure. For example, excess energy supply could be digitized as easily tradable tokens, with any excess converted back into energy supply. Tokenization can also help track carbon emissions and simplify the exchange of carbon offset credits. Tokenization could substantially lower the cost of financing infrastructure projects, and customers could use tokenized payments to pay for electric vehicle charging.

More broadly, distributed ledger technology in asset tokenization could yield efficiency gains (less disintermediation), reduce barriers to investment (enabled by a more efficient fractional ownership that is likely to be useful in real estate funding, for instance), and improve liquidity and transparency. Still, companies must surmount many obstacles—including scalability, interoperability between different networks, energy consumption (particularly for proof-of-work mechanisms), exposure to cyber risk, and above all, regulatory risks—before they can widely implement such uses.

Stable coins have more use cases in payment processes. Usually pegged to a major currency such as the dollar or the euro, stable coins are logically of interest to financial institutions and other companies because they offset the risk of foreign exchange (FX) volatility. Beyond that, stable coins offer more fluidity in FX transactions, lower hedging costs, and lower counterparty risks, and they could be useful to companies for their payment processes with customers and suppliers. Stable coins can also represent a way to enhance customer loyalty programs. Interest in stable coins negatively correlates with interest in real asset tokens, except among financial institutions.

Expected Impact: Multiple Industries Look to Asset Tokenization

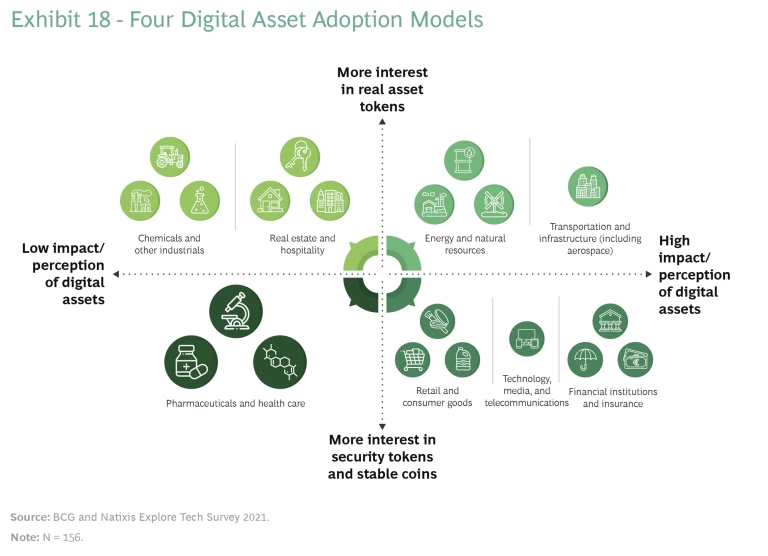

Answers from the 156 respondents who addressed digital assets in our survey suggest that companies fall into four clusters when sorted on the basis of two criteria: the expected impact of digital assets, and relative interest in real asset tokens versus security tokens and stable coins. (See Exhibit 18.)

Almost a third of companies across most industries expect digital assets to have a significant impact. More than 60% of energy and natural resources companies anticipate strong digital assets impact. TMT and finance and insurance companies foresee high impact from security tokens (40% and 30%, respectively), and retail and consumer goods (17%) from stable coins. Chemicals and pharmaceuticals and health care companies have the lowest expectations for digital assets (5% and 0%, respectively). Similarly, real estate and hospitality companies have relatively modest expectations.

Going forward, energy, natural resources, and transportation and infrastructure companies could benefit from paying more attention to real asset tokens, since such tokens could have a disruptive impact in both sectors. This could also be the case for real estate and hospitality and chemical companies, although digital assets are likely to have a lower impact in these industries. Few companies in the pharmaceuticals and health care sector see much potential for disruption from digital assets, although security tokens and, to a lesser extent, stable coins might be of interest to some.

Three Steps in the Journey to Deep Tech Advantage

Companies looking to build a deep tech advantage can follow a three-step path.

Step 1: Use external partners to understand trends and scout innovation. Deep tech comes from R&D. Many companies need to look to external partners to understand tech trends and scout promising innovations. Expertise can come in multiple forms:

- From suppliers (for example, real estate developers can use innovative, low-carbon concrete from suppliers)

- From partnerships with academics (such as the Data Science & Artificial Intelligence for Digitalized Industry and Services faculty chair created at Télécom ParisTech in partnership with Airbus, Engie, Idemia, Safran, and Valeo)

- From public research centers (such as Inria and the Alternative and Atomic Energies Agency in France, which give corporations access to highly skilled scientists, cutting-edge research equipment, and a strong IP and patent portfolio)

Step 2: Make initial investments in startups to test promising solutions. Once companies have identified promising trends and startups that are developing interesting solutions, they can invest in a few opportunities and jointly build PoCs.

Investing directly or bringing the startup into the company’s deep tech portfolio will allow the startup to benefit from the larger company’s expertise, customers, and contacts while giving the company early access to innovative products or technologies. For example, in partnership with HEC Paris Incubator, Icade created the Urban Odyssey startup studio, focusing on low-carbon solutions for buildings. Today the studio incubates more than ten projects and has fostered the creation of specific ventures from successful projects such as Cycle Up with Egis for material reuse and Urbain des Bois for low-carbon construction with bio-sourced materials. Another example is the drone mapping and data analytics company Altametris, which the French railway company SNCF Réseau incubated starting in 2012 for network mapping and monitoring, before extending its focus into other sectors such as airports and maritime freight.

CVC funds or external venture capital and private equity funds are alternative investment routes. According to a partner at a venture capital fund that specializes in digital and deep tech startups, “Venture capital funds are able to interface between startups and big corporations both in the content of the project and regarding different culture and communication style. They can put relevant startups in contact with companies as they mature.” The CEO of a cosmetics company’s CVC fund said, “Having a presence in external funds provides access to deal flow and eventually an opportunity to co-invest if relevant. Venture capital and private equity funds have very strong capabilities in scouting emerging opportunities in promising companies.”

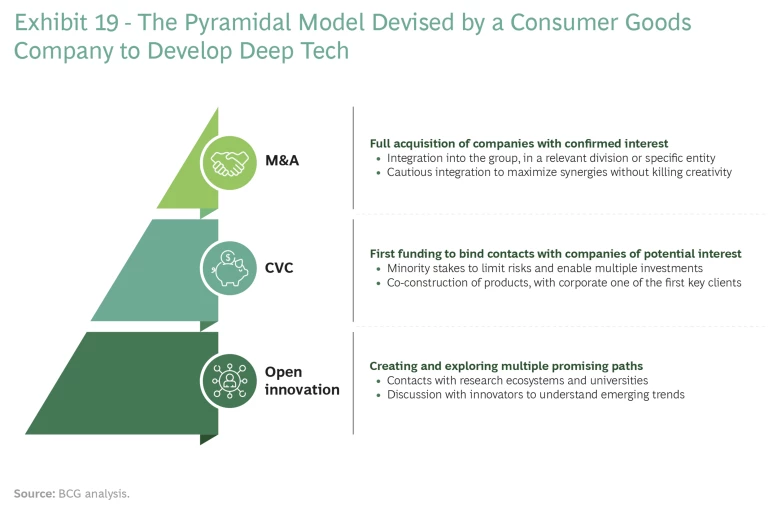

Step 3: Scale up successful solutions. Successful and scalable PoCs can lead to the acquisition of the startup and the integration of the deep tech solution, with the objectives of maximizing synergies and preserving creativity. Companies take a range of approaches to integrating (or not) deep tech startups. One HR director said, “Startups are not fully integrated within the group to avoid ‘killing the startup.’ For instance, we acquired one company which is reporting to the group CDO but is still an autonomous entity.” This company uses a pyramidal model to capture deep tech opportunities systematically. (See Exhibit 19.)

Time to Move

Companies interested in deep tech should take away five points from this study:

- It’s not too late on invest. The deep tech wave is here, and big societal challenges are accelerating it. Many large companies have already taken the plunge and are investing in promising technologies, either directly or through CVC or external funds. More than half of those that have already invested in deep tech projects benefit from public funding or support, and the current EU recovery plans make this a good time for latecomers to invest. But technologies advance quickly and ecosystems solidify, erecting barriers to entry for non-members, so interested companies should not delay.

- Companies should pay special attention to the maturity of individual technologies. How aggressively a company pursues a particular technology depends on its investment horizon and target for building competitive advantage. AR and VR, for example, are relatively mature technologies whose use cases should multiply in the coming years. Technologies such as quantum computing will take longer to develop but eventually will disrupt many industries.

- Companies must take advantage of deep tech to address environmental issues. Deep tech provides new opportunities to reduce corporate carbon footprints, from minimizing energy and resource consumption to using innovative, greener materials in construction and packaging.

- Companies should proceed step by step to manage risks and address the human challenges. The best way to move forward is to start by investing in several startups, prioritize and test solutions with business teams, and increase investments as the technologies become more mature and use cases emerge. Managing change and developing talent and ecosystem connections will be major challenges.

- Digital assets are gaining adoption fast. Companies, especially in impacted industries, should pay attention. This is a unique opportunity to help shape and benefit from the new ecosystems that will emerge. Interest goes far beyond cryptocurrencies and deeper into security tokens, including asset tokens, where use cases are emerging.

Deep tech is an exciting and fast-moving field. Successful participation requires a clear vision, a sound strategy, and a well-developed but flexible plan of attack.