Many companies are eyeing divestitures in the current environment. Are they likely to create value? What is the best path to success?

With M&A activity approaching record levels, companies are turning to divestitures to achieve a variety of corporate objectives, such as raising cash or optimizing the corporate portfolio. The 2021 M&A Report (produced in collaboration with Paderborn University) examines the value creation potential of divestitures and how companies can capture the benefits while managing the costs of these often-complex transactions.

Numerous trends indicate that sellers are likely to continue finding strong demand for their assets. But can they achieve their goals for value creation? And what is the best path to success? To find the answers, we leveraged BCG’s M&A database of more than 840,000 deals covering the period January 1980 through June 2021. Of these deals, we analyzed a subsample of approximately 5,500 corporate divestitures with a value of at least $250 million.

Shareholders Can Capture Substantial Value

The message from our research is clear: periodic portfolio reshufflings and divestitures of non-core assets can create substantial value for shareholders. Two measures of value creation with different time horizons—cumulative abnormal returns (CAR) around the announcement date and relative total shareholder returns (RTSR) during the two years after a divestiture—have both trended strongly upward, on average, since 2016. (Both performance measures are based on the seller’s share price.)

Sellers’ CARs have shot up from a trough of 0.23% in 2016 to 0.74% in the first half of 2021. This may be expected, given the revival of markets’ “animal spirits” following the unprecedented government stimulus measures in 2020 and strong economic recoveries across the globe this year. But the same trend can be observed in two-year RTSRs for sellers, which increased from approximately 1.5% for deals announced in 2014 to 4.0% for those announced in 2019.

The observed value creation makes sense from a market perspective: investors and analysts often subject complex corporate structures to a conglomerate discount because they struggle to distinguish brass from gold in a company’s portfolio and question the synergies between what may be highly heterogeneous divisions.

Although divestitures can create substantial value for shareholders, the averages mask significant variances in performance and returns. Going one level deeper to look at value creation at an industry level provides a more nuanced picture. Sellers’ CARs for all industries are positive, but they vary substantially—from near zero for telecommunications companies to more than 1% for media and entertainment companies. RTSRs of divestitures, in contrast, are negative in some industries, including high tech, health care, and consumer products. The highest RTSRs are seen in utility industries, such as energy and power and telecommunications, as well as financial services.

This points to an interesting correlation: high CARs in flashy industries such as high tech and media and entertainment go hand in hand with low or even negative RTSRs, whereas the relationship is inverse for more staid industries. Presumably, the initial buzz in the stock market frequently turns into a hangover as investors realize that, rather than shedding corporate “fat,” companies may have actually cut into value-creating “muscle.”

The Right Choices Promote Higher Returns

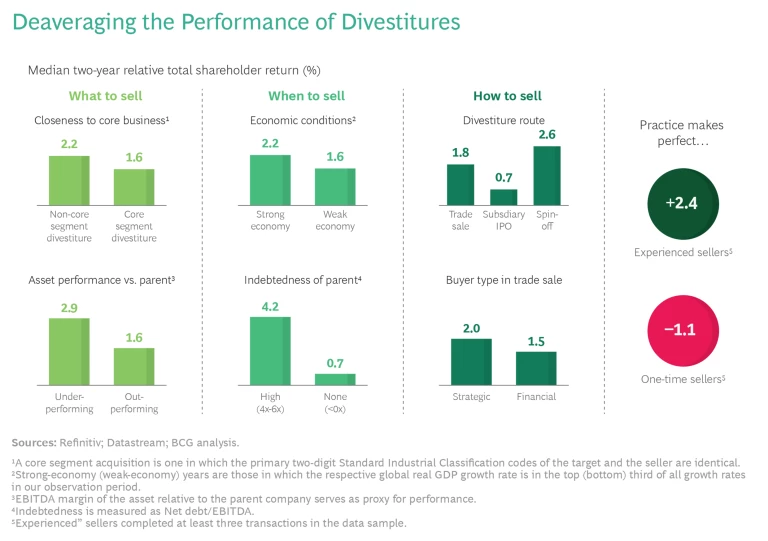

Sellers can get to the good side of the performance gulf between the top and average performers by adequately preparing for every divestiture. This starts with thinking deeply about what, when, and how to divest. Delving into the data related to each of these issues, we identified the choices that promote higher RTSRs. (See the exhibit.)

- What to Sell. Confirming the conventional wisdom voiced in business schools and board rooms across the globe, owners generate the highest RTSRs by selling non-core and/or underperforming assets. This usually frees up cash, reduces complexity, and improves the growth and margin profile.

- When to Sell. Not surprisingly, returns are higher from divestitures made in favorable market conditions. Better economic prospects improve valuation levels and give sellers more negotiating power than in a fire sale during a downturn. As another factor related to timing, we found that RTSRs increase with a company’s level of debt. Investors like to see that the seller has a good use for the cash.

- How to Sell. The choice of exit route also affects returns. In terms of two-year RTSR, spinoffs are the most attractive exit route, followed by trade sales and IPOs . The complexity and inherently higher risk of spinoffs leads decision makers to devote a high level of scrutiny to these transactions, which, in turn, promotes a greater chance of success when finally carried out. Historically, the value added by trade sales has been more than twice that of IPOs. The availability of forward-looking financials in trade sales (versus only historical financials in an IPO) and the sharing of synergies promote higher returns. Among trade sales, selling to corporate buyers generates more value than selling to financial investors, because the latter have few, if any, ways to realize synergies within their portfolio.

Last but not least, stock market analysts appreciate the adage that practice makes perfect. Companies that sell assets relatively frequently generate higher RTSRs than less-experienced sellers. The effect could partly be due to frequent sales being evidence of superior management practices. But it also matches our previous research on frequent acquirers , which showed a clear correlation between deal experience and returns for buy-side transactions.

Conquering the Complexity of Carve-Outs

Although divestitures can create substantial value, the process of divesting generates significant costs and is fraught with risks. The central element of the preparation process, in many cases, is carving out the divested business—that is, separating it operationally and financially from its parent company. Carve-outs , the most complex type of divestiture, are often resource-intensive and costly. Disruptions to business continuity for the carve-out company or the parent, as well as a failure to achieve timing milestones and eliminate stranded costs, can hurt business performance, transaction value, and the capital markets’ perception. That creates a clear imperative to get the transaction’s operational aspects right.

Navigating the challenges requires diligent management and a keen focus on value creation. We see a wide variety of key success factors:

- Focus on creating maximum value from the overall transaction.

- Don’t overlook the details—an 80:20 approach is likely insufficient.

- Closely manage people issues and the overall change and communications process.

- Even while focusing on the carve-out process, keep the business running and help it to further develop and grow.

- Ensure that the project organization is lean and composed of experienced staff with sufficient seniority and weight in the organization.

- Comprehensively plan the carve-out budget, and then rigorously track and manage it throughout the process.

- Tackle stranded costs early and rigorously, potentially also using the exercise to challenge the parent company’s operating model and reset the cost structure.

The time is right for companies to capture the value of divestitures. But strong returns are not guaranteed. Companies need to sell the right assets at the right time and select the best divestment channel. They also must recognize the complexity of carving out the divested asset and apply best practices to ensure that high costs do not undermine the value realized. Companies that master the art of breaking up will be rewarded with more value for their divested assets and, ultimately, a stronger portfolio of businesses.