The telecommunication industry has consistently endeavored to provide higher speeds and lower latency levels when it comes to connectivity solutions for retail, commercial, and government customers. Satellite technologies, introduced in the latter half of the 20th century, have played an important role in providing communication services globally, especially when existing terrestrial infrastructure is weak.

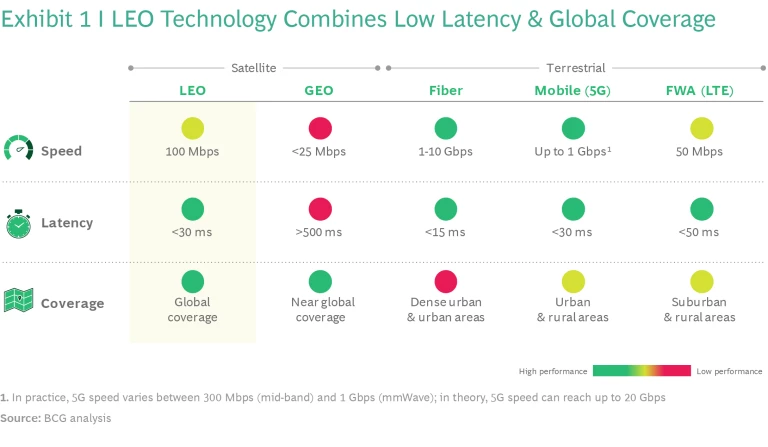

Historically dominated by geosynchronous (GEO) satellite technology, the satellite communication market is now expected to shift towards Low Earth Orbit (LEO) satellite technology. LEO satellites are located approximately 50 times closer to Earth, and typically offer low latency (less than 30ms), coverage with relatively high throughput levels (approximately 100Mbps

By 2030, BCG estimates that the Middle East LEO satellite market will be valued at approximately $110 million

- LEO Satellites: An opportunity to bridge the connectivity divide?

- Driving Adoption: Unlocking value through B2B and B2G use cases?

- Beyond Connectivity: LEO satellites, a missing piece of a broader connected ecosystem?

LEO Satellites: An Opportunity to Bridge the Connectivity Divide?

The COVID-19 pandemic has forced the world to embrace digital transformation at an accelerated pace. However, the pandemic has also highlighted that billions of people remain without internet access, a universal right

Geographic accessibility and the high cost of building physical infrastructure (such as the laying of fiber optic cables) are two key barriers in providing ubiquitous broadband internet access. LEO satellites can address these challenges by providing global coverage and low latency broadband connectivity. Moreover, connecting to LEO satellites does not require large on-premise ground infrastructure – a portable end-user terminal, that can be self-assembled, is sufficient to gain access to the internet.

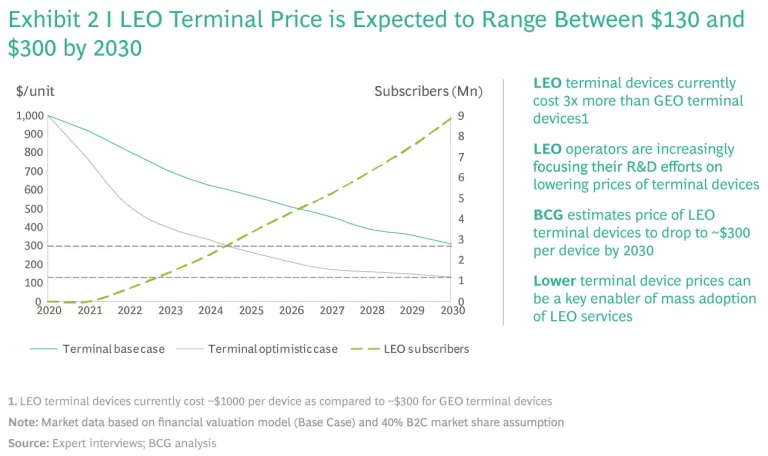

From a technology perspective, LEO is a viable solution to address the digital divide and provide accessibility, however, the business case for its commercialization is still weak. Notably, while subscription fees can be tailored to match market and profitability needs, the cost of end-user terminals is currently estimated to be at least $1,000 (approximately three times more expensive than GEO terminals and seven times more expensive than non-satellite modems). Experts believe that the beta version of end-user terminals released by Starlink in October 2020, at $499 per device, is heavily subsidized to drive adoption and while industry leaders are actively working on addressing this challenge, as seen in recent announcements from Starlink

BCG estimates that the cost of end-user terminals will reach approximately $130-300 per device by 2030, with the lower figure representing an optimistic scenario. Mapping against per capita personal disposable income across regions, and using Starlink’s beta release as a reference, shows that additional measures (in the form of R&D investments, subsidies, or deployment of community WiFi) are needed to position LEO technology as an affordable solution toward bridging the connectivity divide.

Driving Adoption: Unlocking Value Through B2B and B2G Use Cases?

The global satellite communications service market is expected to reach $40 billion by 2030, growing at approximately 7% annually. As the market is still nascent, consensus estimates on its growth and size are difficult to arrive at, and the market has the potential to grow at even faster rates over the next decade. Most of the growth is expected to be driven by LEO technology, forecasted to account for approximately 40% of the overall market by 2030, given its high service quality and enhanced coverage in areas where terrestrial connectivity infrastructure is not easily available.

In addition to improvements in military capabilities for defense, Middle Eastern countries can leverage LEO technology for commercial and government use cases that contribute to the successful delivery of national transformation programs, such as Saudi Arabia’s Vision 2030 or Abu Dhabi Economic Vision 2030. Primarily focused on economic diversification and socio-economic development, these programs typically include three elements – technology, transportation, and connectivity – that could directly benefit from LEO technology.

In terms of technology, LEO can promote business digitalization and Internet of Things (IoT) adoption, particularly in the oil and gas sector

Similarly, the transportation sector is proving to be a key enabler for economic and social activity, driven by the emergence of mega-city development projects such as NEOM. Governments have set ambitions to develop aerial, maritime, and inland transport infrastructure around these cities to develop logistics hubs as well as encourage tourism. LEO technology can help national carriers capitalize on the planned increase in passenger traffic

Finally, LEO technology can provide enhanced connectivity and enable the development of megacities and their digital ambitions by providing an alternative that minimizes investment in-ground infrastructure, and by acting as a backup for always-on connectivity to ensure business continuity in the case of terrestrial infrastructure failure.

Beyond Connectivity: LEO Satellites, a Missing Piece of a Broader Connected Ecosystem?

Because of its CapEx intensive nature, we expect that the LEO satellite internet market will be highly concentrated and dominated by a handful of global players. Starlink, which launched its beta service in the US in late 2020, has the first-mover advantage, but it is expected to face competition from OneWeb and Telesat as they near the launch of their respective commercial operations

Despite this promising race, the LEO satellite business case remains uncertain given its broad range of underlying risks. First and foremost, since no full LEO constellation has been completed yet, the number of use cases remains limited. From a commercial perspective, the lack of awareness and potentially prohibitive prices, as a result of high end-user terminals cost, could translate into insufficient uptake or penetration of services. From a regulatory perspective, the compliance requirements imposed by the international community as well as local authorities could jeopardize service continuity.

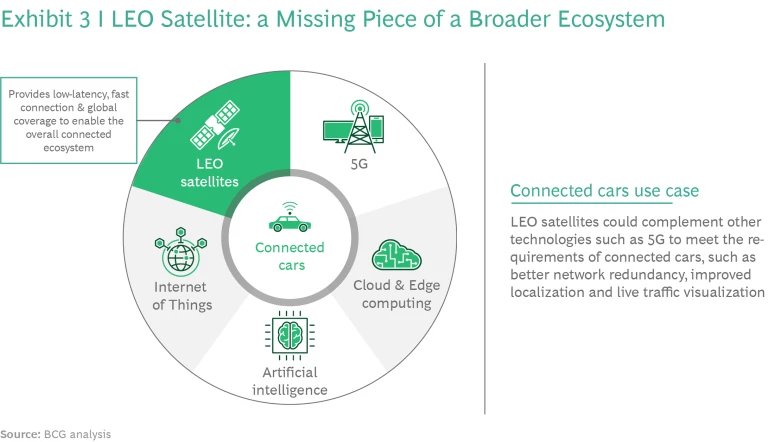

Against this backdrop, rather than being established as a silo, we believe LEO technology should be leveraged to enable the development of connected business ecosystems for technology companies, owing to various adjacent strategic benefits. For instance, by providing high-speed internet connectivity, SpaceX’s Starlink could enable Tesla connected cars and advance the development of use cases such as autonomous vehicles. Similarly, Project Kuiper could enable several services provided by Amazon, including further growth in the global e-commerce market and feeding Amazon Web Services (AWS) with large volumes of data captured through satellites, thus expanding its cloud services business.

Additionally, as evidenced by Eutelsat’s acquisition of a 24% stake in OneWeb in April 2021

As established private players in the developed markets continue to compete in the LEO market, China could emerge as a disruptor with its own planned mega-LEO satellite constellation project announced in October 2020 – it has filed an application with ITU for approximately 13,000 LEO satellites. This network could potentially further China’s national, regional (South East Asia), and global (Africa, Latin America) strategic agenda and promote the growth of state-owned enterprises (operating in autonomous vehicles and e-commerce markets, for example).

Key Takeaways For Decision Makers:

As LEO technology emerges as a prominent technology, four anticipated developments and enablers must be highlighted for Middle Eastern countries:

- Near-term applications of LEO are expected to be relegated to wholesale B2B or B2G

End-user terminal and subscription pricing are expected to remain prohibitive in the near term, limiting mass adoption of LEO-based connectivity. Globally, while R&D emphasis is being placed on reducing costs of end-user terminals, B2C applications are limited to providing connectivity to remote areas in countries with high levels of disposable income.

- International inter-government organizations expected to regulate and enable the LEO technology

Established under the United Nations, ITU has emerged as a critical regulatory body for LEO technology. Its scope of action has primarily focused on establishing and enforcing a regulatory framework that ensures rationale, equitable and efficient use of satellite-orbit resources globally. From setting the principles of orbit spectrum use to allocating orbital slots, and managing space traffic, ITU remains the primary regulatory agency of LEO technology. We anticipate ITU to continue to enhance its scrutiny of new applications for LEO technology orbits as slots becoming increasingly scarce.

- Governments as ‘financial sponsors’ of satellite communication services

Beyond policies and regulations, governments have turned into ‘financial sponsors’, which strategically invest in LEO satellite companies to support their business case and enable their operations. For example, the Government of Canada finalized a $600 million agreement with Telesat in November 2020 to deliver LEO satellite-based internet to rural areas in the country. The United Kingdom’s government acquired a 45% stake in OneWeb in July 2020, after the company collapsed into bankruptcy amid the Covid-19 pandemic. Given the uncertainty in the commercial market, government acquisition of satellite communication services will remain a critical enabler of the future network.

- LEO satellites will pave the way forward for technological disruptions in the future

New technologies such as High-altitude Platform Systems, or pseudo-satellites (HAPS), including balloons, airships, and airplanes could emerge as disruptive technologies that capitalize on the connectivity revolution initiated by LEO. HAPS are radio stations located in the stratosphere, approximately 20km above ground level. They are composed of an unmanned aerial vehicle as well as a payload that houses all communication equipment required to connect users on Earth. HAPS transmit internet signals to ground stations, homes, workplaces, or directly to personal devices. While several HAPS projects have been canceled or put on hold by leading tech players failing to find a sustainable business model (such as Google’s Project Loon and Facebook’s Project Aquila), they have gained significant attention from global aerospace companies, including Lockheed Martin and Thales and Airbus, which are currently working on their development (e.g., Airbus’ Zephyr, Thales’ Alenia and Space's Stratobus).

Traditional technologies such as GEO will also continue to evolve and contribute to disrupting the overall connectivity ecosystem by establishing hybrid networks. Next-generation of GEO satellites (VHTP) will also emerge as leading technologies for mobility use cases such as maritime and air transport. Thus, the global connectivity revolution could only be described as being in its infancy with LEO satellites paving the way for more technological disruptions in the future.