In an ideal world, chief marketing officers (CMOs) and their teams plan the bulk of their annual communication purchases in advance, plotting out allocations by channel and audience based on historical precedents and performance. The CMOs can thus secure premium or scarce inventory, buy at discounted rates, and know how large their residual budget for the year will be. The approach is efficient and effective when consumer preferences and media choices remain relatively stable.

The problem in 2021, however, is that CMOs are no longer operating in anything close to such an ideal world.

Technology and consumer behavior and media habits have been and will remain in constant flux, disrupting the influence and effectiveness of long-established channels as new ones quickly emerge. A crisis such as COVID-19 has only amplified both the speed and magnitude of these disruptions, forcing marketers into periods of tough but disciplined decision making: How can they allocate, re-allocate, or cut spending quickly and nimbly, and how do they respond to ongoing uncertainty and disruption when the crisis subsides and the urgency diminishes?

Addressing these challenges starts with C-suite executives treating communication expenditures as a portfolio of strategic investments rather than as an expense line item on a financial statement. By eliminating the word “spend” from the marketing vocabulary, replacing it with the word “invest,” and adopting the governance processes that accompany a proper investment strategy, CMOs legitimize the role of marketing as a driver of short-term outcomes and long-term value.

The planning cycles for this year and 2022 are forcing every company to revisit the allocation of marketing funds in order to drive competitive advantage. For many companies, this will mean playing catch-up, as they develop a data-driven investor mindset and build the holistic measurement architecture to support it. Organizations also need to confront ongoing uncertainty head-on by incorporating a scenario-planning approach into decision making. Finally, they need to be flexible and open to expanding data pipelines and rethinking their analytical approaches and modeling methods. Nimble CMOs who adopt these approaches can achieve financial improvements of 20% to 40%—in profitability, marketing efficiency, and elsewhere—especially when they cooperate with CFOs to measure success .

Nimble CMOs Adopt an Investor Mindset

Adopting an investor mindset can help CMOs be more confident in their decision making and garner greater support throughout the organization at a time when uncertainty and disruption are givens. The nimble CMO emulates the behaviors and borrows the playbooks of sophisticated investors, who maintain a metrics-based and continuously updated perspective on short- and long-term return expectations as price, cost, and risk scenarios evolve. In contrast to the traditional backward-looking and more rigid approaches to allocating marketing funds, this new approach is highly fluid and future-oriented. CMOs read signals, price in the risk of failure, and double down on successes when they invest marketing resources.

Adopting an investor mindset, nimble CMOs read signals, price in the risk of failure, and use their marketing resources to double down on successes.

Successful investors seek to maintain a healthy amount of liquidity so that they can rebalance their portfolios nimbly as market conditions or other circumstances change. The longer an investment is expected to take to pay off, the more risk it carries. In the same vein, marketers with an investor mindset take a risk-adjusted view and penalize certain investments that will take longer to generate a return. They determine hurdle rates based on the expected returns each potential communication investment can generate, relative to the current and constantly fluctuating price. To take an extreme example, the absolute and relative return on investment expectations would result in a much higher hurdle rate for an investment in a five-year professional sports league sponsorship than for next week’s search-bidding strategy.

The value of budget flexibility rises when uncertainty and disruption increase. Erring on the side of too much advance planning can cost a company the chance to respond swiftly and meaningfully to shifts in consumer preferences. In 2020, this kind of budget rigidity prevented one established retailer from reallocating money to high-ROI programming that a media partner launched faster than expected. A competitor was able to meet the required financial commitment, seized the opportunity, and realized incremental sales as a result.

On the other end of the spectrum, erring on the side of too much flexibility can lead to higher media costs on a per-impression basis or limited access to premium inventory to reach audiences effectively. In the US market, companies have historically bought between 75% and 80% of all national TV volume in a period of four to six weeks at the beginning of the summer. Buying later in the year on the scatter or spot market could mean paying up to 25% more. Having a portfolio that only includes highly flexible investments can reduce the overall marketing ROI, because inflexible, longer-term investments earn what investors call an “illiquidity premium.” This premium is intuitive, as an investor forgoes the opportunity to invest in a new asset when locked up in the long-term asset, and must expect compensation for the opportunity cost. A CMO should seek out balanced portfolios with a mix of highly nimble investments such as programmatic display and longer-horizon investments such as an endorsement contract with a celebrity.

Five Steps to Investing Communication Budgets Wisely

Adopting an investor mindset provides CMOs with clear, data-driven criteria to strike the right balance between achieving short-term outcomes and creating long-term value. As CMOs plan their communication investment strategy for 2021, the five steps below can help them “beat the market” with the right levers to drive effectiveness and efficiency.

1. Understand your appetite for risk. Marketing teams must be able to assess the risk-return profile of their communication investment options from a bottom-up perspective in order to best align their decisions with their company’s overall strategy and risk tolerance. The appetite for risk will vary considerably by company and depends on a variety of factors, including the stage of business growth, competitive environment, and strategic goals such as growing or protecting market share. In the latter case, a company on offense might be willing to invest heavily in customer acquisition among a broad set of new and untapped audiences. They accept higher risk and lower returns in the short term. A company on defense will focus on lower risk, higher return investments on lower-funnel customer acquisition, converting pre-disposed customers. In times of acute uncertainty, such as the COVID-19 pandemic, companies will need to assess how susceptible both their demand and their preferred media channels are to future ebbs and flows in order to continuously calibrate communication investment risk. Marketers can identify investment opportunities to pursue aggressively when products experience spikes in demand and key communication channels see spikes in media consumption. At the same time, some products and services will suffer unprecedented declines and communication channels will see severe drops in efficacy. The longer media plans remain unmodified in either of these scenarios, the more dramatically the risk profile worsens.

2. Think of communication in terms of tranches or investment grades. Thinking of media buys in terms of their investment grade, rather than grouping them by traditional categories, means evaluating them on the basis of risk, reward, and time horizon in a disaggregated way. Every business has certain media investments that would be the last ones they would ever sacrifice. For a quick-service restaurant, it might be out-of-home ads such as highway billboards. For an athletic apparel manufacturer, it might be sponsorship partnerships with major sports leagues. Every business also has a set of communication investments that seem, within the company’s particular context, mutually interchangeable. While the costs will vary, similar levels of reach yield more or less the same return, as with online video and TV, for example. But when analyzed at a more granular level—such as their effectiveness in promoting different products or activating key audiences, or their performance over time—these investment opportunities will show different risk-reward profiles. This disaggregated view of communication investments broadens the allocation options for CMOs, giving them an advantage in optimization.

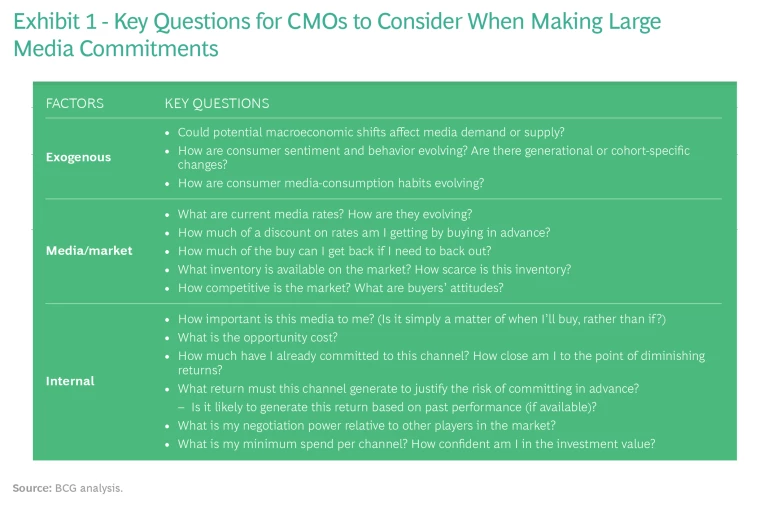

3. Plan large investments first. Once the investment grades are established, the next step in developing and executing an investment strategy is to lock in the company’s own blue chip tranches. These are the large investments with proven impact that offer a discount in exchange for making an advance commitment. Channels that fall into this bucket include upfront national TV, out-of-home, print, and sponsorships. But the risk-reward calculus still applies. Marketers must balance these discounts against the loss of flexibility in adjusting the marketing outlay. The key questions to consider when thinking through large investments that require an advance commitment fall into three categories: exogenous, media/market, and internal factors. (See Exhibit 1.) These self-diagnoses can help marketers understand the value derived from locking in media in advance, enabling them to balance it against the value of retaining flexibility.

4. Budget for scalable experimentation. The traditional annual or quarterly budget cycles lack the speed or fluidity necessary in an increasingly digital world. “Fluidity” in this context means that the company can absorb, process, and act on the flood of incoming data that can help marketers understand if and to what extent investment re-allocations are warranted. A budget for experimentation creates a buffer that allows the company to explore new opportunities and test ways to optimize investments based on incoming signals. On average, we see best-in-class companies allocate a minimum of 10% of their traditional and digital media budgets to experimentation. They encourage their teams to try new things, push those that show promise and quickly stop those things that don’t. This can apply not only to integrating new media channels, but also to achieving greater effectiveness and efficiency in existing communications channels through improved audience activation, geotargeting, or campaign configurations. The experiments can also help with the measurement architecture by completing and calibrating marketing-mix models. But the greatest impact often comes from having the budget to scale successful experiments, not merely conduct them. Private equity funds do this all the time by injecting capital into portfolio companies when they find a playbook that works. Imagine that an experiment reveals within a specific context that 15-second TV spots are just as effective as 30-second spots, or that one online display partner can generate twice the ROI of another. Should the company reallocate spend from the less effective to the more effective opportunity or increase the overall budget and invest in both, since each has a positive ROI? A company has greater flexibility when it has a budget set aside to scale the results of experiments.

5. Measure rigorously. The investor mindset and the culture of experimentation go hand-in-hand with a rigorous and holistic approach to measurement. The holistic approach is necessary for a couple of reasons. First, CMOs have no simple numerators (customer, sales, or profit attributed to a communication investment, for example) relative to denominators (such as marketing investment) at hand that would allow them to effortlessly calculate an ROI. This determination requires advanced measurement methodologies. Second, no single measurement approach is sufficient on its own, especially because marketing impact needs be quantified over different time horizons. (See Exhibit 2.) Marketing has a short-term impact on sales but also creates value to drive sales over a longer time horizon by influencing positive brand perceptions. The implementation of an investor mindset works best in organizations where the rigorous and holistic measurement toolkit empowers the marketing team rather than constrains it. Marketing leadership should aim for enough accuracy and confidence to enable decision making and avoid letting the perfect be the enemy of the good. The simple practice of bringing the various measurement insights together in order to make a decision yields a higher probability of a great outcome, based on our experience.

Taken together, these five steps can help a marketing team strike the right balance not only between individual investment opportunities, but also between advance planning and flexibility.

Making the Investor Mindset Stick

The adoption of an investor mindset is not a coping mechanism for the COVID-19 crisis. It should mark a permanent change in how CMOs allocate and reallocate communications funds in an era when uncertainty and disruption are givens. Viewing the planning for 2022 as analogous to the planning for 2020—and treating the experience of 2020 as an aberration—risks sacrificing the hard-earned discipline and insights from the rapid, high-pressure decision making over the last year.

Rather than look to pre-2020 habits to plan for the future, CMOs should act as investors, requiring each additional allocation in 2022 to earn its way back into the portfolio.

Rather than use pre-2020 habits as a blueprint for 2022 and beyond, the investor mindset would call for each additional allocation in 2022 to continue to earn its way back into the portfolio, the same way that any investment opportunity would need to qualify for the portfolio of a financial or private equity investor. This is especially important when key customer, business, and geographic segments are on different macroeconomic trajectories and thus require discrete scenario planning that is based on analyses of current and future trends. A smart budgeting process would scrutinize and challenge each budget and each investment in terms of the expected impact on key metrics such as profit contribution or brand equity. (See Exhibit 3.) This process leaves no room for sacred cows or “That’s what we’ve usually done” arguments.

Specifically, a company needs to analyze its communications opportunities on the basis of current consumer fundamentals, past performance, and the business’s strategy, targets, and appetite for risk, rather than make blanket “add backs” in line with pre-COVID allocations. Consumer fundamentals can include understanding which channels are currently the most influential in driving preference, consideration, and purchase. Past performance—including 2020—draws on brand lift, marketing-mix modeling, and test-and-learn results to determine the most efficient channels. The data in the latter case may not be ideal, but a triangulated business case is still reliable.

The events of the last year were less of an aberration from some stable norm in media buying, than the final proof that the elegant predictability of an ideal consumer and media landscape no longer exists. Uncertainty and disruption are givens, even if their breadth and intensity vary from year to year. CMOs can capitalize on this uncertainty and disruption when they view their communications purchases as a portfolio of investments, and measure performance with the discipline and rigor that finance and private equity investors do.