No field of medicine receives more attention or resources than oncology. Little surprise that the progress in diagnosing and treating cancers has been substantial, which is good news for patients, who are living longer and better. But there is an inadvertent business impact for the biopharma companies that are leading R&D into new treatments. With all the advances in knowledge, disease understanding, technology, and data come greater fragmentation of patient cohorts and more complex treatment protocols. The lifespans tend to be shorter and the market prospects of today’s potential treatments more modest than they were even a few years ago. It is far more difficult for management teams to assess the potential financial return. Since the bets are so big, companies need new ways to evaluate prospects and make their investments count.

BCG recently researched patterns in treatment paradigms and patient stratification, as well as in the availability and use of high-quality real-world data and real-world evidence, in ten oncological diseases. Many of the trends we examined have been at work for some time, and their impact on standards of care is uneven across diseases and patient groups. Confounding signals from an expanding body of real-world evidence complicate matters further. Companies need to rethink how they assess development candidates and make decisions. Here we explore several implications of our research and outline recommendations for action for biopharma and relevant diagnostics businesses as oncology continues to evolve.

A Fast-Changing Marketplace

Even on the surface, the business of cancer treatment has changed radically in less than a decade. In 2013, pharma oncology revenues totaled about $65 billion, and one company (Roche) dominated, with a handful of mega blockbuster drugs and a 40% market share. Growth has been rapid, and competition has intensified dramatically: in 2020, the top five major players, many with several mega blockbusters each, accounted for 57% of the $156 billion oncology market.

Beneath the surface, the changes are even more profound. The rapid rise in available funding and in the number of researchers working in the field has caused the time advantage of early research to fade. Similarly, speedy advances in the understanding of the biology of various cancers and in their diagnosis have reduced the time advantage of new treatments, in some cases to less than the period of exclusivity conferred by a drug’s patent. Several factors have made more and better information available directly to pharma companies as well as to clinical practices. These include more real-world data of higher quality from more sources and more information that is broadly communicated and disseminated. As a result, the traditional idea of what constitutes a standard of care (SoC) in any given treatment area has come into question.

Three developments have converged to reshape today’s oncology marketplace:

- Greater competitive intensity is focused on smaller patient populations with multiple treatment options.

- Shifting standards of care and overlapping patient stratifications have led to complexity in treatment protocols and widely varying uptake and use of new treatments.

- The combination of the first two developments, plus the fast-rising importance of real-world data and evidence in determining efficacy, make forecasting increasingly difficult, causing headaches for finance, strategy, and executive functions across the industry.

Standards of Care and Patient Stratification

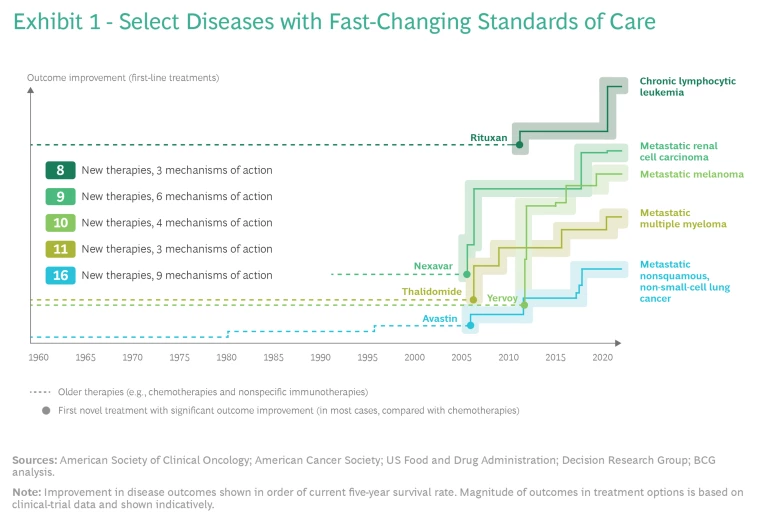

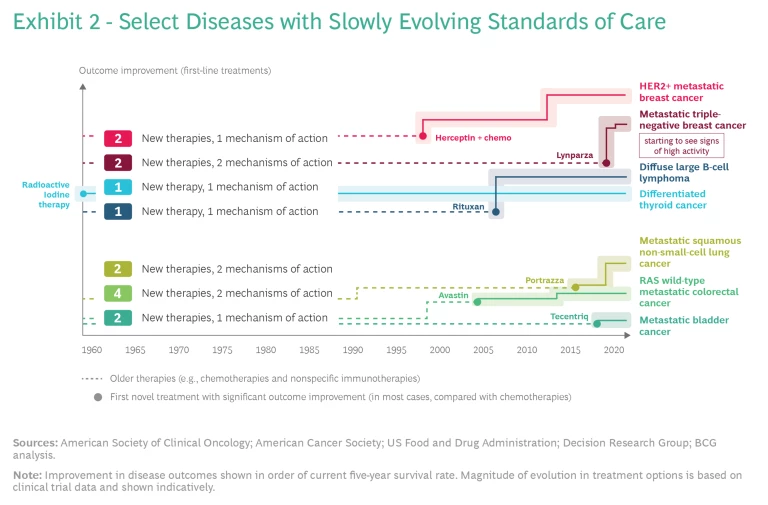

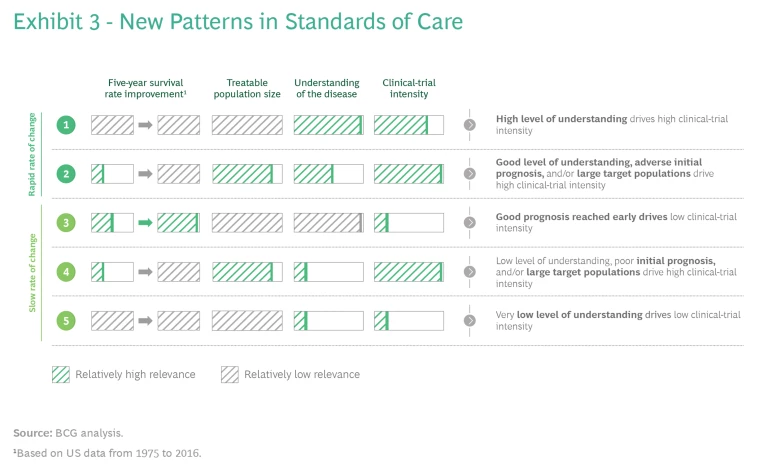

In our research, we studied the evolution of outcome improvements across ten diverse oncological diseases spanning a wide spectrum in terms of the number of clinical trials conducted, overall survival rate, and patient population size. In the case of some diseases, we observed a dramatic acceleration of change in the SoC, while in others the change has been much slower. (See Exhibits 1 and 2.) For any given disease, various factors can influence the pace of change in the SoC. We found that four of the most important are survival rate, the treatable population size, the level of understanding of the disease, and clinical-trial intensity.

Diseases for which the SoC is changing quickly fall into two categories. In the first category are diseases characterized by a very high level of understanding, which drives a relatively high level of clinical-trial activity; in the second category are diseases with either poor initial prognoses or large target populations, combined with a relatively high level of understanding, which similarly drive a high level of clinical-trial activity. Diseases for which the SoC is evolving slowly fall into three categories: diseases with favorable prognoses reached early on, resulting in limited clinical-trial activity; diseases that are not well understood, although poor initial prognoses and/or large target populations drive a high level of clinical-trial activity; and diseases that are poorly understood, resulting in a low level of clinical-trial activity. (See Exhibit 3.)

Not all diseases fall into these groups, and factors other than the four described above (such as the rarity of the disease) can come into play. In addition, with improved knowledge, diagnostic capability, prognoses, or success in developing cures, a disease or its subtypes can move from one category to another.

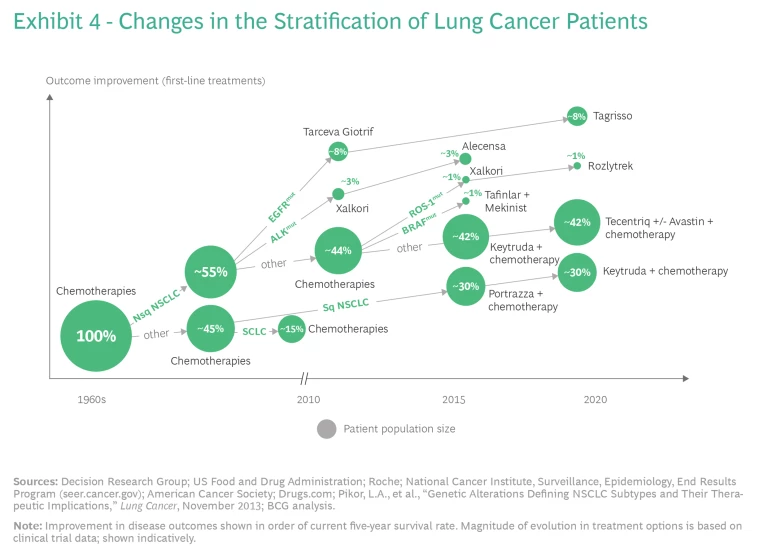

Standards of care are further complicated by changes in patient stratification as the understanding of cancer’s biology, new diagnostic capabilities, and real-world data and analytics evolve. The result is greater complexity in the sequencing of therapies and a further confounding of treatment protocols. For example, Exhibit 4 illustrates how improvements in treatments have caused the universe of lung cancer patients to split into subgroups over time.

Strategic Ramifications for Biopharma

These developments have three key strategic ramifications for biopharma companies:

- The commercial opportunities for individual treatments are likely to be smaller, of shorter duration, and more dynamic moving forward, elevating the importance of early access to real-world data.

- The time compression that new treatments face, combined with the increasing role of real-world evidence, require companies to radically rethink how they engage with health care providers .

- Instead of working with just a few stakeholders, companies need to become part of an ecosystem with dynamic interconnections.

Changing Opportunities. As target patient populations fragment and competition increases, reducing time to market becomes ever more critical. It requires the use of high-quality real-world data, which ultimately accelerates patient access to treatment innovations. Of course, establishing a positive benefit-risk balance is essential, but so is getting new products into the hands of clinical practitioners faster, so that outcomes can be monitored and uncertainty around long-term efficacy and safety reduced. Health care professionals have the ability to experiment with new drugs and optimize their application in existing diseases while exploring uses in adjacent indications.

Engaging Providers. Companies need to seek out knowledge and information in multiple areas as they move through evolving (and faster) treatment development, trial, and commercialization processes.

- Regarding the development of new treatments, companies need answers to these questions: What new modalities and new products with new mechanisms of action are currently being trialed? Where can older modalities be applied in new ways? Where might it make sense to combine two or more products into a single treatment?

- Regarding clinical-trial operations, companies need to ask: How can we recruit patients into clinical trials faster? Can we use external controls to reduce the number of patients under current standards of care?

- Regarding the knowledge of diseases and competitors: What are the ongoing and upcoming trials for new products with the same mechanism of action addressing the same patient subpopulations? What products in the same disease area but with different mechanisms of action are in the portfolio?

- Regarding clinical-practice knowledge: What are the existing products in a specific disease area and how are they differentiated? Are there tumor-agnostic therapies being used today or are any on the horizon?

- Regarding real-world data and evidence: What new evidence on previous standards of care are being derived from real-world data? What real-world data exists on combination therapies? Can we examine weak signals in co-morbidities?

From Partnerships to Ecosystems. Companies will need to determine how to enable continuous collaboration with stakeholders throughout the ecosystem while ensuring well-coordinated and agile connectivity internally across functions. Given the rising number of treatment combinations expected in the future, companies will also need to find new ways to collaborate and expand cooperation with peers.

Questions to Get Started

Management should ask the following questions as a way to start designing a roadmap for future treatment development:

- Does our present planning approach allow for making predictions of performance in smaller target patient populations, as well as for shorter SoC lifetimes and a more dynamic competitive landscape?

- Are our present clinical-practice engagement approaches fit for purpose in terms of both the "what" and the "how"?

- How can we keep all functions up to date on what is changing in real time and remain coordinated and agile (staying true to the principles of autonomy and alignment)?

- How should we partner or work with providers to enable insight generation and sharing by clinical practice and clinical research?

- How can we find the right partnerships with biotech and payer ecosystems to bring the best capabilities to our work with providers?

- With classic sales approaches disappearing and complexity increasing, what new talent and capabilities do we need to be successful?

Oncology will continue to be a major field of pharmaceutical R&D. The treatments of the future will likely take many different forms than those of the past. The successful companies behind them will need to be ever more agile and nimble in their decision making and in the use of data in setting and executing product development strategy .