During the pandemic, a disinfectants manufacturer that typically sells to large distributors realized that small businesses and consumers doing more rigorous cleaning might represent a new market. But establishing a sales channel to reach potential customers risked alienating the company’s existing customer base of large businesses and retailers.

Potential channel conflicts are common whether a company sells cleaning products, building materials, sneakers, beverages, airline flights, streaming video, or many other goods and services. As e-commerce gobbles up a larger portion of total B2C and B2B sales, companies must weigh the new opportunities these channels represent against the friction they may create with existing channels.

It’s not a simple task. In a BCG Digital Ventures survey of corporate e-commerce channel managers, 38% said channel conflicts are their top business concern, and 44% believe that such tensions will increase in the future.

A well-conceived approach to e-commerce channel expansion can mitigate potential conflicts. Conducting a data-based assessment of existing products, customer segments, and sales channels can uncover gaps and help companies weigh the relative merits of rolling out new e-commerce options for each one. From there, they can map out a strategy, adjust pricing and positioning accordingly, and communicate the changes to sales partners.

Sources of Conflict

As e-commerce accounts for more and more sales, it creates both significant opportunities and new challenges that need to be addressed. The opportunities lie in the potential for additional revenue from new customers, new products, and new sales channels. But the more e-commerce channels a company uses, the greater the potential for conflict between them.

In a survey of corporate e-commerce channel managers, 38% said channel conflicts are their top business concern, and 44% believe that such tensions will increase in the future.

Channel conflict may sound innocuous, but the effect on sales can be substantial. Of 600 e-commerce channel managers whom BCG surveyed, the vast majority, 93%, said that choices about product assortment or pricing made to please distributors had led to lost revenue. (See Exhibit 1.) Close to six in ten said they could have increased revenue by more than 10% had they not made such choices. Two-thirds reported avoiding selling through some channels in order to avoid disrupting existing sales in others.

Channel conflict doesn’t just affect sellers. In our survey, three-quarters of consumers said that having multiple options when buying a product was sometimes, often, or almost always confusing.

We identified five key elements of the sales process that can create conflicts when companies expand their e-commerce presence.

- Customer Segments. Conflicts may arise when companies adopt new channels to reach new customers. A home goods manufacturer may sell a product through online home improvement stores that carry only a fraction of its total inventory. To reach new customers, the company may decide to sell its full product line through an online store that it owns and operates. However, that risks alienating existing resellers. In our survey, 56% of e-commerce channel managers said they had experienced conflicts between their external channel partners and direct-to-consumer channels.

- Operating Models. The channel a company uses to sell an existing product may not be the right vehicle for selling a new product. For example, if our home goods manufacturer begins selling an adjacent product line, it may decide that it could sell more on an online platform such as Amazon than through its current online resellers. The result could be friction with those resellers.

- Product Mix and Pricing. Adding a channel to sell directly to consumers can disrupt current pricing structures, including the commissions that sales representatives earn from selling to wholesalers, distributors, or other resellers. In our survey, 53% of e-commerce channel managers said they had experienced conflicts between their in-house sales team and direct-to-consumer channels.

- Customer Service. Companies often sell products that require different levels of customer service, or they may offer additional services for a fee. Channel conflicts can arise when a company has to determine the level of service to offer for specific products or e-commerce channels and the customer service “journey” for each. For example, a company selling flat-screen TVs online could offer one price for home delivery and a higher price for delivery plus installation. Simple home deliveries could be handled through routine shipping methods. But for installation, the company might need to work with a local electronics installation specialist, which could add complexity and cost.

- Stakeholder Management. A lack of clear strategies for individual e-commerce channels can have unintended consequences. A company may sell through an online platform to buyers who then turn around and resell the goods on the same site. Buyers become de facto competitors, which could potentially drive down prices. A company may offer discounts to large corporate customers that buy in bulk through one e-commerce channel but not offer the same terms to smaller businesses that buy through a different channel. Conflicts can arise if the company doesn’t delineate the customers it’s targeting in each channel and match SKUs, prices, and branding accordingly.

A Five-Step Approach to Minimizing Conflict

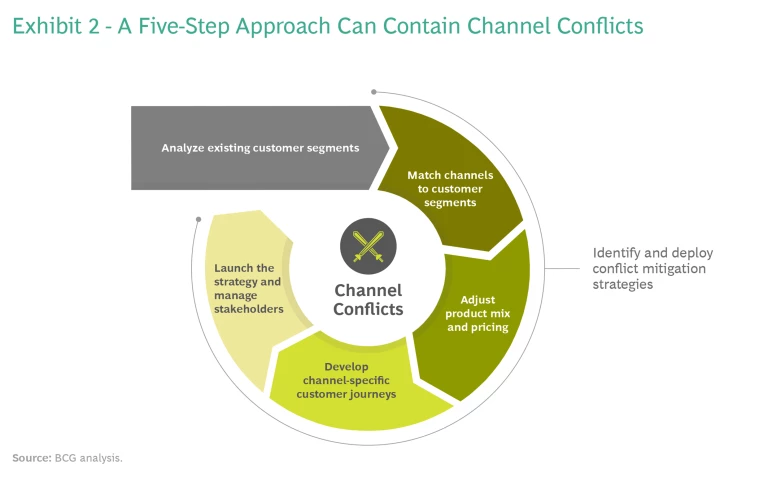

To address channel conflicts, companies must understand the dynamics at play among their existing products, customers, and sales channels and the opportunities that new products, customers, and sales channels represent. We suggest taking a five-step approach to maximizing sales while minimizing friction. (See Exhibit 2.)

1. Analyze existing customer segments. Robust qualitative and quantitative research can help determine a company’s customer segments, the products they need, and the sales channels that each uses to make purchases. Such analyses can reveal opportunities to reach existing customers through new e-commerce channels or new customers through either existing or new channels. Research can include observing customers as they shop and interviewing them about their shopping habits and preferences. Interviewing sales staff or analyzing sales data can also provide insights.

For example, analysis of purchase data at an industrial-goods company we work with revealed that the company was missing out on sales to small businesses. The owners of those businesses needed the products the company sold but were unaware that they could use its existing e-commerce channels to make purchases. Similarly, consumers’ increasing comfort researching, shopping, and buying online is starting to extend to products such as cars, which historically were not sold through e-commerce channels because they were considered too complex or expensive.

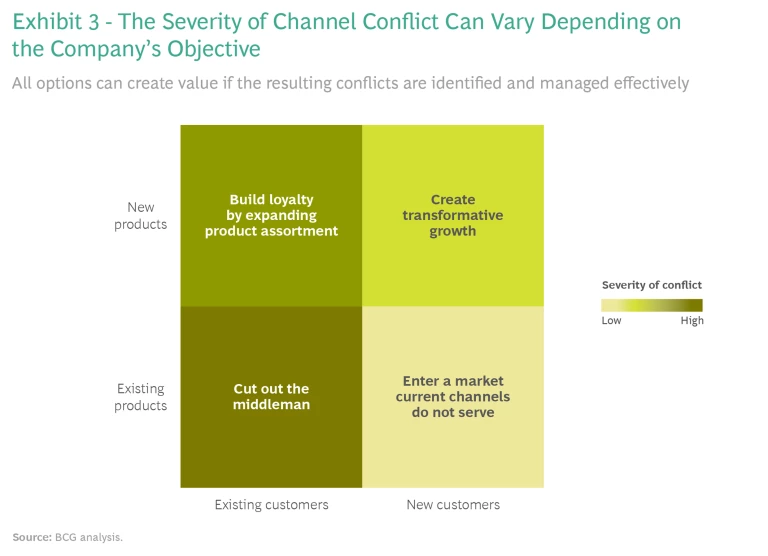

The degree of channel conflict can vary depending on whether a company is expanding e-commerce to reach new customers with new products or to reach existing customers with existing products. (See Exhibit 3.) Generally speaking, offering a new product to new customers generates the least amount of conflict and can lead to significant increases in sales. Selling existing products to existing customers generates the most conflict, especially when existing wholesalers or third parties are removed from the process. One way to mitigate such conflicts is to sell through Amazon or another online marketplace, where a brand can maintain tight control over the placement, description, and image of its products. When it comes to using new e-commerce channels to offer new products to existing customers or existing products to new customers, conflicts can generally be kept to a minimum by identifying and deploying the conflict mitigation strategies outlined below.

2. Match channels to customer segments. Once a company has analyzed its customer segments, it can determine the e-commerce channels best suited to meeting their needs and preferences. But this is complicated by the profusion of available options, including owned and operated websites, third-party marketplaces and platforms like Amazon, other online retailers or resellers, and traditional direct and indirect sales channels.

Companies should analyze their customer segments for buying patterns that indicate shopping preferences, which can then be aligned with the most appropriate channels. This analysis should include identifying who makes purchase decisions. At a large enterprise, for example, a buyer or procurement manager may control purchasing, which could limit purchases to specific, preapproved channels.

When a company is adding e-commerce channels to attract new customer segments, it may need to offer features, benefits, or other incentives that a particular segment is likely to find attractive or can’t get elsewhere. Different customer segments may also require different experiences. For example:

- Enterprise customers may have procurement requirements that limit the channels their buyers can use in order to maximize volume discounts. To reach them, a vendor may need to sell through distributors that support those channels, while maintaining separate channels for other customer segments.

- To reach small businesses, a vendor may need to set up a channel in which multiple employees can make purchases on a single company credit card.

- To reach consumers with access to numerous e-commerce channels, a vendor may need to differentiate itself by offering multiple options for delivery and installation.

3. Adjust product mix and pricing. Once a company has identified its customer segments and the best channels for reaching each one, it can develop strategies for pricing and assortment, as well as related tactics to mitigate channel conflict. All revolve around aligning the customer segment to the appropriate channel:

- Set prices that are channel appropriate—retail prices for retail channels and wholesale prices for wholesale channels—to avoid undercutting existing channel partners. Volume discounts could be offered to B2B customers, for example, but not to retail customers.

- Limit conflict by making comparison shopping more difficult, such as by offering exclusive products or different SKUs in different channels.

- Customize labeling and packaging to communicate product benefits to a channel’s target customer segment and to differentiate new products from those offered through other channels. For example, a cleaning product typically sold in large quantities to big companies through wholesale channels could be repackaged in smaller containers and sold through a channel that targets small businesses or consumers.

- Adjust the products available per channel. Fashion retailers offer a limited number of SKUs on Amazon and the balance on their own sites.

- Bundle products with value-added services not available in other channels in order to target specific customer segments or uses.

- Use contracts that spell out the sales structure and terms that the company and customer agree to abide by for purchases made through authorized distribution channels.

- Create a new brand to reduce the potential for conflict in channels used by existing partners.

When a German roofing materials manufacturer that had previously sold only to distributors wanted to sell directly to consumers, the company minimized potential channel conflict by establishing a separate entity, with its own brand and website. Inquiries from prospective customers visiting the manufacturer’s website were routed to preapproved roofing contractors. The approach paid off. In the first year, the number of roofers that became channel partners jumped from 12 to 500.

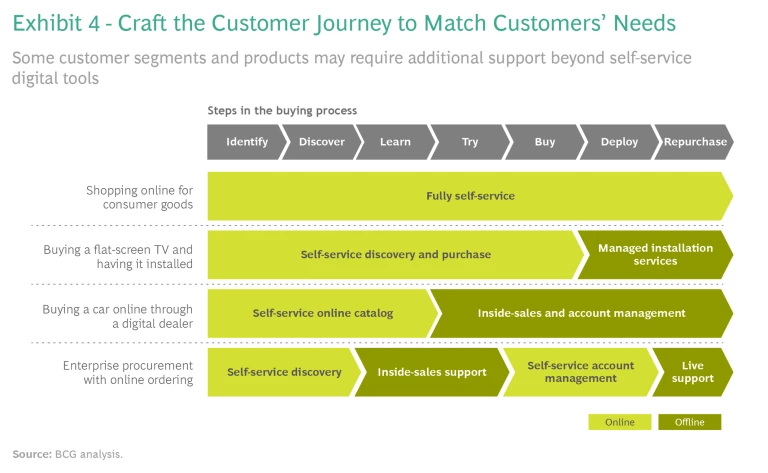

4. Develop channel-specific customer journeys. Customer journeys are the interactions a customer experiences to satisfy a need, from researching products to making a purchase to raising a customer service issue. To get the most out of e-commerce channels, companies must craft the appropriate customer journeys for each one. Likewise, for a channel-specific customer journey to be effective, it has to match the needs of the customer segment across the entire buying process. Different customer segments and channels require different customer journeys. (See Exhibit 4.)

Companies that sell goods or services to enterprise-level customers can afford to create a high-touch customer journey with a mix of digital and face-to-face interactions, because order sizes and margins are relatively large. If the same company launches an e-commerce channel to sell to small businesses, it may need to create a purely digital, self-service customer journey. That would preserve margins on a higher volume of orders with significantly smaller price tags.

Just because a sale is B2C doesn’t mean the customer journey is simple. Some apparel retailers have personal shoppers at their stores to help customers make selections. Others have recommendation engines that suggest items based on what a shopper bought in the past. For a company selling flat-screen TVs online, the customer journey could entail connecting buyers with third-party installers in their area.

5. Launch the strategy and manage key stakeholders. The last step in setting up an e-commerce channel strategy is devising plans to implement it and sharing them with affected internal and external stakeholders.

Running a pilot or rolling out changes in waves are two options for testing how new e-commerce channels and customer journeys perform before expanding them across the business. Companies can take note of questions that come up and make adjustments as needed. Pilots are also a chance to test the effectiveness of new strategies by tracking metrics, such as sales growth across new and existing channels. Collecting data on customers can reveal whether new channels are attracting new customers, as intended, or existing customers who would normally buy through other channels.

The vast majority of e-commerce channel managers surveyed, 93%, said that choices about product assortment or pricing made to please distributors had led to lost revenue.

Plans may need to include remedies for sales teams if new e-commerce channels affect their commissions. In such cases, companies can reduce tensions by offsetting lost commissions while the new strategies are taking hold.

Changing what’s sold through new or existing e-commerce channels may require companies to ask their channel partners to agree to new contracts. Moreover, it may be necessary to wait until current contracts expire before renewing them under new terms and conditions, which could delay rollout plans.

When sharing plans with existing channel partners, companies must be transparent. They should consider in advance how partners may react and prepare talking points or other materials to address their concerns. These materials can highlight what partners stand to gain from new channels, pricing, or customer segments. If it’s feasible, companies can include partners in decision making about the timing or location of a pilot or rollout. If channels are attracting new customers as intended, companies can use that to defend against claims from channel partners that they’ve been harmed by the new strategy.

Getting Started

The conflicts that arise from expanding e-commerce channels vary. A company may choose to stick with an existing channel because supporting an existing channel partner is more important than the incremental revenue that a new channel would generate. Another company may opt to adopt a new channel regardless of the consequences because the expected benefits vastly outweigh the potential conflicts with existing channels and partners.

To sort through those and other issues when implementing the approach outlined above, we recommend the following:

- Make it a priority. Given how much is at stake, a company’s approach to expanding e-commerce should be high on leaders’ to-do list. It should be as important as tracking online sales volume. Getting buy-in from leaders across existing channels can also help overcome resistance from those concerned that the new strategy will adversely affect them.

- Form a dedicated team. To make sure all the bases are covered, the team should be cross-functional, with representatives from sales, pricing, marketing, and finance. Give members responsibility for spearheading the overall strategy, making decisions about e-commerce strategy, and devising rollout plans.

- Be prepared to invest time and money. Results won’t come overnight. It can take time to analyze existing customers and channels, build a strategy, and get buy-in for the changes that will likely be required before launching a pilot.

- Monitor and assess the impact. In addition to monitoring sales growth from new e-commerce channels and new customers, companies can track other metrics to assess progress. These include existing channel sales by geography, specific channel, and customer accounts before and after the addition of new channels; gross and net margin by channel; customer acquisition costs by channel; and impact on commissions paid to sales reps and distributors.

During the pandemic, companies increased what they sold online because they had to. Now they can take a more considered, long-term approach. Whatever e-commerce channel strategy they land on, the goal should be to maximize their investment while avoiding minor conflicts that could snowball into major headaches down the road.